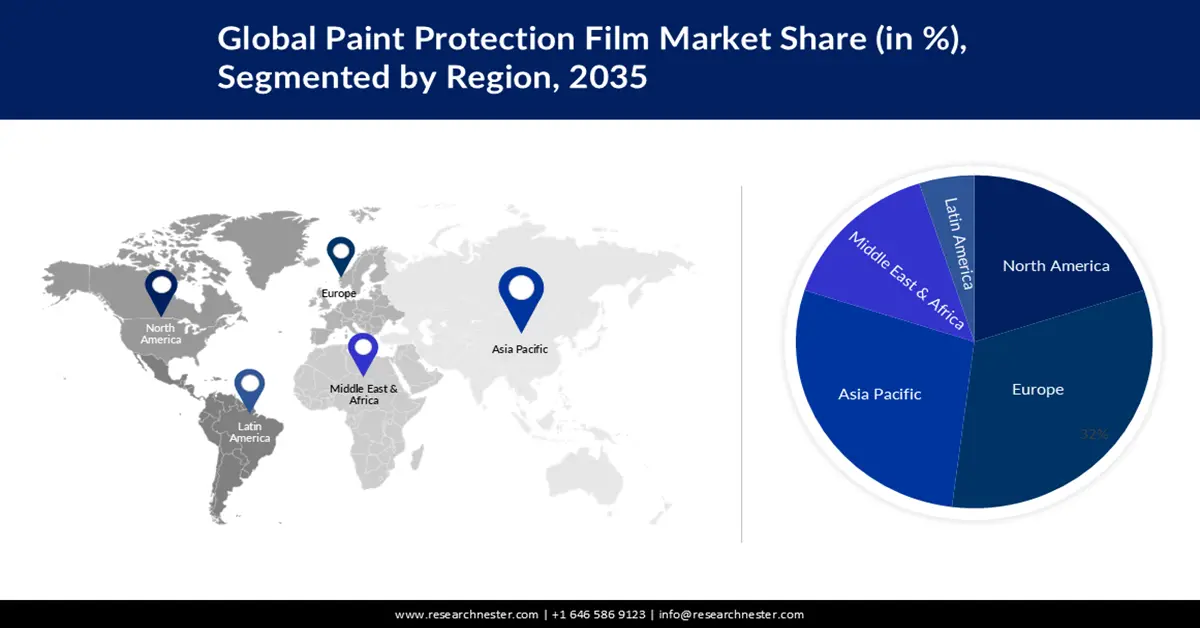

Paint Protection Film Market Regional Analysis:

Europe Market Insights

The paint protection film market in Europe is projected to be the largest, with a share of about 35% by the end of 2035, owing to its strong positioning in the automotive industry and its subsequent demand for paint and coating films. The passenger car fleet has grown exponentially in the past few years and surpassed 256 million cars overall. In 2023, the uppermost number of cars per 1,000 people was the highest in the descending order of Italy, Luxembourg, and Cyprus. Battery-only electric passenger cars also crossed 4 million in the same year, with a CAGR of 77.5% in 2020-2021.

The Germany automotive industry is the country’s largest sector, ascribed for roughly a quarter of cumulative revenues and supporting 780,000 jobs. Germany is the EU’s top market in terms of production and sales. The Germany auto sector garnered USD 611 billion in sales, underscoring an 11% rise from 2022. This comprises trailers (USD 15.7 million), motor vehicles (USD 496.3 million), and parts (USD 99.8 million). Vehicle and engine manufacturers contribute over three-quarters of the cumulative turnover. Suppliers account for approximately 16.3% of the sector's turnover and bodies and trailers manufacturers contribute 2.6%. Notably, around two-thirds of the German automotive industry's annual turnover comes from international markets, especially in countries outside the EU.

APAC Market Insights

The Asia Pacific paint protection film market is estimated to be the second largest, registering a share of about 24% by the end of 2035. Asia Pacific is a major hub for cadmium production, a vital pain protective material, where China, South Korea, and Japan are the main suppliers. A smaller quantity of secondary cadmium is also recovered from NiCd batteries. Some primary uses of cadmium and its compounds are in polyvinyl chloride (PVC) stabilizers, alloys, pigments, and anti-corrosive coatings. China, between 2020 and 2023, accounted for 34% of cadmium pigments and coatings based on its compound exports to the U.S. According to the OECD, China dominated with 29.1% in 2020 of the chemicals segment value-added output and was worth USD 334 billion.

China market is driven by the presence of a strong raw material supply chain. China is ranked among the top five exporters of polyvinyl chloride, amounting to USD 2 billion in outbound trade in 2023 and 15.6% in terms of global export share. Furthermore, rising R&D capacity is factoring in the development of the overall chemicals sector in the country. For instance, in 2022, China’s chemical companies spiked to 16.8% of the world’s industry R&D.