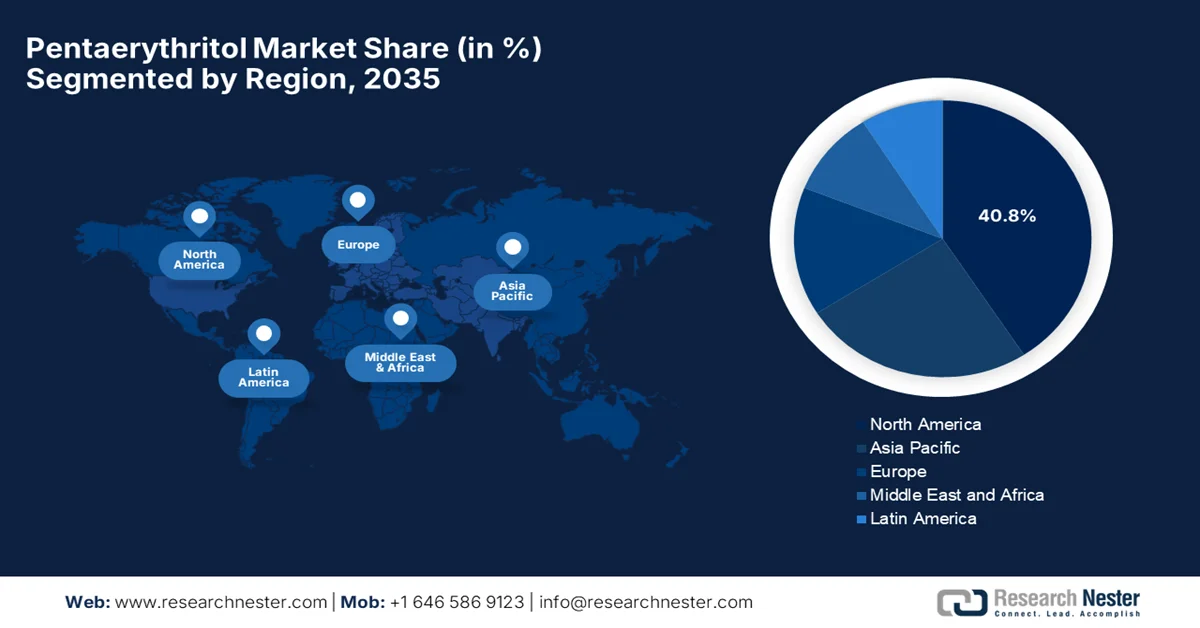

Pentaerythritol Market - Regional Analysis

North America Market Insights

During the forecast period, the North America pentaerythritol market is forecasted to evolve as a dominant region capturing around 40.8%. The region’s progress in this field is mainly propelled by the heightened demand for construction and lubricants. In addition, the region’s strong emphasis on sustainable manufacturing promotes innovation in high-purity derivatives. In February 2024, the U.S. Environmental Protection Agency reported that it has finalized amendments to the 2018 TSCA Fees Rule to strengthen chemical safety reviews and make sure for better public health protections. Besides, the changes allow EPA to recover 25% of authorized implementation costs, improving efficiency and resource allocation for chemical evaluations. Total program cost estimates were reduced by 19% to USD 146.8 million, with fees for EPA-initiated risk evaluations lowered from USD 5.1 million to USD 4.3 million and new chemical submission reviews from USD 45,000 to USD 37,000. Therefore, the presence of such measures facilitates the introduction of high-performance, low-VOC resins and coatings by promoting compliance in the chemical industry.

The U.S. pentaerythritol market is growing significantly, mainly attributable to the robust automotive and aerospace industries, where pentaerythritol-based resins play a highly essential role for high-performance lubricants, flame retardants, and protective coatings. Also, the aspect of federal initiatives is proactively promoting sustainable manufacturing and industrial decarbonization, which enhances adoption in chemical formulations. In January 2025, the U.S. Environmental Protection Agency stated that it had finalized amendments to the National Volatile Organic Compound (VOC) Emission Standards for Aerosol Coatings to improve consistency with state regulations, such as California’s CARB. Besides, it covers approximately 46 regulated sources, including major manufacturers and distributors. The amendments aim to reduce ozone formation by encouraging the use of less reactive VOC ingredients, hence supporting the industry’s shift toward sustainable, low-VOC coatings.

The construction and infrastructure sectors, particularly in terms of durable coatings and protective materials for extreme climatic conditions, are responsibly creating a beneficial business ecosystem for the pentaerythritol market in Canada. The government-backed energy efficiency programs efficiently encourage the adoption of thermally stable resin solutions, supporting sustainable urban development projects. Based on the government data of the country in 2023, Canada’s pentaerythritol imports totaled CAD 2.29 million, wherein there has been a high market concentration among a few players. It also mentioned that the three importers accounted for 52.11% of the value, whereas the top eight importers represented 80.22% of total imports. Major companies included Cloverdale Paint Inc. (Surrey, BC), DKSH Canada Corp. (Toronto, ON), and Polynt Coatings Canada Limited (Port Moody, BC), among others. Therefore, the import landscape in the country emphasizes both domestic and cross-border sourcing for chemical manufacturing in Canada.

APAC Market Insights

The Asia Pacific pentaerythritol market is expected to register the fastest growth, influenced by factors such as industrialization, urban development, and large-scale infrastructure projects. The ongoing construction boom has particularly increased the need for durable, weather-resistant coatings, leveraging polyol’s compatibility with alkyd resins and powder coatings. Meanwhile, the region’s expanding automotive sector, influenced by the rising vehicle production, supports higher consumption of synthetic lubricants and polyol-based intermediates. In this regard, in March 2025, PPG reported that it had inaugurated a waterborne automotive coatings plant in Samut Prakan, Thailand, with an annual capacity of 2,000 tons, and it is aimed at meeting the rising demand for sustainable coatings in Southeast Asia. It also mentioned that the facility includes an automated spray center to enhance service capabilities, hence increasing the growth potential for the pentaerythritol industry.

The strong chemical manufacturing hub and surging export infrastructure drives growth of the China pentaerythritol market. Government policies in the country are proactively encouraging chemical standardization and production facilities, which drive high-volume industrial applications, particularly in terms of coatings, plastics, and industrial lubricants. In September 2025, the country’s government reported that it is proactively supporting the growth of the petrochemical industry through the work plan for stabilizing growth in the petrochemical industry 2025 to 2026, which aims to enhance high-end chemical production, technological innovation, and digital transformation. In addition, the plan promotes upgrading traditional products such as coatings, resins, and fine chemicals by also expanding domestic and international demand, thereby boosting production capabilities for materials such as pentaerythritol.

The large-scale urbanization, infrastructure projects, and the construction of smart cities are fueling the expansion of the pentaerythritol market in India. Also, the government’s initiatives for eco-friendly paints and low-VOC coatings, coupled with rapid automotive and industrial growth, create a heightened demand base for resins, adhesives, and surface treatment solutions. The Ministry of Heavy Industries in July 2025 announced that it has launched the Automotive Mission Plan 2047 (AMP 2047) under the Viksit Bharat @2047 vision to enhance India’s automotive innovation, sustainability, and global competitiveness. Therefore, this initiative aims to increase India’s share in global automotive trade through coordinated stakeholder efforts and industry-led advancements. The constant support from the government in enhancing the automotive sector will propel the pentaerythritol demand for automotive coatings, high-performance lubricants, and specialty resins.

Europe Market Insights

Europe pentaerythritol market is primarily shaped by strict environmental policies and sustainability mandates. The region’s green deal and energy efficiency directives, which encourage manufacturers to adopt bio-based and low-carbon pentaerythritol products. In July 2025, CBE JU reported that the European Commission had launched the European Chemicals Industry Action Plan to promote bio-based chemicals to decarbonize and modernize the EU chemical sector. Therefore, the initiatives such as the AFTER-BIOCHEM, SWEETWOODS, and PEFerence projects demonstrate industrial-scale production of bio-based chemicals from non-food biomass and forestry residues by providing sustainable alternatives for coatings, plastics, and lubricants. Hence, such government-backed programs in the region will encourage the adoption of low-carbon, renewable pentaerythritol derivatives, thereby supporting industrial sustainability and regulatory compliance.

The booming industrial sectors and a prime focus on low-carbon manufacturing enhance the adoption of specialty chemical solutions, thereby benefiting the Germany pentaerythritol market. The precision-engineered manufacturing sectors, which are mainly dependent on pentaerythritol derivatives for enhanced durability and thermal stability, also propel the country’s market. On the other hand, strong government incentives for low-carbon processes and chemical recycling are pushing specialty chemical adoption toward sustainable alternatives. In addition, the country is focused mainly on circular economy principles, which have accelerated demand for bio-based and energy-efficient polyol intermediates. Collaborative initiatives between chemical manufacturers and research institutions are fostering continued innovation by creating customized pentaerythritol solutions.

In the UK, the pentaerythritol market is positively influenced by green construction standards, renewable energy adoption, food contact uses, and protective coatings for infrastructure projects. Simultaneously, there has been a growing interest in sustainable, waterborne, and low-VOC resin technologies for both commercial and residential sectors, which supports market growth in coatings and adhesives. As of 2025, data from assimilated EU regulation (EU) No 10/2011, acids, fatty (C8–C22), esters with pentaerythritol FCM substance No. 880; EEC ref. No. 31348 is approved for use in food-contact materials in England, Scotland, and Wales. It also states that the substance is permitted as an additive or polymer production aid, with no specific migration limit, restrictions, or FRF applicable. Therefore, such administrative support boosts the country’s pentaerythritol industry by providing clear regulatory approval for food-contact uses, enabling continued manufacturing, import, and commercial certainty for downstream industries.