Overactive Bladder Treatment Market Outlook:

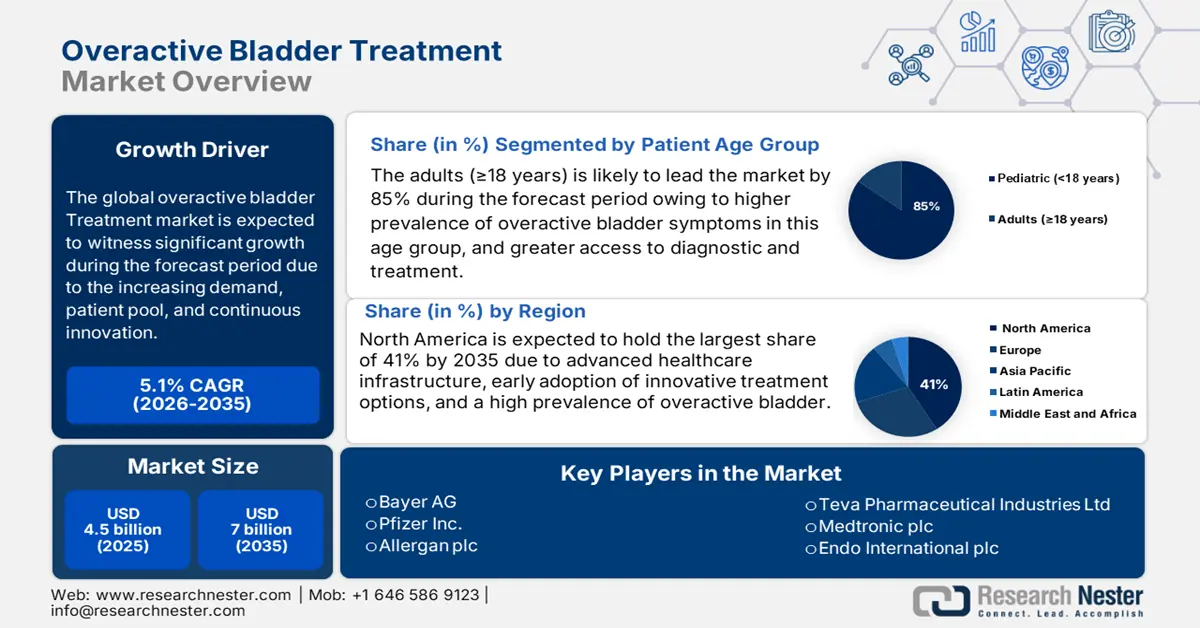

Overactive Bladder Treatment Market size was valued at approximately USD 4.5 billion in 2025 and is projected to reach around USD 7 billion by the end of 2035, rising at a CAGR of about 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of overactive bladder treatment is estimated at USD 4.7 billion.

The market for overactive bladder (OAB) treatment is expanding due to increasing treatment options, an aging population, and a growing number of cases. According to a report by NLM May 2023, women’s OAB has been documented at 16.9% but it increases with age, reaching 30.9% in those older than 65 years. The market includes a complex supply chain of pharmaceuticals such as antimuscarinics and β3-agonists (e.g., mirabegron) and medical devices for both conservative and advanced therapies. Underlying growth is caused by increasing awareness, aging population dynamics, and evolving drug formulations that offer improved tolerability and adherence. This involves holistic management across pharmacological treatment, patient behavioral intervention, and patient education as part of a systemic approach to improve outcomes.

The overactive bladder treatment market is driven by a structured approach to stepwise care. As per a NLM September 2022 report, 64% of patients go for conservative therapies, 76% for medical treatment, while 11% undergo more advanced third-line therapies such as botulinum toxin injections and the use of neuromodulation devices. The tiered utilization thus sustains steady demand for pharmaceuticals and specialized medical devices. Therapeutic options, in combination with conservative, pharmacological, or advanced treatment categories, indicate a highly dynamic supply chain involving raw materials for drug manufacturing and the assembly of high-tech devices. Furthermore, the integration of formalized care pathways is expected to drive market growth and promote efficient resource utilization.