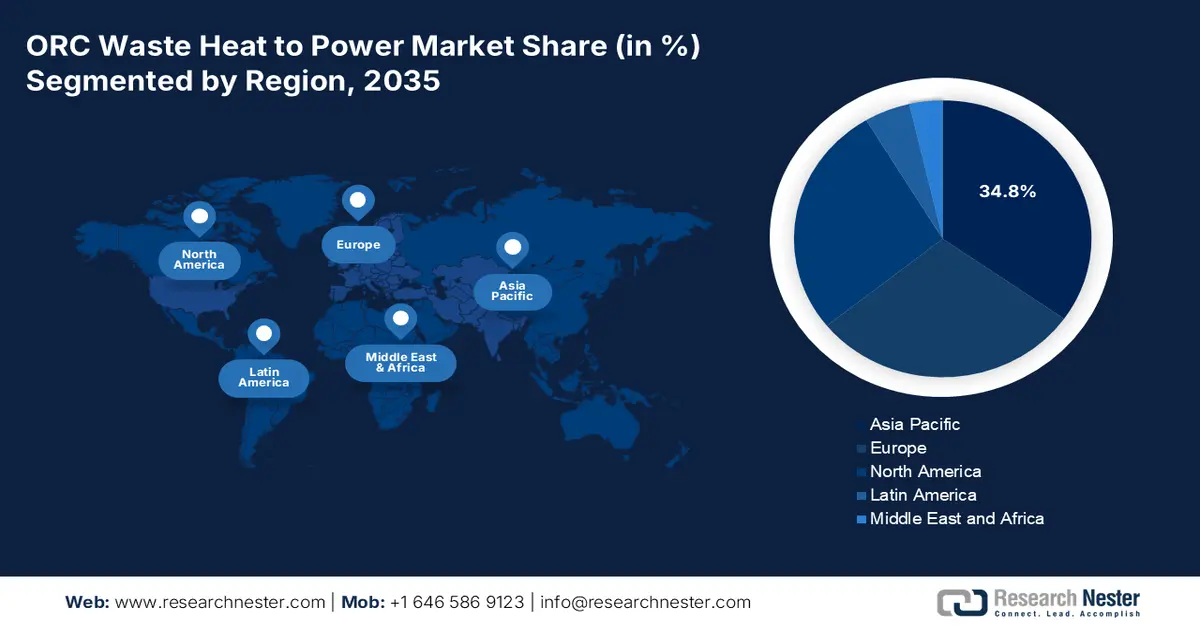

ORC Waste Heat to Power Market - Regional Analysis

APAC Market Insights

The Asia Pacific ORC waste heat to power market is anticipated to hold the highest share of 34.8% by the end of 2035. The market’s upliftment in the region is primarily attributed to robust funding for energy efficiency, strict emission reforms, and an increase in rapid industrialization. According to an article published by Energy Economics in October 2024, implementing energy policies in the region significantly correlates with an average increase in energy efficiency by 0.1%. Even though the overall region’s average energy efficiency stands at 0.34, there has been a continuous upward trend observed. Moreover, the aspect of improving aggregate energy reforms has led to substantial energy savings, averaging 0.15 quadrillion Btu. Besides, by the end of 2050, the overall region is expected to account for 50% of international economic growth, thus creating an upsurge in the energy demand by 45%.

Overall Finalized Energy Consumption in the Asia Pacific (2023)

|

Sector Type |

Capacity (TJ) |

Share (%) |

|

Industry |

76,961,575 |

42.0 |

|

Transport |

34,868,259 |

19.0 |

|

Residential |

31,290,717 |

17.1 |

|

Commercial and Public Services |

10,094,250 |

- |

|

Agriculture and Forestry |

4,334,063 |

- |

|

Other Non-Specified |

4,731,702 |

- |

|

Non-Energy Utilization |

20,690,210 |

11.3 |

The organic rankine cycle (ORC) waste heat to power market in India is growing significantly due to continuous growth in the chemicals base, policy-driven efficiency upgradation, and an upsurge in industrial modernization. Based on government data published by ChemIndia in 2024, the value addition in the chemicals sector successfully reached USD 29.7 billion as of 2024, along with an expected 3.2% growth rate by the end of 2029. Additionally, in the chemicals industry, 100% FDI in the country is permitted under the automatic route. Moreover, the domestic chemical sector spends on research and development, accounting for 2% to 3% of the overall turnover, in comparison to 9% to 10% by the multi-national organizations overseas. Practically, the domestic facilities readily deploy ORC to achieve low-grade heat, diminish energy expenses, and meet tightened environmental standards, thus suitable for positively impacting the market’s growth.

The ORC waste heat to power market in China is also growing due to an increase in the demand for the chemical sector and industrial scale, followed by governmental spending and policy, carbon neutrality targets, environmental regulations, and industry and technological partnerships. As per a data report published by the Energy Transitions Organization in May 2022, the country’s chemical industry readily accounts for 20% of the overall national industrial emissions, along with 13% of domestic carbon dioxide emissions. The aspect of zero-carbon scenario, efficiency optimization, structural modification, and recycling potential is projected to contribute to a 49% reduction of chemicals. Additionally, the country’s emerging end use of new materials and energy is projected to extend significantly, with a surge of over 165%, thus creating an optimistic outlook for the organic rankine cycle waste heat to power market.

North America Market Insights

North America ORC waste heat to power market is expected to emerge as the fastest-growing region during the forecast period. The market's development in the region is fueled by mature retrofit opportunities in refining, steel, cement, and chemicals, along with energy-efficient standards and industrial decarbonization mandates. According to official statistics published by the Department of Energy (DOE) in December 2024, the 2024 Report on U.S. Data Center Energy Use has identified that data centers consume almost 4.4% of overall electricity in the U.S. as of 2023, and are predicted to consume an estimated 6.7% to 12% of the total electricity by the end of 2028. In addition, the report has also indicated that the overall data center electricity utilization has surged from 58 TWh to 176 TWh as of 2023 and denotes an approximate increase between 325 TWh to 580 TWh by 2028, thus making it suitable for the market’s exposure.

The organic rankine cycle (ORC) waste heat to power market in the U.S. is gaining increased traction due to an increase in the demand for the chemical industry and industrial scale, federal funding and policy, environmental regulations, and safety standards. As per an article published by the ITA in 2023, the country readily exported more than USD 494 billion of chemicals as of 2022. In addition, the country is the leader in chemical production, and more than 13% of global chemicals derive from the nation. Besides, the industry comprises 14,000 establishments, readily producing more than 70,000 products. In the middle of 2024, the country’s chemical manufacturing sector directly employed more than 902,300 employees. Moreover, the overall FDI in the sector amounted to USD 766.7 billion in 2023, thereby denoting an optimistic outlook for the overall market’s growth and development.

The ORC waste heat to power market in Canada is also developing, owing to decarbonization targets, energy efficiency, government incentives and spending, modernization in the chemical industry, organizational partnerships, as well as research and development. As per a data report published by the IISD Organization in February 2023, the carbon capture and storage (CCS) sector, especially in the oil and gas industry, is expensive in the country, amounting to CAD 200 per ton for presently operating projects. Despite this, the country’s federal government offers suitable support for CCS, and has significantly committed CAD 9.1 billion, along with CAD 3.8 billion from the governments of Saskatchewan and Alberta. Besides, CCS in the oil and gas industry is readily utilized to reduce emissions from production, thus demonstrating almost 15% of overall life-cycle emissions.

Europe Market Insights

Europe ORC waste heat to power market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly driven by regional funding for clean technologies, industrial efficiency mandates, and strict decarbonization policies. As per official statistics published by Europe Commission in November 2025, the administrative body unveiled the Horizon Europe approach, with an estimated €600 million to ensure funding for research and innovation projects that support the clean industrial deal. Besides, the December 2025 Europe Commission article estimated that the Horizon Europe Work Program ensured generous funding opportunities, and with an overall budget of €14 billion, the work program is focused on dedicating almost 35% of its funding to climate objectives. Therefore, based on all these funds and investments, the market is flourishing in the overall region.

The organic rankine cycle waste heat to power market in Germany is gaining increased exposure due to emission standards, rigorous efficiency, and the presence of massive refining, cement, metals, and chemical bases. As stated in an article published by Clean Energy Wire Organization in May 2024, 155 million tons of carbon dioxide equivalents are derived from the industrial sector in the country as of 2023. Besides, the basic chemicals, cement, and steel production accounted for more than 40% of industrial greenhouse gases. Moreover, to ensure smooth production processes, nearly EUR 15 billion in cumulative additional investments are necessary to shift to low-emission technologies. Besides, chemical infrastructures in the country have leveraged ORC to diminish energy emissions and expenses, thereby enhancing the organic rankine cycle waste heat to power market’s demand throughout.

The organic rankine cycle (ORC) waste heat to power market in Poland is also growing, owing to tightening environmental compliance, regional cohesion funding, and accelerating industrial modernization, along with the presence of substantial low-grade heat recovery opportunities. Besides, according to an article published by the ITA in January 2024, the country is deliberately an emerging innovator, with its performance at 62.8% of the overall regional average. In addition, the country spends 1.3% of its gross domestic product (GDP) on research and development, leading to industrial modernization. Moreover, in June 2023, Intel Corporation provided an FDI of USD 5 billion Semiconductor Integration and Testing Plant in the country. Simultaneously, PepsiCo invested USD 1 billion in the most environmentally sustainable facility in the whole of Europe, thereby making it suitable for boosting the organic rankine cycle waste heat to power market’s growth.