Orthopedic Footwear Market Outlook:

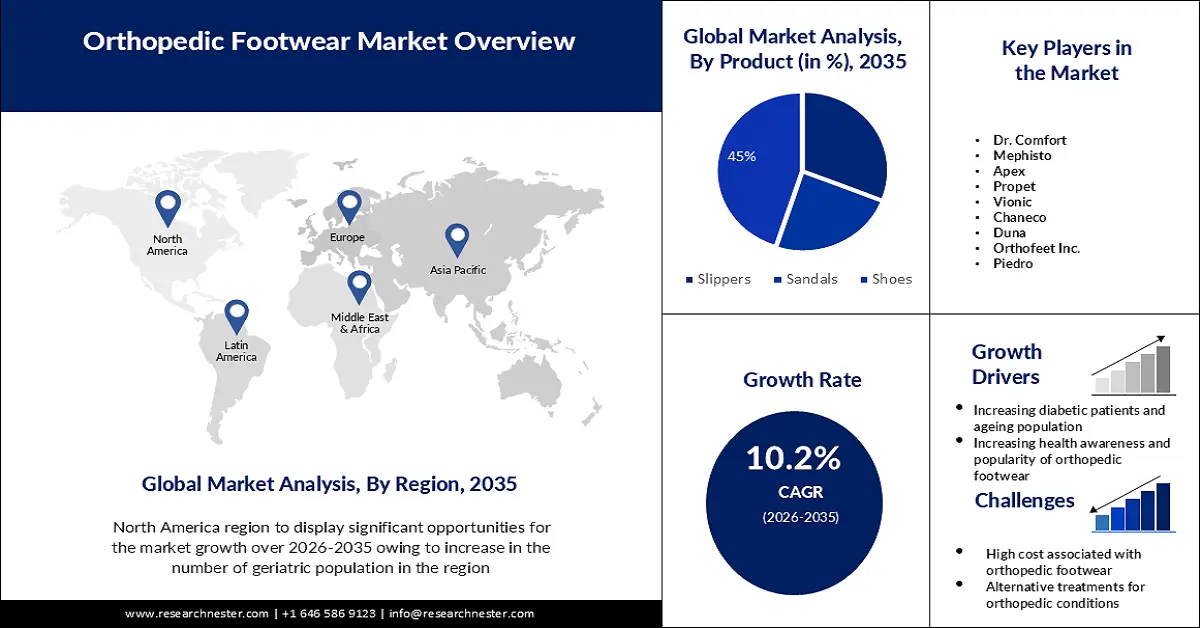

Orthopedic Footwear Market size was over USD 5.11 billion in 2025 and is poised to exceed USD 13.5 billion by 2035, witnessing over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of orthopedic footwear is estimated at USD 5.58 billion.

The major driving growth factors for this market are is increasing population with chronic diseases and pain. Orthopedic shoes are specially designed for people with deformities in the foot and ankle. They help to provide support to muscles and joints and help reduce pain while walking or standing. According to our research, at least one in four older people is affected by foot pain around the world.

In addition, the increased interest in participating in physical activities like walking, jogging, and playing sports is anticipated to open up a lot of chances for orthopedic footwear market expansion in the years to come. The World Health Organization (WHO) recommends that persons between the ages of 18 and 64 engage in at least 150–300 minutes of moderate-intensity or 75–150 minutes of vigorous-intensity aerobic physical activity each week

Key Orthopedic Footwear Market Insights Summary:

Regional Highlights:

- By 2035, the shoes segment in the orthopedic footwear market is expected to account for a 45% share, propelled by benefits such as enhanced stability, shock absorption, and improved weight distribution supporting flat-footed individuals.

- The diabetes & edema segment is projected to secure a 47% share by 2035, impelled by the rising global incidence of diabetes leading to increased cases of swollen feet.

Segment Insights:

- By 2035, the shoes segment in the orthopedic footwear market is expected to command a 45% share, propelled by its advantages in enhancing stability, shock absorption, and overall walking comfort.

- The diabetes & edema segment is forecasted to achieve a 47% share by 2035, impelled by the rising global diabetes burden that contributes to increased cases of swollen feet.

Key Growth Trends:

- Increasing Health awareness and Popularity of Orthopedic Footwear

- Increasing Patients of Plantar Fasciitis

Major Challenges:

- Lack of Skilled Labor

- High Cost Associated with the Orthopedic footwear

Key Players: Darco, Dr. Comfort, Mephisto, Apex, Propet, Vionic, Chaneco, Duna, Orthofeet Inc., Piedro.

Global Orthopedic Footwear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.11 billion

- 2026 Market Size: USD 5.58 billion

- Projected Market Size: USD 13.5 billion by 2035

- Growth Forecasts: 10.2%

Key Regional Dynamics:

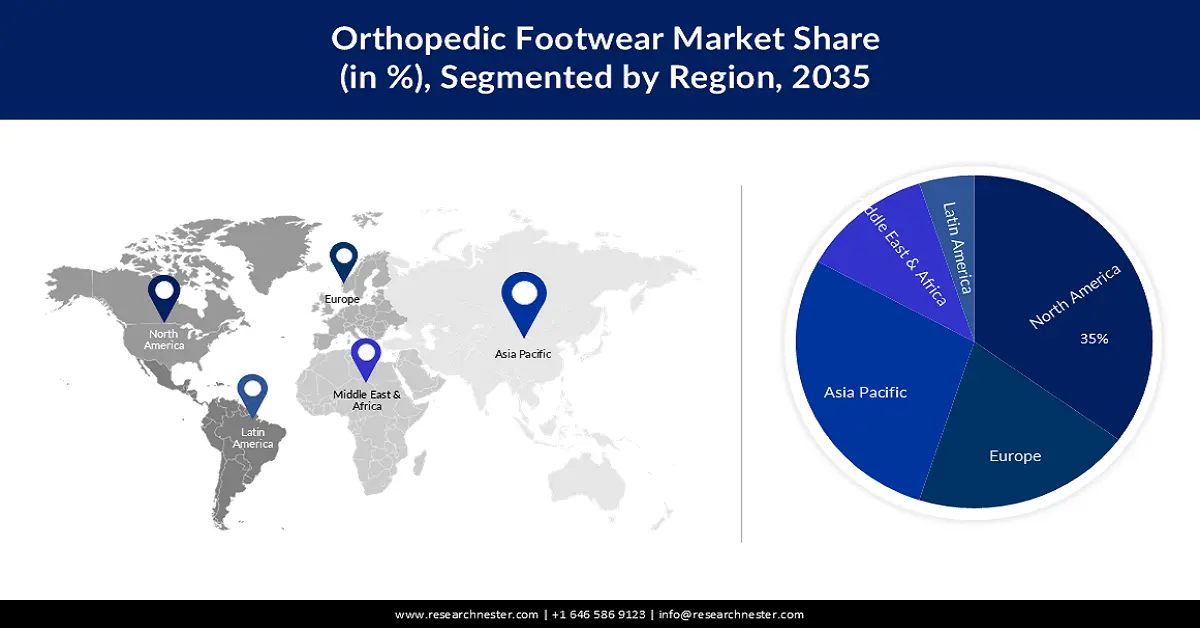

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 19 November, 2025

Orthopedic Footwear Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Health awareness and Popularity of Orthopedic Footwear- There has been growing awareness amongst the population about foot care and rising consumer spending on healthcare products. Owing to the various features associated with orthopedic footwear such as removable insole, extra width, and supportive heel, could be a factor projected to propel the growth of this orthopedic footwear market.

- Increasing Injuries- Increasing sports injuries, fractures, neuromuscular problems, and disorders are increasing the growth of this market. Fall injuries accounted for 51 % of medical care and 61% of emergency orthopedic surgery cases.

- Increasing Patients of Plantar Fasciitis- The global market is expected to grow as a result of the increased incidence of plantar fasciitis. People dealing with plantar fasciitis require extra cushioning in their footwear in order to provide support to their feet. Thus, orthopedic footwear is also opted by people for managing plantar fasciitis. According to a report published in the year 2022 by NCBI, in the United States, between 25 and 65 years of age, 83% of patients with plantar fasciitis are working adults.

Challenges

- Lack of Skilled Labor- Despite improving the orthopedic footwear market, there is a lack of necessary equipment as well as a lack of skilled labor in research and development. This is estimated to restrain the growth of the market in the forecasted period.

- High Cost Associated with the Orthopedic footwear

- Alternative treatments for Orthopedic Condition

Orthopedic Footwear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 5.11 billion |

|

Forecast Year Market Size (2035) |

USD 13.5 billion |

|

Regional Scope |

|

Orthopedic Footwear Market Segmentation:

Product Segment Analysis

The shoes segment is estimated to hold 45% share of the global orthopedic footwear market by the end of 2035. Orthopedic shoes are used to provide support to flat feet. In addition, there are numerous benefits of orthopedic shoes such as shock absorption, stability, and high ability to walk as well as distributing weight evenly, this segment is predicted to grow in the market during the forecasted period.

Indication Segment Analysis

The diabetes & edema segment in the orthopedic footwear market is set to garner the highest gain in the upcoming years with 47%. This segment is said to be increasing the market growth owing to the rising cases of diabetes worldwide as diabetes results in swollen feet. According to the International Diabetes Federation, around 700 million people are predicted to suffer from diabetes by 2045. Moreover, an increase in the number of diabetic patients in developing countries anticipates the demand for orthopedic footwear and diabetic footwear across the globe. The bulk of the approximately 422 million individuals with diabetes globally reside in low- and middle-income nations, and diabetes is directly responsible for 1.5 million fatalities annually.

Our in-depth analysis of the global orthopedic footwear market includes the following segments:

|

Product |

|

|

End User |

|

|

Distribution Channel |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopedic Footwear Market - Regional Analysis

North American Market Insights

The North America industry is likely to account for largest revenue share of 35% by 2035. One of the main reasons for the growth of this market in the particular region is an increase in the number of geriatric populations, as they are highly prone to numerous diseases. In addition, during this age, people usually require tailored products that are suitable to them according to their needs. Moreover, there has been a surge in the number of keyhole orthopedic surgeries, as well as a rise in the research and development for better products in countries such as the United States. There are approximately 25,500 orthopedic surgeons practicing in the United States, according to the American Academy of Orthopaedic Surgery. Also, the older population increased by 50.9 million, from 4.9 million (or 4.7% of the total U.S. population) in 1920 to 55.8 million (16.8%) in 2020. This represents a growth rate of about 1,000%, almost five times that of the total population (about 200%).

APAC Market Insights

The orthopedic footwear market in Asia pacific is estimated to garner the second-largest revenue with a 28% share in the market. The growth of the market is anticipated to increase because of the developing healthcare infrastructure. Moreover, there has been an increasing investment by key players in the manufacturing of orthopedic footwear. In this region, people are opting for regular check-ups in order to keep themselves fit in different stages of life.

Orthopedic Footwear Market Players:

- Darco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dr. Comfort

- Mephisto

- Apex

- Propet

- Vionic

- Chaneco

- Duna

- Orthofeet Inc.

- Piedro

Recent Developments

- Orthofeet, Inc. ("Orthofeet"), a leading designer and manufacturer of biomechanically designed footwear, announced the launch of its first direct-to-consumer website – www.orthofeet.com. The new website, a re-design of its existing health care provider website, offers a convenient, secure way to browse and purchase a wide variety of therapeutic shoes for men and women. The site also features educational resources about foot care, with customized content for adults with diabetes who are prone to medical foot conditions.

- Mephisto launches its Nature is Future collection worldwide. At the latest edition of Micam, held from Sept. 18 to 20 in Milan for the presentation of spring/summer 2023 collections, Mephisto started distributing worldwide its sustainable women and men’s sneakers brand Nature is Future by Mephisto.

- Report ID: 2508

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthopedic Footwear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.