Osteotomy Plates Market Outlook:

Osteotomy Plates Market size was valued at USD 630.8 million in 2025 and is estimated to reach approximately USD 997.7 million by the end of 2035, exhibiting a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of osteotomy plates is assessed at USD 660.9 million.

According to a report published by NLM in March 2023, over 14 million people in America undergo knee osteoarthritis symptoms, with the majority being younger than 65 years. The growing patient pool, which mostly includes single-compartment osteoarthritis cases, helps drive continued demand for osteotomy plates, as High Tibial Osteotomy (HTO) can delay or prevent total knee replacement. A survey report published by NLM in May 2025 concluded that the 100 surveyed surgeons performed a total of 1,068 opening/closing wedge proximal tibial osteotomies, 615 distal femoral osteotomies, and 267 slope-correcting tibial osteotomies over the past five years, indicating increasing usage of osteotomy plates across the spectrum of lower limb realignment procedures.

Current trends in osteotomy care demonstrate the present innovation to improve surgical outcomes and patient recovery. According to a report by the NLM dated May 2025, recent trends show that most osteotomy patients follow a six-week partial weight-bearing plan. As per the survey by NLM, 44% of the total 100 surgeons participating prefer closing-wedge over opening-wedge techniques, and 74% use unloader braces. These clinical practices illustrate how RDD funds have been invested in osteotomy plate designs and postoperative protocols to improve patient outcomes. The main focus of RDD in the osteotomy plates market is design innovations, improving implant materials, and refining surgical techniques to better fixation stability and patient recovery.

Key Osteotomy Plates Market Insights Summary:

Regional Highlights:

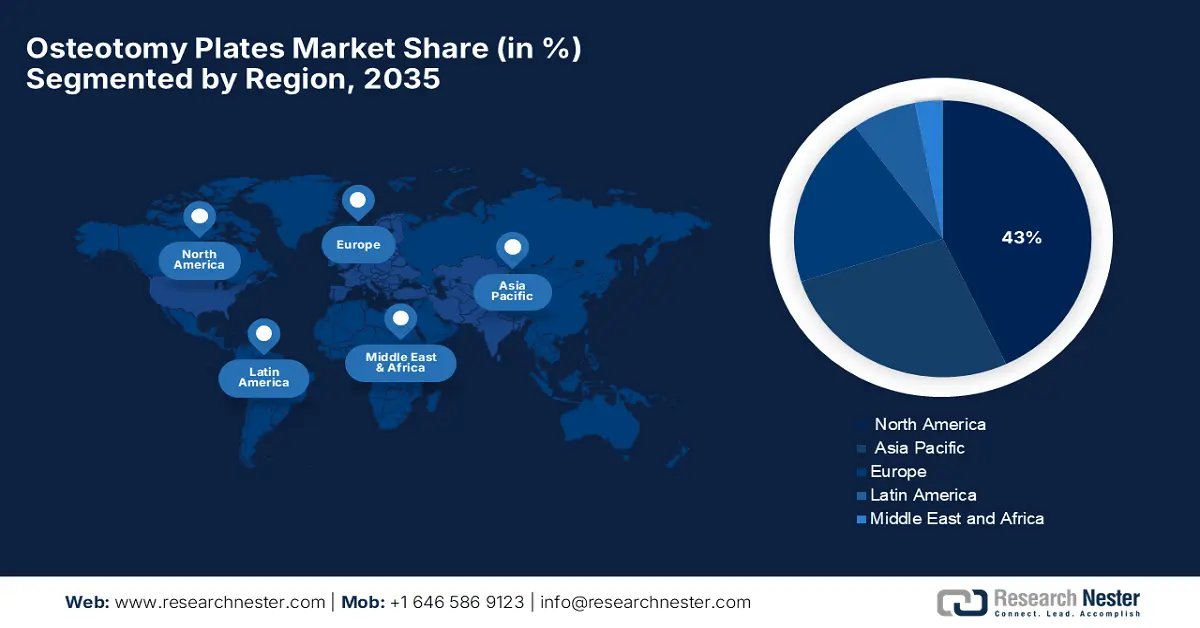

- Across 2026-2035, the North America region is expected to command a 43% share of the osteotomy plates market, attributed to the growing aging demographic and rising osteoporosis incidence.

- The Asia Pacific region is anticipated to secure nearly 27% share by 2035, strengthened by the rising geriatric base and increased adoption of advanced osteotomy procedures.

Segment Insights:

- By 2035, the hospital sub-segment is forecasted to capture 61% of the osteotomy plates market share, supported by its central role as the primary end user in osteotomy surgeries.

- The titanium plates sub-segment is expected to secure a considerable share by 2035, propelled by their strong biocompatibility and mechanical performance.

Key Growth Trends:

- Government spending on orthopedic devices

- Healthcare quality improvement initiatives

Major Challenges:

- High cost of advanced implants

- Regulatory and approval delays

Key Players: DePuy Synthes (Johnson & Johnson), Zimmer Biomet Holdings, Inc., Stryker Corporation, Smith & Nephew plc, Orthofix Medical Inc., Arthrex, Inc., B. Braun Melsungen AG (Aesculap), Medartis AG, Integra LifeSciences Corporation, Acumed LLC, Amplitude Surgical, OrthoPediatrics Corp., aap Implantate AG, Wright Medical Group N.V., TriMed, Inc.

Global Osteotomy Plates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 630.8 million

- 2026 Market Size: USD 660.9 million

- Projected Market Size: USD 997.7 million by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 25 August, 2025

Osteotomy Plates Market - Growth Drivers and Challenges

Growth Drivers

-

Government spending on orthopedic devices: As per the Health of Health report 2024, government expenses, especially through Medicare and Medicaid, play a crucial role in developing the osteotomy plate market. The report further states that Medicare and Medicaid spending for 2023 Durable Medical Equipment were valued at USD 15.9 billion and USD 51 billion, respectively, showcasing a change of 14% and 1.6% from 2022. Access to critical devices such as osteotomy plates is improved by Medicare Part B, which covers necessary DME, prosthetics, and orthotics used in osteotomy treatments. CMS cost-cutting initiatives have increased patient access to enable wider use in surgical care.

-

Healthcare quality improvement initiatives: According to a report by CONGRESS.GOV 2024, the Medicare Orthotics and Prosthetics Patient-Centered Care Act (S.3977), incorporated in March, 2024, introduced in the 118th Congress that aims to improve the quality of healthcare by ensuring that every beneficiary receives orthotic and prosthetic care that is appropriate, safe, and effective. The bill protects patients by mandating that Medicare payments not be made for prostheses, custom-fabricated orthoses, or off-the-shelf orthotics that are drop-shipped, since this method provides no opportunity for adequate training and care from qualified practitioners.

-

Enhanced recovery pathways (ERPs) in orthopedic surgery: Enhanced Recovery Pathways (ERPs) are transforming orthopedic care by improving outcomes, reducing complications, and increasing patient satisfaction. According to a report by NLM in May 2025, Enhanced Recovery Pathways (ERPs) have been considered the biggest driver for shaping the global osteotomy plate market. Five RCTs involving 710 patients showed ERPs reduced hospital stays by an average of 4.7 days compared to standard care. Although ERPs were related to fewer postoperative complications and a shorter period of hospital stay compared with traditional care, they went further to improve "functional recovery" and increased the satisfaction level of patients.

Challenges

-

High cost of advanced implants: In emerging osteotomy plates markets, the steadily escalating pricing of technologically advanced osteotomy plates, which are made of premium materials or with smart designs, creates difficulty in affordability and accessibility. It is this economic restriction that, in turn, also delays usage by healthcare providers and patients, restricting the market growth. On account of a financial crunch, hospitals and clinics are inclined to lower-cost solutions over the innovative osteotomy plates, which may well enhance surgical results and patient recovery.

-

Regulatory and approval delays: Stringent regulatory requirements and lengthy approval processes in key markets delay the introduction of new osteotomy plate designs and materials. This raises the time-to-market and development costs, rendering investment and innovation unattractive. Therefore, manufacturers are inhibited from meeting evolving clinical needs on time, hence limiting the availability of the latest implant technology and impeding overall osteotomy plates market growth.

Osteotomy Plates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 630.8 million |

|

Forecast Year Market Size (2035) |

USD 997.7 million |

|

Regional Scope |

|

Osteotomy Plates Market Segmentation:

End user Segment Analysis

The hospital sub-segment is expected to dominate with 61% of the osteotomy plates market share by 2035. The hospitals act as the main end users for osteotomy plates. According to the report by NLM 2024, a retrospective cohort study from The Third Hospital of Hebei Medical University evaluated 202 patients undergoing High Tibial Osteotomy (HTO) for medial knee osteoarthritis. Clinical outcomes were assessed preoperatively and at a minimum of one-year postoperative follow-up using validated knee function scores such as IKDC (International Knee Documentation Committee), KOOS (Knee Injury and Osteoarthritis Outcome Score), and WOMAC (Western Ontario and McMaster Universities Osteoarthritis Index). The study hence highlights the fact that the hospitals segment has a major role in adopting osteotomy plates for orthopedic surgeries, the most common being high tibial osteotomy.

Material Segment Analysis

The titanium plates sub-segment is projected to hold a considerable share by 2035. As per a report published by NLM in December 2022, although 10-12% of plates are removed due to infection, exposure, or discomfort, titanium plates are used as the construction choice in osteotomy surgical procedures. The study stresses that the biocompatibility and mechanical properties of titanium make it a viable option for use in surgeries. Further, the article mentions that titanium plates have the least cytotoxic effects, allowing for safe blasting alongside human tissues. These features make titanium a foremost choice in most osteotomy surgeries.

Technology Segment Analysis

Locking plate technology is anticipated to register a considerable share by 2035. Locking plates offer the best fixation stability, particularly in osteoporotic or defective bone, by locking the screws into the plate; micromovements are minimized. This technology considerably improves the success rate of surgery by reducing complications such as loosening of the implant or malalignment and the early recovery of patients. The acceptance of this technology on a global scale gets a further increase with the preference by surgeons for locking plate systems and advances in minimally invasive surgical techniques.

Our in-depth analysis of the osteotomy plates market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Material |

|

|

Application |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Osteotomy Plates Market - Regional Analysis

North America Market Insights

The osteotomy plates market in North America is expected to continue dominating the forecast period, accounting for a significant share of 43%. This is due to the aging population and the incidence of osteoporosis. The North America osteotomy plate market is growing due to many postmenopausal women lose bone mass each year, leading to more cases of osteoporosis and a higher need for orthopedic treatment. A higher parity and history of abortions can cause an increased risk of osteoporosis, thus broadening the shadowed patient population needing surgical support.

In the U.S. osteotomy plates market, the growing incidence of bone disorders and fractures among the aging population has immensely stimulated its demand for more advanced surgical approaches such as osteotomy plates. According to the NLM Report 2022, various healthcare and reimbursement systems in the U.S. form the basis of government initiatives in support of the osteotomy plates market. Medicare reimbursement for some necessary diagnostic tools for osteoporosis, including bone mineral density (BMD) testing, was drastically cut down, resulting in a sharp decrease in utilization of diagnostic services.

The Canada osteotomy plates market is witnessing steady growth owing to the rising incidence of osteoarthritis and related joint ailments. According to a report by the Government of Canada, the government initiatives led by the Public Health Agency of Canada, along with the provincial health authorities, focus mainly on surveillance and management of osteoarthritis through different programs, such as the Canadian Chronic Disease Surveillance System. With an aging population accompanied by increasing cases of osteoarthritis, more and more provincial healthcare funds are being channeled into surgical interventions.

North America Osteotomy Plates Market High Tibial Osteotomy (HTO) Procedures Relative to Total Knee Arthroplasty (TKA) - 2010-2021

|

Year |

Number of TKA Procedures |

HTO |

Number of HTO Procedures |

HTO/TKA Utilization (%) |

|

2010 |

119,177 |

259 |

259 |

0.217% |

|

2011 |

112,361 |

244 |

244 |

0.217% |

|

2012 |

114,756 |

267 |

267 |

0.233% |

|

2013 |

123,659 |

241 |

241 |

0.195% |

|

2014 |

122,339 |

233 |

233 |

0.190% |

|

2015 |

115,132 |

194 |

194 |

0.169% |

|

2016 |

116,440 |

191 |

191 |

0.164% |

|

2017 |

113,502 |

154 |

154 |

0.136% |

|

2018 |

127,224 |

131 |

131 |

0.103% |

|

2019 |

154,616 |

126 |

126 |

0.081% |

|

2020 |

140,593 |

105 |

105 |

0.075% |

|

2021 |

53,626 |

38 |

38 |

0.071% |

Source: NLM 2023

Asia Pacific Market Insights

The Asia Pacific osteotomy plates market is the fastest-growing region, anticipated to capture close to 27% of the market share by 2035. The increasing geriatric population in this region, coupled with an increasing incidence of ortho-related disorders, including osteoporosis, is creating demand for novel treatment options. There is a growing interest and adoption of advanced osteotomy surgeries, such as Double Level Osteotomy (DLO), in Asia especially Japan. This indicates increasing surgical activity that requires specialized fixation devices like osteotomy plates. With Sea-Bio’s affordable prices, strong sales team, and lots of academic promotions before launch, the company is ready to take advantage of the fast-growing APAC market.

The China osteotomy plates market is experiencing significant growth driven by an aging population and increasing prevalence of musculoskeletal disorders such as osteoporosis. Due to the government's impetus on enhancing the healthcare infrastructure and quick approvals from regulatory authorities, patients can receive innovative orthopedic devices faster. Increased demand for surgical procedures for the treatment of deformities and fractures of bones, coupled with increased spending on health at both the central and provincial levels, is thus expected to drive the market.

A high prevalence of 82.2% osteoporosis has been detected among post-menopausal women in India. Early onset of menopause, high parity, poor literacy, and tobacco use combine to build up a critical crisis, needing an orthopedic focus in addressing it. As per a report by NLM January 2023, between 37.7% to about 48.8% have had more than six children and are postmenopausal for over 10 years, which is the reason for increased demand for osteotomy solutions over grout fragility in an aging population, remains for the underserved female population.

Europe Market Insights

Europe osteotomy plates market is projected to maintain an estimated 20% share of the worldwide market by 2035 and, during the forecast timeline, would experience lucrative growth with the aging population and the rising incidence of osteoporotic fractures in the region. As per a report by NLM in October 2021, in the last year, an estimated 100,000 new fragility fractures were reported in 2019, with an average of 274 fractures occurring every day. This number is expected to increase to 123,000 by 2034 due to demographic changes.

Osteotomy plates in Germany are growing in demand as the population ages and fragility fractures due to osteoporosis rise. As per a report by IOF in February 2024, over 831,000 fractures happen per year, which is increasing the demand for surgical osteotomy plates in Germany. The limited application of Fracture Liaisons (FLS), which is currently offered in only about 1-10% of hospitals, is both a gap and an opportunity given enhanced financial incentives. Government intervention and structuring care, such as the Disease Management Program and the Fraction Liaison Service, offer proper patient support and coordination of care.

In the UK, the osteotomy plates market is growing, owing to the increasing incidence of hip fractures in an aging population, chiefly induced by osteoporosis. As per a report by ScienceDirect, December 2024, hospitals can save costs by using cement augmentation when the cost per patient is below the breakeven point of £491. Cement augmentation is less costly when accounting for shorter hospital stays and fewer revision surgeries. Efforts from the government to optimize fracture care, along with budget allocations for the reduction of long-term healthcare expenses, pointed at wider take-up of advanced surgical procedures.

Key Osteotomy Plates Market Players:

- DePuy Synthes (Johnson & Johnson)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- Smith & Nephew plc

- Orthofix Medical Inc.

- Arthrex, Inc.

- B. Braun Melsungen AG (Aesculap)

- Medartis AG

- Integra LifeSciences Corporation

- Acumed LLC

- Amplitude Surgical

- OrthoPediatrics Corp.

- aap Implantate AG

- Wright Medical Group N.V.

- TriMed, Inc.

The osteotomy plates market is in the hands of bigger multinationals such as DePuy Synthes, Zimmer Biomet, and Stryker, which are at the forefront through their continuous innovation and wide array of product portfolios. These companies aim to achieve minimally invasive and patient-specific solutions through stringent R&D programs. The adoption of Government healthcare reforms, coupled with increasing cases of osteoarthritis, is a lucrative market opportunity. The Japanese direct their efforts towards local product adaptation and innovations in biomaterials to serve very narrowly defined niche markets. Competition, in general, leads to the development of high-tech yet cost-competitive solutions, increasingly focused on improving surgical outcomes and lowering recovery time worldwide.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Johnson & Johnson MedTech brought forth a new strategic co-promotion agreement with Pacira BioSciences to enlarge the Early Intervention portfolio, introduce ZILRETTA for knee osteoarthritis pain, and enrich the non-surgical approach to treatment and educational efforts directed towards patients.

- In September 2024, the Osteotomy Truss System and Ankle Truss System were two extensions introduced to the Foot & Ankle portfolio by Stryker, which was recently acquired from 4WEB Medical.

- Report ID: 8016

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Osteotomy Plates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.