Non-opioid Pain Patch Market Outlook:

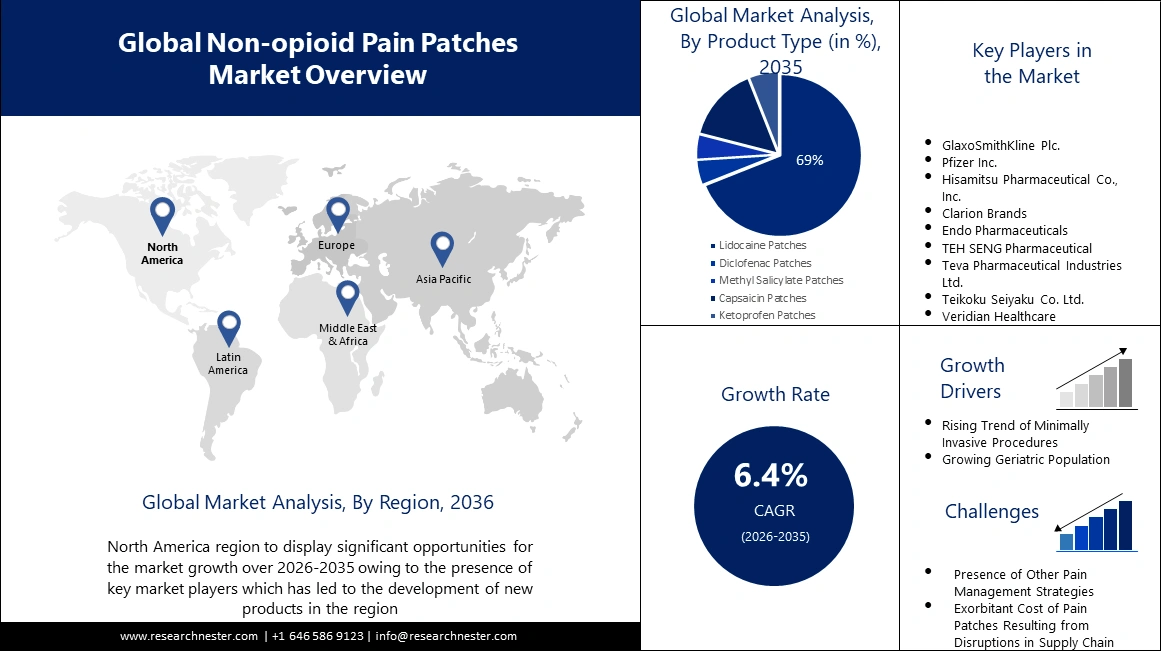

Non-opioid Pain Patch Market size was valued at USD 998.64 million in 2025 and is set to exceed USD 1.86 billion by 2035, expanding at over 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-opioid pain patch is estimated at USD 1.06 billion.

The reason behind the growth is due to the growing burden of diabetes across the globe. Diabetic neuropathy may present as the initial symptom of diabetes caused by excessive blood sugar levels that harm the nerves resulting in pain and discomfort in the hands, feet, or limbs.

According to the World Health Organization (WHO), around 422 million individuals globally suffer from diabetes, and the disease is directly responsible for roughly 1.5 million fatalities annually.

The growing development of advanced products is believed to fuel the non-opioid pain patch market growth. For instance, A scientific team led by Duke University has created a biocompatible polymer patch surgical patch that dissolves after releasing non-opioid medicines and it is assumed that during the crucial period following surgery, the patch should be able to manage wound discomfort for three or four days.

Key Non-opioid Pain Patch Market Insights Summary:

Regional Highlights:

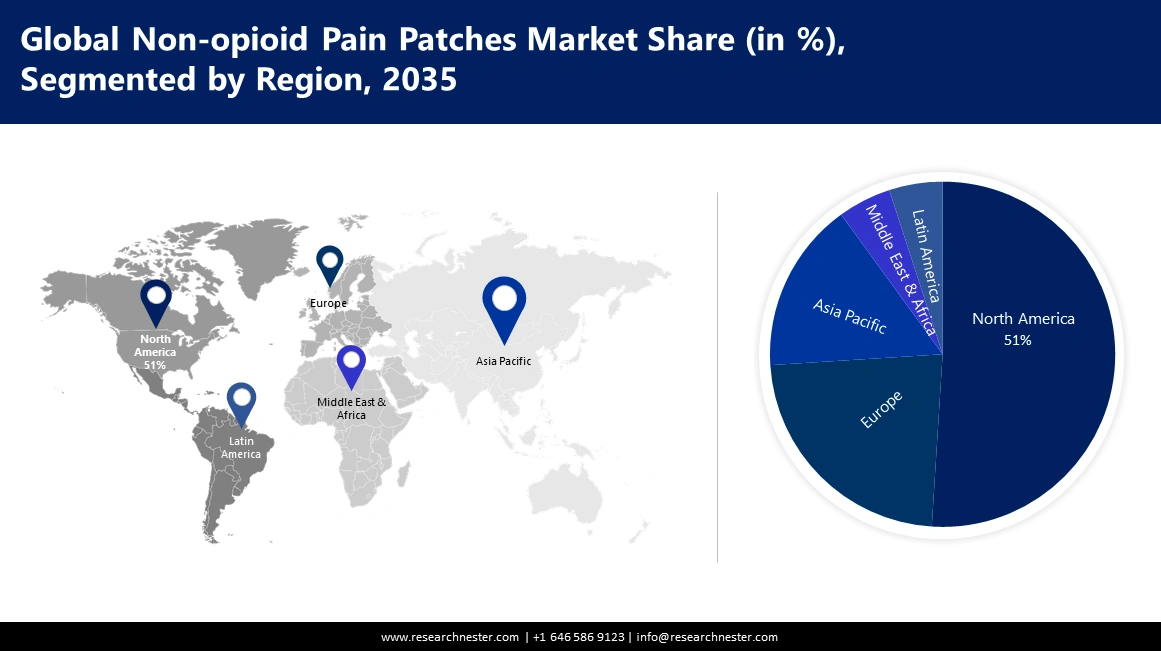

- North America’s non-opioid pain patch market dominates with a 51% share by 2035, driven by the presence of key players leading to the development of new products.

Segment Insights:

- The lidocaine patch segment in the non-opioid pain patch market is expected to capture a 69% share by 2035, driven by the increasing incidence of chronic pain worldwide.

Key Growth Trends:

- Rising Trend of Minimally Invasive Procedures

- Growing Geriatric Population

Major Challenges:

- Presence of Other Pain Management Strategies

- Stringent Rules & Regulations for Product Approval

Key Players: GlaxoSmithKline Plc., Pfizer Inc., Hisamitsu Pharmaceutical Co., Inc., Clarion Brands, Endo Pharmaceuticals, TEH SENG Pharmaceutical, Teva Pharmaceutical Industries Ltd., Teikoku Seiyaku Co. Ltd., Veridian Healthcare, Sorrento Therapeutics (SCILEX Pharmaceuticals Inc.

Global Non-opioid Pain Patch Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 998.64 million

- 2026 Market Size: USD 1.06 billion

- Projected Market Size: USD 1.86 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Non-opioid Pain Patch Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Trend of Minimally Invasive Procedures – Non-opioid pain patch are kind of minimally invasive treatments as they aid in administrating non-addictive pain medication by being applied to the skin similar to a bandage.

-

Growing Geriatric Population- Even though there are numerous options for pain alleviation, a large number of older persons choose not to seek therapy and opt for patch such as transdermal patch which are frequently used to address chronic pain in older adults.

- Lately, more than 8% of the global population, are 65 years of age or older.

- Non-Opioid Pain Patch for the Treatment of Cancer- If a doctor wants to use fewer opioids’ patients with cancer pain can safely and effectively use a lidocaine or buprenorphine patch for 3-5 days that might be able to help with pain management.

Challenges

-

Presence of Other Pain Management Strategies - Apart from non-opioid pain patch pain management techniques include at-home therapies such as yoga, psychological therapies including cognitive behavioral therapy, relaxation techniques, and meditation, mind-body techniques, massage therapy, and aqua therapy that can benefit people who suffer from low back pain, migraines, fibromyalgia, arthritis, and other chronic pain as they are simple, accessible, and safe method of managing pain that people can use in a class with an instructor or at home with online videos.

-

There are numerous drugs available to manage pain including acetaminophen a first choice for many types of pain, paracetamol which is advised as the initial medication to treat acute pain, and other medications including aspirin, ibuprofen, and naproxen that are usually used to treat minor to severe pain.

- Furthermore, the two easiest and least expensive ways to get rid of acute and chronic pain are heat and cold therapy which also help increase blood flow and metabolism.

- Stringent Rules & Regulations for Product Approval

- Exorbitant Cost of Pain Patch Resulting from Disruptions in Supply Chain

Non-opioid Pain Patch Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 998.64 million |

|

Forecast Year Market Size (2035) |

USD 1.86 billion |

|

Regional Scope |

|

Non-opioid Pain Patch Market Segmentation:

Product Type Segment Analysis

The lidocaine patch segment is estimated to account for 69% share of the global non-opioid pain patch market by 2035 owing to the growing incidence of chronic pain. An increasing number of people worldwide are affected by chronic pain, which can endure for months or years and disrupts day-to-day activities such as working, socializing, and taking care of others.

In order to lessen the intensity of all typical pain characteristics including arthritis, disk-related pain, and chronic lower back pain, and reduce opioid use in individuals, patch such as lidocaine patch can be used which are offered in both OTC and prescription strength formulations. According to estimates, in the US more than 6% of people experienced high-impact chronic pain in 2021.

Besides this, the capsaicin patch segment in the non-opioid pain patch market is anticipated to gain a noteworthy share in the coming years. Capsaicin is the component that gives chili peppers their heat and also what gives them their burning and irritating sensation. The pepper's seeds contain a significant amount of this unusual, organic compound and the hotter a pepper is, the more capsaicin it contains which acts as a pain reliever and the main component of pepper spray.

Qutenza, a high-dose capsaicin patch that has been licensed in recent years, to treat diabetic peripheral neuropathy (DPN) of the feet and to reduce the pain associated with postherpetic neuralgia.

Distribution Channel Segment Analysis

The online pharmacies segment in the non-opioid pain patch market is set to garner a notable share. The non-narcotic painkiller patch that are filled with painkilling medicine used for chronic painful disorders are easily accessible to the public through online pharmacies. Moreover, regardless of location, patients can acquire their pain patch from licensed pharmacists online, which not only makes purchasing more convenient nonetheless also benefits many consumers monetarily and is accompanied by a guarantee of the customer's safety and security.

Additionally, the non-opioid pain patch market from hospital Pharmacies, and retail pharmacies segment are poised to jointly hold notable shares during the forecast period. Retail pharmacies offer a large selection of prescription medications and over-the-counter pain patch to alleviate discomfort. Furthermore, hospital pharmacies frequently provide specialized services that improve patients' quality of life overall, working in tandem with doctors and other healthcare providers.

Our in-depth analysis of the global non-opioid pain patch market includes the following segments:

|

Product Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-opioid Pain Patch Market Regional Analysis:

North American Market Insights

Non-opioid pain patch market in North America is predicted to account for the largest share of 51% by 2035 propelled by the presence of key players which has led to the development of new products. For instance, in October 2020 Vizuri Health Sciences Consumer Healthcare Inc. an innovative healthcare facility in Maryland, USA, launched a groundbreaking New Pain Relief PatchBloc24 Flexi-Stretch Pain Tape with 4-way stretch fabric and potent anesthetic to numb the pain, making it perfect for use on moving joints, including elbows and knees.

European Market Insights

The Europe non-opioid pain patch market is estimated to be the second largest, during the forecast timeframe led by a higher prevalence of stress. For instance, Greece has over 6% frequency of depression in Europe, and more than 55% of people in the country are reported to have frequent stress. This may drive the demand for non-opioid pain patch in the region since people with stress usually experience migraine which causes pain behind one eye or in the area surrounding the temples and lasts for hours or days.

Non-opioid Pain Patch Market Players:

- Sanofi S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline Plc.

- Pfizer Inc.

- Clarion Brands

- Endo Pharmaceuticals

- TEH SENG Pharmaceutical

- Teva Pharmaceutical Industries Ltd.

- Teikoku Seiyaku Co. Ltd.

- Veridian Healthcare

- Sorrento Therapeutics (SCILEX Pharmaceuticals Inc.

Recent Developments

- GlaxoSmithKline Plc. Received approval from the U.S. Food and Drug Administration for Voltaren Arthritis Pain a nonsteroidal anti-inflammatory drug for the momentary alleviation of arthritis pain, and to enhance public health by expanding the range of medications to the millions of people who experience everyday joint pain from arthritis.

- Scilex Holding Company announced to boost the production of ELYXYB to obtain, and create non-opioid painkillers to deliver fast and long-lasting migraine relief, and also allow doctors an additional tool for managing pain.

- Report ID: 5423

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-opioid Pain Patch Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.