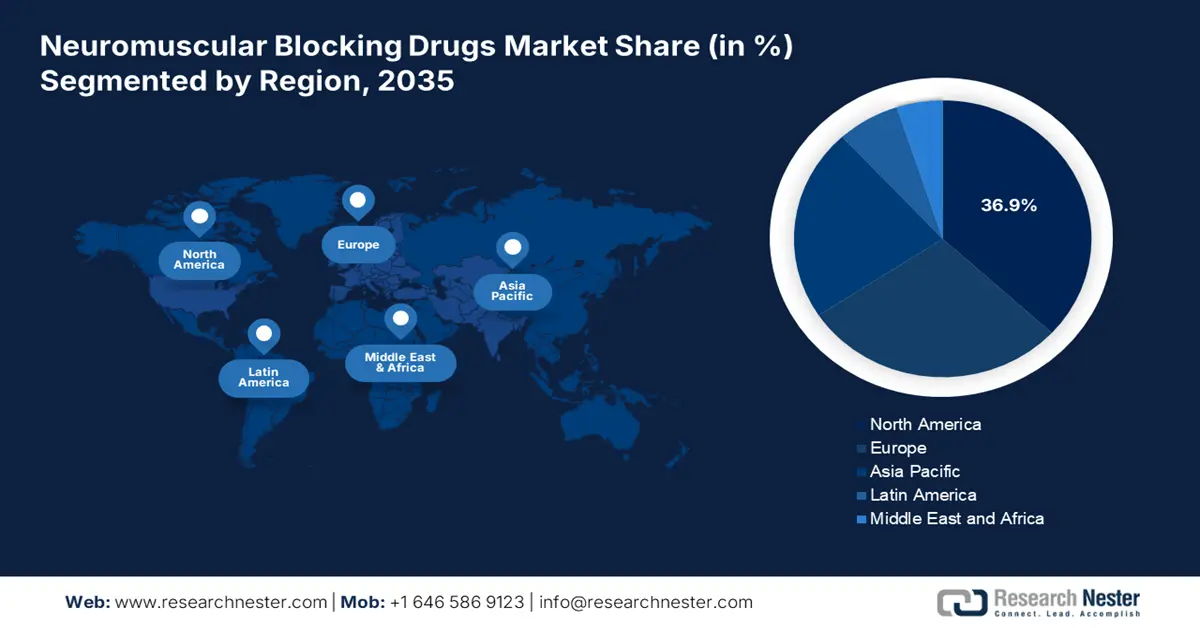

Neuromuscular Blocking Drugs Market - Regional Analysis

North America Market Insights

North America neuromuscular blocking drugs market is expected to maintain the highest regional share by 2035, with about 36.9% of total revenue at a CAGR of 6.1% due to large volumes of surgical procedures, strong healthcare infrastructure, and government-supported reimbursements. Increasing demand for general anesthetics in inpatient and outpatient surgery, as well as ICU modernization and national readiness programs, continues to promote adoption. Supported by top associations like AMA, PhRMA, and Innovative Medicines Canada, the region is experiencing faster regulatory clearances, generics growth, and public-private R&D partnerships, making North America a market and innovation center for neuromuscular blocking drugs up to 2035.

The neuromuscular blocking drugs market in U.S. is driven by the inpatient surgery procedures, 12.0 to 21.4 operations per 100,000 people having undergone surgeries for various issues, based on the NLM report in April 2024. A primary driver dominating the market is the favourable reimbursement for sugammadex, which reached a significant portion of Medicare Part B spending on reversal agents. Federal support is substantial, with the NIH allocating significant funding for research into safer anesthetic agents. Continued investment from federal agencies and a strong surgical volume base ensure steady market growth.

The neuromuscular blocking drugs market in Canada is driven by the universal and publicly funded healthcare system. The key trend is the proactive assessment and new drugs funding by the Canadian Agency for Drugs and Technologies in Health which has recommended the newer NMBDs and reversal agents to enhance patient outcome. The Government of Canada report in 2023 has depicted that the prescription drugs is growing at a CAGR of 7.1% from 2018 to 2023. This growth is further supported by the adoption of advanced neuromuscular blocking drugs within Canada’s hospital and surgical settings.

Prescription Drug Utilization Trends

|

Year |

Drug costs |

Dispensing costs |

Claims |

Claimants |

|

2013 |

1.00 |

1.00 |

1.00 |

1.00 |

|

2014 |

1.06 |

1.04 |

1.04 |

1.03 |

|

2015 |

1.12 |

1.06 |

1.07 |

1.06 |

|

2016 |

1.17 |

1.11 |

1.11 |

1.09 |

|

2017 |

1.25 |

1.16 |

1.15 |

1.13 |

|

2018 |

1.30 |

1.21 |

1.19 |

1.13 |

|

2019 |

1.42 |

1.29 |

1.25 |

1.22 |

|

2020 |

1.50 |

1.39 |

1.30 |

1.13 |

|

2021 |

1.61 |

1.39 |

1.27 |

1.16 |

|

2022 |

1.68 |

1.45 |

1.30 |

1.20 |

|

2023 |

1.92 |

1.51 |

1.39 |

1.30† |

Source: Government of Canada 2023

Asia Pacific Market Insights

The APAC is the fastest-growing region in the neuromuscular blocking drugs market and is anticipated to hold a considerable market share by 2035. The market is supported by rising ICU admissions, increasing surgical volumes, and national investment in perioperative and emergency care. India, Japan, and China are dominating countries in the market, with Japan focusing on advanced anesthetic drugs. This growth is further being fueled by trends including aging populations, a rise in the prevalence of trauma and chronic illnesses, and easier access to anesthetic treatments in remote hospitals. The region is strengthened by high R&D investments and fast drug review by AMED, CDSCO, and NMPA.

China is the dominating shareholder in the market in Asia Pacific region. The NLM study in February 2025 has provided evidence that the annual number of surgeries in china exceeded 1.25 million, highlighting the immense requirement of neuromuscular blocking drug, sustaining robust market growth. Further, the Healthy China 2030 initiative has prioritized access to essential perioperative drugs in public hospitals across Tier 2 and Tier 3 cities. This strategy lines up with the availability of critical care drugs and expanded health care reform goals across rural areas.

The neuromuscular blocking drugs market in India is experiencing rapid growth due to the rising surgical procedures performed, increasing use of anesthesia in critical care, and expanding healthcare infrastructure. With the rising elderly population and incidence of chronic diseases that require surgeries are the crucial drivers of the market. Further, the government initiatives are strengthening the hospitals and raising the private sector investment for advanced facilities in the healthcare sector for market expansion. Additionally, greater awareness of safe anesthesia practices is enhancing NMBD adoption.

Europe Market Insights

The neuromuscular blocking drugs market in Europe is significantly expanding and is poised to hold the largest market share by 2035. The market is fueled by the rising demand for intensive care interventions and surgical procedures. The region witnesses a rise in cardiovascular and chronic respiratory conditions, raising the demand for NMBD mainly in critical care units. Further, the technological advancements in enhanced monitoring protocols and short-acting NMBDs are improving patient care. Countries like the UK, Germany, and France are driving the market with the rise in the aging population and procedural volume in public hospitals.

Germany is expected to dominate the neuromuscular blocking drugs market in Europe and is estimated to capture the largest share by 2035. The market is propelled as a result of strong national procurement policies, centralized delivery of healthcare, and technological advancement. The Federal Ministry of Health has initiated a large-scale investment in the procurement of surgical and ICU medicines via national tenders, which have improved efficiency and access. As per the Eurostat report in November 2024, the healthcare expenditure reached €488,677 in 2022, including anesthesiology. Additionally, collaborations with local pharma producers (such as Fresenius Kabi) have promoted production locally and reduced drug shortages.

France Neuromuscular Blocking Drugs (NMBDs) market is growing steadily due to a rise in surgical intervention and increasing intensive care units. The strong public healthcare system and high per capita healthcare spending in France favor the use of both conventional and newer NMBDs, including reversal agents. Rising demand for patient safety, fast recovery, and newer forms of anesthesia further fuels market growth. On the other hand, public policy and hospital purchase programs increases the availability, making France a major player in the European NMBD market.

Healthcare Expenditure in Europe

|

Country |

2019 |

2020 |

2021 |

2022 |

Overall Change 2014-22 (%) |

|

Germany |

407,025 |

431,941 |

466,713 |

488,677 |

51.4 |

|

France |

270,562 |

279,815 |

307,568 |

313,574 |

26.6 |

|

Spain |

113,776 |

120,093 |

126,001 |

131,114 |

39.7 |

Source: Eurostat, November 2024