Pallet Market Outlook:

Pallet Market size was over USD 83.46 billion in 2025 and is anticipated to cross USD 141.22 billion by 2035, witnessing more than 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pallet is assessed at USD 87.52 billion.

The growth of the market is significantly attributed to the growing demand for reliable packaging solutions around the globe. The increased use of commodities from this sector in bulk packaging to keep the products in position is making them an essential tool in the specified industry. Moreover, the enlarging international trade of various products, such as dairy, cosmetics, chemicals, and electronic goods, is also creating a surge for safe packaging solutions, which, in turn, is predicted to boost this sector. For instance, the worldwide business of electrical machinery and electronics surpassed USD 3.3 trillion in 2023, exhibiting an annual growth rate of 4.1% over the past 5 years (OEC).

Similarly, the United Nations calculated the size of globalized trading to account for approximately USD 33 trillion in 2024, up by USD 1 trillion from 2023. It also projected the net annual rate of hike to be 3.3%, driven by a 7% and 2% rise in services and goods, respectively. Furthermore, the magnified focus on packaged product handling, transporting, and storing is thriving for efficiency and quality maintenance, obtaining a steady inclusion and utility of offerings from the pallet market. Particularly, the specific needs for attaining safety, hygiene, and compliance in the food & beverages and pharmaceutical merchandise highly depend on this sector, fostering a continuous demand.

Key Pallet Market Insights Summary:

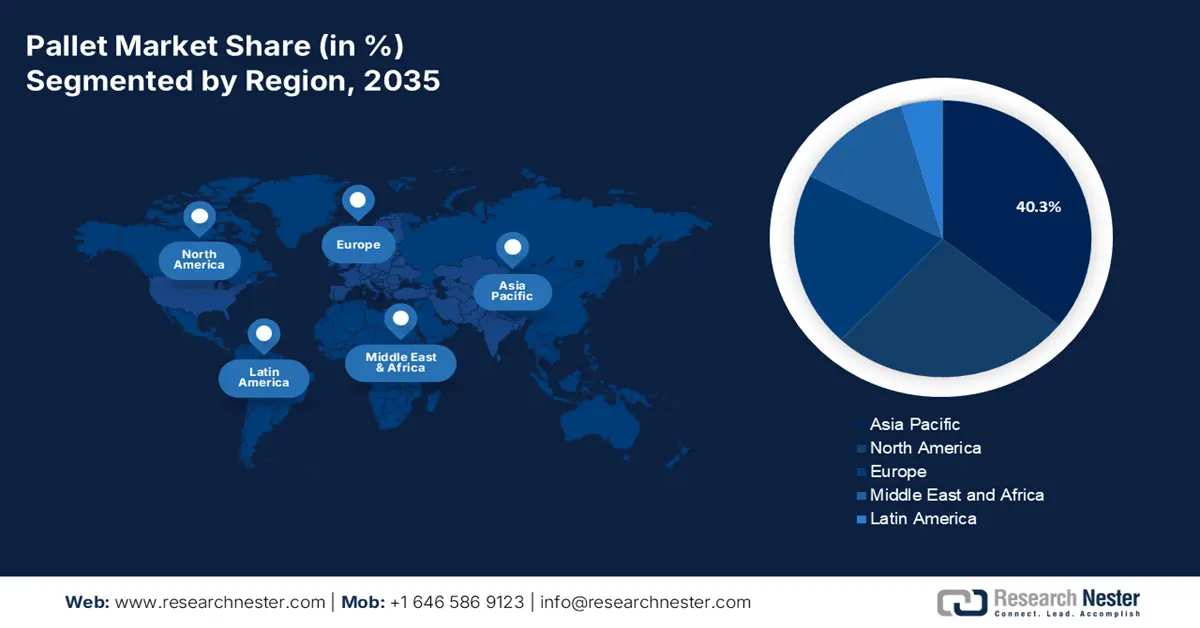

Regional Highlights:

- The Asia Pacific pallet market is projected to capture a 40.3% share by 2035, driven by the accelerating manufacturing capacity of emerging economies and increasing e-commerce activities.

- The North America market is expected to achieve considerable shrare of 25% during 2026-2035, driven by the increasing import-export of products and demand for packaged or instant food.

Segment Insights:

- The food & beverages segment is expected to secure the largest share by 2035, influenced by rapid globalization and continuous expansion of the food & beverages sector.

- The plastic segment in the pallet market is projected to hold the largest share by 2035, propelled by the easy availability of raw materials and high recycling success rate.

Key Growth Trends:

- Global expansion of the e-commerce industry

- Direct and associated impact of advanced technology

Major Challenges:

- Volatility in production cost and quality

Key Players: Totre Industries; Palcon LLC; Shur-way Group Inc.; FCA, LLC Coxco, Inc.; Brambles Ltd (CHEP); PalletOne Inc.; Rowlinsons Packaging Ltd.; Pilco Storage Systems Private Limited; CABKA Group; PalletTrader.

Global Pallet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.46 billion

- 2026 Market Size: USD 87.52 billion

- Projected Market Size: USD 141.22 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Pallet Market Growth Drivers and Challenges:

Growth Drivers

- Global expansion of the e-commerce industry: The rapid penetration of online retailing in global trade demands large-scale warehousing and logistics solutions, fueling a surge in the pallet market. According to the International Trade Administration, after 2020, over 90% of worldwide business-to-business (B2B) companies converted their sales model into a virtual system. Further, the e-commerce sale value of this category is projected to touch USD 36 trillion by 2026 with a notable CAGR of 14.5%. Subsequently, the investments in this sector are intensifying due to the contribution of the pallets to optimize the whole e-commerce product handling operation.

- Direct and associated impact of advanced technology: Besides the sales channel, the wave of digitalization has also revolutionized efficiency in storage and import & export. Specifically, the introduction of AI is enhancing the capabilities of both the warehousing and logistics industries, creating a larger consumer base for the pallet market by automating storage and retrieval systems. For instance, in October 2024, Pallet raised a series A funding of USD 18 million from a consortium of Bain Capital Ventures, Bessemer Venture Partners, and Activant Capital. This investment was dedicated to building an all-in-one AI-based transportation and warehouse management system.

Challenges

- Volatility in production cost and quality: Fluctuations in pricing and supply of raw materials, such as wood, plastic, and metal, significantly impact the cost per product in the pallet market. In addition, the accumulative hurdles related to their recyclability and durability often create compliance issues for manufacturers. Thus, the difficulties in waste management and quality assurance may add up to the overall budget of the customers, discouraging them from investing in this sector. Furthermore, the lack of universal standardization may magnify the complications in proper utilization and production output, highlighting the limitations of pallets as a business asset.

Pallet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 83.46 billion |

|

Forecast Year Market Size (2035) |

USD 141.22 billion |

|

Regional Scope |

|

Pallet Market Segmentation:

Material Segment Analysis

The plastic segment is anticipated to hold the largest share of the pallet market throughout the discussed timeline. The easy availability of raw materials, along with the high success rate in recycling, is mitigating some of the major challenging factors in this sector. Additionally, their endurance in hot and humid climatic conditions makes them a perfect option for long-term use, attracting a majority of both customers and pioneers to invest in plastic pallets. Furthermore, recent innovations in product features and manufacturing methods are encouraging more engagement from investors in this segment. For instance, in August 2024, Chuan Lih Fa (CLF) Machinery Works developed a Two Platen Injection Molding Machine, producing 11 kg plastic pallets in just 86 seconds.

End user Industry Segment Analysis

The food & beverages segment is expected to establish its significance in generating greater revenue from the pallet market by 2035. The rapid globalization of this sector in recent years and continuous expansion are contributing to its leadership over other sub-categories. This can be testified by the report from OEC, which calculated the value of foodstuffs merchandise around the globe to be USD 806 billion in 2023, showcasing a 4.4% increment from 2022. It also valued the global business of sweetened or flavored beverages at USD 14.9 billion in the same year with a 4.9% rise from 2022. These figures, coupled with the growing popularity of instant food, are indicating a steady in-flow of cash in this segment.

Our in-depth analysis of the global pallet market includes the following segments:

|

Type |

|

|

Material |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pallet Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 40.3% market share by 2035. The accelerating manufacturing capacity of emerging economies, such as India, China, Japan, and South Korea, is playing a crucial role in the region’s propagation. In addition, its projected captivity in the global B2B e-commerce industry by 2026, accounting for 80%, is also driving growth in this category (International Trade Administration). Moreover, the developing countries in APAC, including India and China, are becoming the world’s production hub of pharmaceuticals and electronics, heightening the urge for hygienic and durable pallet solutions.

China ranked 1st in exporting electrical machinery and electronics globally in 2023, with a value of USD 1 trillion. The country also secured one of the leading positions in importing these goods during the same timeline, accounting for USD 353 billion: OEC. Additionally, the country also acquired 30% of the total worldwide cross-border e-commerce purchases in 2020 (International Trade Administration). The introduction of advanced technologies for producing, utilizing, and managing pallets is also solidifying the regional and global leadership of China pallet market over other nations. On this note, in March 2025, the European Pallet Association e.V. (EPAL) announced the official launch of a web-based pallet management software application, EPAL Pallet, in China.

North American Market Insights

The pallet market in North America is estimated to hold a substantial share of 25% by the end of 2035. The increasing import-export of products, such as pharmaceuticals, electronics, and cosmetics, across the region is garnering a large consumer base for this segment. For instance, in 2024, the United Nations observed a 4% and 2% yearly rise in U.S. merchandise imports and exports, respectively. In addition, the continuously magnifying utilization and demand for packaged or instant food in North America is also augmenting its progress in this sector.

Several driving factors, including the emphasized food & beverages industry, steady growth in online retailing, and product innovation, are stimulating the U.S. pallet market to establish greater revenue and profit margins. For instance, this country was the largest importer and exporter of foodstuffs in 2023, securing values of USD 57.7 billion and USD 98.4 billion, respectively: OEC. Simultaneously, in 2024, the total value of e-commerce sales in this country accounted for USD 1,192.6 billion, presenting an 8.1% increase from the previous year (the U.S. Census Bureau). Similarly, in February 2023, PECO Pallet partnered with Optilogic to optimize and model pallet depot operations. This collaboration allowed the company to possess and upgrade Optilogic’s advanced modeling and cost analysis tools.

Pallet Market Players:

- Totre Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palcon LLC

- Shur-way Group Inc.

- FCA, LLC

- Coxco, Inc.

- Brambles Ltd (CHEP)

- PalletOne Inc.

- Rowlinsons Packaging Ltd.

- Pilco Storage Systems Private Limited.

- CABKA Group

- PalletTrader

The pallet market is gaining remarkable traction with the creative production and utilization pathways, introduced by key players. They are continuously working to introduce more cost-effective and durable products, expanding the sector’s pipeline. For instance, in October 2024, IFCO leveraged its portfolio of reusable plastic pallets by unveiling Nestor at the Fruit Attraction in Madrid. The innovative lightweight design of this model is crafted to deliver greater stability with the potential to endure up to 1000 kg of product while contributing to carbon footprint reduction. Such innovations are inspiring other competitors to invest more in R&D, securing wide acceptance through a broader range of options. Such key players are:

Recent Developments

- In June 2024, PalletOne commenced an automated pallet assembly machine redeployment program to serve nationwide customers with enhanced products. This initiative was intended to escalate its coast-to-coast expansion as UFP Packaging’s premier wood pallet builder.

- In March 2024, PalletTrader partnered with PopCapacity to streamline and simplify pallet procurement for businesses of all sizes. Their strategic alliance aimed at cultivating innovations to reduce transportation costs and eliminate complexity by identifying warehouse capacity convenient to operations.

- Report ID: 118

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pallet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.