Sterile Tubing Welder Market Outlook:

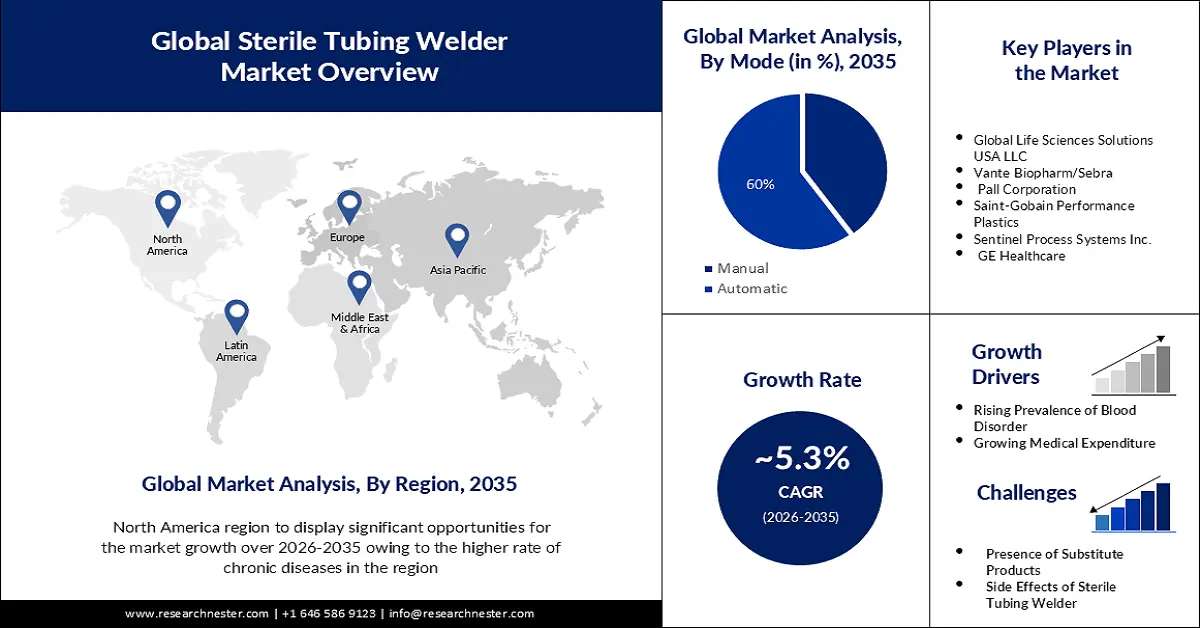

Sterile Tubing Welder Market size was over USD 2.71 billion in 2025 and is poised to exceed USD 4.54 billion by 2035, witnessing over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sterile tubing welder is estimated at USD 2.84 billion.

The growth of the market can be attributed to the growing concern over the increasing number of blood disorders, and non-cancerous blood diseases worldwide, followed by the need to follow protocols related to sterile and hygienic environments in hospitals and clinical laboratories is increasing. Furthermore, growing concern related to chronic diseases worldwide, increasing the demand for various blood transfusion procedures, is also expected to drive market growth during the forecast period. According to statistics from the Food and Agriculture Organization of the United Nations (FAO), the rate of non-communicable diseases is expected to increase by up to 57% by the end of 2020.

Welding machines are used in biotechnology applications involving larger diameter pipes. The sample is transferred or placed directly into a sterile tube, which must then be tightly sealed and transported to the laboratory for analysis. Growing demand for personalized medicines is a key factor driving the growth of the global sterile tubing welder market.

Key Sterile Tubing Welder Market Insights Summary:

Regional Highlights:

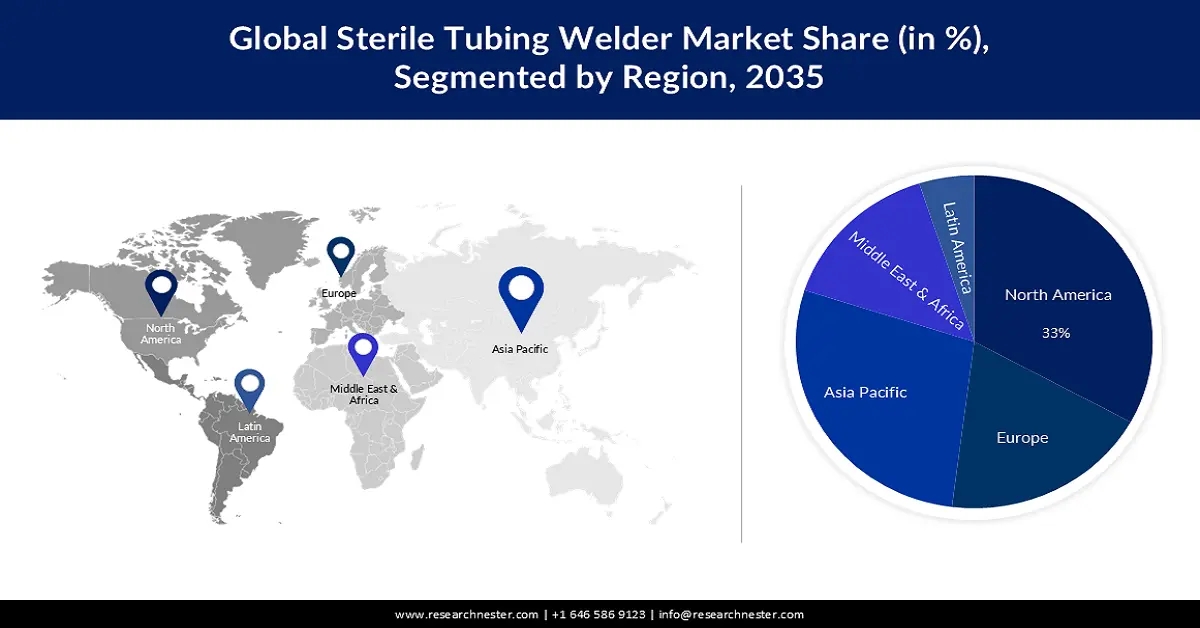

- North America sterile tubing welder market will hold around 33% share by 2035, driven by the rising prevalence of chronic diseases, technological advancements, and high demand for hygienic and sterile environments.

- Asia Pacific market will register substantial CAGR during 2026-2035, driven by the increase in multinational companies' R&D investments and the growing aging population in the region.

Segment Insights:

- The automatic segment in the sterile tubing welder market is projected to achieve a 60% share by 2035, fueled by the user-friendliness, higher weld speed, and lower labor reliance of automatic welding machines.

- The biopharmaceutical (application) segment in the sterile tubing welder market is projected to experience significant growth over 2026-2035, driven by increasing demand for reliable connections in advanced biomanufacturing processes.

Key Growth Trends:

- Increasing Demand for Blood Products

- Increasing Technological Advancements

Major Challenges:

- Availability of Alternatives

- Strict Regulatory Requirements is Set to Hamper the Market Growth in the Forecast Period.

Key Players: of Global Life Sciences Solutions USA LLC, Vante Biopharm/Sebra, Pall Corporation, Saint-Gobain Performance Plastics, Sentinel Process Systems Inc., GE Healthcare.

Global Sterile Tubing Welder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.71 billion

- 2026 Market Size: USD 2.84 billion

- Projected Market Size: USD 4.54 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 9 September, 2025

Sterile Tubing Welder Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Medical Expenditure - One of the main factors driving the global sterile tubing welder market's expansion is the fast-expanding healthcare infrastructure in numerous nations. Because of the increase in cancers, illnesses, and other ailments, governments are already devoting more time and resources to their countries' healthcare systems. The market is expanding as a result of the aging population, and an increase in the prevalence of specific illnesses such as dementia Alzheimer's, and orthopedic disorders. Although proper blood transfusions can enhance health and save lives, many patients lack prompt access to them. The provision of safe, adequate blood must be part of every nation's national healthcare infrastructure and policy.

- Increasing Demand for Blood Products - It is projected that high demand for blood items will drive up the need for sterile processing, blood processing, and related facilities. The market is expected to be driven by the wide-ranging ongoing biopharmaceutical study for the creation of novel and therapeutically advanced medications. These developed medications address a number of important therapeutic areas, including hemophilia, cancer, amyotrophic lateral sclerosis, and genetic disorders, which will help the market expand. A number of products were halted in their manufacturing during the pandemic in 2020, but the pharmaceutical industry led the way in developing new products.

- Increasing Technological Advancements - Many technological advances and equipment purchases that allow for faster turnaround times have been noted. In fact, post-pandemic, we have identified a number of new biopharmaceutical research facilities expected to be established in countries such as Sweden, the Netherlands, Ireland, Scotland, etc. According to the "National Plan on Industrial Biotechnology" Published by IBioIC, a network organization established to promote the biotechnology industry in Scotland, the region is expected to house 220 companies by 2025, with a total workforce Labor is 4,000 people.

Challenges

-

Availability of Alternatives – There are a number of alternative methods for sealing sterile tubing, such as heat sealing, ultrasonic sealing, and laser sealing. These methods can be more cost-effective or easier to use than sterile tubing welders, which can limit the growth of the market.

-

Strict Regulatory Requirements is Set to Hamper the Market Growth in the Forecast Period.

-

Lack of Skilled Labor to Pose Limitation on the Market Expansion in the Upcoming Time Period

Sterile Tubing Welder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.71 billion |

|

Forecast Year Market Size (2035) |

USD 4.54 billion |

|

Regional Scope |

|

Sterile Tubing Welder Market Segmentation:

Mode Segment Analysis

The automatic segment is predicted to account for 60% share of the global sterile tubing welder market during the forecast period. Considering these welding machines are more user-friendly and produce better welds, the category is expected to continue leading during the projected period. Because automatic welding machines have a significantly greater weld speed than qualified welders, they can be used to set up weld speed and duration without the need for a highly trained professional, which reduces the reliance on human labor. It is therefore expected that the demand for these devices will rise in response to higher output and lower labor expenses.

Application Segment Analysis

The biopharmaceutical segment in the sterile tubing welder market is anticipated to grow significantly by the end of 2035. Reliable component connections are necessary for improved biomanufacturing processes, which call for advanced equipment. Sterile tubing welder usage is increasing in the biopharmaceutical industry, and this is expected to drive robust segment growth over the projected period. Sterile tubing welders are offered by a number of industry leaders for use in biopharmaceutical applications. For example, Sartorius offers an automated device known as the Biowelder TC that is used to sanitize connections between the components of TPE (thermoplastic elastomer) tubes. This time-tested technique uses special spinning tube holders to join dry or liquid-filled TPE tubing. By reconnecting discarded tube ends, ensures that process fluids are completely contained. Sterile Biowelder TC connections are guaranteed via validation processes.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Mode |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sterile Tubing Welder Market Regional Analysis:

North America Market Insights

The sterile tubing welder market in North America region is expected to hold 33% of the revenue share in the forecast period. The rising prevalence of chronic diseases, recent technological advancements, and high demand for hygienic & sterile environments to avoid contamination are some of the key factors contributing to the market growth in this area. The growing burden of chronic diseases in the United States is one of the key factors driving market growth. According to a 2020 National Health Council report, an estimated 157 million people have at least one chronic disease. It is also estimated that 7 out of 10 deaths are due to chronic disease, with kidney failure being one of the leading conditions in the United States.

APAC Market Insights

The sterile tubing welder market in the Asia Pacific region is set to grow substantially by the end of 2035. The increase in the number of large multinational companies investing in research and development in this region has proven to be a key factor driving the growth of the pharmaceutical and biopharmaceutical industry. Furthermore, the growing aging population and the presence of a large segment of the population belonging to the middle-income group are significantly increasing the demand for innovative and cost-effective aseptic tube welding equipment to attract medical services from leading equipment companies in the region.

Sterile Tubing Welder Market Players:

- Genesis BPS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medicaltech Cp., Ltd.

- Sartorius AG

- MGA Technologies

- Global Life Sciences Solutions USA LLC

- Vante Biopharm/Sebra

- Pall Corporation

- Saint-Gobain Performance Plastics

- Sentinel Process Systems Inc.

- GE Healthcare

Recent Developments

- Sartorius completed the acquisition of Albumedix by means of a French listed subsidiary, Sartorius Stedim Biotech, in September 2022.

- April 13, 2018: One of Saint-Gobain Group's subsidiaries, Saint-Gobain Performance Plastics announced that it has acquired the Irish company Micro Hydraulics' pharmaceutical business. The company is known for manufacturing and supplying disposable liquid handling systems and components made of high-performance plastics, which are widely used in the biopharmaceutical and pharmaceutical industries.

- Report ID: 3644

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sterile Tubing Welder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.