ORC Waste Heat to Power Market Outlook:

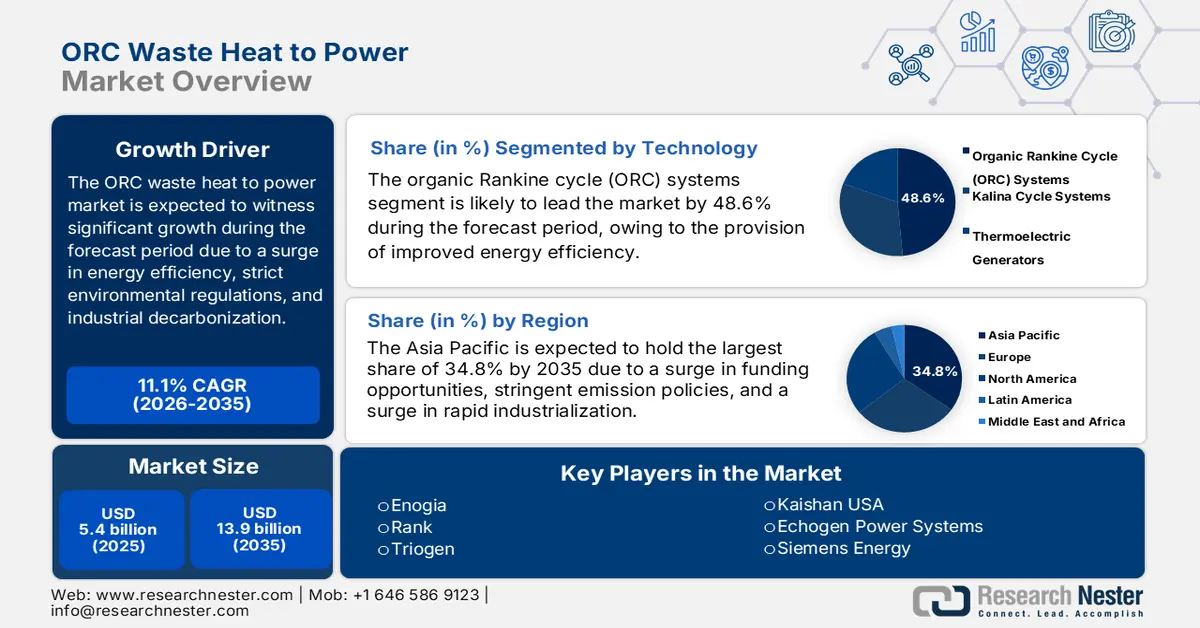

ORC Waste Heat to Power Market size was over USD 5.4 billion in 2025 and is estimated to reach USD 13.9 billion by the end of 2035, expanding at a CAGR of 11.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of ORC waste heat to power is evaluated at USD 6 billion.

The international ORC waste heat to power market is continuously witnessing increased exposure, and this momentum is highly driven by a rise in the need for energy efficiency for heavy industries, such as chemicals, petrochemicals, steel, and cement, stringent environmental regulations, and industrial decarbonization. According to official statistics published by the UNEP Organization in October 2024, nations are required collectively to reduce 42% of yearly greenhouse gas emissions by the end of 2030, along with 57% by 2035. This is projected to be initiated in the upcoming round of Nationally Determined Contributions (NDCs). Besides, the failure to enhance ambition in this objective is poised to result in a surge in temperature, ranging between 2.6 and 3.1 degrees Celsius, thus making it suitable for bolstering the market’s growth.

Furthermore, the presence of government incentives, emission reduction mandates, technological innovations, integration with renewable energy, and circular economy adjustment are other drivers fueling the organic rankine cycle (ORC) waste heat to power market internationally. As per official statistics published by the IEA Organization in June 2023, the government expenditure for clean energy denoted an investment of USD 1.3 trillion. Additionally, this played a centralized role in the rapid growth of clean energy investment, which further increased by almost 25% as of 2023. Besides, as per the September 2025 Energy Conversion and Management article, an estimated 99% of the global shipment for energy demand is readily met by fossil fuels, with marine gas oil and fuel oil accounting for almost 95% of the overall demand, thus boosting the market’s exposure.

Key ORC Waste Heat to Power Market Insights Summary:

Regional Highlights:

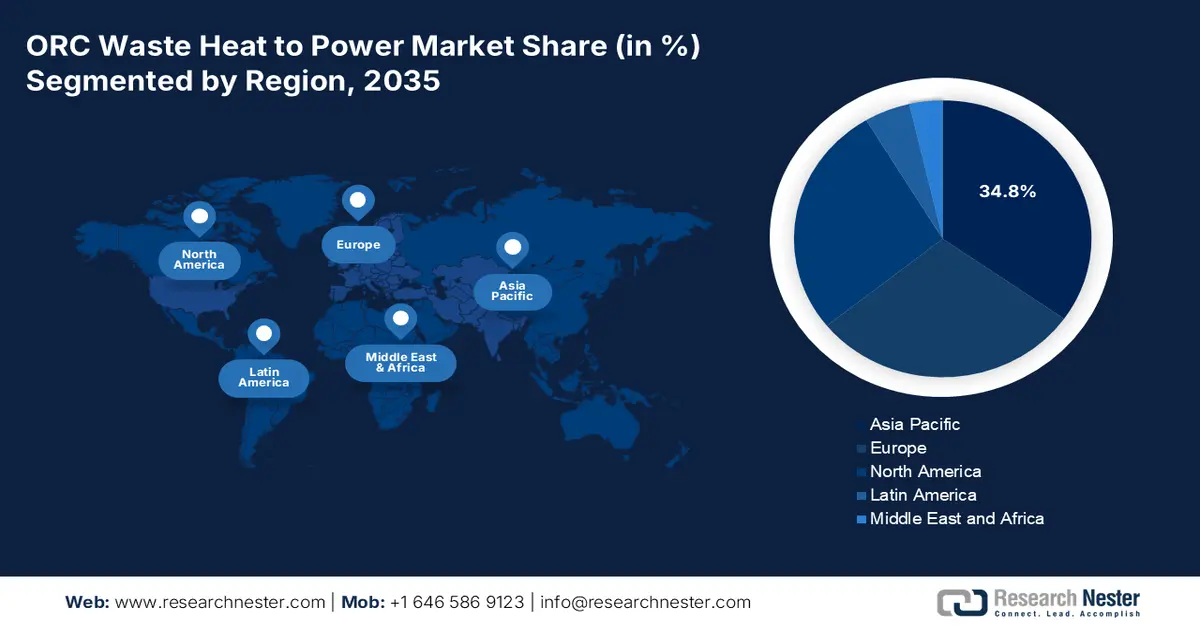

- The Asia Pacific region is projected to command a leading 34.8% share by 2035 in the orc waste heat to power market, supported by strong investments in energy efficiency, tightening emission reforms, and accelerating industrialization.

- North America is expected to register the fastest growth through 2035, reinforced by mature retrofit potential across refining, steel, cement, and chemicals, combined with stringent energy-efficiency standards and industrial decarbonization mandates.

Segment Insights:

- The organic Rankine cycle (ORC) systems sub-segment under the technology segment is anticipated to secure a substantial 48.6% share by 2035 in the orc waste heat to power market, enabled by its effectiveness in enhancing energy efficiency through the conversion of low-to-medium temperature renewable and waste heat sources into electricity.

- The industrial processes segment based on heat source is forecast to capture a prominent revenue share by 2035, fueled by extensive low-grade waste heat generation from energy-intensive industries and strengthened by regulatory pressure for emission reduction and energy optimization.

Key Growth Trends:

- Rise in energy expenses

- Focus on corporate sustainability commitments

Major Challenges:

- Technical integration risks

- Policy and regulatory uncertainty

Key Players: Turboden, Ormat Technologies, Exergy International, ElectraTherm, Enertime, Orcan Energy, Enogia, Rank, Triogen, Zuccato Energia, Mitsubishi Heavy Industries, IHI Corporation, Kawasaki Heavy Industries, Kaishan, Kaishan USA, Echogen Power Systems, Siemens Energy, General Electric, Thermax, Doosan Enerbility

Global ORC Waste Heat to Power Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.4 billion

- 2026 Market Size: USD 6 billion

- Projected Market Size: USD 13.9 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: South Korea, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 14 January, 2026

ORC Waste Heat to Power Market - Growth Drivers and Challenges

Growth Drivers

- Rise in energy expenses: Systems in the organic rankine cycle (ORC) waste heat to power market tend to diminish operational costs by converting waste heat into electricity by offering a competitive edge for energy-based sectors. As per official statistics put forth by the UNCTAD Organization in 2023, gaining the energy transition is expected to cost almost USD 5.8 trillion every year by the end of 2030 across 48 developing economies, which is equivalent to 19% of their GDP. Besides, breaking the overall cost down, 80% is required to be spent in the high-income and upper-middle-income developing nations. The per-person yearly expenses across these countries amount to USD 2,042, which is four times more than for low and lower-middle-income nations, thus making it suitable for bolstering the market’s exposure.

International Yearly Expense of Achieving Energy Transition (2023)

|

Economy Type |

Economies Covered |

Total Expense (USD Billion) |

Cost per Capita (USD) |

GDP % |

Gap (USD Billion) |

|

Low and Lower-Middle Income |

19 |

1,133 |

497 |

21 |

5 |

|

Upper-Middle and High-Income |

29 |

4,672 |

2,042 |

18 |

281 |

|

Least Developed Nation |

6 |

74 |

379 |

46 |

2 |

|

Landlocked Developing Countries |

9 |

110 |

695 |

27 |

5 |

|

Small Island Developing States |

8 |

53 |

1,703 |

10 |

3 |

Source: UNCTAD Organization

- Focus on corporate sustainability commitments: The presence of multinational corporations in the ORC waste heat to power market is readily focused on initiating investments. The ultimate purpose is to meet ESG-based targets and significantly demonstrate leadership in sustainability. As per a report published by the OECD in October 2025, 91% of overall listed organizations tend to disclose sustainability-driven information. In addition, 81% of the listed organizations disclosed sustainability information by receiving third-party assurance. Moreover, USD 671 billion has been allocated for 2024 listed energy-sector buybacks and dividends, thus tripling the level, while the investing activity significantly remained stabilized, thereby bolstering the organic rankine cycle waste heat to power market’s upliftment.

- Increase in strict environmental regulations: Governments across different nations are significantly enforcing stringent emission norms. For instance, the Green Deal mandate in Europe is highly focused on industrial decarbonization, directly fueling the ORD waste heat to power market globally. As stated in an article published by the Energy Transition Organization in August 2022, the highly ambitious 2030 decarbonization target in India constitutes decarbonizing energy to 50% and gaining 500 GW of fossil fuel-free generating capacity by the end of 2030. Besides, the per capita electricity consumption in the country deliberately stands at 1,208 kWh, denoting an increase from 559 kWh. This resulted in an increase of almost three times the nation’s economic development, denoting an optimistic outlook for the organic rankine cycle waste heat to power market.

Challenges

- Technical integration risks: Integrating ORC systems into existing industrial processes presents complex engineering challenges, which negatively impact the organic rankine cycle (ORC) waste heat to power market. Waste heat streams vary significantly in temperature, pressure, and consistency across industries, requiring customized ORC designs. This variability makes standardization difficult and increases project costs. For example, cement plants generate intermittent high‑temperature exhaust, while chemical plants often produce continuous low‑grade heat. Designing ORC systems that can efficiently handle these diverse conditions demands advanced engineering and site‑specific feasibility studies. Moreover, ORC efficiency is highly dependent on the quality of the heat source, and fluctuations in industrial operations can reduce output and affect ROI.

- Policy and regulatory uncertainty: While government incentives are a major driver for the ORC waste heat to power market, inconsistent policies across regions create uncertainty for investors and manufacturers. In Europe, strong frameworks, such as the Europe Green Deal and Horizon Europe provide clear support for industrial decarbonization, but in many developing economies, policies remain fragmented or short‑term. This lack of consistency discourages long‑term investments in ORC projects, as companies cannot reliably forecast regulatory compliance costs or incentive availability. In some countries, subsidies are focused on solar or wind, leaving waste heat recovery underfunded despite its potential. Additionally, regulatory hurdles such as permitting, environmental approvals, and grid interconnection requirements can delay projects by months or even years.

ORC Waste Heat to Power Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 5.4 billion |

|

Forecast Year Market Size (2035) |

USD 13.9 billion |

|

Regional Scope |

|

ORC Waste Heat to Power Market Segmentation:

Technology Segment Analysis

The organic Rankine cycle (ORC) systems sub-segment, which is part of the technology segment, is anticipated to garner the largest share of 48.6% in the ORC waste heat to power market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance in optimizing energy efficiency by converting low-to-medium renewable sources and temperature waste into electricity. According to official statistics published by NLM in November 2024, regenerative organic Rankine cycle (R-ORC) systems are regarded to be 1.8% to 25.5% more efficient. In addition, these systems readily demonstrate an estimated 7.6% better performance, and at the same time offer an optimistic economic contribution in comparison to regular ORC. Therefore, both ORC and R-ORC systems deliberately play a key role in providing valuable guidance and ensuring sustainable energy production.

Heat Source Segment Analysis

Based on the heat source, the industrial processes segment in the organic rankine cycle (ORC) waste heat to power market is projected to hold the second-largest share during the forecast period. The segment’s growth is highly fueled by robust industries such as cement, steel, petrochemicals, glass, and chemicals, generating massive amounts of low‑grade waste heat, which is ideal for ORC systems. This segment is projected to hold the highest revenue share by 2035, driven by stringent emission regulations and the need for energy efficiency. For example, cement kilns and blast furnaces in steel plants release continuous streams of exhaust gases that can be captured and converted into electricity through ORC technology. The adoption of ORC in industrial processes is further supported by government initiatives promoting decarbonization and circular economy practices, which is positively impacting the segment’s growth.

Application Segment Analysis

By the end of the stipulated timeline, the power generation sub-segment, part of the application segment, is expected to account for the third-largest share in the ORC waste heat to power market. The sub-segment’s development is highly propelled by the ability to convert waste heat into electricity, reducing reliance on fossil fuels and lowering operational costs. This segment is expected to grow steadily through 2035, supported by rising energy demand, decarbonization goals, and government incentives for renewable integration. ORC systems are particularly valuable in distributed generation, where they provide reliable electricity from industrial exhaust streams without additional fuel consumption. For instance, ORC units installed in petrochemical plants or refineries can generate several megawatts of electricity, offsetting grid demand and improving energy security.

Our in-depth analysis of the ORC waste heat to power market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Heat Source |

|

|

Application |

|

|

Capacity |

|

|

End user Industry |

|

|

Cycle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ORC Waste Heat to Power Market - Regional Analysis

APAC Market Insights

The Asia Pacific ORC waste heat to power market is anticipated to hold the highest share of 34.8% by the end of 2035. The market’s upliftment in the region is primarily attributed to robust funding for energy efficiency, strict emission reforms, and an increase in rapid industrialization. According to an article published by Energy Economics in October 2024, implementing energy policies in the region significantly correlates with an average increase in energy efficiency by 0.1%. Even though the overall region’s average energy efficiency stands at 0.34, there has been a continuous upward trend observed. Moreover, the aspect of improving aggregate energy reforms has led to substantial energy savings, averaging 0.15 quadrillion Btu. Besides, by the end of 2050, the overall region is expected to account for 50% of international economic growth, thus creating an upsurge in the energy demand by 45%.

Overall Finalized Energy Consumption in the Asia Pacific (2023)

|

Sector Type |

Capacity (TJ) |

Share (%) |

|

Industry |

76,961,575 |

42.0 |

|

Transport |

34,868,259 |

19.0 |

|

Residential |

31,290,717 |

17.1 |

|

Commercial and Public Services |

10,094,250 |

- |

|

Agriculture and Forestry |

4,334,063 |

- |

|

Other Non-Specified |

4,731,702 |

- |

|

Non-Energy Utilization |

20,690,210 |

11.3 |

The organic rankine cycle (ORC) waste heat to power market in India is growing significantly due to continuous growth in the chemicals base, policy-driven efficiency upgradation, and an upsurge in industrial modernization. Based on government data published by ChemIndia in 2024, the value addition in the chemicals sector successfully reached USD 29.7 billion as of 2024, along with an expected 3.2% growth rate by the end of 2029. Additionally, in the chemicals industry, 100% FDI in the country is permitted under the automatic route. Moreover, the domestic chemical sector spends on research and development, accounting for 2% to 3% of the overall turnover, in comparison to 9% to 10% by the multi-national organizations overseas. Practically, the domestic facilities readily deploy ORC to achieve low-grade heat, diminish energy expenses, and meet tightened environmental standards, thus suitable for positively impacting the market’s growth.

The ORC waste heat to power market in China is also growing due to an increase in the demand for the chemical sector and industrial scale, followed by governmental spending and policy, carbon neutrality targets, environmental regulations, and industry and technological partnerships. As per a data report published by the Energy Transitions Organization in May 2022, the country’s chemical industry readily accounts for 20% of the overall national industrial emissions, along with 13% of domestic carbon dioxide emissions. The aspect of zero-carbon scenario, efficiency optimization, structural modification, and recycling potential is projected to contribute to a 49% reduction of chemicals. Additionally, the country’s emerging end use of new materials and energy is projected to extend significantly, with a surge of over 165%, thus creating an optimistic outlook for the organic rankine cycle waste heat to power market.

North America Market Insights

North America ORC waste heat to power market is expected to emerge as the fastest-growing region during the forecast period. The market's development in the region is fueled by mature retrofit opportunities in refining, steel, cement, and chemicals, along with energy-efficient standards and industrial decarbonization mandates. According to official statistics published by the Department of Energy (DOE) in December 2024, the 2024 Report on U.S. Data Center Energy Use has identified that data centers consume almost 4.4% of overall electricity in the U.S. as of 2023, and are predicted to consume an estimated 6.7% to 12% of the total electricity by the end of 2028. In addition, the report has also indicated that the overall data center electricity utilization has surged from 58 TWh to 176 TWh as of 2023 and denotes an approximate increase between 325 TWh to 580 TWh by 2028, thus making it suitable for the market’s exposure.

The organic rankine cycle (ORC) waste heat to power market in the U.S. is gaining increased traction due to an increase in the demand for the chemical industry and industrial scale, federal funding and policy, environmental regulations, and safety standards. As per an article published by the ITA in 2023, the country readily exported more than USD 494 billion of chemicals as of 2022. In addition, the country is the leader in chemical production, and more than 13% of global chemicals derive from the nation. Besides, the industry comprises 14,000 establishments, readily producing more than 70,000 products. In the middle of 2024, the country’s chemical manufacturing sector directly employed more than 902,300 employees. Moreover, the overall FDI in the sector amounted to USD 766.7 billion in 2023, thereby denoting an optimistic outlook for the overall market’s growth and development.

The ORC waste heat to power market in Canada is also developing, owing to decarbonization targets, energy efficiency, government incentives and spending, modernization in the chemical industry, organizational partnerships, as well as research and development. As per a data report published by the IISD Organization in February 2023, the carbon capture and storage (CCS) sector, especially in the oil and gas industry, is expensive in the country, amounting to CAD 200 per ton for presently operating projects. Despite this, the country’s federal government offers suitable support for CCS, and has significantly committed CAD 9.1 billion, along with CAD 3.8 billion from the governments of Saskatchewan and Alberta. Besides, CCS in the oil and gas industry is readily utilized to reduce emissions from production, thus demonstrating almost 15% of overall life-cycle emissions.

Europe Market Insights

Europe ORC waste heat to power market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly driven by regional funding for clean technologies, industrial efficiency mandates, and strict decarbonization policies. As per official statistics published by Europe Commission in November 2025, the administrative body unveiled the Horizon Europe approach, with an estimated €600 million to ensure funding for research and innovation projects that support the clean industrial deal. Besides, the December 2025 Europe Commission article estimated that the Horizon Europe Work Program ensured generous funding opportunities, and with an overall budget of €14 billion, the work program is focused on dedicating almost 35% of its funding to climate objectives. Therefore, based on all these funds and investments, the market is flourishing in the overall region.

The organic rankine cycle waste heat to power market in Germany is gaining increased exposure due to emission standards, rigorous efficiency, and the presence of massive refining, cement, metals, and chemical bases. As stated in an article published by Clean Energy Wire Organization in May 2024, 155 million tons of carbon dioxide equivalents are derived from the industrial sector in the country as of 2023. Besides, the basic chemicals, cement, and steel production accounted for more than 40% of industrial greenhouse gases. Moreover, to ensure smooth production processes, nearly EUR 15 billion in cumulative additional investments are necessary to shift to low-emission technologies. Besides, chemical infrastructures in the country have leveraged ORC to diminish energy emissions and expenses, thereby enhancing the organic rankine cycle waste heat to power market’s demand throughout.

The organic rankine cycle (ORC) waste heat to power market in Poland is also growing, owing to tightening environmental compliance, regional cohesion funding, and accelerating industrial modernization, along with the presence of substantial low-grade heat recovery opportunities. Besides, according to an article published by the ITA in January 2024, the country is deliberately an emerging innovator, with its performance at 62.8% of the overall regional average. In addition, the country spends 1.3% of its gross domestic product (GDP) on research and development, leading to industrial modernization. Moreover, in June 2023, Intel Corporation provided an FDI of USD 5 billion Semiconductor Integration and Testing Plant in the country. Simultaneously, PepsiCo invested USD 1 billion in the most environmentally sustainable facility in the whole of Europe, thereby making it suitable for boosting the organic rankine cycle waste heat to power market’s growth.

Key ORC Waste Heat to Power Market Players:

- Turboden (Italy)

- Ormat Technologies (U.S.)

- Exergy International (Italy)

- ElectraTherm (U.S.)

- Enertime (France)

- Orcan Energy (Germany)

- Enogia (France)

- Rank (Spain)

- Triogen (Netherlands)

- Zuccato Energia (Italy)

- Mitsubishi Heavy Industries (Japan)

- IHI Corporation (Japan)

- Kawasaki Heavy Industries (Japan)

- Kaishan (China)

- Kaishan USA (U.S.)

- Echogen Power Systems (U.S.)

- Siemens Energy (Germany)

- General Electric (U.S.)

- Thermax (India)

- Doosan Enerbility (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Turboden, part of Mitsubishi Heavy Industries Group, is a leading global supplier of Organic Rankine Cycle (ORC) systems. The company has installed hundreds of ORC units worldwide, particularly in industrial waste heat recovery and biomass applications, positioning itself as a dominant player in Europe.

- Ormat Technologies is a pioneer in geothermal and ORC-based waste heat recovery solutions. With decades of experience, Ormat has a strong presence in North America and Asia, leveraging its expertise in renewable energy to expand ORC adoption across industrial sectors.

- Exergy International specializes in advanced ORC systems with patented radial outflow turbine technology. Its innovations improve efficiency and flexibility, making Exergy a competitive force in Europe’s industrial waste heat recovery market.

- ElectraTherm focuses on small-scale ORC systems designed for distributed generation and low-temperature waste heat recovery. Its Power+ Generator technology is widely used in oil and gas, manufacturing, and renewable energy projects, particularly in modular applications.

- Enertime designs and manufactures ORC turbines for industrial energy efficiency and district heating. The company is active in France and broader Europe, aligning with regional decarbonization policies and supporting industrial clients in reducing emissions through waste heat recovery.

Here is a list of key players operating in the global organic rankine cycle waste heat to power market:

The worldwide ORC waste heat to power market is competitive and geographically diverse, led by established Europe and Japan-based OEMs, U.S. innovators, and fast‑scaling Asia-specific manufacturers. Strategies center on industrial retrofits, modular ORC platforms, and integration with CHP and district energy. Key players pursue EU and national grants, joint ventures, and long‑term service agreements to de‑risk deployments. Product roadmaps emphasize higher efficiency working fluids, sub/supercritical designs, and digital performance monitoring. Besides, in July 2025, Goltens Worldwide signed a significant deal with Munich-based cleantech organization, Orcan Energy AG. The purpose is to emerge as the authorized and preferred installation and engineering partner for Orcan’s Marine Organic Rankine Cycle (ORC) systems, thus creating a positive impact on the ORC waste heat to power industry globally.

Corporate Landscape of the ORC Waste Heat to Power Market:

Recent Developments

- In October 2025, Turboden S.p.A. announced the significant commissioning of North America’s first waste heat to power project in steam-based gravity drainage infrastructure, and the solution is based on its Organic Rankine Cycle (ORC) power plant at the Orion steam-assisted gravity drainage (SAGD) facility.

- In October 2025, Clean Energy Technologies, Inc. declared that its Clean Cycle II Organic Rankine Cycle (ORC) technology has been readily deployed in Tennessee, and it has been designed for delivering a waste heat recapture system by utilizing ORC technology.

- In April 2025, Orcan Energy AG has effectively entered into a distributorship agreement with Energas Technologies for distributing Orcan’s advanced ORC waste heat recovery solutions to consumers in the energy sector across whole of South Africa.

- Report ID: 5570

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ORC Waste Heat to Power Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.