Next Generation Memory Market Outlook:

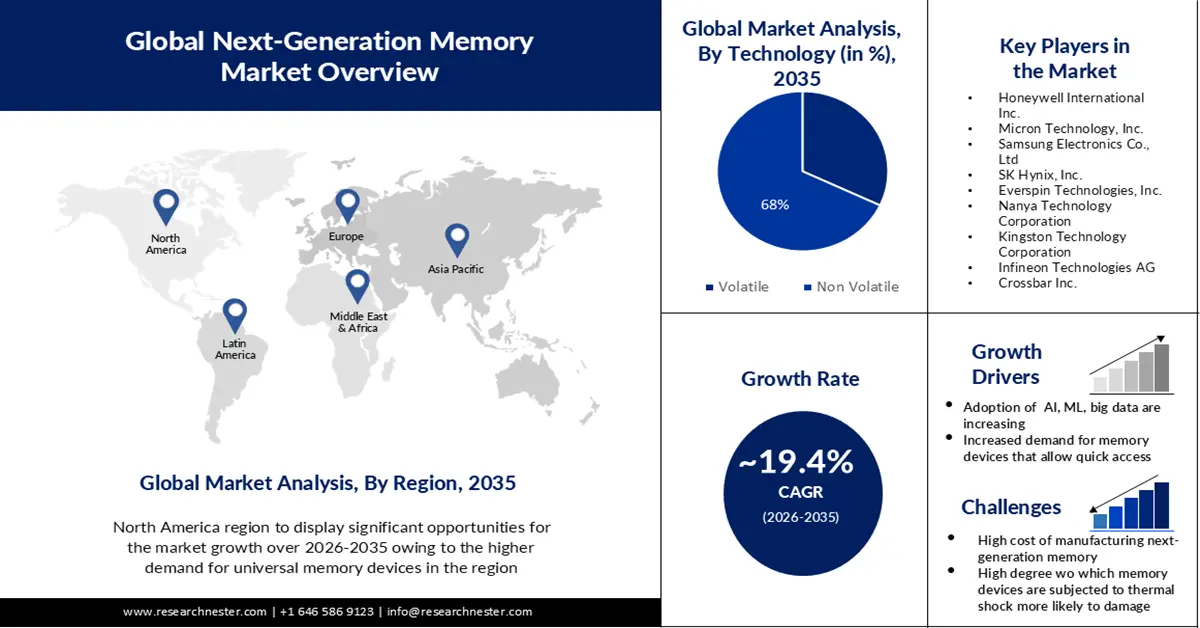

Next Generation Memory Market size was over USD 9.82 billion in 2025 and is poised to exceed USD 57.83 billion by 2035, growing at over 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of next generation memory is estimated at USD 11.53 billion.

The rising demand for universal memory devices, which is supported by numerous benefits associated with this type of memory, can be attributed to growth in the market. Over the period from 2023 to 2028, the global volume in storage units of consumer electronics is expected to grow by an overall figure of 6.9 million pieces. It is projected that in 2028 the volume will be 2.6 billion pieces.

In addition, the increase in demand for high-technology devices is the main factor driving the growth of the next generation memory market in this region. An increase in internet usage has been observed across a number of countries in the region. Consequently, there is an increasing demand from internet users for advanced computing products that in turn will lead to the production of next generation memory devices. The number of people using the internet in Asia & Pacific has increased from 355 million to 1901 million between 2005 and 2019, according to statistics provided by the international telecommunications union (ITU).

Key Next-Generation Memory Market Insights Summary:

Regional Highlights:

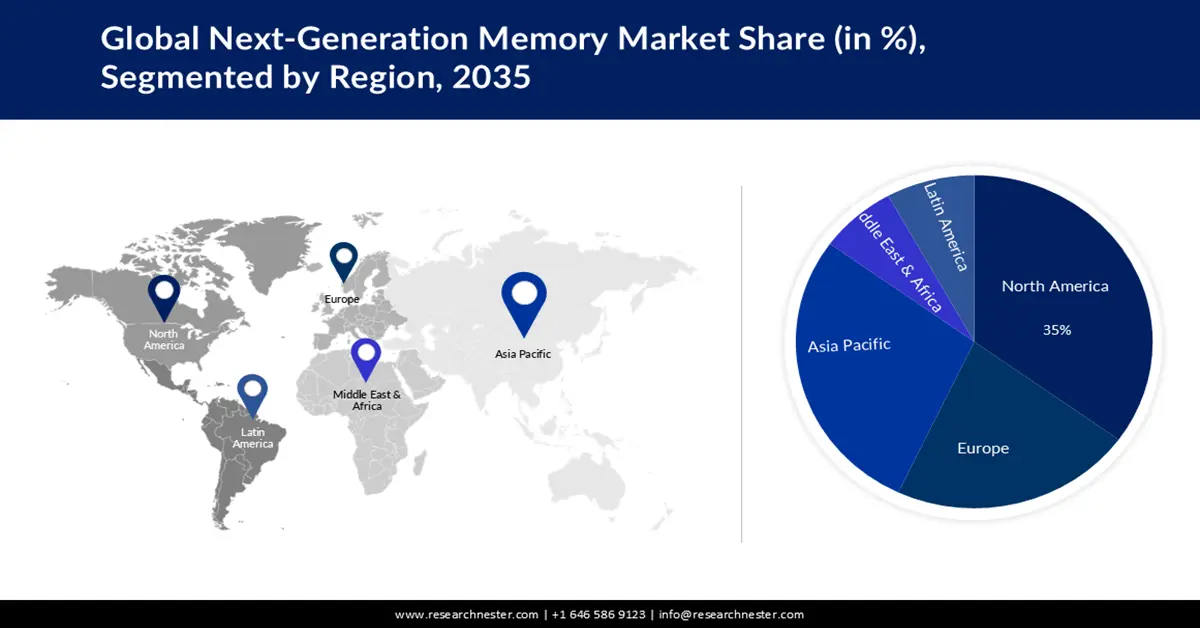

- North America next generation memory market will hold around 35% share by 2035, driven by early adoption of next-gen technologies and strong IT infrastructure.

- Asia Pacific market will capture a 28% share by 2035, fueled by growing consumer electronics use including smartphones and tablets.

Segment Insights:

- The non-volatile memory segment in the next generation memory market is forecasted to achieve a 68% share by 2035, attributed to the increased demand for better, more effective, and less costly memory solutions.

- The mass segment in the next generation memory market is expected to capture a 52% share by 2035, fueled by demand for high-capacity storage with fast access speeds and reliability.

Key Growth Trends:

- Increasing Use of Next Generation Memory Technologies In Embedded Systems And IOT Devices

- Growing Adoption of Artificial Intelligence, Big Data, Machine Learning and Cloud Computing

Major Challenges:

- Increasing Use of Next Generation Memory Technologies In Embedded Systems And IOT Devices

- Growing Adoption of Artificial Intelligence, Big Data, Machine Learning and Cloud Computing

Key Players: Honeywell International Inc., Micron Technology, Inc., Samsung Electronics Co., Ltd, SK Hynix, Inc., Everspin Technologies, Inc., Nanya Technology Corporation, Kingston Technology Corporation.

Global Next-Generation Memory Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.82 billion

- 2026 Market Size: USD 11.53 billion

- Projected Market Size: USD 57.83 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, South Korea, China, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Next Generation Memory Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Use of Next Generation Memory Technologies In Embedded Systems And IOT Devices- Next generation memory like MRAM and ReRAM, which offers high performance read and write speed with low energy consumption and no volatility, makes them appropriate for use in embedded systems and Internet of Things (IoT) devices that are increasingly replacing traditional memories. The number of connected Internet of Things devices is estimated to be about 15.14 billion by the latest available data. By 2030, it is estimated that this figure will more than double to 29.42 billion. This memory can enable instanton capabilities, improve energy efficiency and enhance storage of data in smart devices.

- Growing Adoption of Artificial Intelligence, Big Data, Machine Learning and Cloud Computing- The rise in demand for high bandwidth, low power consumption and large scalable memory is due to the increasing adoption of advanced technologies such as big data, artificial intelligence, machine learning, cloud computing etc. Every day, approximately 2.5 quintillion bits of data are created. The global data is 70% user generated cloud computing end user expenditure that totals around USD 500 billion per year.

- Increased Demand for Memory Devices Allowing Quick Access, and Consuming Little Power- High capacity and fast storage memory is becoming increasingly popular due to the growing number of data in companies as well as the popularity of cloud storage solutions. Advanced products continue to improve their performance, which drives a large part of the semiconductor industry. To meet the demands of memory devices with high speed, lower power consumption, and higher scale. Different new non-volatile memories have been created, including RRAM, MRAM, FeRAM, and NRAM. These technologies have more scale, density, speed, and endurance than traditional technology. After a command request, most emerging memory technologies take between 1 and 10 nano second for their output to meet the specified requirements.

Challenges

- The Cost of Manufacturing Next Generations' Memories Continues to Rise- The production cost of high-density DRAM and SRAM is very high today, while there are also significant costs for the manufacturing of high-bit density next generation memory. More complicated production processes are commonly involved in a new generation of memory technologies compared to traditional technology for the storage of memories. The use of specialist equipment, materials, and expertise may be required for these processes which can lead to higher costs. Next generation memory technologies have the potential to show lower production yields as a result of problems like defects, process variation or material challenges during their first stage of development and manufacture. As a result, the cost per functional chip is higher due to low yields.

- The higher the degree to which memory devices are subjected to thermal shock, the more likely they will be damaged and thus hamper market growth.

- The growth of the market may be hindered by higher design costs as a result of a lack of standardized production processes.

Next Generation Memory Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 9.82 billion |

|

Forecast Year Market Size (2035) |

USD 57.83 billion |

|

Regional Scope |

|

Next Generation Memory Market Segmentation:

Technology Segment Analysis

In next generation memory market, non-volatile memory segment segment is set to capture around 68% revenue share by the end of 2035. The increased demand for better, more effective and less costly memory solutions can be attributed to the growth of the segment in the market. The limitation of conventional non-volatile memory devices in terms of scalability, stability and other parameters has also been eliminated by the emergence of modern memory technologies. The global accumulation of data creates a need for more efficient storage solutions with high capacity, which is due to the large volume of data generated. Each day around 328,77 terabytes of data are generated. This year, approximately 120 zettabytes of data will be produced. The speed and performance of non-volatile memory are comparable to flash memory technologies such as DRAM or SRAM, with higher storage densities, e.g. in the case of ReRAM and STT RAM PCM.

Storage Type Segment Analysis

mass segment in Next generation memory market is set to capture over 52% revenue share by 2035. The mass storage is commonly used in the data centers, enterprise storage systems, consumer electronics and other applications that require high-capacity with fast access speeds and reliable data retention. There are approximately 8,000 data center locations worldwide. Artificial intelligence is being used for about 20% of global data center capacity.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Storage Type |

|

|

Size |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Next Generation Memory Market Regional Analysis:

North American Market Insights

North America is estimated to capture over 35% next generation memory market share by 2035. Early adoption of the next generation technologies and infrastructure has been led by the Northern America region. In the United States, IT is an important driver of economic growth. More effective processing systems need to be developed in order to cope with the rapid evolution of technologies and a growing volume of data across sectors in the North America region. The US technology market makes up 35% of the world's overall economy. In 2023, the USA’s tech sector is projected to grow by 5.4%. The US has more than 585,000 tech companies.

APAC Market Insights

Asia Pacific region is anticipated to capture around 28% next generation memory market share by the end of 2035. The region is expected to grow strongly as a result of major consumer electronics adoption in this area, especially smartphones, tablets, and laptops. According to a report, by 2021, mobile phone usage in Asia Pacific will be 74% and is expected to increase to 84% over the next decade. Moreover, in the same year, it is expected that 62% of mobile subscribers will be present.

Next Generation Memory Market Players:

- Intel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Micron Technology, Inc.

- Samsung Electronics Co., Ltd

- SK Hynix, Inc.

- Everspin Technologies, Inc.

- Nanya Technology Corporation

- Kingston Technology Corporation

- Infineon Technologies AG

- Crossbar Inc.

Recent Developments

- SK Hynix Inc. became the industry’s first to develop a 12-layer HBM31 product with a 24 gigabyte 2 memory capacity, currently the largest in the industry. The company succeeded in developing the 24 GB package product that increased the memory capacity by 50% from the previous product, following the mass production of the world’s first HBM3 in June 2022.

- Samsung announced the start of mass production of its 8th generation vertical NAND (V-NAND) chips to enable expanded storage space in next generation server systems. These chips feature the industry's highest bit density and storage capacity. They are expected to enable organizations to expand the storage capacity of next generation enterprise servers while extending their use into the automotive market.

- Report ID: 3724

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Next-Generation Memory Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.