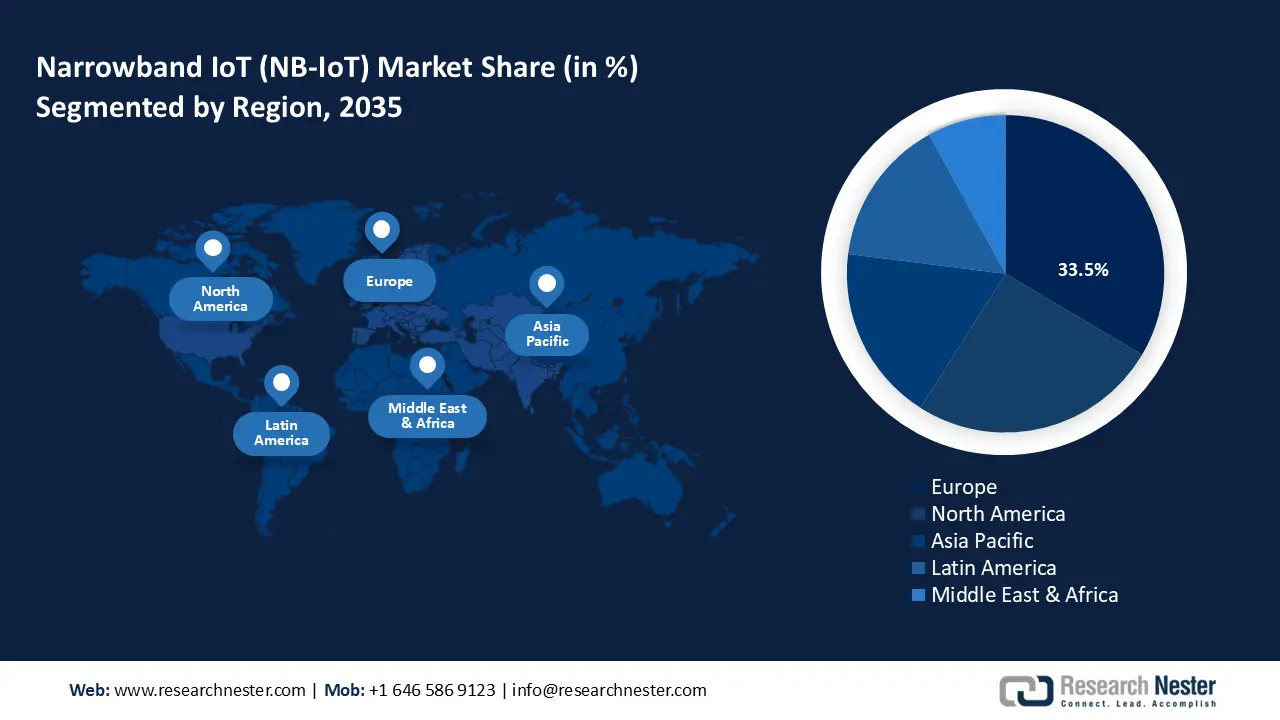

Narrowband IoT Market - Regional Analysis

Europe Market Insights

The Europe market is projected to hold the largest share of 33.5% by the end of 2035. The regional narrowband IoT market is supported by a heightened emphasis on industrial automation, supported by the Industry 4.0 initiatives. A key demand segment within Europe is the rising demand for low-power wide-area (LPWA) connectivity across domains such as manufacturing, utilities, agriculture, and transportation.

UK market is slated to hold a leading revenue share in Europe. The narrowband IoT market is boosted by major operator investments toward national connectivity infrastructure. Government policy drivers include the push toward smart cities, net zero emissions, and regulatory pressure on energy efficiency. To address this, in July 2020, Vodafone UK collaborated with the UK Department for Environment, Food and Rural Affairs (Defra) and Forest Research to test how NB-IoT technology could be used to study and overlook the role of trees in addressing climate change. Overall, these initiatives together drive the growth of NB IoT applications in the country.

The NB-IoT ecosystem in Germany is expected to expand at a rapid pace, owing to operator activity, public sector smart city projects, and trials demonstrating NB-IoT’s performance in challenging environments. In energy and utilities, the provider ista conducting measurement tests of NB-IoT in multiple apartments in the Cologne/Bonn area, placing NB-IoT modules on different floors; signal connectivity was successful in 100% of all transmissions in this field trial. Government-funded smart city programs in Germany, backed by EU and federal money, are also enabling funding for infrastructure upgrades and IoT sensor roll-outs, e.g., intelligent lighting, parking, and environmental monitoring that favor NB-IoT.

APAC Market Insights

The APAC market is projected to register a dominant revenue share of 41.6% revenue share throughout the forecast timeline. The growth of the region is underpinned by the rising investments in healthcare digitization, smart infrastructure, and industrial automation across multiple economies in the region. The Industry 4.0 initiatives have proliferated in the region, boosting multiple opportunities to integrate NB-IoT in manufacturing processes.

The China narrowband IoT market is poised to hold a leading revenue share by the end of 2035. China leads the market with nationwide coverage and aggressive government-driven IoT strategies. The market is rising due to its scalability in applications like smart metering and tracking, with 1.8 billion connections till December 2022, driven by the dominance of three major telecoms reporting strong revenue growth. Extensive 5G coverage, leadership in IoT chip supply, and government-backed ecosystem development enable widespread adoption across industries like public services and agriculture. These trends are expected to fuel the demand for NB-IoT solutions in the coming years.

The India narrowband IoT market is poised to expand at a rapid pace owing to government mandates for smart metering and digital infrastructure under the National Smart Grid Mission and the Revamped Distribution Sector Scheme (RDSS). The Smart Meter National Programme (SMNP) aims to install 250 million smart meters, many using NB-IoT for connectivity in challenging situations. Telecom operators such as Bharti Airtel and Vodafone Idea have partnered with meter manufacturers to deploy NB-IoT solutions at scale. in April 2023, Airtel enabled 1.3 million NB-IoT smart meters in Bihar with fallback options on 2G/4G to ensure reliable data transfer. Such initiatives reflect India’s strong commitment to using NB-IoT to modernize utilities and promote digital inclusion in all spheres.

North America Market Insights

North America market is anticipated to garner a robust share from 2026-2035, owing to nationwide deployments of NB-IoT solutions by top telecom operators such as T-Mobile, Verizon, and AT&T for large-scale IoT connectivity. The rising adoption in utilities, logistics, healthcare, and smart cities is creating demand for low-power, wide-area networks. Additionally, government initiatives for the development of smart infrastructure and digital transformation are expected to enhance the demand for NB-IoT adoption across the region.

The U.S. market is likely to expand rapidly due to technological advancements, digitization in several industries, along with favorable government research and policies. A study by the National Institute of Standards and Technology (NIST) issued in September 2025 revealed that federal investments in IoT infrastructure can deliver a return of 10 to 20 times the amount spent, supporting the case for public funding in areas like spectrum and standards. The U.S. IoT Advisory Board has also suggested promoting satellite-based NB-IoT to improve connectivity in rural and agricultural regions. At the same time, companies like Sateliot are working with the FCC to launch satellite NB-IoT services under new 3GPP standards, which would let devices switch seamlessly between terrestrial and satellite networks.

The key players in the Canada market are expected to witness lucrative growth opportunities owing to increasing utilities and large-scale smart meter rollouts, and rising investments and funds by public and private sectors. Canada’s key carriers promote LTE-M/NB-IoT as a part of their IoT profiles and continue expanding network coverage and 5G backbones, complementing NB-IoT deployments. This is expected to fuel the sales of NB-IoT systems and solutions in the coming years.