Peanut Butter Market Outlook:

Peanut Butter Market size was over USD 8.3 billion in 2025 and is estimated to reach USD 15.5 billion by the end of 2035, expanding at a CAGR of 7.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of peanut butter is assessed at USD 8.9 billion.

The international market is considered an evolving and dynamic segment in the food industry, gradually shifting from a conventional pantry staple to an innovative, health-conscious, and modernized category. Factors, such as increased focus on health and wellness, premiumization and progression, and ethical and sustainable sourcing, are effectively driving the market’s growth. For instance, according to an article published by the PRS India Organization in March 2025, the Department of Health Research has provided funding of Rs. 3,901 crores. This denotes a 15% rise in overall health expenditure, which constitutes a positive impact on the overall market.

Source: ITA

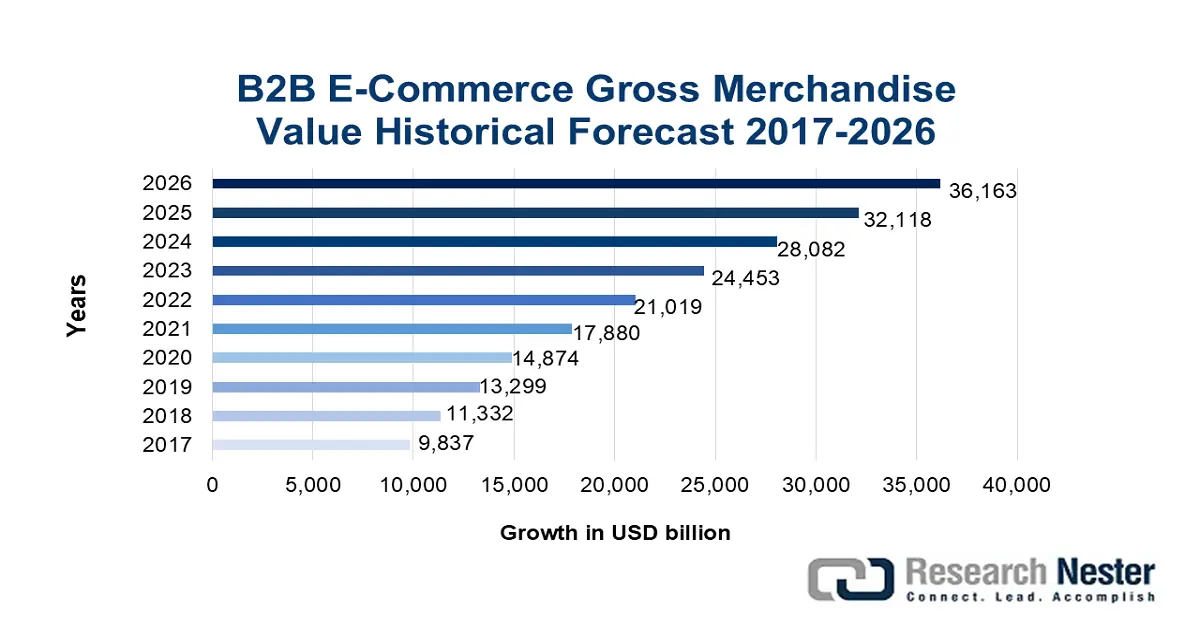

Furthermore, the aspect of consumer awareness, trust, and brand loyalty is also responsible for bolstering the market’s exposure across different nations. In this regard, as per an article published by NLM in October 2024, customers of healthy brands have significantly expressed their respective interest in consuming them and also initiating a purchase of more than 20%, since these brands tend to protect health and improve the overall well-being. Meanwhile, an expansion in direct-to-consumer (DTC) and e-commerce is also uplifting the market globally. As per the 2025 ITA data report, the international B2B e-commerce industry is projected to grow at 14.5% by the end of 2026, thereby making it suitable for enhancing the market’s demand.

Key Peanut Butter Market Insights Summary:

Regional Highlights:

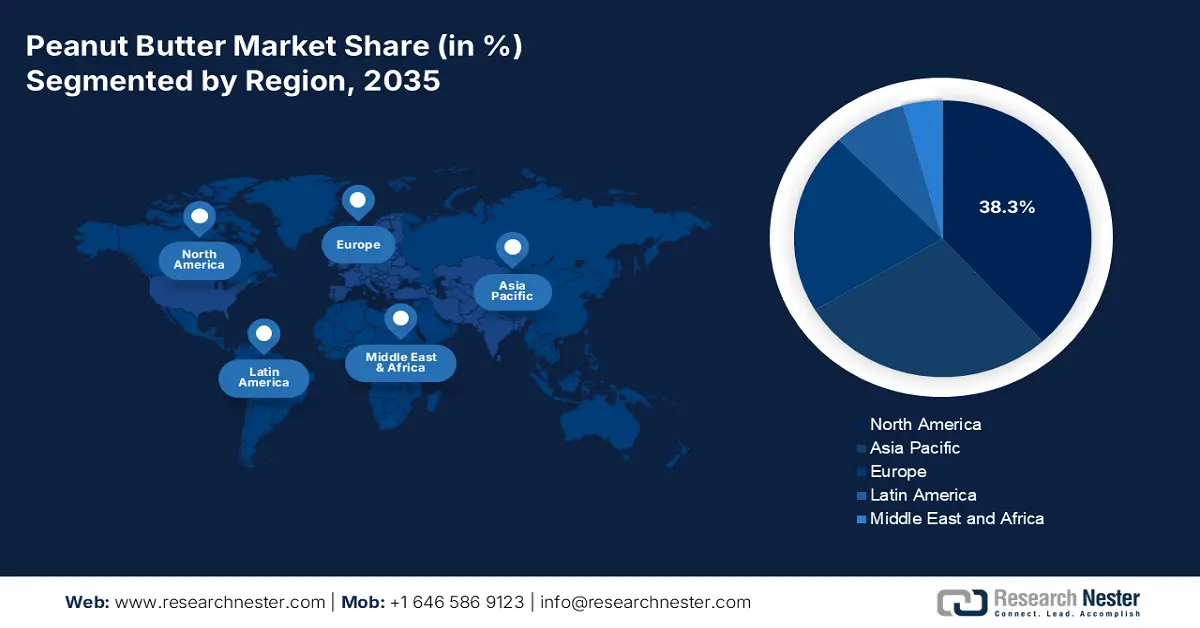

- North America is projected to garner a 38.3% share by 2035 in the peanut butter market as a result of rising preference for healthy fats and plant-based protein.

- Europe is anticipated to emerge as the fastest-growing region through the forecast period owing to the expanding adoption of plant-specific diets and heightened demand for suitable protein sources.

Segment Insights:

- The jars segment is anticipated to secure an 85.8% share of the peanut butter market by 2035 supported by its versatility and strong consumer reliance on nutrient-rich packaged spreads.

- The residential/consumer segment is predicted to obtain the second-highest share during the forecast period propelled by growing demand for convenient, cost-effective, and nutritionally balanced pantry staples.

Key Growth Trends:

- Increase in plant-based diets

- Globalization in food trends

Major Challenges:

- Increased competition from alternative spread options

- Major allergen liability and labeling

Key Players: Hormel Foods Corporation, The Hershey Company, Conagra Brands, Inc., Post Holdings, Inc., B&G Foods, Inc., Unilever PLC, Bega Cheese Limited, Bonne Maman, Dr. Oetker, Algood Food Company, The Kraft Heinz Company, Nuts 'N More, Wild Friends Foods, Once Again Nut Butter, Pic's Peanut Butter, Buddha Brands, Mayver's, Dalli-Werke GmbH & Co. KG, Hain Celestial Group.

Global Peanut Butter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 20 October, 2025

Peanut Butter Market - Growth Drivers and Challenges

Growth Drivers

- Increase in plant-based diets: Peanut butter is considered as a cost-effective source of plant-based protein, and is a primary beneficiary of the growing vegan, vegetarian, and flexitarian population globally. According to an article published by the Journal of the Academy of Nutrition and Dietetics in June 2025, vegetarian dietary practices usually vary from country to country and are projected to be of interest to an estimated 15% of the global population. In case of India, this practice caters to only 4 in 10 people who consider themselves to be vegetarian, thus suitable for uplifting and skyrocketing the market.

- Globalization in food trends: The upliftment of the market readily aligns with the worldwide demand for satiating, convenient, and nutritious food options, which is backed by dietary policies that endorse seeds and nuts as integral parts of a healthy diet. As per a data report published by the UNICEF in August 2025, the nutrition prevalence decreased by 23.2% as of 2024, resulting in a lack of nutrition from 180.4 million in 2012 to 150.2 million in 2024. Besides, the aspect of food wastage and overweight remains constant, with 5.5% in the same year. Therefore, this denotes an increase in the production and commercialization of the market in different countries.

- Product convenient and versatility: The use of peanut butter caters to be included in diet as a smoothie base, baking ingredient, dip, and a spread. This significantly ensures increased utility, hence driving repetitive purchase and development of the market in diversified customer events. As stated in the January 2025 NLM article, the U.S. effectively produces more than 2.5 million tons of peanuts, with over 500,000 tons provided for export purposes. Likewise, Brazil deliberately produces 900,000 tons, of which 420,000 tons are utilized for export. Besides, over 50% of peanuts are used in the production process, which has emerged as an essential part of the country’s food culture.

Global Peanut Butter Standards Uplifting the Market Growth (2022)

|

Specification |

Country or Region |

||

|

U.S. |

Malaysia |

East Africa |

|

|

Minimum peanuts |

90% |

85% |

90% |

|

Maximum lipids |

55% |

55% |

55% |

|

Maximum salt |

1.6% |

2% |

2% |

|

Moisture content |

- |

3% |

2% |

|

Maximum stabilizer |

4% |

5% |

3% |

|

Maximum dextrose |

6% |

- |

- |

Source: NLM

Payer’s Pricing of Different Peanut Butter Types Bolstering the Market Demand (2025)

|

Product Item |

Size |

Retail Pricing |

|

Libby’s Creamy Peanut Butter |

8 oz |

USD 15.1 |

|

Valrico Creamy Peanut Butter |

8 oz |

USD 8.0 |

|

Country Barn Creamy Peanut Butter |

16 oz |

USD 10.9 |

|

Swiss Crunchy Peanut Butter |

17 oz |

USD 15.0 and USD 14.5 |

Source: Consumer Affairs Government

Challenges

- Increased competition from alternative spread options: The market currently operates in an extremely crowded field of seed and nut-based spreads. This leads to facing tough competition from soy, sunflower, cashew, and almond butter internationally. Additionally, the development of these alternatives is readily fueled by different factors, such as the severe need for allergen-free options, superior health advantages, and the desire for variety. Therefore, this competitive pressure has pressured brands to generously initiate investment to successfully defend their innovation and market share, thereby restricting the seamless development of the market.

- Major allergen liability and labeling: Peanuts are considered one of the most severe and common food allergens, which pose a persistent hindrance in the market globally. This has readily necessitated expensive and strict manufacturing protocols to combat cross-contamination and ensure dedicated facilities and production lines. Besides, the aspect of compliance with complicated and various international labeling policies has enhanced operational complexities. The continuous risk of a recall, owing to accidental or mislabeling contamination, displays an effective reputational and financial liability for the overall market.

Peanut Butter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 8.3 billion |

|

Forecast Year Market Size (2035) |

USD 15.5 billion |

|

Regional Scope |

|

Peanut Butter Market Segmentation:

Packaging Segment Analysis

The jars segment in the peanut butter market is anticipated to garner the highest share of 85.8% by the end of 2035. The segment’s exposure is effectively driven by its variability, along with nutritious food source that provides minerals, vitamins, healthy fats, and protein, supporting muscle development, growth, and overall health. According to an article published by the National Peanut Buying Points Association in May 2025, more than 241,920 jars of peanut butter have been shipped for regional humanitarian relief to almost 7 states in the U.S., thereby suitable for bolstering the segment’s growth.

End user Segment Analysis

The residential/consumer segment in the peanut butter market is predicted to account for the second-highest share during the forecast period. The segment’s growth is fueled by its valuation for its cost-effectiveness, sheer convenience, nutritional profile as a plant-specific protein, and status as a household pantry staple. In addition, the growth is further propelled by uplifting customer trends, such as a transition towards wellness and health, which readily enhances the need for reduced, organic, and natural sugar variants. Moreover, its versatility as a key component, cooking ingredient, and spread in snacks has solidified its recurring purchase cycle.

Product Form Segment Analysis

The conventional segment in the peanut butter market is expected to account for the third-largest share by the end of the projected duration. The segment’s exposure is attributed to its high content of standard nutrients that optimize blood sugar management and heart health. As per a data report published by the CBP Organization in December 2024, traditional peanut butter is increasingly supplied to different countries, with a limited quantity of 3,650,000 kg in Argentina, 14,500,000 kg in Canada, 1,600,000 kg in 6 Australia-based nations, and 250,000 kg in other countries, excluding Mexico, which denotes an optimistic outlook for the segment’s development.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Packaging |

|

|

End user |

|

|

Product Form |

|

|

Type |

|

|

Distribution Channel |

|

|

Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Peanut Butter Market - Regional Analysis

North America Market Insights

North America market is projected to garner the largest share of 38.3% by the end of 2035. The market’s exposure in the region is attributed to the robust need for healthy fats and plant-based protein, the proliferation of functional, reduced-sugar, organic, and natural varieties, and the aspect of brand loyalty. According to an article published by the National Cancer Institute in April 2025, the 2020-2025 Dietary Guidelines for America suggest that consumers need to consume less than 10% of calories from saturated fatty acids. In addition, this particular guideline has also recommended maintaining overall fat intake between 20% and 35%, especially for adults, which in turn is positively impacting the market.

The peanut butter market in the U.S. is growing significantly, owing to the growth of the organic and natural segment, since customers are increasingly focused on clean-label products without added sugars and hydrogenated oils. As per an article published by NLM in June 2022, the country is considered the world’s largest consumer of peanut butter by volume, and 90% of households consume this. Besides, the FDA’s role in maintaining the final determination on partial hydrogenated oils has successfully removed artificial trans-fat. This led to regional brands reformulating traditional food products and escalating the market’s growth.

The peanut butter market in Canada is also growing due to a rising demand for organic as well as non-GMO verified product options, Health Canada’s food guide for selecting food with healthy fats, increased dependency on peanut imports, and a surge in consumer interest. According to the November 2024 Government of Canada article, the nation is allocated a country-based share of 14,500,000 kilograms of tariff rate quota (TRQ), and it is open for peanut butter manufacturing from peanuts that are sourced from any country. In addition, the over-access rate has reached 0% at the beginning of 2025, owing to the manufacturing process is granted duty-free, thereby making it suitable for the market’s upliftment.

Fat Intake 2021-2023 Comparison in North America

|

Fat Type |

Most Recent Estimates |

|

|

Percent of total calories |

95% Confidence Interval |

|

|

Overall |

36.8 |

36.3 to 37.2 |

|

Saturated Fat |

11.9 |

11.7 to 12.2 |

|

Monounsaturated Fat |

12.3 |

12.2 to 12.5 |

|

Polyunsaturated Fat |

8.5 |

8.3 to 8.6 |

Source: National Cancer Institute

Europe Market Insights

Europe in the peanut butter market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is propelled by an upsurge in the integration of plant-specific diets, along with the demand for suitable protein sources, the presence of health-conscious customers, and alignment with regional sustainability and health strategies. According to a data report published by Proveg Organization in February 2024, 38% of the population is presently following a vegetarian diet. Additionally, 40% in Germany is flexitarian, 6% pescatarian in Denmark, 7% vegetarians in the UK, and 5% vegans in Austria, thus bolstering the market’s exposure.

The peanut butter market in the UK is gaining increased importance, owing to the comprehensive integration of wellness and health trends, prolific product advancement, supportive approach for the Food Standards Agency, and the current trend towards veganism. As per an article published by the UK Government in June 2025, the average intake of saturated fats among children between 2019 and 2023 was 12.5%, 12.6% among adults, and 13.7% among adults aged more than 75 years. Therefore, this denotes a huge growth opportunity for the overall market by maintaining the appropriate amount of nutrient intake.

The peanut butter market in Germany is also developing due to the customers’ demand for premium quality, non-GMO, and organic products, the aspect of exhibiting high brand quality, paying for premium products with trusted certifications, such as the Europe Organic Logo, and expansion in discount provision. As stated in the January 2022 Agency Bio Organization data report, the target for organic products in Berlin is 50% as of 2022. Besides, supermarkets have emerged as the ultimate distribution channel, and over 7,000 stores comprise an organic range, thus creating an optimistic outlook for the overall market.

APAC Market Insights

Asia Pacific in the peanut butter market is expected to grow steadily by the end of the stipulated duration. The market’s upliftment in the region is fueled by rapid urbanization, a surge in disposable incomes, integration of West-based dietary trends, the growing awareness regarding peanut butter, and the notable introduction of products that are tailored to localized palates. According to an article published by MDPI in March 2025, more than half a million students from India and over 1 million from China leave their home country. This leads to these children witnessing modifications in their diets, wherein they incorporate dietary habits of the host country, which also uplifts the overall market.

The peanut butter market in China is also gaining increased traction, owing to an upsurge in the middle class, an increase in the familiarity of international food products, guideline provision by the National Health Commission, and the presence of robust marketing, along with expansion in distribution by localized and international brands. According to the November 2024 USDA report, the peanut production in the country boosted to 18.4 MMT as of 2024 and 2025, in comparison to 18.3 MMT in 2023 and 2024. In addition, it is estimated that there has been a 10% increase in peanut planted locations, which is deliberately bolstering the market’s demand in the country.

The peanut butter market in India is also developing due to the existence of the National Institute of Nutrition that functions under the Council of Medical Research to identify the nutritional value of nuts and pulses, along with the government’s strategies to enhance the production of horticultural crops, which include groundnuts. As per an article published by ICRISAT in September 2022, the current groundnut line in the country has been reported to constitute 80.7% of oleic acid, along with 3.6% of linoleic acid. Additionally, the protein content is 26% as well as 51% of oil content, thereby supporting health and boosting the market.

Key Peanut Butter Market Players:

- The J.M. Smucker Company (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hormel Foods Corporation (U.S.)

- The Hershey Company (U.S.)

- Conagra Brands, Inc. (U.S.)

- Post Holdings, Inc. (U.S.)

- B&G Foods, Inc. (U.S.)

- Unilever PLC (UK/Netherlands)

- Bega Cheese Limited (Australia)

- Bonne Maman (France)

- Dr. Oetker (Germany)

- Algood Food Company (U.S.)

- The Kraft Heinz Company (U.S.)

- Nuts 'N More (U.S.)

- Wild Friends Foods (U.S.)

- Once Again Nut Butter (U.S.)

- Pic's Peanut Butter (New Zealand)

- Buddha Brands (Canada)

- Mayver's (Australia)

- Dalli-Werke GmbH & Co. KG (Germany)

- Hain Celestial Group (U.S.)

- The J.M. Smucker Company is one of the undisputed market leaders, which has readily commanded the majority of share in the U.S., and its contribution originates from driving customer demand and defining the mass-market taste profile. Besides, according to its 2025 annual report, an estimated 90% of households in the U.S. comprise the firm’s products, denoting more than 127 deliveries to potential customers.

- Hormel Foods Corporation is the ultimate international powerhouse in this industry, and it has tactically extended its market influence by acquiring advanced brands, such as Justin’s. This has permitted the company to capture both premium and mass-market health-conscious segments.

- The Hershey Company effectively holds an outstanding position by adopting strong confectionery equity to successfully cross-promote its Reese’s peanut butter segment. As per its 2024 annual report published in May 2025, the company comprises 20,030 employees internationally, USD 11.2 billion in yearly revenue, and more than 90 brands. Besides, its generous contribution is associated with peanut butter to indulge and capture a loyal consumer base that expands from its well-known candy products.

- Conagra Brands, Inc. is one of the major players, known as the owner of the historic Peter Pan peanut butter brand. The organization readily contributes to the competitive market by maintaining a consistent and significant value-based existence on grocery shelves, constituting to a price-sensitive and broad customer base.

- Post Holdings, Inc. is considered the actual manufacturer of private-label peanut butter for foodservice providers and retail chains. Its involvement in the market caters to effectively supplying a huge volume of product that readily supports and influences the store-brand segment as well as the market availability and pricing.

Here is a list of key players operating in the global market:

The international market is highly fragmented, and is readily characterized by the dominance of certain legacy America-based brands, along with contributions by advanced niche players. Notable organizations, such as Hormel Foods (Skippy) and The J.M. Smucker Company (Jif), are successfully maintaining leadership through massive brand equity, mass-market advertising, and extended distribution. Their ultimate approach is portfolio diversification by reducing sugar and unveiling natural variants to constitute the development of standard brands in the market. For instance, in November 2024, The Hershey Company successfully introduced the latest Reese's Peanut Butter Cups Sugar Cookie and Kit Kat Milk Chocolate Santas, thereby denoting a huge growth opportunity for the market globally.

Corporate Landscape of the Peanut Butter Market:

Recent Developments

- In September 2025, Squarefield, the shareholder of Bredabest, entered into a tactical agreement to sell the company to Natra, with the intention of boosting Natra’s complementary portfolio and international scale in terms of organic peanut butter.

- In April 2025, ITC Limited has successfully acquired Sresta Natural Bioproducts to effectively strengthen its existence in the organic food industry, both in international as well as its regional market.

- In January 2024, Tata Consumer Products declared that it has significantly signed an agreement to acquire 100% of the equity share capital of Organic India, with the objective of extending its target and product portfolio and addressable market in fast-growing margin segments.

- Report ID: 2716

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Peanut Butter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.