Waste Heat Recovery System Market Outlook:

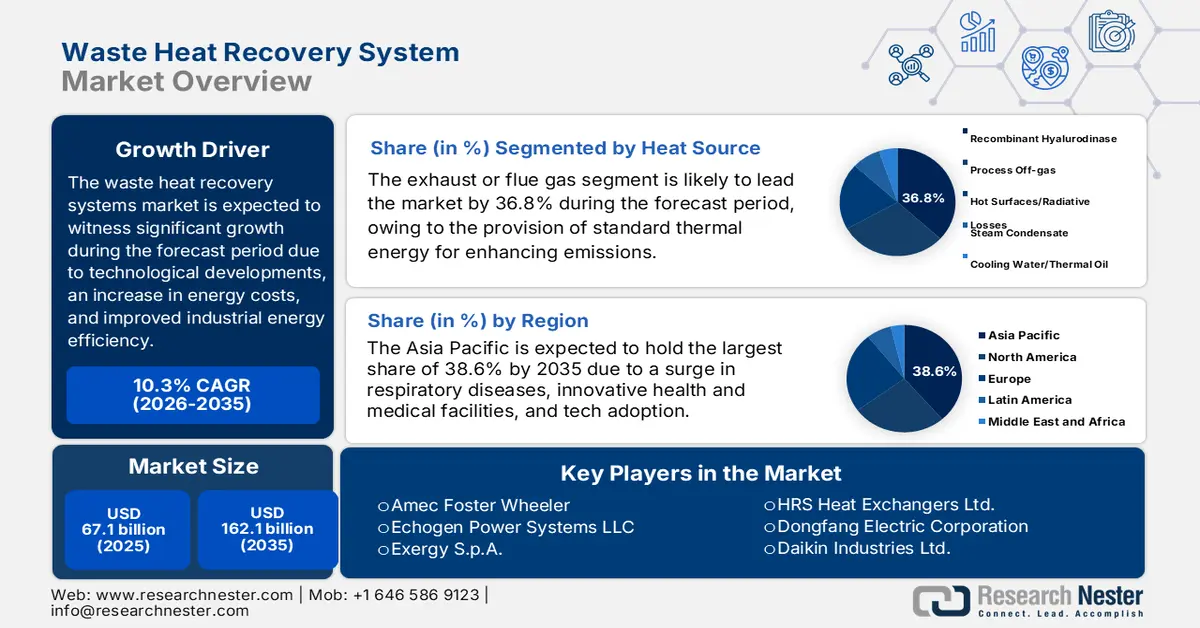

Waste Heat Recovery System Market size was over USD 67.1 billion in 2025 and is estimated to reach USD 162.1 billion by the end of 2035, expanding at a CAGR of 10.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of Waste Heat Recovery System is evaluated at USD 74 billion.

The international waste heat recovery system market is rapidly expanding, owing to technological advancements, the rise in energy expenses, and optimization of industrial energy efficiency. According to an article published by the UNEP Organization in November 2023, greenhouse gas emissions achievement by 2030 is based on policies, wherein it has been expected to increase by 16% at the time of the deal’s adoption, while the projection surged by 3%. However, the predicted 2030 greenhouse gas emissions need to be reduced by 28% of the overall Paris Agreement 2°C pathway and 42 per cent for the 1.5°C pathway. Besides, as per the 2025 IEA Organization article, there has been an increase in energy-based carbon dioxide emissions by 0.8% as of 2024, readily hitting the all-time high of 37.8 Gt carbon dioxide, thus suitable for bolstering the market’s exposure.

International Carbon Dioxide Emissions Yearly Change from Energy Combustion (2014-2024)

|

Year |

Changes in Emissions (Gt C02) |

|

2014 |

34.8 |

|

2015 |

34.7 |

|

2016 |

34.8 |

|

2017 |

35.4 |

|

2018 |

36.3 |

|

2019 |

36.3 |

|

2020 |

34.5 |

|

2021 |

36.4 |

|

2022 |

36.8 |

|

2023 |

37.3 |

|

2024 |

37.6 |

Source: IEA Organization

Furthermore, the integration with digitalized technologies, a sudden shift toward organic Rankine cycle, a policy-based adoption, and sector-specific uptake are other factors that are driving the market globally. As per an article published by NLM in June 2025, AI-based models have readily displayed suitable predictive capabilities for improving heat transfer efficiency with test data exceeding 0.9 in solar-based thermal systems. Besides, by adopting AI models on engineered wind flow simulations, researchers in the U.S. evaluated more than 6,800 potential onshore wind facilities. This has resulted in co-optimizing plant layouts with wake steering to diminish land requirements by 18% per plant, along with site-specific advantages ranging from 2% to 34%. In addition, wake steering is expected to surge power production during high-value timelines, potentially bolstering yearly revenue by USD 3.7 million for individual hubs, thus suitable for uplifting the market internationally.

Key Waste Heat Recovery Systems Market Insights Summary:

Regional Highlights:

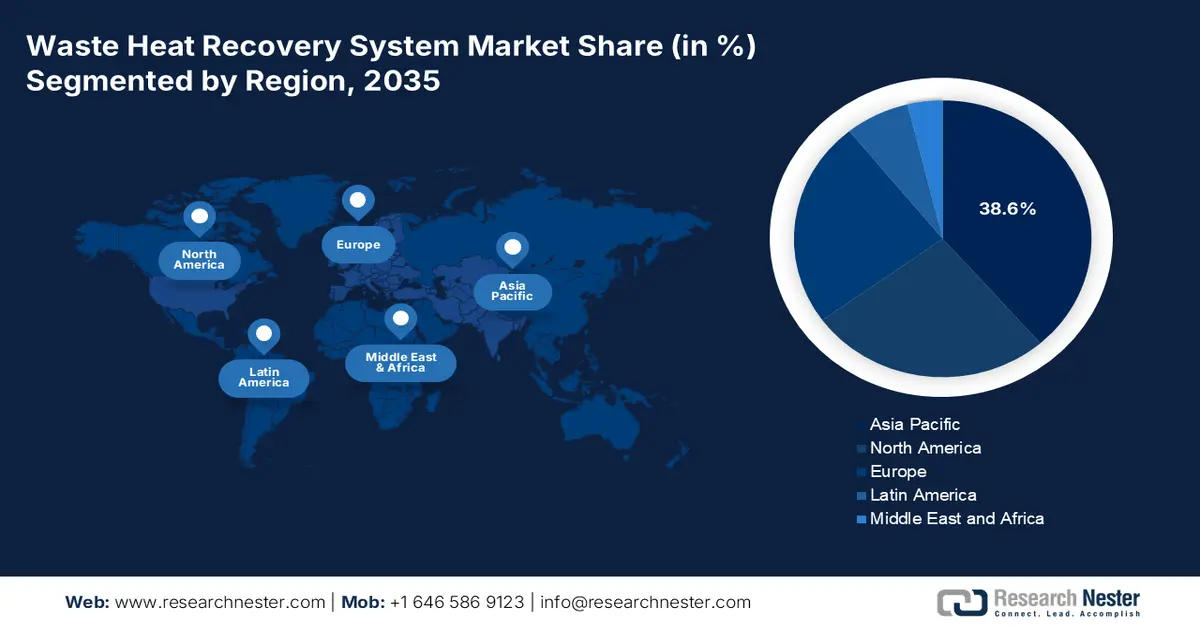

- Asia Pacific is projected to command a leading 38.6% share of the waste heat recovery system market by 2035, supported by policy-led energy efficiency upgrades and a strong concentration of heavy industrial manufacturing bases.

- Europe is expected to register the fastest growth trajectory in the waste heat recovery system market through 2035, underpinned by stringent decarbonization targets and regulatory frameworks accelerating low-carbon industrial technologies.

Segment Insights:

- The exhaust or flue gas sub-segment within the heat source segment is forecast to capture a dominant 36.8% share of the waste heat recovery system market by 2035, aided by its effectiveness in recovering usable thermal energy to curb fuel consumption and greenhouse gas emissions.

- The steam Rankine cycle (SRC) sub-segment in the technology segment is anticipated to secure the second-largest market share by the end of the forecast period, reinforced by its established capability to efficiently convert high-temperature waste heat into reliable power generation.

Key Growth Trends:

- Rise in energy expenses

- Presence of environmental regulations

Major Challenges:

- Complexity integration with existing infrastructure

- Operational and maintenance drawbacks

Key Players: General Electric Company (U.S.), Mitsubishi Heavy Industries Ltd. (Japan), ABB Ltd. (Switzerland), Bosch Industriekessel GmbH (Germany), Thermax Limited (India), John Wood Group PLC (UK), Ormat Technologies Inc. (U.S.), Kawasaki Heavy Industries Ltd. (Japan), Alfa Laval AB (Sweden), Amec Foster Wheeler (UK), Echogen Power Systems LLC (U.S.), Exergy S.p.A. (Italy), HRS Heat Exchangers Ltd. (UK), Dongfang Electric Corporation (China), Daikin Industries Ltd. (Japan), Babcock & Wilcox Enterprises Inc. (U.S.), Kelvion Holding GmbH (Germany), Spirax-Sarco Engineering PLC (UK), Enogia SAS (France).

Global Waste Heat Recovery Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 67.1 billion

- 2026 Market Size: USD 74 billion

- Projected Market Size: USD 162.1 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 6 January, 2026

Waste Heat Recovery System Market - Growth Drivers and Challenges

Growth Drivers

- Rise in energy expenses: With fluctuation in international energy prices, several industries are turning to the waste heat recovery system market to diminish dependency on external fuel sources. According to an article published by the UNCTAD Organization in 2023, the aspect of energy transition is expected to cost almost USD 5.8 trillion yearly from 2023 to 2030 for 46 developing economies, which is equal to 19% of the GDP. Besides, the yearly cost for per person amounts to USD 1,271 to gain objectives, such as universal accessibility to electricity and optimizing access to clean energy, which includes clean cooking solutions. Moreover, 80% of the overall cost down is needed to be spent in high and upper-middle-income developing economies, thus creating a positive impact on the market.

- Presence of environmental regulations: The existence of stringent emission norms from administrative agencies, including the DOE, EPA, and Europe Commission, is readily pushing sectors to adopt the market. For instance, as stated in an article published by Europe Commission in June 2024, Europe has significantly disbursed €2.967 billion through the Modernization Fund for supporting 39 energy projects across 10 regional member states. This particular investment supports the modernization of energy systems, along with greenhouse gas emission reduction in the energy industry and transport sectors, and optimizing energy efficiency. Besides, this is also considered the largest disbursement, which has brought the overall expenditure to €12.6 billion, thereby suitable for boosting the market globally.

- Focus on industrial decarbonization goals: Steel, chemicals, and cement are considered the most energy-intensive sectors, which are under pressure to diminish carbon emissions. As per an article published by Energy Transitions Organization in August 2022, India has successfully declared its 2030 decarbonization target, with an objective that includes decarbonizing energy to 50% and gaining 500 GW of fossil fuel generating capacity by the end of 2030. Besides, the country has significantly electrified all households, with per capita electricity consumption standing at 1,208 kWh from 559 kWh. Moreover, wind power capacity is considered the 4th largest, and solar caters to the 5th largest, with an overall capacity of more than 100 GW, thereby denoting an optimistic outlook for the market’s growth.

Challenges

- Complexity integration with existing infrastructure: Systems in the market need to be integrated into existing industrial processes, which often involves technical and operational challenges. Industrial plants vary widely in design, age, and process flow, making it difficult to implement standardized WHRS solutions. Retrofitting requires careful mapping of heat sources, compatibility checks with existing boilers, turbines, and process equipment, and sometimes redesigning plant layouts. This complexity increases project timelines and costs, while also raising risks of operational disruptions. In industries like cement and steel, where continuous production is critical, downtime for installation can result in significant revenue losses, thus creating a hindrance to the market’s expansion.

- Operational and maintenance drawbacks: Even after successful installation, the waste heat recovery system market faces operational and maintenance challenges that can hinder long-term performance. Waste heat recovery equipment operates under harsh conditions, such as high temperatures, corrosive gases, and fluctuating loads, leading to wear and tear. Heat exchangers, turbines, and ORC modules require regular maintenance to sustain efficiency, but many industries lack the technical expertise or resources to manage these systems effectively. In regions with limited skilled labor, maintenance delays can reduce system reliability and ROI. Additionally, monitoring and optimizing WHRS performance requires advanced digital tools and predictive analytics, which are not universally adopted.

Waste Heat Recovery System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 67.1 billion |

|

Forecast Year Market Size (2035) |

USD 162.1 billion |

|

Regional Scope |

|

Waste Heat Recovery System Market Segmentation:

Heat Source Segment Analysis

The exhaust or flue gas sub-segment, which is part of the heat source segment, is anticipated to hold the largest share of 36.8% in the waste heat recovery system market by the end of 2035. The sub-segment’s upliftment is highly attributed to the provision of suitable thermal energy that readily lowers industrial efficiency and enhances emissions. In addition, this particular gas has the ability to capture heat for reducing fuel expenses, diminishes carbon dioxide emissions, and bolsters overall process efficiency and enhances emissions. Besides, according to an article published by the EPA Government in May 2025, the overall greenhouse gas emissions constitute 28% from transportation, 25% from electric power, 23% from industry, 13% from residential and commercial, and 10% from agriculture. Therefore, exhaust or flue gas has the capacity to reduce greenhouse gas emissions, thereby suitable for bolstering its expansion globally.

Technology Segment Analysis

By the end of the forecast period, the steam Rankine cycle (SRC) sub-segment in the technology segment is projected to account for the second-largest share in the market. The sub-segment’s growth is highly driven by its proven efficiency in converting high-temperature waste heat into usable power. SRC systems operate by using recovered heat to generate steam, which drives turbines to produce electricity or mechanical work. This technology is particularly effective in industries such as cement, steel, and refining, where exhaust gases and furnace operations generate large volumes of high-temperature waste heat. The maturity of SRC technology ensures reliability, scalability, and compatibility with existing industrial infrastructure, making it a preferred choice for large-scale operations. Furthermore, SRC systems are capable of handling variable loads and continuous-duty cycles, which are critical in energy-intensive industries.

Phase System Segment Analysis

The closed-loop systems sub-segment, part of the phase system segment, is expected to cater to the third-largest share in the market during the stipulated timeline. The sub-segment’s development is extremely propelled by its design to maximize efficiency and safety by continuously circulating a working fluid within a sealed environment. Unlike open-loop systems, closed-loop configurations prevent contamination, reduce emissions, and ensure consistent thermal performance. These systems are particularly effective in industries where process integrity and environmental compliance are paramount, such as chemicals, food processing, and pharmaceuticals. Closed-loop WHRS typically employ fluids like water, steam, or organic compounds in ORC setups, enabling recovery from both high- and medium-temperature waste heat sources.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Heat Source |

|

|

Technology |

|

|

Phase System |

|

|

Application |

|

|

Temperature Band |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Waste Heat Recovery System Market - Regional Analysis

APAC Market Insights

The Asia Pacific waste heat recovery system market is anticipated to garner the highest share of 38.6% by the end of 2035. The market’s upliftment in the region is primarily attributed to policy-based efficiency upgradation and the presence of heavy industrial bases. According to an article published by the EDB Singapore in March 2022, the region is considered one of the international facilities for accounts and manufacturing for almost 48.5% of the global manufacturing output. Besides, as per the August 2026 TNI Organization article, China accounts for 32% of raw materials, 52% of cathode and anode materials, and 66% of lithium-ion cells, all of which cater to the market’s growth. Additionally, 6% of raw material facilities are available in the overall region, and meanwhile, Singapore’s Green Plan 2030 is a wide-ranging strategy, which is projected to gain net-zero emissions by the end of 2050, along with a target of effectively sourcing 60% of electricity from low-carbon sources in 2035.

The waste heat recovery system market in China is growing significantly due to policy emphasis on emissions reduction and energy efficiency, large-scale industrial infrastructures, and expanded chemical and refining capacities. As stated in an article published by Climate Action Tracker Organization in June 2025, the country successfully submitted its 2023 NDC, with an effective commitment to diminish economy-based greenhouse gas emissions by 7% to 10%. Besides, strong growth in clean energy readily contributed to a 1% year-on-year (YoY) decline in carbon dioxide emissions, with renewable energy accounting for almost 40% of the country’s overall power generation. Moreover, the country has already installed 1,200 GW of solar and wind capacity, and significantly achieved a stock volume of 18.5bn m³, thus denoting an optimistic outlook for the market’s growth.

The waste heat recovery system market in India is also growing, owing to a rise in energy expenses, and the presence of industrial corridors, including steel furnaces, chemical reforming and distillation, and cement kilns. As stated in the March 2025 MOSPI Government data report, coal reserves stood at 389.4 billion tons as of 2024, of which Odisha constitutes the highest share of 25.4%, which is followed by 23.5% for Jharkhand, 21.2% for Chhattisgarh, 8.7% for West Bengal, and 8.4% for Madhya Pradesh. Likewise, crude oil reserves cater to 671.4 million tons, of which Western Offshore accounts for 32%, 21.6% for Assam, 19.5% for Rajasthan, and 17.7% for Gujarat. Besides, natural gas reserves are recorded at 1,094.1 billion cubic meters between 2023 and 2024, with 31.2% at Western Offshore, followed by 24.0% for Eastern Offshore, and 15.0% for Assam, thus suitable for the market’s upliftment.

Europe Market Insights

Europe waste heat recovery system market is expected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly propelled by the presence of strict decarbonization policies, technological innovation in ORC/SRC systems, regulatory demands, and environmental concerns. According to an article published by the Europe Electric Organization in May 2023, the region eventually committed to reducing almost 40% of carbon dioxide emissions by the end of 2030. This is effectively projected to set a suitable aspiration of 80% to 95% reduction by 2050. Moreover, there has been a rise in decarbonization with the Fit for 55 packages, which is aimed at diminishing the Union’s net greenhouse gas emissions by nearly 55% by the end of 2030 and also gain climate neutrality by 2050, thereby suitable for boosting the market.

The waste heat recovery system market in Germany is gaining increased traction due to a massive industrial base, ambitious climate targets, and strong green financing. As per an article published by the Clean Energy Wire Organization in January 2025, the country has aimed to diminish greenhouse gas emissions by 65% by the end of 2030 and successfully reach climate neutrality in 2045. Besides, the domestic climate law is based on the Paris Agreement target of restricting global warming to below 2 degrees Celsius and 1.5 degrees Celsius. Besides, an increase in the contribution by the land use, land-use change, and forestry (LULUCF) industry has resulted in reducing 25 million tons of carbon dioxide by 2030, 35 million tons by 2040, and 40 million tons by 2045. In addition, the presence of a sectoral yearly emission budget by the country’s government is also bolstering the market’s expansion.

Germany’s Yearly Sectoral Emissions Budget (2020-2030)

|

Components (in million carbon dioxide tons) |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|

Energy |

280 |

- |

257 |

- |

- |

- |

- |

- |

- |

- |

108 |

|

Industry |

186 |

182 |

177 |

172 |

165 |

157 |

149 |

140 |

132 |

125 |

118 |

|

Buildings |

118 |

113 |

108 |

102 |

97 |

92 |

87 |

82 |

77 |

72 |

67 |

|

Transport |

150 |

145 |

139 |

134 |

128 |

123 |

117 |

112 |

105 |

96 |

85 |

|

Agriculture |

70 |

68 |

67 |

66 |

65 |

63 |

62 |

61 |

59 |

57 |

56 |

|

Waste and Others |

9 |

9 |

8 |

8 |

7 |

7 |

6 |

6 |

5 |

5 |

4 |

Source: Clean Energy Wire Organization

The waste heat recovery system market in the Netherlands is also developing due to robust private and public collaboration through agencies, such as industrial bodies, including VNCI and RVO, along with stringent sustainability targets. As stated in an article published by the OECD in June 2025, there has been an increase in material productivity by 61% in the country. Besides, the environmentally-based tax revenues in GDP are extremely high, with 2.4% as of 2022. Additionally, 77.2% of greenhouse gas emissions have been readily subject to an optimistic Net Effective Carbon Rate (ECR) in 2023. Furthermore, explicit carbon expenses in the country comprise emissions trading system (ETS) carbon taxes and permit prices, which significantly cover 42% of emissions in carbon dioxide equivalent. Therefore, based on all these strategies, there is a huge growth opportunity for the market in the country.

North America Market Insights

The North America waste heat recovery system market is projected to witness considerable growth during the stipulated timeline. The market’s growth in the overall region is highly driven by mature deployment in refining, metals, chemicals, and cement, followed by energy cost volatility and the presence of industrial decarbonization mandates. According to a data report published by the Energy Innovation Organization in October 2022, the shift to heat pumps for the industrial field benefited workers and the economy in the U.S., with an expected increase in gross domestic product (GDP) by over USD 42 billion by the end of 2030, along with USD 8 billion by 2050. In addition, more than 275,000 U.S.-based job opportunities are projected by 2030 and nearly 75,000 by 2050. Moreover, there has been a surge in the industrial electricity demand, accounting for 946 TWh to 1,059 TWh, as well as from 1,016 TWh to 1,428 TWh within the same timeline, thereby driving the market’s growth.

The waste heat recovery system market in the U.S. is gaining increased exposure due to the existence of industrial efficiency programs, EPA emissions regulations, along with an increase in the demand for the chemical industry, federal funding, and compliance and safety. For instance, as per an article published by the Earth Organization in May 2022, the U.S. Department of Energy (DOE) has declared a USD 3.5 billion investment for direct air carbon capture technologies. These are suitable for diminishing planet-warming greenhouse gas emissions in the atmosphere. This funding has been provided for 4 direct air capture facilities, with the ability to reduce almost a million tons of carbon dioxide every year, which is readily equivalent to removing 200,000 fossil fuel-based vehicles off the road. Besides, the utilization of the U.S. Energy Policy Simulator (EPS) version 3.4.1 has been suitable for shifting to heat pumps for low-temperature industrial heat, thus positively impacting the market’s growth.

Low-Temperature Industrial Process Heat Share Analysis Through Electricity in the U.S. (2020-2050)

|

Year |

Share |

|

2020 |

25.6% |

|

2025 |

36.4% |

|

2030 |

48.3% |

|

2035 |

55.4% |

|

2040 |

71.7% |

|

2045 |

83.1% |

|

2050 |

94.5% |

Source: Energy Innovation Organization

The market in Canada is also growing, driven by net-zero commitments, provincial programs, district thermal and energy storage initiatives, government spending, and industrial adoption. As stated in an article published by the IISD Organization in March 2023, the 2023 federal budget represents a significant step forward for the country’s economy, with provisions of CAD 800 million for freshwater protection, along with CAD 1.6 billion for the deliberate integration of Canada’s National Adaptation Strategy. Additionally, the budget also notified the newest clean energy investment tax credits and offered CAD 3 billion as direct clean electricity expenditure. Furthermore, an additional CAD 520 million has been provided for the carbon capture and storage (CCS) investment tax credit, thus creating an optimistic outlook for the overall market.

Key Waste Heat Recovery System Market Players:

- Siemens AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric Company (U.S.)

- Mitsubishi Heavy Industries Ltd. (Japan)

- ABB Ltd. (Switzerland)

- Bosch Industriekessel GmbH (Germany)

- Thermax Limited (India)

- John Wood Group PLC (UK)

- Ormat Technologies Inc. (U.S.)

- Kawasaki Heavy Industries Ltd. (Japan)

- Alfa Laval AB (Sweden)

- Amec Foster Wheeler (UK)

- Echogen Power Systems LLC (U.S.)

- Exergy S.p.A. (Italy)

- HRS Heat Exchangers Ltd. (UK)

- Dongfang Electric Corporation (China)

- Daikin Industries Ltd. (Japan)

- Babcock & Wilcox Enterprises Inc. (U.S.)

- Kelvion Holding GmbH (Germany)

- Spirax-Sarco Engineering PLC (UK)

- Enogia SAS (France)

- Siemens AG is a leading player in the market, leveraging its expertise in industrial automation and energy efficiency solutions. The company focuses on integrating advanced Rankine cycle systems and digital monitoring technologies to optimize industrial heat recovery. Siemens’ strong presence in Europe and Asia enables it to capture demand from the cement, steel, and chemical industries.

- General Electric Company has a significant footprint in electricity and steam generation WHRS, with systems designed for large-scale industrial operations. GE emphasizes sustainability and compliance with U.S. DOE and EPA efficiency mandates, positioning its solutions as cost-saving and emissions-reducing. The company’s WHRS portfolio supports petrochemical, refining, and heavy manufacturing sectors.

- Mitsubishi Heavy Industries Ltd. specializes in marine and industrial WHRS, particularly systems that recover exhaust gas energy from large engines. Its technology is widely adopted in shipping and heavy industries, aligning with Japan’s decarbonization goals. MHI’s innovation in turbine-based WHRS systems strengthens its competitive edge in Asia.

- ABB Ltd. integrates WHRS into its broader energy efficiency and electrification portfolio, focusing on industrial automation and grid-interactive solutions. The company’s systems are designed to reduce carbon footprints in energy-intensive industries, aligning with EU sustainability mandates. ABB’s global reach, along with research and development investments, makes it a key competitor in Europe and emerging markets.

- Bosch Industriekessel GmbH, part of Bosch Thermotechnology, provides WHRS solutions tailored for industrial boilers and process heating. The company emphasizes modular and closed-loop systems that improve efficiency in the cement, chemicals, and food processing industries. Bosch’s strong engineering base in Germany supports its leadership in high-efficiency heat recovery technologies.

Here is a list of key players operating in the global market:

The international waste heat recovery system market is extremely competitive, with Europe and U.S. players dominating market share, while Japan, India, and South Korea are rapidly expanding through technology innovation and government-backed sustainability programs. Key players such as Siemens, GE, and Mitsubishi Heavy Industries leverage strategic partnerships, research and development investments, and acquisitions to strengthen their portfolios. Companies are focusing on organic Rankine cycle (ORC) advancements, digital monitoring, and modular solutions to capture emerging demand. Besides, in September 2025, Johnson Controls declared the expected provision of green heat to Zürich through the latest waste incineration project, which has been spearheaded by the municipal utilities of Zürich ERZ, thereby making it suitable for boosting the market globally.

Corporate Landscape of the Waste Heat Recovery System Market:

Recent Developments

- In November 2025, SAIHEAT Limited announced that it has successfully secured the patent for a waste heat recovery system and method, with the ultimate objective for the industry pain, wherein mainstream server directly discharges a huge amount of heat carried by the cooling medium.

- In October 2025, Mitsubishi Heavy Industries Thermal Systems, Ltd. notified the newly developed ETI-W, which is a centrifugal heat pump, effectively utilizes waste heat for the Japan-based market.

- In April 2025, ArcelorMittal Poland and E.ON Polska declared the introduction of a modernized heat recovery system, which is completely operational and effectively generates the assumed energy savings.

- Report ID: 935

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Waste Heat Recovery Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.