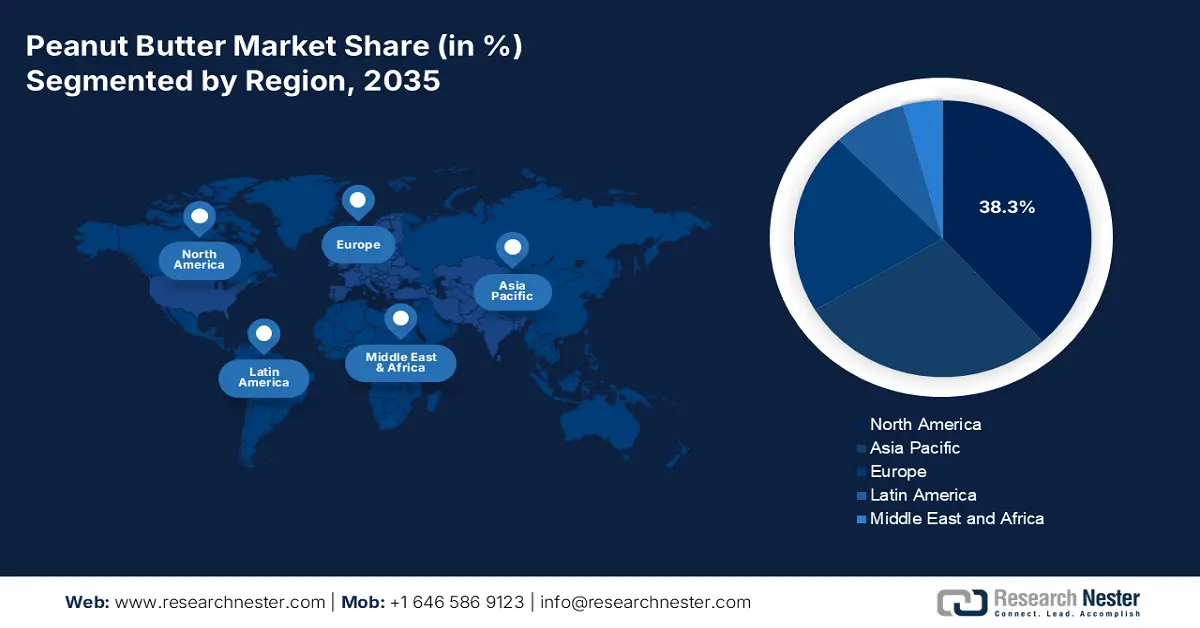

Peanut Butter Market - Regional Analysis

North America Market Insights

North America market is projected to garner the largest share of 38.3% by the end of 2035. The market’s exposure in the region is attributed to the robust need for healthy fats and plant-based protein, the proliferation of functional, reduced-sugar, organic, and natural varieties, and the aspect of brand loyalty. According to an article published by the National Cancer Institute in April 2025, the 2020-2025 Dietary Guidelines for America suggest that consumers need to consume less than 10% of calories from saturated fatty acids. In addition, this particular guideline has also recommended maintaining overall fat intake between 20% and 35%, especially for adults, which in turn is positively impacting the market.

The peanut butter market in the U.S. is growing significantly, owing to the growth of the organic and natural segment, since customers are increasingly focused on clean-label products without added sugars and hydrogenated oils. As per an article published by NLM in June 2022, the country is considered the world’s largest consumer of peanut butter by volume, and 90% of households consume this. Besides, the FDA’s role in maintaining the final determination on partial hydrogenated oils has successfully removed artificial trans-fat. This led to regional brands reformulating traditional food products and escalating the market’s growth.

The peanut butter market in Canada is also growing due to a rising demand for organic as well as non-GMO verified product options, Health Canada’s food guide for selecting food with healthy fats, increased dependency on peanut imports, and a surge in consumer interest. According to the November 2024 Government of Canada article, the nation is allocated a country-based share of 14,500,000 kilograms of tariff rate quota (TRQ), and it is open for peanut butter manufacturing from peanuts that are sourced from any country. In addition, the over-access rate has reached 0% at the beginning of 2025, owing to the manufacturing process is granted duty-free, thereby making it suitable for the market’s upliftment.

Fat Intake 2021-2023 Comparison in North America

|

Fat Type |

Most Recent Estimates |

|

|

Percent of total calories |

95% Confidence Interval |

|

|

Overall |

36.8 |

36.3 to 37.2 |

|

Saturated Fat |

11.9 |

11.7 to 12.2 |

|

Monounsaturated Fat |

12.3 |

12.2 to 12.5 |

|

Polyunsaturated Fat |

8.5 |

8.3 to 8.6 |

Source: National Cancer Institute

Europe Market Insights

Europe in the peanut butter market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is propelled by an upsurge in the integration of plant-specific diets, along with the demand for suitable protein sources, the presence of health-conscious customers, and alignment with regional sustainability and health strategies. According to a data report published by Proveg Organization in February 2024, 38% of the population is presently following a vegetarian diet. Additionally, 40% in Germany is flexitarian, 6% pescatarian in Denmark, 7% vegetarians in the UK, and 5% vegans in Austria, thus bolstering the market’s exposure.

The peanut butter market in the UK is gaining increased importance, owing to the comprehensive integration of wellness and health trends, prolific product advancement, supportive approach for the Food Standards Agency, and the current trend towards veganism. As per an article published by the UK Government in June 2025, the average intake of saturated fats among children between 2019 and 2023 was 12.5%, 12.6% among adults, and 13.7% among adults aged more than 75 years. Therefore, this denotes a huge growth opportunity for the overall market by maintaining the appropriate amount of nutrient intake.

The peanut butter market in Germany is also developing due to the customers’ demand for premium quality, non-GMO, and organic products, the aspect of exhibiting high brand quality, paying for premium products with trusted certifications, such as the Europe Organic Logo, and expansion in discount provision. As stated in the January 2022 Agency Bio Organization data report, the target for organic products in Berlin is 50% as of 2022. Besides, supermarkets have emerged as the ultimate distribution channel, and over 7,000 stores comprise an organic range, thus creating an optimistic outlook for the overall market.

APAC Market Insights

Asia Pacific in the peanut butter market is expected to grow steadily by the end of the stipulated duration. The market’s upliftment in the region is fueled by rapid urbanization, a surge in disposable incomes, integration of West-based dietary trends, the growing awareness regarding peanut butter, and the notable introduction of products that are tailored to localized palates. According to an article published by MDPI in March 2025, more than half a million students from India and over 1 million from China leave their home country. This leads to these children witnessing modifications in their diets, wherein they incorporate dietary habits of the host country, which also uplifts the overall market.

The peanut butter market in China is also gaining increased traction, owing to an upsurge in the middle class, an increase in the familiarity of international food products, guideline provision by the National Health Commission, and the presence of robust marketing, along with expansion in distribution by localized and international brands. According to the November 2024 USDA report, the peanut production in the country boosted to 18.4 MMT as of 2024 and 2025, in comparison to 18.3 MMT in 2023 and 2024. In addition, it is estimated that there has been a 10% increase in peanut planted locations, which is deliberately bolstering the market’s demand in the country.

The peanut butter market in India is also developing due to the existence of the National Institute of Nutrition that functions under the Council of Medical Research to identify the nutritional value of nuts and pulses, along with the government’s strategies to enhance the production of horticultural crops, which include groundnuts. As per an article published by ICRISAT in September 2022, the current groundnut line in the country has been reported to constitute 80.7% of oleic acid, along with 3.6% of linoleic acid. Additionally, the protein content is 26% as well as 51% of oil content, thereby supporting health and boosting the market.