Global Organic Pigment Market

- An Outline of the Global Organic Pigment Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Organic Pigment Market Recent News

- Regional Demand

- Global Organic Pigment by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Organic Pigment Demand Landscape

- Organic Pigment Demand Trends Driven by Sustainability, Strategic Collaborations, and Regulatory Compliance (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Organic Pigment Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Organic Pigment – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Burford Capital LCC

- ANSHAN HIFICHEM CO., LTD

- Artience Co., Ltd.

- ASAHI SONGWON COLORS LTD.

- Atul Ltd

- BASF Group

- DIC CORPORATION.

- Lily Group Co., Ltd

- Longkou Union Chemical Co., Ltd.

- Meghmani Organics Ltd

- Pidilite Industries Limited

- Sudarshan Chemical Industries Limited

- SUNLOUR PIGMENT CO., LTD.

- Trust Chem Co., Ltd.

- Vibrantz

- VOXCO Pigments and Chemicals Pvt. Ltd.

- Burford Capital LCC

- Global Organic Pigment Market Outlook

- Market Overview

- Market Revenue by Value (USD Thousand), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Organic Pigment Market Segmentation Analysis (2026-2036)

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Thousand), 2026-2036

- North America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Source

- Market Overview

- North America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- U.S. Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Source

- Overview

- Europe Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- UK Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Source

- Overview

- Asia Pacific Market Excluding Japan

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- China Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zealand Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Source

- Overview

- Japan Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Source

- Overview

- Latin America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2026-2036, By

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- Brazil Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Source

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2026-2036, By

- By Source

- Synthetic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Natural, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Type

- Azo Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- Phthalocyanine Pigments, Market Value (USD Thousand), and CAGR, 2026-2036F

- High-Performance Pigments (HPPs), Market Value (USD Thousand), and CAGR, 2026-2036F

- Alizarin, Market Value (USD Thousand), and CAGR, 2026-2036F

- Arylide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Printing Inks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Paints and Coatings, Market Value (USD Thousand), and CAGR, 2026-2036F

- Plastics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End User

- Construction, Market Value (USD Thousand), and CAGR, 2026-2036F

- Automotive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Packaging, Market Value (USD Thousand), and CAGR, 2026-2036F

- Textile & Apparel, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Food & Beverage, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- Saudi Arabia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Source

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Organic Pigments Market Outlook:

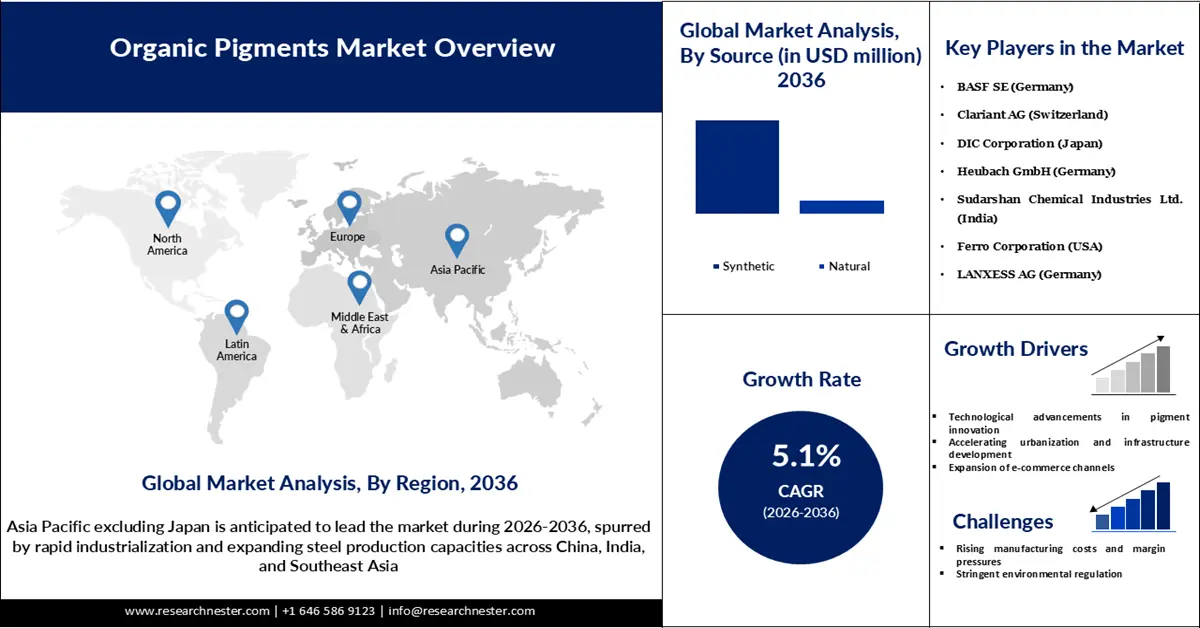

Organic Pigments Market is valued at USD 5.88 billion in 2025 and is anticipated to surpass USD 10.13 billion by 2036, expanding at a CAGR of 5.1% during the forecast period, i.e., 2026 to 2036. In 2026, the industry size of organic pigment is estimated at USD 6.14 billion.

The primary growth driver of the organic pigments market is the increasing demand for eco-friendly, sustainable, and non-toxic colorants. As global regulations tighten on the use of heavy metals and volatile organic compounds (VOCs), companies are shifting toward organic pigments that comply with laws such as REACH and offer lower environmental impact. In June 2020, the Ministry of Ecology and Environment of the PRC (MEE) issued the 2020 Volatile Organic Compounds (VOCs) Management Plan, which sets a target of reducing VOC emissions by 10 %. The Plan emphasizes source substitution (e.g., replacing high-VOC raw materials) and mandates that manufacturers of coatings, adhesives, inks, and cleaning agents prepare for and comply with forthcoming national product standards for VOC content.

At the same time, consumers are favoring products with green credentials, intensifying demand in industries such as paints & coatings, plastics, textiles, and packaging. In emerging economies, rapid industrialization and expanding end-use sectors further accelerate growth, supported by technological advancements in pigment dispersion and performance. Together, these forces make the transition to organic pigments a core driver in the market’s expansion.

Key Organic Pigments Market Insights Summary:

Regional Insights:

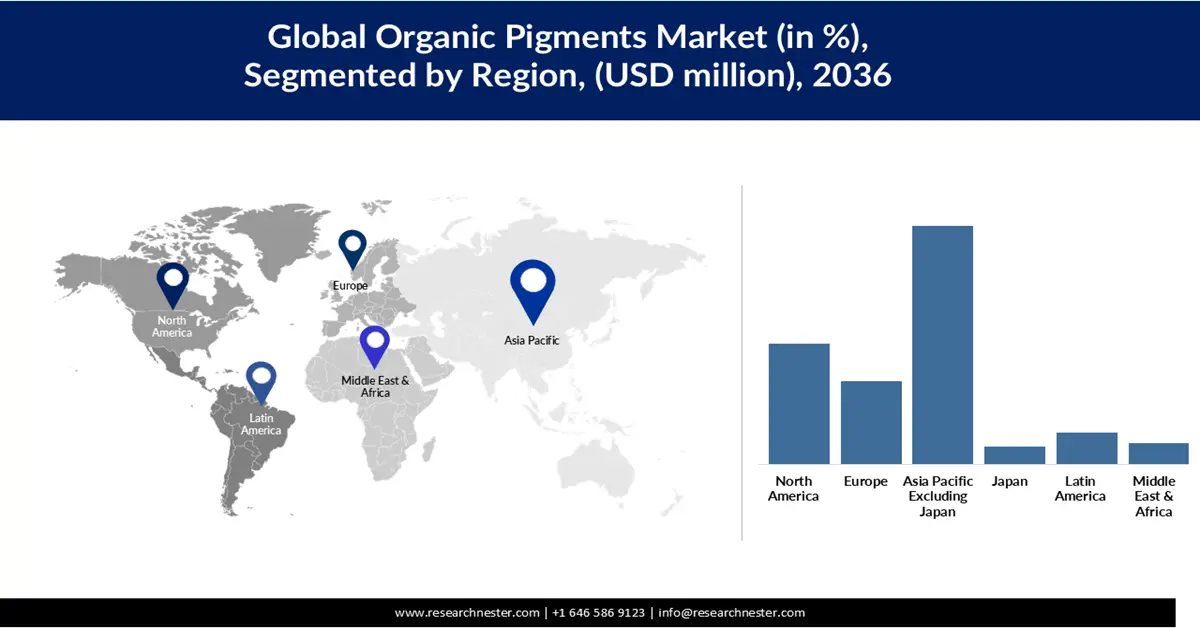

- Asia Pacific excluding Japan is projected to lead the organic pigments market with a 39% share by 2036, underpinned by rapid industrialization and a strong manufacturing base across construction, automotive, textile, and packaging sectors.

- North America is forecast to secure a 25% market share by 2036, supported by advanced manufacturing capabilities and sustained demand from paints, coatings, plastics, and printing inks industries.

Segment Insights:

- The synthetic-organic pigments segment is projected to command an 86.65% share of the organic pigments market by 2036, supported by high color strength, cost efficiency, and versatility across coatings, plastics, and printing inks.

- The paint & coatings segment is anticipated to capture a 42.18% share by 2036, underpinned by vivid coloration, high opacity, and long-term weather resistance.

Key Growth Trends:

- Technological advancements in pigment innovation

- Accelerating urbanization and infrastructure development

Major Challenges:

- Rising manufacturing costs and margin pressures

- Stringent environmental regulation

Key Players: BASF SE (Germany), Clariant AG (Switzerland), DIC Corporation (Japan), Heubach GmbH (Germany), Sudarshan Chemical Industries Ltd. (India), Ferro Corporation (USA), LANXESS AG (Germany), Toyo Ink SC Holdings Co., Ltd. (Japan), Trust Chem Co., Ltd. (China), Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan).

Global Organic Pigments Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.88 billion

- 2026 Market Size: USD 6.14 billion

- Projected Market Size: USD 10.13 billion by 2036

- Growth Forecasts: 5.1% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding Japan (39% Share by 2036)

- Fastest Growing Region: Asia Pacific excluding Japan

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 3 December, 2025

Organic Pigments Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements in pigment innovation: Technological advancements are increasingly transforming the organic pigments industry by enabling pigments that not only offer richer color but also higher durability and environmental compatibility. Breakthroughs such as nano-sized pigment particles and microfluidic synthesis enable finer control over color strength, dispersibility, and stability, making these pigments suitable for high-performance applications like automotive coatings and electronics. At the same time, production innovations, including AI-driven process optimization and closed-loop dispersion systems, are improving manufacturing efficiency, reducing waste, and supporting sustainability goals. According to Hangzhou Poezie Stationery, the adoption of closed-loop grinding and milling systems in pigment production has enabled water-reuse rates of up to 92%, significantly reducing process wastewater and enhancing sustainability performance. These technical improvements are expanding the usable application range of organic pigments, enabling them to replace older inorganic or less advanced alternatives in demanding fields while meeting stricter regulatory and environmental requirements.

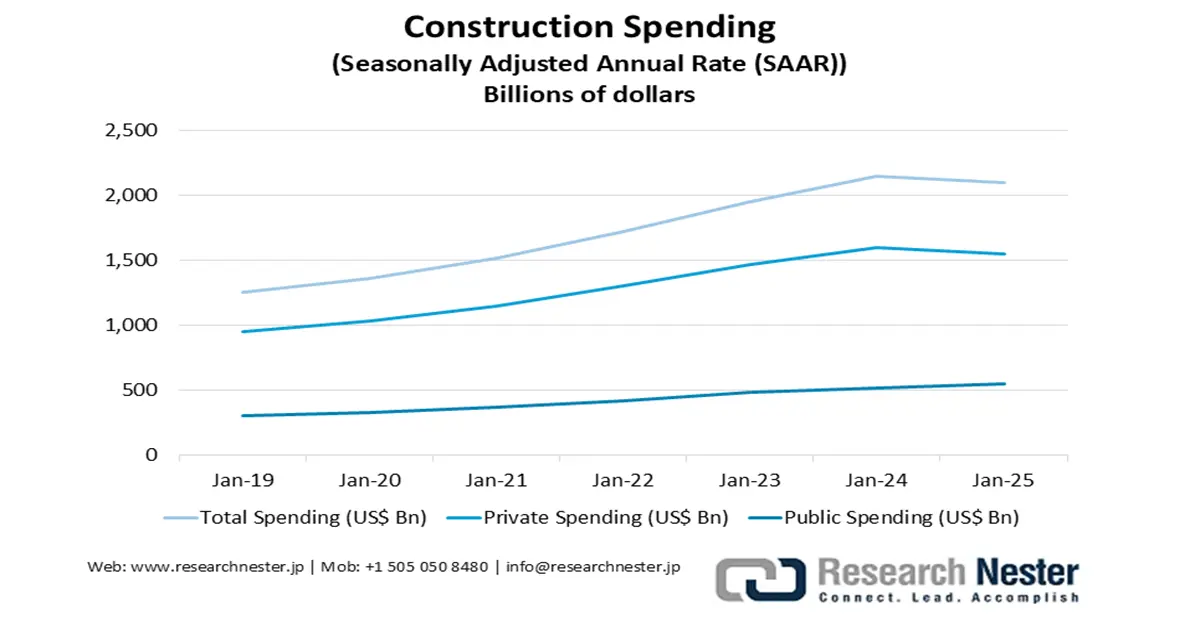

- Accelerating urbanization and infrastructure development: Urban migration and major infrastructure investments are driving significant demand within the construction and coatings sectors. Expanding city populations are triggering large-scale residential, commercial, and transportation projects, thereby increasing the need for high-performance paints and coatings. According to the World Bank, more than half of the world’s population —over 4 billion people —now live in urban areas, and this trend is projected to continue, with nearly 7 in 10 people expected to live in cities by around 2050. Governments’ focus on roads, bridges, airports and transit networks further amplifies demand for protective and decorative finishes in buildings and infrastructure. At the same time, the push for durable, maintenance-efficient surfaces in urban environments boosts consumption of advanced coatings, which rely heavily on quality pigments.

- Expansion of e-commerce channels: The rapid growth of e-commerce has intensified demand for high-quality printed packaging, with brands seeking vibrant, durable finishes to enhance the online unboxing experience. According to the U.S. Census Bureau, in the second quarter of 2025, e-commerce retail sales in the United States reached $304.2 billion and accounted for 16.3 % of total retail sales. As more products are shipped directly to consumers, packaging and labeling volumes rise—thereby increasing the need for printing inks that rely on advanced organic pigments. The shift toward short-run, personalized, and digitally-printed packaging formats further boosts the use of organic pigments, given their superior color performance and compatibility with flexible substrates. Moreover, e-commerce companies are increasingly prioritizing sustainability, which favors organic-based pigment systems that comply with eco-friendly standards and regulations. All told, the e-commerce boom is meaningfully expanding the application base for organic pigments in the packaging-printing domain.

Challenges

- Rising manufacturing costs and margin pressures: The shift to higher-performance, eco-friendly pigments is increasingly imposing cost burdens on producers of organic pigments. Many organic pigments involve complex multi-step synthesis, high-purity intermediates, and stringent quality controls, which drive their raw material and process costs well above those of conventional inorganic pigments.

Moreover, volatility in fuel, energy, and chemical feedstocks such as the petroleum-derived intermediates central to organic pigment manufacturing further compresses margins.As a result, firms supplying cost-sensitive end-use segments like packaging or printing inks face difficulty absorbing these added costs, which in turn may slow their willingness to adopt pricier organic pigment formulations despite their environmental advantages. - Stringent environmental regulation: Strong and evolving environmental regulations are also a hindrance in the organic pigments space, despite the eco-friendly label often applied to organic pigments. Many organic pigment producers still use chemical intermediates regulated under frameworks such as REACH (EU) or the Toxic Substances Control Act (TSCA) in the U.S., which require costly registration, testing, and compliance. For example, one regulatory impact document notes that higher-cost environmental compliance in the U.S. makes domestic pigment manufacturing less competitive than in lower-cost jurisdictions with laxer regulation. Such regulatory burdens raise entry barriers for smaller producers and limit flexibility in reformulation or innovation, which can impede the pace at which organic pigment alternatives are scaled for broad applications.

Organic Pigments Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 5.88 billion |

|

Forecast Year Market Size (2036) |

USD 10.13 billion |

|

Regional Scope |

|

Organic Pigments Market Segmentation:

Source Segment Analysis

The synthetic-organic pigments segment is expected to hold 86.65% of the organic pigments market share, driven by its high color strength, cost efficiency, and versatility across coatings, plastics, and printing inks. This strong position is expected to persist throughout the forecast period, supported by mature production technologies and a robust supply chain. Growing demand for vibrant, long-lasting, and eco-friendly colors across industries is further boosting adoption. Additionally, ongoing innovations in pigment formulations are enhancing heat stability, lightfastness, and chemical resistance, making them suitable for high-performance applications. The segment also benefits from economies of scale and well-established distribution networks, ensuring consistent availability worldwide. Regulatory support for safer, non-toxic pigments in consumer products is likely to reinforce organic pigments market growth. Overall, synthetic-organic pigments are positioned as the preferred choice for manufacturers seeking both performance and sustainability.

Application Segment Analysis

The paint & coatings segment is expected to hold a 42.18% organic pigments market share by 2036, driven by its ability to provide vivid colors, high opacity, and long-term weather resistance. These pigments enhance both the aesthetic appeal and durability of surfaces across architectural, decorative, and industrial applications. Growing demand for eco-friendly, low-VOC, and sustainable coating solutions is further fueling adoption. Advances in pigment technology are enabling better lightfastness, corrosion resistance, and application versatility, meeting the needs of high-performance coatings. Additionally, established supply chains and widespread availability ensure consistent quality and reliability for manufacturers. The segment’s alignment with global sustainability trends and increasing infrastructure development continues to reinforce its strong market position.

End user Segment Analysis

The construction end user segment is expected to grow at a market share of 31.31% by 2036. The segment drives the organic pigments market through high demand for paints, protective coatings, sealants, and finishing materials that improve durability and weather resistance. Rapid urbanization, residential and commercial infrastructure expansion, and government-led development projects are key growth factors. Organic pigments help coatings withstand harsh environmental conditions, including UV exposure, moisture, and temperature fluctuations. Large-scale construction projects create consistent, high-volume pigment consumption throughout the year. Advancements in pigment performance, such as enhanced chemical and abrasion resistance, further encourage adoption. Overall, the construction sector remains a major contributor to the steady growth of the organic pigments market.

Our in-depth analysis of the organic pigments includes the following segments:

|

Segments |

Subsegments |

|

Source |

|

|

Types |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Pigments Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

Asia Pacific excluding Japan is expected to dominate the market, accounting for 39% of the total share by 2036, driven by its strong manufacturing base and rapid industrialization. Expanding construction, automotive, textile, and packaging industries across countries like China and India generate substantial demand for pigments. The region benefits from abundant raw material availability and lower production costs, supporting large-scale pigment manufacturing. Rising consumer demand for high-quality and durable products further boosts pigment usage in coatings and plastics. Overall, APAC remains the leading hub for both production and consumption, anchoring global market growth for organic pigments.

China drives the organic pigments market through its extensive manufacturing capacity and strong demand from end-use industries such as coatings, plastics, textiles, and printing inks. The country serves as a global production hub, supported by cost-efficient raw materials, skilled labor, and advanced chemical processing infrastructure. In 2022, China accounted for 44 % of global chemical production and 46 % of global chemical industry capital investment. Rapid urbanization and large-scale construction and automotive activities continue to fuel pigment consumption. Additionally, China’s export-oriented pigment industry supplies a major share of global demand. Overall, the nation’s industrial strength and expanding domestic market make it a key driver of growth in the global organic pigments market.

In India, the organic pigments market is propelled by a strong chemical manufacturing base and expanding end-use industries such as paints, coatings, plastics, and textiles. The country’s competitive production costs, skilled workforce, and easy access to raw materials make it a major exporter of organic pigments. Rapid urbanization, infrastructure expansion, and growing automotive demand are driving steady domestic consumption. Continuous technological advancements in pigment formulation are improving product quality and application performance. Supported by government initiatives like Make in India, the country continues to play a pivotal role in shaping global organic pigment supply and demand.

North America Market Insights

The organic pigments market in North America is expected to hold a share of 25% by 2036. The market is driven by advanced manufacturing capabilities and strong demand from industries such as paints, coatings, plastics, and printing inks. The region’s well-established construction and automotive sectors continuously generate high pigment consumption for durable and high-performance applications. Stringent environmental and safety regulations have encouraged the shift toward cleaner, non-toxic pigment formulations. Ongoing R&D investments and technological innovation support the development of customized, application-specific pigments. Additionally, the presence of major pigment manufacturers and a robust supply network ensures steady organic pigments market growth. Overall, North America remains a key region contributing to product innovation and quality advancement in the global organic pigments market.

In the U.S., the organic pigments market is driven by strong demand from the paints, coatings, plastics, and printing ink industries. The country’s focus on innovation and product quality encourages the development of high-performance pigments with improved durability, chemical resistance, and weather stability. Growth in residential and commercial construction, coupled with a thriving automotive and packaging sector, continues to fuel pigment usage. Additionally, robust R&D activity and the presence of major global pigment manufacturers strengthen the domestic supply base. Strict environmental regulations have also promoted the shift toward safer, more advanced pigment formulations, supporting steady market expansion.

Source: U.S. Census Bureau

In Canada, the market is influenced by rising infrastructure development and a growing emphasis on high-quality coating materials for industrial and architectural applications. The country’s expanding construction and automotive industries create consistent pigment demand, particularly for protective and decorative coatings. Canada’s close trade ties with the U.S. further enhance market integration and access to advanced pigment technologies. The government’s support for manufacturing modernization and environmental compliance encourages the adoption of efficient and long-lasting pigment solutions. Overall, Canada’s stable industrial growth and technological adoption play a supportive role in driving the North American organic pigments market.

Europe Market Insights

Europe's organic pigments market will grow with a market share of 18% by 2036, propelled by a well-established coating, automotive, and plastics manufacturing base that prioritizes high-performance colorants with strong weather and heat stability. The region’s stringent environmental regulations and REACH compliance have encouraged a shift from heavy-metal-based pigments toward safer organic alternatives. Countries such as Germany, Italy, and the Netherlands are key production hubs due to their advanced chemical industries and focus on innovation in pigment formulations. Growing demand from the packaging and printing sectors, particularly for eco-compliant inks, further strengthens market growth. Additionally, rising infrastructure renovation and automotive refinishing activities continue to sustain steady consumption of organic pigments across the region.

In the Netherlands, the organic pigments market is driven by its advanced chemical manufacturing ecosystem and strong focus on sustainable production technologies. The country serves as a strategic hub for pigment exports across Europe, supported by efficient logistics infrastructure and innovation-led research in color chemistry. Dutch manufacturers are investing in bio-based intermediates and energy-efficient synthesis processes to meet EU environmental standards. The growing use of organic pigments in printing inks, coatings, and plastics, especially for packaging and industrial applications, continues to reinforce the Netherlands’ role as a key contributor to Europe’s pigment supply chain.

In Germany, the market benefits from its dominant position in specialty chemicals and extensive R&D capabilities in colorant technology. The presence of major pigment producers, coupled with a robust automotive and coatings sector, drives demand for high-performance and durable organic pigments. Germany’s emphasis on environmentally compliant, non-toxic pigments aligns with the EU Green Deal objectives, fostering innovation in sustainable pigment production. Additionally, the expanding use of advanced organic pigments in high-end applications, such as automotive coatings, plastics, and decorative finishes, further cements Germany’s leadership in the European pigment landscape.

Organic Pigments Key Market Players:

- BASF SE (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clariant AG (Switzerland)

- DIC Corporation (Japan)

- Heubach GmbH (Germany)

- Sudarshan Chemical Industries Ltd. (India)

- Ferro Corporation (USA)

- LANXESS AG (Germany)

- Toyo Ink SC Holdings Co., Ltd. (Japan)

- Trust Chem Co., Ltd. (China)

- Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan)

- BASF SE is one of the leading producers of organic pigments globally, offering a diverse portfolio for coatings, plastics, and printing applications. The company emphasizes innovation in sustainable pigment technologies, focusing on high color strength, durability, and environmental compliance. Its advanced R&D facilities enable the development of eco-friendly and high-performance pigment solutions that cater to global industries. BASF’s strong distribution network and continuous investment in digitalization enhance production efficiency and customer engagement worldwide.

- Clariant AG is a major player in the organic pigments market, known for its premium pigment dispersions and customized solutions. The company’s product line focuses on color intensity, stability, and sustainability, serving industries like automotive coatings, packaging, and textiles. Clariant invests significantly in sustainable chemistry and innovation, particularly in low-VOC and non-hazardous pigment systems. Its global presence and emphasis on circular economy principles help drive the transition toward greener manufacturing practices.

- Heubach GmbH has established a strong presence in the organic pigments market through its expertise in colorants and sustainable pigment technologies. The company focuses on providing high-performance pigments with superior weather resistance and color consistency for coatings, plastics, and inks. Following its merger with Clariant’s pigment business, Heubach has expanded its technological base and global footprint. The company’s strategic focus on environmental stewardship and innovation strengthens its role as a leading pigment supplier worldwide.

- Sudarshan Chemical Industries Ltd. is a key player in the global organic pigments market, recognized for its extensive pigment range catering to coatings, plastics, inks, and cosmetics. The company emphasizes cost-effective and high-quality pigment solutions supported by strong R&D capabilities. Its continuous investment in capacity expansion and sustainability initiatives positions it as a major supplier to both domestic and international markets. Sudarshan’s focus on process optimization and innovation enhances its competitiveness in the pigment value chain.

- Ferro Corporation specializes in color solutions and performance materials, including a broad portfolio of organic pigments. The company’s pigments are widely used in coatings, ceramics, and industrial applications for their excellent dispersion and color properties. With a strong focus on innovation, Ferro continuously develops advanced pigment technologies that meet stringent performance and environmental standards. Its global manufacturing presence and commitment to quality and customer service make it a reliable supplier in the pigments industry.

Below is the list of the key players operating in the global organic pigments market:

Key players in the organic pigments market are driving growth through continuous innovation, strategic expansions, and sustainability-focused product development. Leading manufacturers are investing heavily in R&D to enhance pigment performance, including improved lightfastness, heat stability, and dispersibility for high-end industrial applications. Collaborations and mergers are strengthening global supply chains and expanding product portfolios to meet rising demand from coatings, plastics, and printing sectors. Moreover, companies are increasingly adopting eco-efficient manufacturing practices and developing non-toxic, bio-based pigments to comply with evolving environmental regulations and consumer preferences.

Corporate Landscape of the Global Organic Pigments Market:

Recent Developments

- In October 2024, Sudarshan Chemical Industries Ltd. announced that it had entered into a definitive agreement to acquire Heubach Group (Germany) in a combination of asset and share deal. This strategic acquisition is aimed at creating a global pigments company combining both parties’ capabilities.

- Report ID: 1015

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Pigments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.