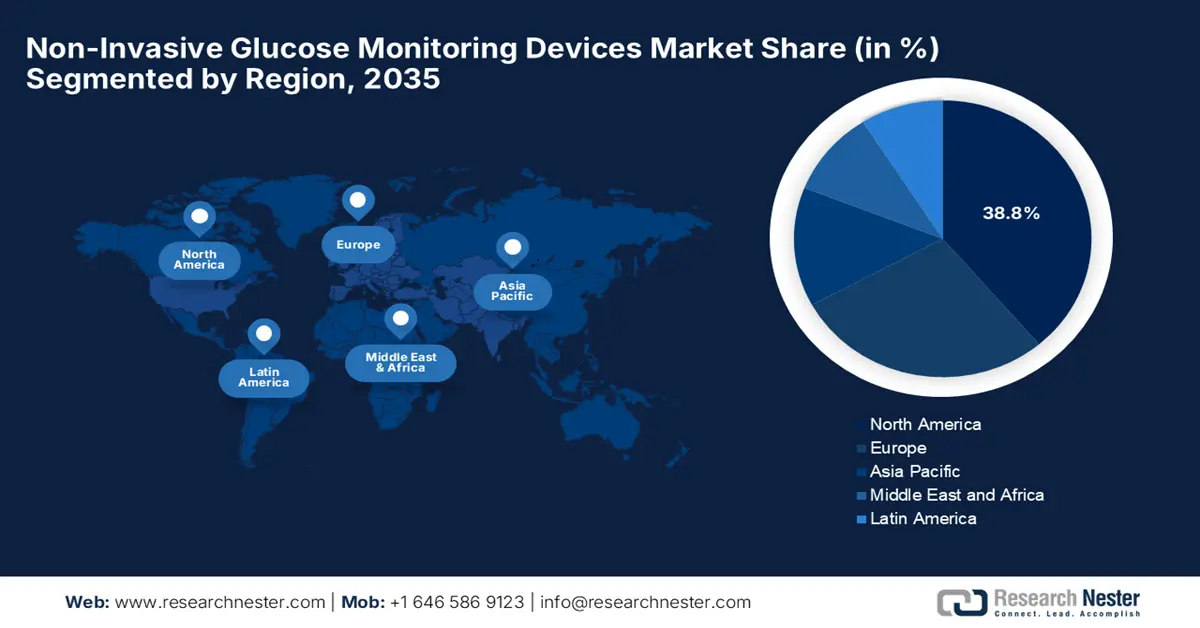

Non-Invasive Glucose Monitoring Devices Market - Regional Analysis

North America Market Insights

The North America non-invasive glucose monitoring devices market is projected to register the highest share of 38.8%, growing at a CAGR of 9.3% during the forecast period. The leadership of the region is highly focused on the enhanced healthcare budget and diabetes prevalence across its vast geography. The cutting-edge technological innovations are another major driver driving business in this sector. Comprehensive insurance coverage, government initiatives like the CDC’s National Diabetes Prevention Program will continue to expand the market demand. Additionally, North America houses several large CGM players that will continue to innovate in AI-enabled, wearable, and app-based non-invasive technology. Increased consumer awareness, ongoing incorporation of mobile health platforms, and favorable pathways for digital diagnostic development by the FDA will also increase the adoption rate of non-invasive devices both clinically and personally.

The U.S. non-invasive glucose monitoring devices market continues to rapidly grow each year due to the huge diabetes burden and the increasing focus on preventive health and wellness initiatives. Recent FDA approvals of over-the-counter CGMs allow access beyond diabetes and expand the base of consumers to include those who exercise and those who are health-conscious. Strong insurance coverage and government programs allow more people to transition to using a non-invasive glucose monitoring method. Finally, leading U.S.-based innovators continue to place massive amounts of money into R&D to create more compact. In addition, the digital health ecosystem and partnerships that are creating branded programs mark the beginning of glucose data becoming integrated into a broader health initiative that includes continuous, painless, consumer-monitoring and marketing.

Canada occupies a respectable position in the North America non-invasive glucose monitoring devices market with increased adoption towards AI and provincial medical investments. Some provinces have begun covering continuous glucose monitoring systems for select patients, which opened the door for mass adoption. There is a trend with more demand coming from consumers for wearable devices that have no pain and can provide date at any time and with consistent accuracy. Canada has shown strong adoption of digital health, that allow patients and providers to be able to manage levels remotely. Furthermore, an increase in awareness around metabolic health, aging population and government improvement to chronic disease management has made for no shortage of opportunities and innovation with non-invasive glucose monitoring products.

Europe Market Insights

Europe stands as the second-largest contributor to growth in the non-invasive glucose monitoring devices market, accounting for a share of 28.3%. The market is primarily driven by the rising patient pool and government-backed digital health initiatives. Also, there is a heightened adoption of wearable glucose monitors, which encourages the domestic players to develop more of such devices. Hence, this outlook of the country tremendously offers expansion internationally. For instance, in July 2025, with strong support from Horizon Europe, Afon Technology has made a great step forward in reshaping diabetes management. The pioneering company is now funded over €2 million to speed up the development of its Glucowear device. The funding from Horizon Europe affirms that Afon's innovation has global potential.

Germany is unfolding remarkable growth opportunities in the non-invasive glucose monitoring devices market, with a secured share of 16.3%, driven by the substantial government healthcare expenditure and complementary regulatory approvals. In addition, the ongoing development of app-supported CGM merging sensor data, insulin calculators, and remote coaching improves usability and clinical outcomes to stimulate engagement by patients and providers and the uptake of CGM, an important component of diabetes management.

The expansion of France's non-invasive glucose monitoring devices market continues due to increased frequency of diabetes diagnoses, and increased public demand for painless and easy-to-use alternatives. The pendulum has swung toward eliminating finger pricks alongside advancements in innovations for sensor accuracy and smart device integration. In addition, due to the aging population being more vulnerable to diabetes diagnosis, there is a steady stream of volume for non-invasive glucose monitoring alternatives. Lastly, the adoption of tele-health and remote patient management is having a long-lasting impact across all healthcare providers.

APAC Market Insights

The non-invasive glucose monitoring devices market in the Asia-Pacific is expected to grow considerably. The industry's rapid growth is being driven by the increasing prevalence of diabetes, a growing population with disposable income, and a quicker operational urbanization in the region. According to a report by the Endocrinology and Metabolism, in Korea, the incidence of diabetes was 12.5% among individuals aged 19 and older, and 14.8% among individuals aged 30 and older as of 2022. Additionally, advancements and technological growth in non-invasive sensors and wearables, and an initiative for digital health and government support surrounding this digital health initiative, will help to accelerate the growth of the Asia-Pacific region. Furthermore, Advances in technology are moving the non-invasive field forward.

India, with a large diabetic population, is significantly driving market demand across the Asia‑Pacific. Local governments are supporting health initiatives like Ayushman Bharat, which facilitate early detection and adoption of novel glucose monitoring technologies. However, urban and middle-class consumers are becoming more willing to purchase convenient, non-invasive options, fueled by the healthcare community's growing interest in telehealth and app-based health platforms. India's digital health ecosystem is similarly evolving rapidly, with smartphone penetration and app-based platforms.

The non-invasive glucose monitoring devices market in China is poised for tremendous expansion due to the rapidly increasing population of diabetics and rising healthcare costs associated with complication management and disease burden. With Healthy China 2030 and ongoing reforms in China's health care system, additional funds are flowing into preventive medicine and early diagnosis. Technological advances are another major driver of growth. Domestic businesses are developing low-cost, accurate CGM sensors, including third-generation sensors utilizing better chemistries, that are driving down prices and closing the gap with global brand offerings. Collaboration between industry and academia is also fostering advancement.