Non-Invasive Glucose Monitoring Devices Market Outlook:

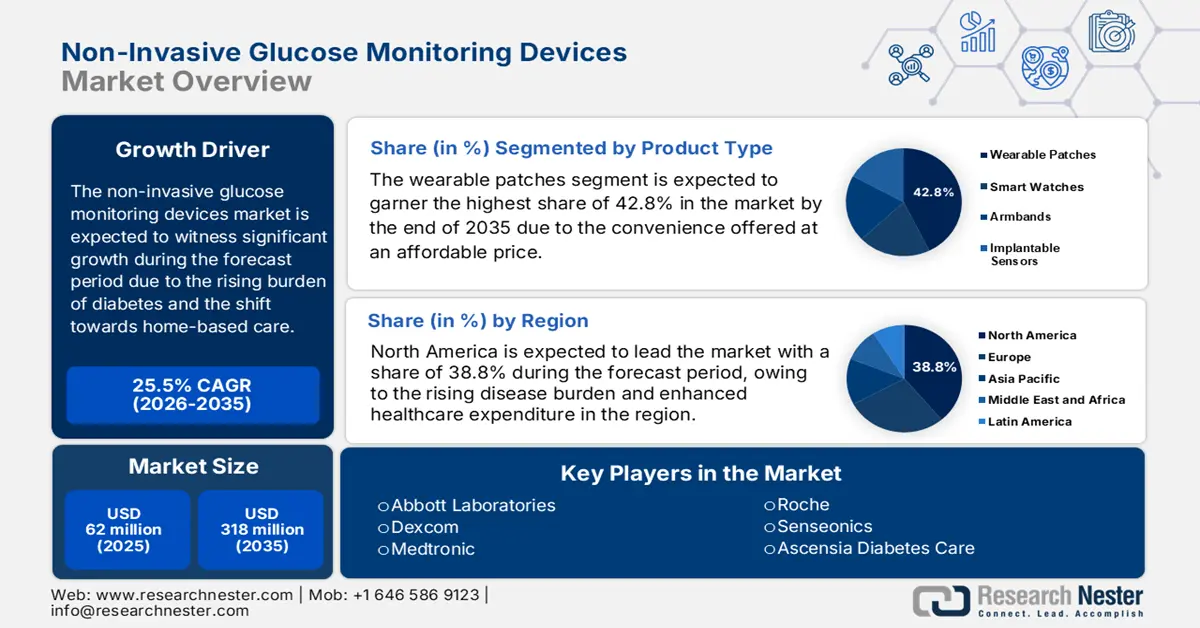

Non-Invasive Glucose Monitoring Devices Market size was valued at USD 62 million in 2025 and is projected to reach USD 318 million by the end of 2035, rising at a CAGR of 25.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of non-invasive glucose monitoring devices is evaluated at USD 96 million.

The responsibility for market growth is critically held by the worldwide diabetic population that requires continuous glucose monitoring. The National Institutes of Health predicts that an estimated 643 million persons between the ages of 20 and 79 will have diabetes by 2030, and 783 million will by 2045. Emerging trends in the global non-invasive glucose monitoring devices market point to the direction of personalized solutions. One very exciting trend is the emergence of wearable, patch-based glucose monitor devices that use optical, electrochemical, and spectroscopic sensors to provide the user with real-time continuous glucose tracking without pain and seamlessly integrate into their smartphone or health apps. The emergence of artificial intelligence being incorporated into these solutions to provide accuracy of data, better trending of glucose levels, and insights that are personalized for the user will allow these devices to monitor their glucose levels and provide forecasts.

Moreover, regulatory support has increased for novel over-the-counter (OTC) devices. The increasing acceptability of home care, or telehealth, is also fuelling the demand for non-invasive glucose monitoring and remote glucose monitoring platforms. This enables those with diabetes to share glucose data directly with healthcare providers to enhance management and to improve real-time intervention. These relationships and regulatory support collectively signal the rise of a more digital, connected, user-centered approach to diabetes management.

Key Non-Invasive Glucose-Monitoring Market Insights Summary:

Regional Highlights:

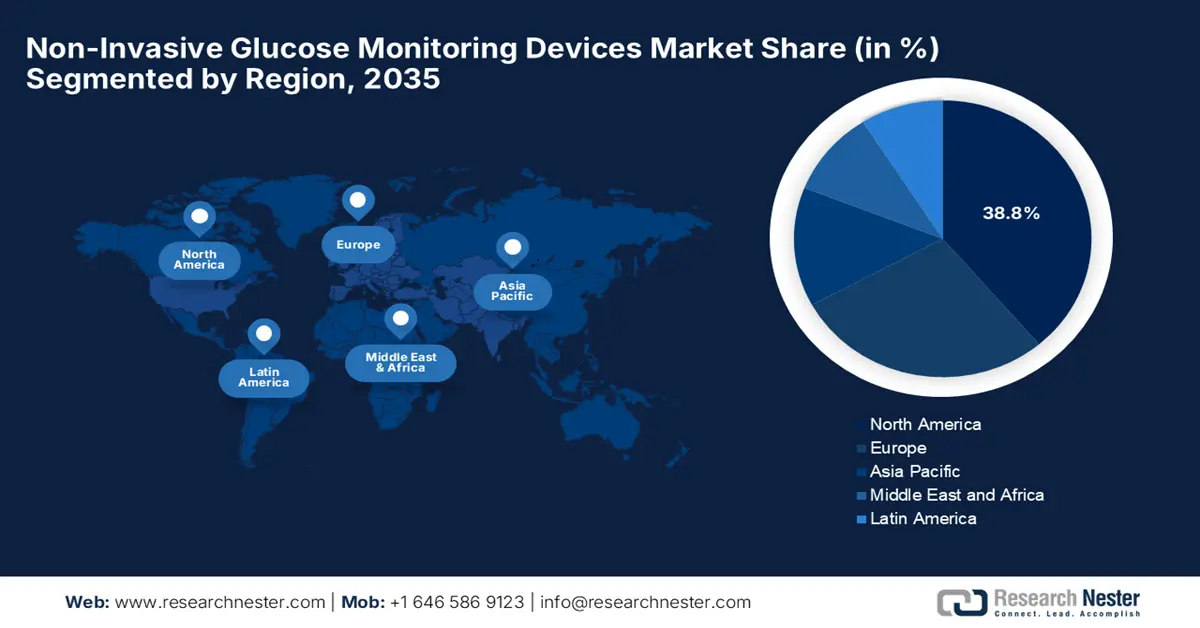

- The North America non-invasive glucose monitoring devices market is anticipated to command a 38.8% share by 2035, underpinned by the strengthened healthcare budget and rising diabetes prevalence.

- Europe is projected to secure a 28.3% share by 2035, supported by the expanding patient pool and government-backed digital health initiatives.

Segment Insights:

- By 2035, the wearable patches segment in the non-invasive glucose monitoring devices market is set to attain a 42.8% share, bolstered by ease of use and the broad range of benefits provided.

- The home care settings segment is forecast to capture a 55.3% share by 2035, fueled by the rising inclination toward convenient, self-managed diabetes care.

Key Growth Trends:

- Shift towards home-based care

- Regulatory support in terms of technological innovations

Major Challenges:

- Limited awareness

- Regulatory hurdles

Key Players: Abbott Laboratories, Dexcom, Medtronic, Roche, Senseonics, Ascensia Diabetes Care, Nemaura Medical, LifePlus, Integrity Applications, Terumo Corporation, AgaMatrix, Biolinq, PKvitality, GlucoRx, Cnoga Medical, Bionime, i-SENS, BeatO, MEDTRUM Technologies, ForaCare.

Global Non-Invasive Glucose-Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62 million

- 2026 Market Size: USD 96 million

- Projected Market Size: USD 318 million by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 2 September, 2025

Non-Invasive Glucose Monitoring Devices Market - Growth Drivers and Challenges

Growth Drivers

- Shift towards home-based care: In the face of a global desire to attain better medical access for all of humanity, organizations are providing devices that are intended to be used without needing medical supervision. A shift to home-based care is increasing demand for the non-invasive glucose monitoring devices segment of the market. The expansion of Telehealth and remote patient monitoring technologies has also justified the demand for accurate home-based glucose monitoring products that can integrate with smartphones and cloud-based programmes. The need for accuracy will lower healthcare costs, omit clinic visits, and present another opportunity for better disease management by sharing data with healthcare professionals. Moreover, with demand for non-invasive glucose monitors increased by home-based care models, there is now no doubt that monitoring products represent an important measure for modern chronic disease management.

- Regulatory support in terms of technological innovations: There has been constant support from the governing bodies, which readily encourages manufacturers involved in the non-invasive glucose monitoring devices market to develop accessible devices. Regulatory agencies, including the FDA and CE, are implementing more flexible and faster approval pathways for innovative medical devices for devices that demonstrate safety and efficacy. This support encourages manufacturers to invest in innovative research so they can market sustainable and client-friendly products. Regulatory incentives, paired with collaboration with innovators, help reduce some of the many barriers related to delays of regulatory approvals and associated costs dramatically. This facilitates new diabetes solutions that make available non-invasive glucose monitors that meet the needs of the real world.

- Advancements in technology and integration: Advances in sensor design, optics, and artificial intelligence have recently made non-invasive glucose monitors more convenient and accurate. Devices utilize state-of-the-art technology in wearable sensors, interface with smartphones, and drive cloud connections to enable real-time glucose data and actionable insights at the user’s fingertips. AI analytics can help to predict trends in glucose responses and to offer advice specific to the patient’s pattern throughout the day, enhancing disease management. The continual macro and micro changes in devices, including miniaturizing devices and improved battery life, also create a user experience that enhances accessibility. Increasingly, it is also potential non-diabetic purchasers, who are looking after their own health concerns about BMI, obesity, or associated discomfort due to limited movement, that are encouraging new users to join the market outside of a traditional delineation.

Challenge

- Limited awareness: Despite continuous and rigorous innovations in the non-invasive glucose monitoring devices market, there is limited awareness and education regarding these advanced devices. In this regard, an initiative must be undertaken by the healthcare providers to offer education in terms of the benefits offered by non-invasive glucose monitors. Lack of proper knowledge diminishes the consumer interest in leveraging at-home glucose monitoring, thereby hindering growth in the market.

- Regulatory hurdles: Due to strict safety and accuracy requirements from regulatory bodies like the FDA and CE, obtaining regulatory approval for non-invasive glucose monitors is no easy task. A number of devices are still in clinical trials or have limited approval from the FDA and CE. The approval process is draining and costly, and will take time to collect enough data to convince regulatory bodies that there is evidence that a non-invasive device's accuracy is equivalent or superior to existing device. This counteracts the expedient manner by which the clinical market could enter, and the ability to commercialize a device.

Non-Invasive Glucose Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 62 million |

|

Forecast Year Market Size (2035) |

USD 318 million |

|

Regional Scope |

|

Non-Invasive Glucose Monitoring Devices Market Segmentation:

Product Type Segment Analysis

Based on product type, the wearable patches segment is expected to garner the highest share of 42.8% in the non-invasive glucose monitoring devices market by the end of 2035. The augmentation of the segment is highly stimulated by the ease of use and substantial benefits offered. For instance, in 2024, the U.S FDA notified that it approved 6 exclusive wearable models, reflecting appreciable support. Advanced technologies will be used in patches to detect glucose to detect blood glucose levels through the skin, providing a painless and discreet option to traditional glucose monitoring systems. Glucose monitoring patches have become increasingly popular among health-conscious users who track and monitor their glucose levels.

End User Segment Analysis

Based on the end user, the home care settings segment is projected to grow at a considerable rate, with a share of 55.3% in the non-invasive glucose monitoring devices market during the forecast period. The growth is led by the increased interest in convenient, self-managed diabetes care. As patients also look for methods to monitor glucose levels non-invasive devices that can easily be used at home are appealing. Many of these devices collect real-time, continuous data and are linked to smartphones or cloud services, allowing users to see trends, receive notifications, and share results with their health care providers from a distance. The growth is further promoted by an increase in the number of older patients and chronic disease patients wanting to receive care in their own homes due to mobility or cost.

Technology Segment Analysis

The spectroscopy segment is leading the non-invasive glucose monitoring devices market in part due to the accurate measurement of glucose using light-based techniques without skin penetration. These light-based techniques utilize physiological measures of glucose concentration to quantify glucose in real-time, non-painful glucose monitoring in response to how light interacts and is absorbed by biological molecules. Spectroscopy metrics and signals give patients opportunities to monitor glucose levels without analyzing blood and do in a much less invasive process that makes it more realistic, simple, and likely to enhance patient compliance. Advancements in portable forms, miniaturized sensors, wearable technologies, machine learning, and artificial intelligence is supporting the reliability and portability of spectroscopy-based approaches.

Our in-depth analysis of the non-invasive glucose monitoring devices market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-Invasive Glucose Monitoring Devices Market - Regional Analysis

North America Market Insights

The North America non-invasive glucose monitoring devices market is projected to register the highest share of 38.8%, growing at a CAGR of 9.3% during the forecast period. The leadership of the region is highly focused on the enhanced healthcare budget and diabetes prevalence across its vast geography. The cutting-edge technological innovations are another major driver driving business in this sector. Comprehensive insurance coverage, government initiatives like the CDC’s National Diabetes Prevention Program will continue to expand the market demand. Additionally, North America houses several large CGM players that will continue to innovate in AI-enabled, wearable, and app-based non-invasive technology. Increased consumer awareness, ongoing incorporation of mobile health platforms, and favorable pathways for digital diagnostic development by the FDA will also increase the adoption rate of non-invasive devices both clinically and personally.

The U.S. non-invasive glucose monitoring devices market continues to rapidly grow each year due to the huge diabetes burden and the increasing focus on preventive health and wellness initiatives. Recent FDA approvals of over-the-counter CGMs allow access beyond diabetes and expand the base of consumers to include those who exercise and those who are health-conscious. Strong insurance coverage and government programs allow more people to transition to using a non-invasive glucose monitoring method. Finally, leading U.S.-based innovators continue to place massive amounts of money into R&D to create more compact. In addition, the digital health ecosystem and partnerships that are creating branded programs mark the beginning of glucose data becoming integrated into a broader health initiative that includes continuous, painless, consumer-monitoring and marketing.

Canada occupies a respectable position in the North America non-invasive glucose monitoring devices market with increased adoption towards AI and provincial medical investments. Some provinces have begun covering continuous glucose monitoring systems for select patients, which opened the door for mass adoption. There is a trend with more demand coming from consumers for wearable devices that have no pain and can provide date at any time and with consistent accuracy. Canada has shown strong adoption of digital health, that allow patients and providers to be able to manage levels remotely. Furthermore, an increase in awareness around metabolic health, aging population and government improvement to chronic disease management has made for no shortage of opportunities and innovation with non-invasive glucose monitoring products.

Europe Market Insights

Europe stands as the second-largest contributor to growth in the non-invasive glucose monitoring devices market, accounting for a share of 28.3%. The market is primarily driven by the rising patient pool and government-backed digital health initiatives. Also, there is a heightened adoption of wearable glucose monitors, which encourages the domestic players to develop more of such devices. Hence, this outlook of the country tremendously offers expansion internationally. For instance, in July 2025, with strong support from Horizon Europe, Afon Technology has made a great step forward in reshaping diabetes management. The pioneering company is now funded over €2 million to speed up the development of its Glucowear device. The funding from Horizon Europe affirms that Afon's innovation has global potential.

Germany is unfolding remarkable growth opportunities in the non-invasive glucose monitoring devices market, with a secured share of 16.3%, driven by the substantial government healthcare expenditure and complementary regulatory approvals. In addition, the ongoing development of app-supported CGM merging sensor data, insulin calculators, and remote coaching improves usability and clinical outcomes to stimulate engagement by patients and providers and the uptake of CGM, an important component of diabetes management.

The expansion of France's non-invasive glucose monitoring devices market continues due to increased frequency of diabetes diagnoses, and increased public demand for painless and easy-to-use alternatives. The pendulum has swung toward eliminating finger pricks alongside advancements in innovations for sensor accuracy and smart device integration. In addition, due to the aging population being more vulnerable to diabetes diagnosis, there is a steady stream of volume for non-invasive glucose monitoring alternatives. Lastly, the adoption of tele-health and remote patient management is having a long-lasting impact across all healthcare providers.

APAC Market Insights

The non-invasive glucose monitoring devices market in the Asia-Pacific is expected to grow considerably. The industry's rapid growth is being driven by the increasing prevalence of diabetes, a growing population with disposable income, and a quicker operational urbanization in the region. According to a report by the Endocrinology and Metabolism, in Korea, the incidence of diabetes was 12.5% among individuals aged 19 and older, and 14.8% among individuals aged 30 and older as of 2022. Additionally, advancements and technological growth in non-invasive sensors and wearables, and an initiative for digital health and government support surrounding this digital health initiative, will help to accelerate the growth of the Asia-Pacific region. Furthermore, Advances in technology are moving the non-invasive field forward.

India, with a large diabetic population, is significantly driving market demand across the Asia‑Pacific. Local governments are supporting health initiatives like Ayushman Bharat, which facilitate early detection and adoption of novel glucose monitoring technologies. However, urban and middle-class consumers are becoming more willing to purchase convenient, non-invasive options, fueled by the healthcare community's growing interest in telehealth and app-based health platforms. India's digital health ecosystem is similarly evolving rapidly, with smartphone penetration and app-based platforms.

The non-invasive glucose monitoring devices market in China is poised for tremendous expansion due to the rapidly increasing population of diabetics and rising healthcare costs associated with complication management and disease burden. With Healthy China 2030 and ongoing reforms in China's health care system, additional funds are flowing into preventive medicine and early diagnosis. Technological advances are another major driver of growth. Domestic businesses are developing low-cost, accurate CGM sensors, including third-generation sensors utilizing better chemistries, that are driving down prices and closing the gap with global brand offerings. Collaboration between industry and academia is also fostering advancement.

Key Non-Invasive Glucose Monitoring Devices Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dexcom

- Medtronic

- Roche

- Senseonics

- Ascensia Diabetes Care

- Nemaura Medical

- LifePlus

- Integrity Applications

- Terumo Corporation

- AgaMatrix

- Biolinq

- PKvitality

- GlucoRx

- Cnoga Medical

- Bionime

- i-SENS

- BeatO

- MEDTRUM Technologies

- ForaCare

The presence of dominating players such as Abbott, Dexcom, and Medtronic intensifies the landscape in the global non-invasive glucose monitoring devices market as they leverage the tremendous approved systems to strengthen their ecosystem. Meanwhile, firms such as Roche and Senseonics are making a move through implantable and hybrid solutions. Their strategies to promote AI and ML for predictive analysis are fostering a favorable business environment in this sector.

Recent Developments

- In August 2025, Abbott launched the FreeStyle Libre 2 Plus sensor. This fresh device provides automatic glucose readings every minute, sent directly to your phone, giving people with diabetes the information they need to confidently, accurately, and easily manage their diabetes. People with diabetes can view their glucose readings and automatically receive alerts on their compatible smartphone, enabling them to make informed decisions.

- In January 2025, Researchers at the Birla Institute of Technology and Science (BITS) Pilani, Hyderabad campus, have come up with a new Machine Learning (ML)-assisted non-invasive portable device to detect and monitor diabetes that uses a light and chemical reaction to promote the signals from biomarkers, which leads to accurate detection of glucose.

- Report ID: 2942

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.