Narrowband IoT Market - Growth Drivers and Challenges

Growth Drivers

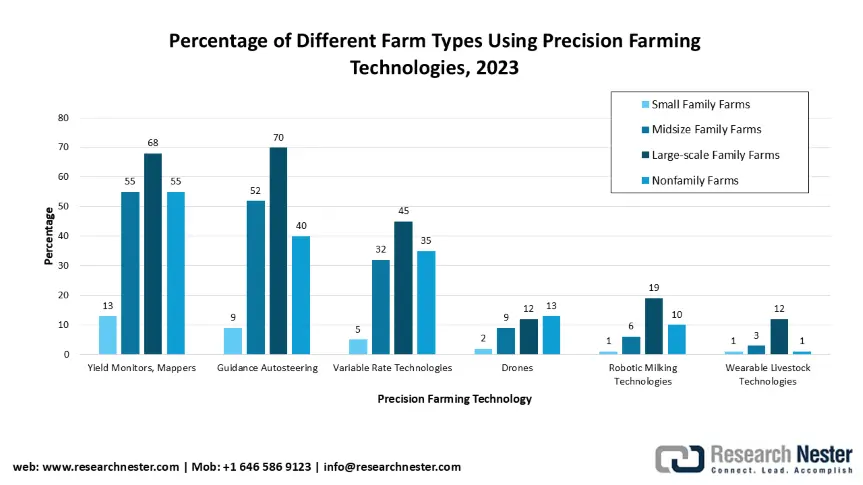

- Increasing integration of NB-IoT in smart agriculture: The rapid adoption of NB-IoT in smart agriculture is expected to fuel the market growth. The rising adoption of yield monitors, soil maps, and other precision tools is creating demand for NB-IoT connectivity to collect, transmit, and analyze real-time farm data. This shift allows smarter decision-making, enhancing productivity and resource efficiency in large-scale agricultural operations. According to a report by the U.S. Department of Agriculture 2023, yield monitors, yield maps, and soil maps were utilized on 68% of large-scale crop farms. It also states that the use of precision agriculture technologies rises significantly with farm size, while small family farms with gross cash farm income below USD 350,000 report the lowest adoption levels across all technology categories.

Source: USDA

- Deployment of NB-IoT in smart cities enhances urban infrastructure management: The integration of smart city programs across multiple economies has created multiple opportunities for the deployment of NB-IoT. Recent developments include the launch of a multi-million-pound NB-IoT network by BT in the UK, which was announced in February 2024. The network is predicted to cover more than 97% of the UK population to enable connectivity for devices such as streetlights and water sensors. The NB-IoT network has facilitated automation of work that requires manual oversight, such as leaks in water infrastructure, creating ample opportunities in the market.

- High adoption of NB-IoT in energy and utilities sector: Energy & utilities have regular, well‐defined use cases in metering, remote monitoring, and grid reliability, often with regulatory mandates, which makes their investment highly predictable. These systems benefit especially from NB-IoT’s long device battery life, ability to reach indoor/subterranean environments, and low traffic per device. For instance, in April 2021, Tata Power-Delhi Distribution Ltd (Tata Power-DDL), a major power distribution utility in North Delhi, started deploying smart meters that use NB-IoT technology. This is noteworthy as it is among the first huge NB-IoT-based smart meter deployments in India. They have already installed 2.3 lakh smart meters using RF tech, and now the NB-IoT meters are being added.

Challenges

- Limited network coverage in remote and rural areas impeding NB-IoT device deployment: Despite the ability of narrowband IoT to provide wide-area connectivity with low power, a significant impediment faced is the insufficient network coverage in rural regions. Operators may prioritize urban deployments due to quicker ROI, causing accessibility challenges in rural areas. This creates uneven investments in infrastructure. Additional challenges occur in spectrum allocation, restricting reliable NB-IoT connectivity.

- Competition from alternative LPWAN & 5G technologies: NB-IoT competes with other low-power wide area network (LPWAN) technologies such as LoRaWAN, Sigfox, and with LTE-M. In many cases, LoRaWAN grants open, unlicensed spectrum operation with lower deployment costs, while LTE-M provides higher mobility support and lower latency as compared to NB-IoT. With the ongoing expansion of 5G massive IoT capabilities, some enterprises may prefer to go directly to 5G-based solutions instead of committing to NB-IoT. This competition creates uncertainty in the ecosystem, as device manufacturers and solution providers hesitate to invest heavily in one standard.

Narrowband IoT Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

28.2% |

|

Base Year Market Size (2025) |

USD 6.7 billion |

|

Forecast Year Market Size (2035) |

USD 80.3 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

In 2025, the industry size of the narrowband IoT market is over USD 6.7 billion.

The global narrowband IoT market was valued at USD 6.7 billion in 2025 and is projected to reach USD 80.3 billion, expanding at a CAGR of 28.2% during the forecast timeline from 2026 to 2035.

The major players in the market are Huawei Technologies Co., Ltd., Qualcomm Technologies Inc., Ericsson AB, Nokia Corporation, Verizon Communications Inc., AT&T Inc., Vodafone Group Plc, Sierra Wireless, Inc., Telit Cinterion, and ZTE Corporation

The network segment is anticipated to hold a dominant share of 65.1% by 2035 and display lucrative growth opportunities during 2026-2035.

The Europe narrowband IoT market is projected to hold the largest share of 33.5% by the end of 2035 and provide more business opportunities in the future.