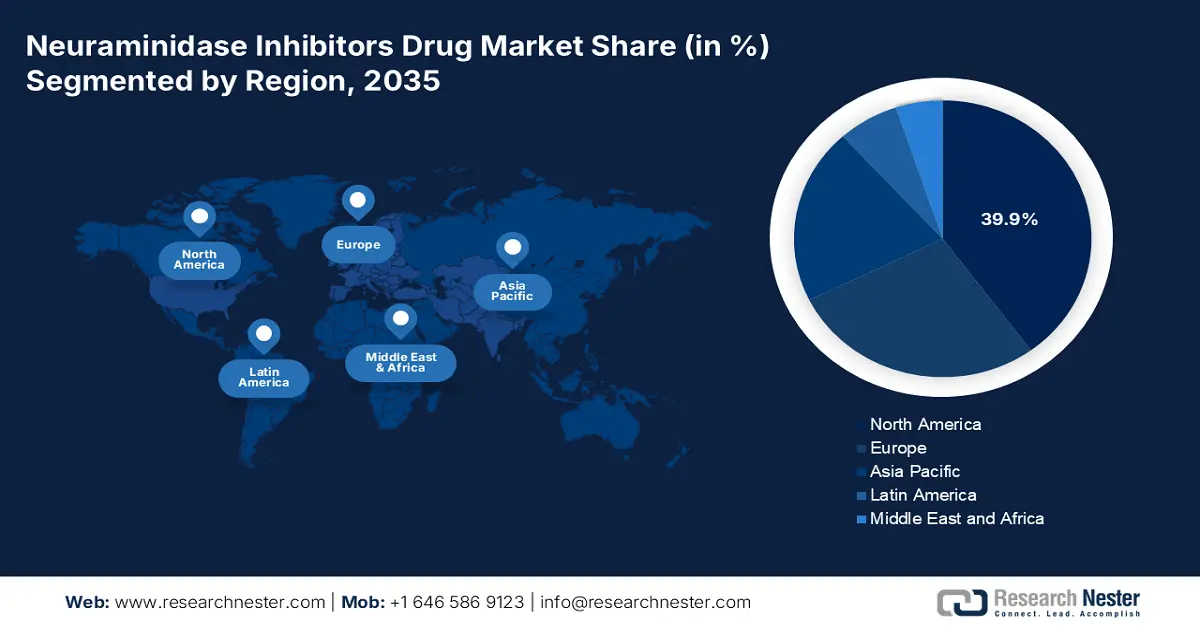

Neuraminidase Inhibitors Drug Market - Regional Analysis

North America Market Insights

The North America neuraminidase inhibitors drug market is expected to have a market share of 39.9% at a CAGR of 6.1% through 2035. The market undergoes steady growth, spurred by robust public health investment, extensive antiviral use, and government support. The U.S. leads the market with significant federal funding by agencies such as the CDC, NIH, and CMS, which increased Medicare and Medicaid benefits for influenza antivirals. On the other hand, Canada's Health Ministry and provincial government have raised spending on flu, aided via CIHI and PHAC. Aging populations, recurrent flu outbreaks, and stockpiling tactics are driving market growth in both countries.

The U.S. neuraminidase inhibitors drug market is growing rapidly and is driven by strong federal funding and policy changes in favor of infectious disease preparedness. The CDC report in November 2024 states that the cases of hospitalizations registered in the U.S. due to flu is nearly 120,000 to 710,000. This rise in the flu-related hospitalizations highlights the critical role of neuraminidase inhibitors in reducing severity and aiding national influenza management strategies. Additionally, market demand in hospital sectors and retail pharmacy channels is being increased by active government investment and stockpiling programs.

Canada's neuraminidase inhibitors market is fueled by a publicly funded healthcare system and significant emphasis on pandemic and seasonal influenza planning. The Public Health Agency of Canada (PHAC) holds a national stockpile of antivirals as part of its pandemic strategy. According to the 2025 report from the CMA, the health budget in Canada was USD 344 billion in 2023, equivalent to 12.1% of GDP. The market is also driven by guidelines from the National Advisory Committee on Immunization (NACI), which, along with treatment recommendations, provides backing for the use of antivirals within managed clinical networks to provide stable demand across provinces.

U.S. Influenza Burden (2019-2024)

|

Year |

Hospitalization |

Illness |

Death |

|

2019 - 2020 |

390,000 |

36,000,000 |

26,000 |

|

2021 - 2022 |

120,000 |

11,000,000 |

6,300 |

|

2022 - 2023 |

370,000 |

31,000,000 |

21,000 |

|

2023 - 2024 |

470,000 |

40,000,000 |

28,000 |

Source: CDC, November 2024

Asia Pacific Market Insights

The APAC is the fastest-growing region in the neuraminidase inhibitors drug market and is projected to hold a significant market share of by 2035. The market is driven by the increasing antiviral drug stockpiling, robust governmental focus on influenza pandemic preparedness, and rising disease prevalence in densely populated areas. China and Japan are the major nations that contribute to advanced healthcare infrastructure and elevated seasonal flu cases. In South Korea, the Health Insurance Review & Assessment Service has broadened the reimbursement as part of the national influenza control policy for neuraminidase drugs. Additionally, expanded universal health coverage program, digital surveillance tools, public public-private partnership enhance the market growth.

Japan is the highest shareholder in the neuraminidase inhibitors drug market and is forecasted to hold a considerable market share by 2035. According to the Pharma Japan report in December 2024, 44.2 billion yen is invested for pharmaceutical-related initiatives, including neuraminidase inhibitors, indicating the high level of commitment towards influenza preparedness. This funding was fueled by increasing influenza occurrences and the government's stockpiling programs. These initiatives highlight Japan's strategic focus on antiviral preparedness and local pharmaceutical innovation to address seasonal and pandemic influenza threats.

The China market for neuraminidase inhibitors is marked by large scale and strategic significance. Expansion is driven mainly by the size of the population and high clinical burden of seasonal influenza. Favorable government policies, such as the inclusion of these antivirals in national treatment guidelines and pandemic stockpiles, are the key drivers. The market is also influenced by a robust domestic manufacturing base, which guarantees timely supply and availability across the country's healthcare system.

Influenza Peak Forecast Results in China

|

Province |

Peak date |

Peak week |

Total cases in peak |

|

Shanghai |

2023-12-22 (2023-12-19, 2023-12-26) |

51 (51, 52) |

333460 (288935, 381245.5) |

|

Yunnan |

2023-12-26 (2023-12-22, 2023-12-30) |

52 (51, 52) |

615448.5 (530156, 700422.5) |

|

Sichuan |

2023-12-26 (2023-12-22, 2023-12-30) |

52 (51, 52) |

1102986.5 (950188.5, 1258233) |

|

Anhui |

2023-12-23 (2023-12-19, 2023-12-27) |

51 (51, 52) |

803065.5 (696546, 919976) |

|

Guangdong |

2023-12-23 (2023-12-19, 2023-12-27) |

51 (51, 52) |

1706515 (1485689, 1954301) |

Source: NLM September 2024

Europe Market Insights

The neuraminidase inhibitors market within Europe is a mature but increasingly growing market, characterized by strong public healthcare and government emphasis on pandemic readiness. Major drivers are seasonal influenza disease burden, most notably in the elderly population, and national approaches toward antiviral stockpiling. The European Centre for Disease Prevention and Control (ECDC) collects surveillance and issues recommendations, ensuring uniform treatment approach across member states. One of the key trends is greater cross-border cooperation through the European Health Union, with a view to providing fair access to essential medicines during health emergencies.

Germany is expected to hold the largest revenue share in Europe by 2035, fueled by its huge population, robust healthcare spending, and strong public health strategy. The government agency responsible for disease control at the federal level, delivers intense surveillance and treatment guidelines that directly impact market demand. Germany's early and widespread national stockpiling approach for pandemic flu maintains steady market volume. One of the most important trends is the incorporation of antiviral therapy into usual care pathways among high-risk patients, as recommended by the Standing Committee on Vaccination (STIKO), to ensure continued use off-season.

France is powered by high vaccine and antiviral consumption, highlighted by an extensive national healthcare system. The French Public Health Agency (Santé Publique France) carries out widespread influenza surveillance, which activates regional antiviral deployment plans. As per the OEC report in 2023, the pharmaceutical products exported are accounted to be USD 39.5 billion, highlighting the market demand. On the other hand, government expenditure is an important driver, with the National Authority for Health (HAS) making reimbursement decisions quickly and hence ensuring patient access.