Nafion Market Outlook:

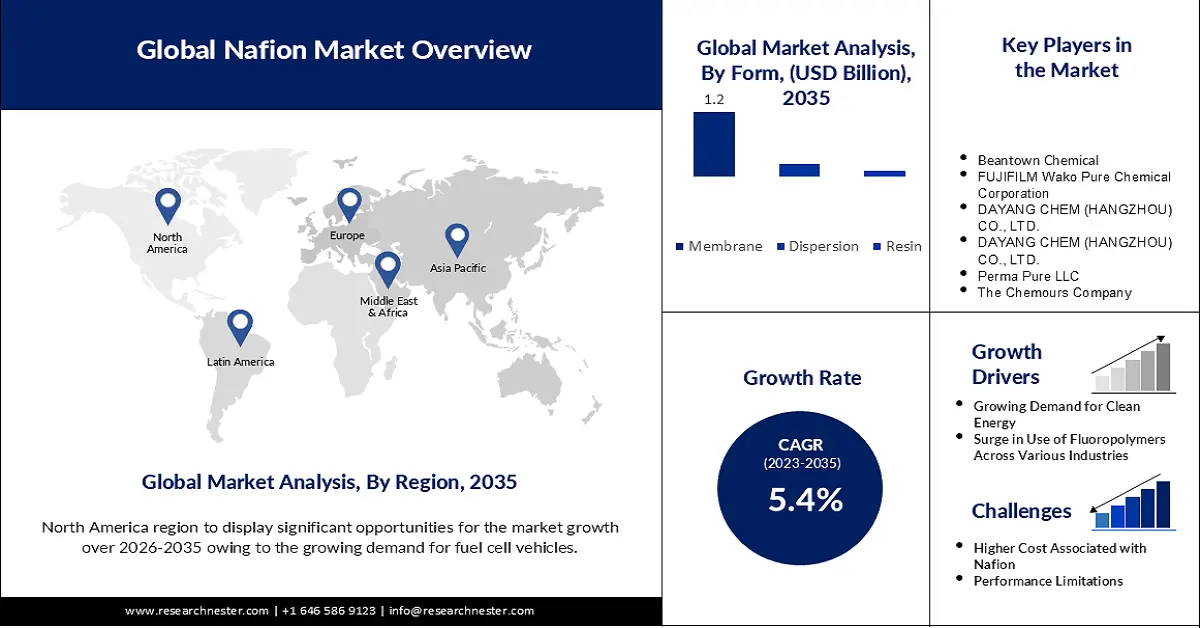

Nafion Market size was valued at USD 1.02 billion in 2025 and is expected to reach USD 1.73 billion by 2035, expanding at around 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nafion is assessed at USD 1.07 billion.

The demand for nafion is growing faster due to the increasing demand for FCEV vehicles. In comparison to 2021, there were about 39% more hydrogen fuel cell electric vehicles (FCEVs) on the road in 2022, representing over 71,000 vehicles in world.

Comparable to all-electric vehicles, fuel cell electric vehicles (FCEVs) utilize electricity to operate an electric motor. FCEVs, in contrast to other electric cars, produce electricity using hydrogen-powered fuel cells as opposed to only a battery. The power of the vehicle is defined throughout the vehicle design phase by the size of the electric motor(s) that obtain electricity from the proper size fuel cell and battery combination. Hence, the market is expanding as more electric vehicles use fuel cells to power them since protons are exchanged in membrane fuel cells and hydrogen generation usually uses nafion membranes.

Key Nafion Market Insights Summary:

Regional Highlights:

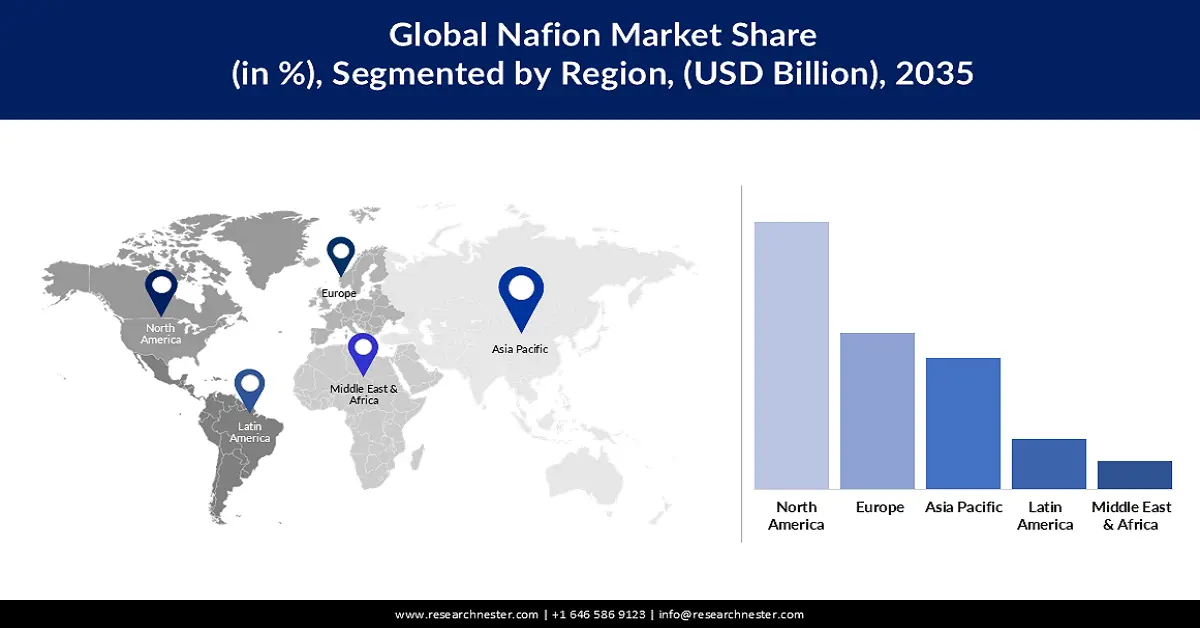

- North America is set to hold the largest revenue share of 44% by 2035, driven by extensive adoption of Nafion in fuel cell technologies and rising investments in clean energy.

- Asia Pacific is estimated to hold a significant market share by 2035, impelled by growing R&D in hydrogen production, fuel cells for EVs, and increasing demand across consumer electronics and automotive sectors.

Segment Insights:

- The membrane segment is expected to hold a remarkable revenue share by 2035, driven by Nafion’s high efficiency, selectivity, chemical resistance, and durability across fuel cells, batteries, and water treatment applications.

- The energy segment is poised to account for a substantial revenue share by 2035, owing to its high proton conductivity and chemical and thermal stability, enhancing performance in energy conversion devices.

Key Growth Trends:

- Growing Demand for Clean Energy

- Surge in Use of Fluoropolymers Across Various Industries

Major Challenges:

- Higher Cost Associated with Nafion

- Performance Limitations

Key Players: BEANTOWN CHEMICAL, FUJIFILM Wako Pure Chemical Corporation, DAYANG CHEM (HANGZHOU) CO., Ltd., DuPont de Nemors, Inc., Perma Pure LLC, The Chemours Company, Merck KGaA, Santa Cruz Biotechnology, Alfa Aesar (Thermo Fisher).

Global Nafion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.02 billion

- 2026 Market Size: USD 1.07 billion

- Projected Market Size: USD 1.73 billion by 2035

- Growth Forecasts: 5.4%

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, Canada, South Korea

- Emerging Countries: China, India, Brazil, Australia, Mexico

Last updated on : 19 November, 2025

Nafion Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand for Clean Energy: The average worldwide concentration of carbon dioxide (CO2) climbed by 2.13 parts per million (ppm) to 417.06 ppm, nearly at the same rate as the previous ten years. Compared to pre-industrial levels, atmospheric CO2 is currently 50% greater. Hence, the need to reduce this emission is growing. Therefore, the market for nafion is on surge.

- Surge in Use of Fluoropolymers Across Various Industries: Due to their wide range of qualities, fluoropolymers have garnered a lot of interest in the realm of energy applications. The incorporation of nanofillers into the fluoropolymer to form the nanohybrid enhances properties including thermal, mechanical, gas permeation, and more. Nanohybrids based on fluoropolymers have supplanted various commercial materials owing to their chemical inertness, enhanced efficacy, and durability. These elements play a part in the expanding use of fluoropolymers including Nafion in numerous sectors.

- Increasing Product Launch & Investments: The demand for nafion membranes in the power industry is rising as a result of rising product releases, investments, and funding in proton exchange membrane (PEM) fuel cell technology. Nafion membrane is essential to proton exchange membrane (PEM) fuel cells, consequently, its development is anticipated to offer abundant chances for market expansion.

Challenges

- Higher Cost Associated with Nafion

- Performance Limitations – While Nafion is highly efficient in some applications, such as fuel cells, it may not be the best material for all applications. For instance, it may not be as effective in certain water treatment applications, particularly in the case where larger molecules or particles need to be removed from the water. As a result, there is a need to develop alternative materials that can provide better performance in specific applications.

- Environmental Concerns

Nafion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 1.02 billion |

|

Forecast Year Market Size (2035) |

USD 1.73 billion |

|

Regional Scope |

|

Nafion Market Segmentation:

Form Segment Analysis

By 2035, membrane segment in nafion market is expected to account for remarkable revenue share.The growth of the segment can be attributed to its unique properties and advantages for certain applications. Nafion membranes are highly efficient and selective ion exchange membranes that are used in various applications, including fuel cells, batteries, and water treatment. They have a high proton conductivity and are highly resistant to chemical degradation and high temperatures. This makes them ideal for use in applications where high efficiency, selectivity, and durability are required.

Application Segment Analysis

By 2035, energy segment in market is poised to account for substantial revenue share, due to its high proton conductivity, which allows for high efficiency and low resistance in energy conversion devices. As a result, it can improve overall system performance. In addition, Nafion is also highly resistant to chemical degradation and high temperatures. This makes it well-suited for use in harsh environments, such as fuel cells and batteries, where chemical and thermal stability are critical for long-term performance.

Our in-depth analysis of the global market includes the following segments:

|

By Form |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nafion Market - Regional Analysis

North American Market Insights

North America industry is set to hold largest revenue share of 44% by 2035, There is a significant usage and development of Nafion-based technologies in North America, particularly in the United States. One reason for this is that the U.S. has been a leader in the development and commercialization of fuel cell technologies, which are one of the major applications of Nafion. As a result, there has been significant research and development of Nafion-based membranes and other components for fuel cells in the U.S., which has led to the commercialization and adoption of Nafion in fuel cell applications. In addition, the investment for clean energy is also increasing in North America which would boost market revenue. Since, August 2022, about USD 270 billion in domestic utility-scale sustainable energy investments have been announced.

APAC Market Insights

By 2035, Asia Pacific region is estimated to hold significant market share.The region is witnessing increasing investments in research and development activities of new applications for Nafion. For instance, Nafion membranes are being used in water electrolysis to produce hydrogen gas, which is increasingly being used as a clean energy source. His growing interest in such technologies is driving the demand for Nafion in the region. Furthermore, the region has a large and growing population, which is driving the demand for a wide range of products and services, including consumer electronics and automobiles. Nafion is used in various applications in such industries, such as the production of fuel cells for electric vehicles. Therefore, the growing demand for such products is contributing to the growth of the Nafion market in the Asia Pacific.

Nafion Market Players:

- BEANTOWN CHEMICAL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FUJIFILM Wako Pure Chemical Corporation

- DAYANG CHEM (HANGZHOU) CO., Ltd.

- DuPont de Nemors, Inc.

- Perma Pure LLC

- The Chemours Company

- Merck KGaA

- Santa Cruz Biotechnology

- Alfa Aesar (Thermo Fisher)

Recent Developments

- The Chemours Company, a U.S.-based chemicals company, announced a USD 200 million investment to boost capacity and advance technology for its industry-leading Nafion ion exchange products at its Villers-Paul, France, production facility. The investment by Chemours complements the existing initiatives in the United States to establish a stable supply chain and robust capacity to enable the hydrogen economy.

- Merck KGaA, a German pharmaceutical company, signed a definitive agreement to acquire the chemical business of Mecaro Co. Ltd., a Korean manufacturer of semiconductor spare parts. The acquisition entails significant investments of over USD 3.27 billion from 2021 to 2025, with a focus on four key priorities: scale, technology, portfolio, and capabilities.

- Report ID: 3384

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nafion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.