Pentaerythritol Market Outlook:

Pentaerythritol Market size was valued at USD 4.1 billion in 2025 and is projected to reach USD 111.9 billion by the end of 2035, rising at a CAGR of 44.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pentaerythritol is assessed at USD 5.9 billion.

The global pentaerythritol market is entering into an extensive pace of growth owing to its vital role as a raw material in industries such as paints and coatings, automotive, construction, and pharmaceuticals. Its chemical properties make it essential for producing alkyd resins, radiation-cured coatings, and advanced lubricants, which are seeing rising adoption across manufacturing and infrastructure sectors. In this context, WITS trade data suggests that in 2023, the worldwide pentaerythritol trade represented concentrated activity amongst a set of major importing countries, reflecting the presence of constant industrial demand. It was observed that the U.S. was the largest importer of pentaerythritol, bringing in approximately 24,228,300 kg which was valued at USD 55,632.69 K whereas Italy closely followed with imports valued at USD 52,862.25 K, and the European Union made imports of 14,817,500 kg valued at USD 25,054.22 K. Therefore, these figures illustrate the geographic spread of demand across North America, Europe, and Asia Pacific.

Pentaerythritol Imports by Major Economies, 2023

|

Importing Country / Region |

Trade Value (USD ‘000) |

Import Quantity (Kg) |

|

U.S. |

55,632.69 |

24,228,300 |

|

Italy |

52,862.25 |

- |

|

India |

32,042.73 |

23,174,000 |

|

European Union |

25,054.22 |

14,817,500 |

|

United Kingdom |

15,501.92 |

6,393,350 |

|

Mexico |

14,509.41 |

6,317,540 |

|

Korea, Rep. |

14,129.13 |

- |

|

Japan |

12,265.32 |

- |

|

China |

11,720.44 |

7,160,600 |

|

Germany |

10,727.18 |

5,670,790 |

|

Portugal |

10,095.61 |

5,913,600 |

|

Brazil |

10,084.71 |

6,754,770 |

Source: WITS

Furthermore, the pentaerythritol market continues to progress with increased demand, encouraging both national and international players to maintain value-based pricing. FRED reported that the Producer Price Index (PPI) for chemicals and allied products, industrial chemicals (WPU061), reflects sustained pricing momentum across the industrial chemicals segment. According to officially reported U.S. government data, the index reached 292.560 in November 2025, indicating that producer-level prices are nearly three times higher than when compared to the baseline four decades previous. From a strategic perspective, the elevated index level signals continued cost pass-through pressures across upstream chemical intermediates that depend on industrial chemical inputs. Therefore, to address exceptional demand, Perstorp stated that it will implement a global price increase of up to 100% on its Di-Pentaerythritol portfolio, which will be effective January 1, 2026, or as contractually permitted.

Key Pentaerythritol Market Insights Summary:

Regional Highlights:

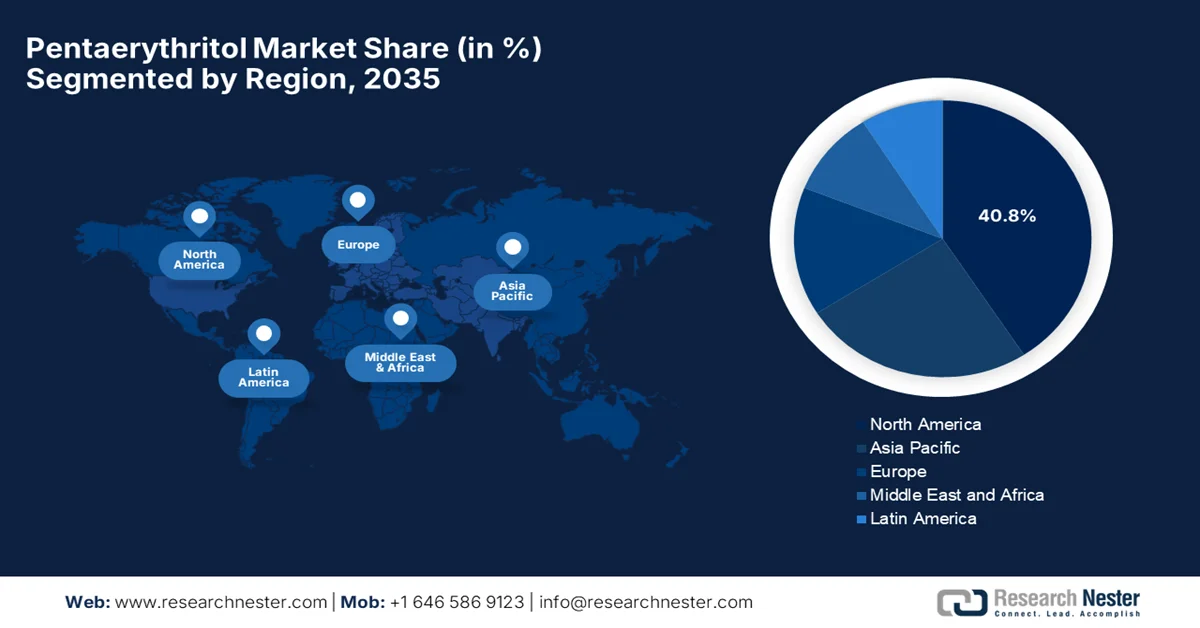

- North America is projected to dominate the pentaerythritol Market, capturing around 40.8% share by 2035, supported by robust demand from construction and lubricant applications alongside regulatory-led advancement of compliant, low-VOC chemical manufacturing.

- Asia Pacific is anticipated to emerge as the fastest-growing region during the forecast period toward 2035, fueled by rapid industrialization, large-scale infrastructure development, and rising automotive production driving higher consumption of durable coatings and synthetic lubricants.

Segment Insights:

- Mono pentaerythritol is projected to account for the largest revenue share of 45.6% by 2035 in the pentaerythritol Market, reflecting its strong penetration across resins, lubricants, plasticizers, and advanced formulations, underpinned by expanding demand for eco-friendly and high-performance industrial materials.

- Paints & Coatings as an application subsegment is expected to register considerable growth by 2035, supported by the extensive use of pentaerythritol in alkyd resin–based formulations aligned with rising adoption of low-VOC and sustainable coating solutions.

Key Growth Trends:

- Strong demand in coatings & paints

- Construction and urbanization

Major Challenges:

- Dependence on end use industry cyclicality

- Limited product differentiation in commodity grades

Key Players: Perstorp Holding AB (Sweden), Ercros S.A. (Spain), Celanese Corporation (U.S.), Evonik Industries AG (Germany), Mitsui Chemicals, Inc. (Japan), U-Jin Chemical Co., Ltd. (South Korea), Kanoria Chemicals & Industries Ltd. (India), Hubei Yihua Group Co., Ltd. (China), Yunnan Yuntianhua Co., Ltd. (China), Henan Pengcheng Group (China), Liyang Ruiyang Chemical (China), Baoding Guoxiu Chemical Industry (China), LCY Chemical Corp. (Taiwan), Samyang Corp. (South Korea), Copenor (Brazil), Zarja Chemical (Russia), MKS Marmara Entegre Kimya (Turkey), BASF SE (Germany), Exxon Mobil Corporation (U.S.), Hexion Inc. (U.S.)

Global Pentaerythritol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.1 billion

- 2026 Market Size: USD 5.9 billion

- Projected Market Size: USD 111.9 billion by 2035

- Growth Forecasts: 44.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Saudi Arabia, Australia

Last updated on : 6 February, 2026

Pentaerythritol Market - Growth Drivers and Challenges

Growth Drivers

- Strong demand in coatings & paints: This is the main driving factor for the expansion of the pentaerythritol market since it is the primary raw material for alkyd resins, which are highly essential in paints and coatings used in various applications. In addition, its ability to improve durability, gloss, adhesion, and weather resistance makes it highly preferred, especially as the global coatings sector is readily expanding. In this context, the American Coatings Association stated that from 2023 to 2025, the U.S. paint and coatings industry witnessed modest growth, wherein the volume increased by an estimated 2.6% in 2024 and 2.3% in 2025, and value rose to 5.3%, reflecting recovery from supply chain disruptions that had existed. Therefore, the presence of this stable demand in coatings supports strong consumption of alkyd resins, and consequently, pentaerythritol as a key raw material.

- Construction and urbanization: Rapid infrastructure progression, especially in terms of emerging economies, is effectively boosting demand for construction chemicals such as sealants, adhesives, and weather-resistant coatings, all of which are majorly dependent on pentaerythritol. As per the article published by the government of India in February 2025, the country’s infrastructure development has accelerated through exclusive programs such as PM Gati Shakti, Bharatmala Pariyojana, and the Smart Cities Mission, thereby driving record investments and connectivity improvements. It also mentioned that national highways expanded at an extensive pace, aviation capacity nearly doubled, and ports and shipping efficiency improved. In addition, urban housing and sanitation programs further strengthened India’s growth trajectory, signaling a huge growth potential for the pentaerythritol market.

- Trade flows in the international landscape: The huge demand in different sectors has led to significant trade flows, efficiently driving business in the pentaerythritol market. World Integrated Trade Solution reported that in 2023, the international pentaerythritol trade was led by China, which dominated exports with a total worth of USD 105,999.85K worth of shipments totaling 68,934,000 kg, and it was followed by Germany at USD 51,618.67K and 22,643,600 kg. On the other hand, nes contributed significantly with USD 40,551.27K and 28,824,000 kg, whereas the European Union exported USD 36,749.11K and 15,164,900 kg. Furthermore, this demand highlights the strategic importance of Asia and Europe in the global supply chain, hence fueling cross-border trade in pentaerythritol.

Pentaerythritol Exports by Major Economies, 2023

|

Country / Region |

Export Value (USD 1000) |

Quantity (Kg) |

|

Saudi Arabia |

21,660.12 |

14,605,600 |

|

U.S. |

7,391.34 |

2,595,670 |

|

India |

5,611.11 |

1,937,710 |

|

Netherlands |

2,921.41 |

1,401,800 |

|

Belgium |

1,797.70 |

1,019,630 |

|

Romania |

703.45 |

430,248 |

|

Korea, Rep. |

436.37 |

203,912 |

|

United Arab Emirates |

358.68 |

227,451 |

|

Brazil |

263.52 |

150,000 |

|

Malaysia |

185.62 |

134,316 |

|

Poland |

163.43 |

40,786 |

|

Japan |

127.15 |

21,819 |

|

Peru |

112.60 |

40,000 |

|

Denmark |

83.19 |

25,020 |

|

Kuwait |

72.75 |

17,000 |

|

Austria |

51.11 |

24,596 |

Source: WITS

Challenges

- Dependence on end use industry cyclicality: The demand for pentaerythritol is mainly associated with cyclical end use industries such as construction, automotive, paints and coatings, and lubricants. Therefore, the aspects of economic shutdowns, reduced infrastructural spending, and any type of downturn in automotive production can negatively impact consumption levels. For example, any slowdown in terms of construction activity directly affects alkyd resin and coating demand, leading to inventory buildup and pricing pressure. Hence, the presence of this cyclical exposure creates demand uncertainty and revenue volatility for producers. In addition, manufacturers need to diversify applications or geographic exposure to mitigate risk, which in turn necessitates R&D investment and pentaerythritol market development efforts.

- Limited product differentiation in commodity grades: This is yet another hurdle for pentaerythritol market expansion since standard-grade pentaerythritol is most likely viewed as a commodity, with limited scope for differentiation based on performance alone. This leads to competition primarily on price and scale efficiency. In such a landscape, producers find it very difficult to maintain margins unless they achieve cost leadership or backward integration. The aspect of specialty and high-purity grades offers better margins, but they require advanced technology and strong customer relationships. Therefore, this lack of differentiation increases vulnerability to low-cost producers and heightens the impact of pentaerythritol market downturns.

Pentaerythritol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

44.4% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 111.9 billion |

|

Regional Scope |

|

Pentaerythritol Market Segmentation:

Product Type Segment Analysis

Mono‑pentaerythritol is expected to be the dominant product type, capturing the largest revenue share of 45.6% in the pentaerythritol market, facilitated by its broad application versatility, particularly in resins, lubricants, and plasticizers. Besides, its chemical structure allows for excellent thermal stability and reactivity, making it suitable for high-performance alkyd resins as well as synthetic lubricants. On the other hand, the heightened demand for eco-friendly and high-efficiency coatings solidifies its adoption across more industrial sectors. Furthermore, the subtype’s flexibility in formulating advanced adhesives, sealants, and polyurethane derivatives favors a continued strong demand in both emerging and developed pentaerythritol markets.

Application Segment Analysis

By the conclusion of 2035, the paints & coatings subsegment, which is a part of the application, is anticipated to grow at a considerable rate in the pentaerythritol market. The growth of the subtype is mainly attributable to its central role in alkyd resin production, which makes it essential for paints and coatings used in construction and automotive finishes. In addition, the governments in developed nations have enforced low‑VOC and eco-friendly formulations that include pentaerythritol-based resins, supporting the continued growth of the segment. In February 2024, Arkema reported that it showcased its sustainable paint and coating technologies at Paint India by highlighting low-VOC and bio-based alkyd resins that enhance performance by significantly reducing environmental impact. The company’s Navi Mumbai facility supports waterborne, high-solid, and UV/LED/EB coating solutions with a prime focus on circularity and energy efficiency. Hence, the presence of such continued innovations demonstrates the growing adoption of eco-friendly, pentaerythritol-based resins in construction as well as industrial coatings.

End use Segment Analysis

The automotive is predicted to capture a significant share in the pentaerythritol market. The automotive industry’s expanding demand for high-performance lubricants, flame retardants, and protective coatings is the key factor driving this leadership. The aspect of vehicle production continues to grow internationally, wherein this end‑use remains the most prominent revenue contributor. BASF Coatings in November 2025 reported that it has commissioned an automotive OEM coatings plant in Germany, which is especially designed to produce high-demand color products with consistent quality and efficiency. Besides this facility leverages advanced automation to enhance sustainability and reduce CO₂ emissions, saving around 4,000 tonnes on a yearly basis. Hence, the continued investments from global players position the subtype as the gold standard to generate revenue in the upcoming years.Top of Form

Our in-depth analysis of the pentaerythritol market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pentaerythritol Market - Regional Analysis

North America Market Insights

During the forecast period, the North America pentaerythritol market is forecasted to evolve as a dominant region capturing around 40.8%. The region’s progress in this field is mainly propelled by the heightened demand for construction and lubricants. In addition, the region’s strong emphasis on sustainable manufacturing promotes innovation in high-purity derivatives. In February 2024, the U.S. Environmental Protection Agency reported that it has finalized amendments to the 2018 TSCA Fees Rule to strengthen chemical safety reviews and make sure for better public health protections. Besides, the changes allow EPA to recover 25% of authorized implementation costs, improving efficiency and resource allocation for chemical evaluations. Total program cost estimates were reduced by 19% to USD 146.8 million, with fees for EPA-initiated risk evaluations lowered from USD 5.1 million to USD 4.3 million and new chemical submission reviews from USD 45,000 to USD 37,000. Therefore, the presence of such measures facilitates the introduction of high-performance, low-VOC resins and coatings by promoting compliance in the chemical industry.

The U.S. pentaerythritol market is growing significantly, mainly attributable to the robust automotive and aerospace industries, where pentaerythritol-based resins play a highly essential role for high-performance lubricants, flame retardants, and protective coatings. Also, the aspect of federal initiatives is proactively promoting sustainable manufacturing and industrial decarbonization, which enhances adoption in chemical formulations. In January 2025, the U.S. Environmental Protection Agency stated that it had finalized amendments to the National Volatile Organic Compound (VOC) Emission Standards for Aerosol Coatings to improve consistency with state regulations, such as California’s CARB. Besides, it covers approximately 46 regulated sources, including major manufacturers and distributors. The amendments aim to reduce ozone formation by encouraging the use of less reactive VOC ingredients, hence supporting the industry’s shift toward sustainable, low-VOC coatings.

The construction and infrastructure sectors, particularly in terms of durable coatings and protective materials for extreme climatic conditions, are responsibly creating a beneficial business ecosystem for the pentaerythritol market in Canada. The government-backed energy efficiency programs efficiently encourage the adoption of thermally stable resin solutions, supporting sustainable urban development projects. Based on the government data of the country in 2023, Canada’s pentaerythritol imports totaled CAD 2.29 million, wherein there has been a high market concentration among a few players. It also mentioned that the three importers accounted for 52.11% of the value, whereas the top eight importers represented 80.22% of total imports. Major companies included Cloverdale Paint Inc. (Surrey, BC), DKSH Canada Corp. (Toronto, ON), and Polynt Coatings Canada Limited (Port Moody, BC), among others. Therefore, the import landscape in the country emphasizes both domestic and cross-border sourcing for chemical manufacturing in Canada.

APAC Market Insights

The Asia Pacific pentaerythritol market is expected to register the fastest growth, influenced by factors such as industrialization, urban development, and large-scale infrastructure projects. The ongoing construction boom has particularly increased the need for durable, weather-resistant coatings, leveraging polyol’s compatibility with alkyd resins and powder coatings. Meanwhile, the region’s expanding automotive sector, influenced by the rising vehicle production, supports higher consumption of synthetic lubricants and polyol-based intermediates. In this regard, in March 2025, PPG reported that it had inaugurated a waterborne automotive coatings plant in Samut Prakan, Thailand, with an annual capacity of 2,000 tons, and it is aimed at meeting the rising demand for sustainable coatings in Southeast Asia. It also mentioned that the facility includes an automated spray center to enhance service capabilities, hence increasing the growth potential for the pentaerythritol industry.

The strong chemical manufacturing hub and surging export infrastructure drives growth of the China pentaerythritol market. Government policies in the country are proactively encouraging chemical standardization and production facilities, which drive high-volume industrial applications, particularly in terms of coatings, plastics, and industrial lubricants. In September 2025, the country’s government reported that it is proactively supporting the growth of the petrochemical industry through the work plan for stabilizing growth in the petrochemical industry 2025 to 2026, which aims to enhance high-end chemical production, technological innovation, and digital transformation. In addition, the plan promotes upgrading traditional products such as coatings, resins, and fine chemicals by also expanding domestic and international demand, thereby boosting production capabilities for materials such as pentaerythritol.

The large-scale urbanization, infrastructure projects, and the construction of smart cities are fueling the expansion of the pentaerythritol market in India. Also, the government’s initiatives for eco-friendly paints and low-VOC coatings, coupled with rapid automotive and industrial growth, create a heightened demand base for resins, adhesives, and surface treatment solutions. The Ministry of Heavy Industries in July 2025 announced that it has launched the Automotive Mission Plan 2047 (AMP 2047) under the Viksit Bharat @2047 vision to enhance India’s automotive innovation, sustainability, and global competitiveness. Therefore, this initiative aims to increase India’s share in global automotive trade through coordinated stakeholder efforts and industry-led advancements. The constant support from the government in enhancing the automotive sector will propel the pentaerythritol demand for automotive coatings, high-performance lubricants, and specialty resins.

Europe Market Insights

Europe pentaerythritol market is primarily shaped by strict environmental policies and sustainability mandates. The region’s green deal and energy efficiency directives, which encourage manufacturers to adopt bio-based and low-carbon pentaerythritol products. In July 2025, CBE JU reported that the European Commission had launched the European Chemicals Industry Action Plan to promote bio-based chemicals to decarbonize and modernize the EU chemical sector. Therefore, the initiatives such as the AFTER-BIOCHEM, SWEETWOODS, and PEFerence projects demonstrate industrial-scale production of bio-based chemicals from non-food biomass and forestry residues by providing sustainable alternatives for coatings, plastics, and lubricants. Hence, such government-backed programs in the region will encourage the adoption of low-carbon, renewable pentaerythritol derivatives, thereby supporting industrial sustainability and regulatory compliance.

The booming industrial sectors and a prime focus on low-carbon manufacturing enhance the adoption of specialty chemical solutions, thereby benefiting the Germany pentaerythritol market. The precision-engineered manufacturing sectors, which are mainly dependent on pentaerythritol derivatives for enhanced durability and thermal stability, also propel the country’s market. On the other hand, strong government incentives for low-carbon processes and chemical recycling are pushing specialty chemical adoption toward sustainable alternatives. In addition, the country is focused mainly on circular economy principles, which have accelerated demand for bio-based and energy-efficient polyol intermediates. Collaborative initiatives between chemical manufacturers and research institutions are fostering continued innovation by creating customized pentaerythritol solutions.

In the UK, the pentaerythritol market is positively influenced by green construction standards, renewable energy adoption, food contact uses, and protective coatings for infrastructure projects. Simultaneously, there has been a growing interest in sustainable, waterborne, and low-VOC resin technologies for both commercial and residential sectors, which supports market growth in coatings and adhesives. As of 2025, data from assimilated EU regulation (EU) No 10/2011, acids, fatty (C8–C22), esters with pentaerythritol FCM substance No. 880; EEC ref. No. 31348 is approved for use in food-contact materials in England, Scotland, and Wales. It also states that the substance is permitted as an additive or polymer production aid, with no specific migration limit, restrictions, or FRF applicable. Therefore, such administrative support boosts the country’s pentaerythritol industry by providing clear regulatory approval for food-contact uses, enabling continued manufacturing, import, and commercial certainty for downstream industries.

Key Pentaerythritol Market Players:

- Perstorp Holding AB (Sweden)

- Ercros S.A. (Spain)

- Celanese Corporation (U.S.)

- Evonik Industries AG (Germany)

- Mitsui Chemicals, Inc. (Japan)

- U-Jin Chemical Co., Ltd. (South Korea)

- Kanoria Chemicals & Industries Ltd. (India)

- Hubei Yihua Group Co., Ltd. (China)

- Yunnan Yuntianhua Co., Ltd. (China)

- Henan Pengcheng Group (China)

- Liyang Ruiyang Chemical (China)

- Baoding Guoxiu Chemical Industry (China)

- LCY Chemical Corp. (Taiwan)

- Samyang Corp. (South Korea)

- Copenor (Brazil)

- Zarja Chemical (Russia)

- MKS Marmara Entegre Kimya (Turkey)

- BASF SE (Germany)

- Exxon Mobil Corporation (U.S.)

- Hexion Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Perstorp Holding AB is recognized as the market leader in pentaerythritol production. The company has built its reputation on an enhanced product portfolio and strong R&D capabilities, particularly in high-purity and specialty grades for paints, coatings, and lubricants. In addition, Perstorp also continues to expand production capacity in Europe and the Asia Pacific to meet global demand.

- Mitsui Chemicals, Inc. is yet another major player that has a solid global footprint. The company’s strategy revolves around technological innovation and product quality by offering advanced pentaerythritol derivatives, which are used in automotive, construction, and consumer goods industries.

- Celanese Corporation is based in North America and is best known for its integrated chemical manufacturing capabilities and enhanced distribution network. Besides, the company is focused on innovative ester derivatives and high-performance formulations for industrial applications.

- Ercros S.A. is yet another prominent manufacturer of pentaerythritol that has a diversified product range and a strong focus on specialty and technical grade products. The firm deliberately concentrates on expanding production capacity and entering new application segments, such as synthetic lubricants and coatings, which provides it a competitive advantage in regional pentaerythritol markets.

- Hubei Yihua Group Co., Ltd. is one of the largest producers in the Asia‑Pacific that has benefited from cost-competitive production and large-scale operations. The company focuses heavily on technical-grade pentaerythritol for traditional applications such as alkyd resins, and is also expanding into adjacent markets with customized solutions.

Below is the list of some prominent players operating in the global pentaerythritol market:

The global pentaerythritol market hosts large chemical producers who are extensively dominating regional and application-specific segments. Europe and North America-based companies, such as Perstorp Holding AB and Celanese Corporation, are mainly focused on innovation, sustainable production, and capacity expansion. Meanwhile, the pioneers from Asia Pacific, particularly from China, Japan, South Korea, and India, leverage cost-effective production and growing local demand. Geographic expansion and investment in renewable feedstocks are the primary strategies opted for by these players to secure their market positions. In October 2022, PETRONAS Chemicals Group Berhad announced that it had completed the acquisition of Perstorp by making it a wholly-owned subsidiary. The move strengthens Perstorp’s global specialty chemicals position, particularly in the Asia Pacific, in which the initiatives include Project Air, a large-scale green tech program aimed at reducing carbon emissions.

Corporate Landscape of the Pentaerythritol Market:

Recent Developments

- In October 2025, Celanese unveiled new digital services and specialty materials at K 2025 in Düsseldorf, highlighting its AI-based Chemille digital assistant for faster, smarter material selection across industries, including automotive, electronics, medical, and consumer goods.

- In February 2024, Perstorp inaugurated an ISCC Plus-certified Pentaerythritol plant in Sayakha, India, with an annual capacity of 40,000 t Penta and 26,000 t calcium formate. The facility, producing both conventional Penta and renewable-based Voxtar, and it aims to enhance product availability.

- Report ID: 4008

- Published Date: Feb 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pentaerythritol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.