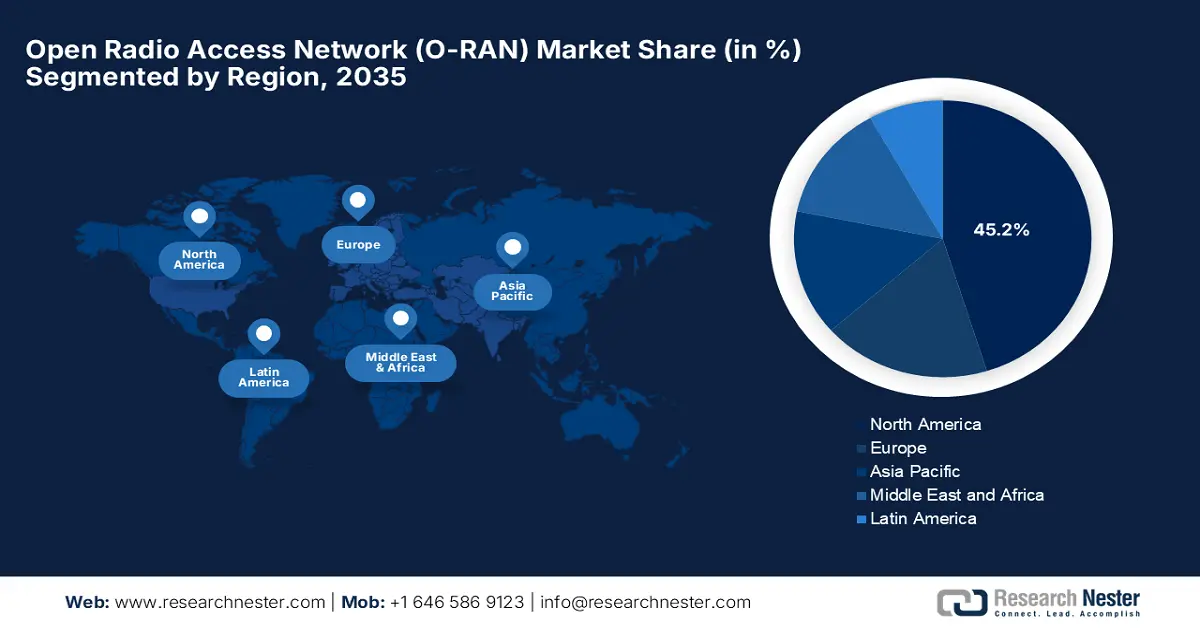

Open Radio Access Network Market - Regional Analysis

North America Market Insights

North America open radio access network market is projected to dominate the industry by the end of 2035 with a significant share of 45.2%. In North America, O-RAN is growing due to operators wanting more flexible, software-based networks that are easier to upgrade. Furthermore, the move to cloud and AI-powered networks, the need for stronger and more secure supply chains, and the rising demand for private 5G and enterprise services are driving further growth. O-RAN helps operators roll out new features faster and adapt their networks more easily. In January 2025, Airspan Networks, was awarded USD 42,729,740 from the Public Wireless Supply Chain Innovation Fund by the NTIA. The funding is aimed at advancing Open RAN planning by developing an extensible radio unit (O-RU) platform that can integrate advanced features and maximize power efficiency and performance.

U.S. is steadily developing its market, with major operators like Verizon and DISH running pilot projects and testing networks that use equipment from multiple vendors. Open RAN is helping make networks more flexible, lower in cost, and better at covering both cities and rural areas. The U.S. government is supporting these efforts through funding programs and policies to encourage adoption and strengthen the domestic telecom supply chain.

Canada open radio access network market is still in the early stages. Trials and pilot deployments are underway to test Open RAN solutions and see how they can make networks more flexible, cost-efficient, and able to reach remote or underserved areas. The Canadian government and industry groups are supporting research and development to encourage adoption. Large-scale commercial rollouts are limited for now, but Canada is following global trends closely. Open RAN deployment is expected to expand gradually over the next decade as the technology matures and more vendor options become available.

APAC Market Insights

Asia Pacific open radio access network (O-RAN) market is projected to be the fastest-growing region by 2035, gaining a considerable share. The region's development is attributed to the growing demand for advanced infrastructure for telecommunication, a rising subscriber base in terms of mobile, and advantageous government regulations. Strategic initiatives by the major providers and the government to boost 5G connectivity are advancing the market growth in the region. In November 2024, Viettel High Tech announced the commercial launch of its Open RAN (O-RAN) 5G Network, featuring key equipment developed in-house. Furthermore, the company deployed over 300 sites across various Vietnamese provinces in Q1 2025.

India is developing its O-RAN market network rapidly, with support from the government and interest from major telecom operators. Open RAN is currently being tested to reduce costs, improve network flexibility, and expand coverage to more areas, including rural regions. Several operators in India are running pilot projects and small-scale deployments to see how the technology works in real networks. The market in India is expected to grow significantly during the forecast period as more operators adopt it and the ecosystem matures.

Australia is gradually developing its Open Radio Access Network (O-RAN) market, with several telecom operators conducting trials and small-scale deployments to test how the technology works in real networks. Open RAN allows networks to be more flexible and cost-efficient, which is especially helpful for expanding coverage to rural and remote areas. Australia is also collaborating with other Quad countries, such as the US, Japan, and India, to share knowledge, best practices, and lessons from Open RAN trials. The government and industry are encouraging these efforts to prepare for future 5G upgrades and ensure that networks remain competitive and scalable.

Europe Market Insights

Europe Open Radio Access Network (O-RAN) market is growing as operators and governments push for more open, flexible 5G networks instead of relying on a few big vendors. Key things driving this growth are government support and funding, especially from the European Union and national telecom programs that encourage open standards and network sovereignty (less dependence on single suppliers). Strong interest from major carriers like Vodafone, Deutsche Telekom, Orange, and Telefónica, who are running trials and planning larger O-RAN rollouts, is also helping adoption. Europe’s focus on digital transformation, interoperability, and competitive innovation makes O-RAN attractive as networks expand and modernize across the region.

Germany O-RAN market is quickly developing Open RAN with real network deployments. O₂ Telefónica has opened its first commercial Open RAN and virtual RAN sites in Bavaria with Samsung, and more sites are planned. This is one of the first real Open RAN rollouts in Europe and shows the technology is moving from testing to actual use. In May 2024, Samsung Electronics, in partnership with O2 Telefonica, launched their first Open RAN and virtualized RAN commercial site in Germany. This site provides high-performance, reliable 4G and 5G services to customers in the country.

France O-RAN market is led by major operator Orange, is progressing steadily in O‑RAN through innovation partnerships and field pilots. Orange has conducted successful pilot tests of virtualized RAN and Open RAN technology, including live 4G and 5G calls on O‑RAN networks with partners such as Samsung, moving beyond lab environments. France has strong industry engagement with several Open RAN deployments and integration labs that foster ecosystem development.