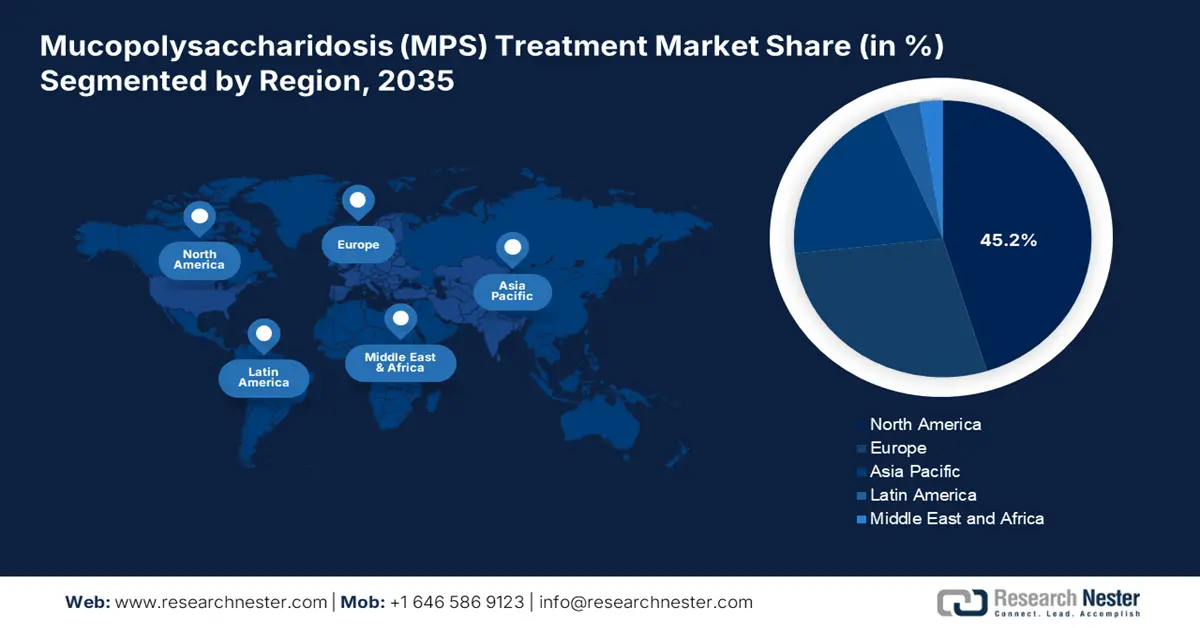

Mucopolysaccharidosis (MPS) Treatment Market - Regional Analysis

North America Market Insights

North America mucopolysaccharidosis treatment market is anticipated to garner to highest market share of 45.2% by the end of 2035. The market’s growth in the region is highly attributed to the existence of a synergistic ecosystem that strongly commercializes, approves, and funds high-cost advancements. This includes increased drug expenses, robust venture capital funding, and sophisticated insurance. As stated in the February 2023 NLM article, latest orphan and non-orphan drugs have been approved by the FDA, with an expenditure of USD 218,872 and USD 12,798, thus uplifting the market’s development in the region.

The mucopolysaccharidosis treatment market in the U.S. is growing significantly, owing to the complicated interplay between federal regulations, the presence of a multi-payer insurance system, Medicaid and Medicare reimbursements, along with a highly competitive marketplace. Besides, the November 2023 NLM article has indicated that the economic burden of Sanfilippo syndrome has been estimated to be USD 2.0 billion as of 2023, which is vigorously bolstering the market in the country. In addition, the burden for individual families increased by USD 8 million, particularly from the time their children were born with the symptom.

The mucopolysaccharidosis treatment market in Canada is also uplifting due to the affordable evaluation conducted by the Canada Agency for Drugs and Technologies in Health (CADTH), Health Canada’s clearance for review and availability, and subsequent negotiations, which are governed by the pan-Canada Pharmaceutical Alliance (pCPA). Besides, the April 2025 NLM article indicated that the country’s Health Minister declared the latest national strategy for drugs for rare diseases (DRDs) by providing USD 1.5 billion as an investment for more than three years. This has further aimed to optimize accessibility to treatments for rare diseases, and includes almost USD 1.4 billion for territories and provinces to increase drug access.

Historical Savings from Generic Drug Approvals in North America

|

Years |

Total Savings (USD Billion) |

First-Generic Savings (USD Billion) |

|

2018 |

17.8 |

4.0 |

|

2019 |

24.8 |

9.4 |

|

2020 |

10.7 |

1.8 |

|

2021 |

16.6 |

1.7 |

|

2022 |

18.9 |

5.2 |

Source: FDA, October 2024

APAC Market Insights

Asia Pacific market is predicted to emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is extremely driven by the prevalent population, along with diagnosed and aided patients, improved diagnostic capabilities, and suitable negotiation for including ultra-expensive orphan drugs into national reimbursement schemes. Besides, the April 2022 APAC Med report demonstrated that investments in the region’s universal health coverage (UHC) contributed USD 2.5 trillion, which has conventionally underfunded accessibility to technologies of high-quality. Besides, democratized and decentralized testing takes place at the same time, leading to personal care models, which are positively impacting the market’s growth.

The market in China is gaining increased exposure, owing to the presence of the National Reimbursement Drug List (NRDL), standardized discount facilities, volume-for-value model, and strategies implementation through partnerships. According to an article published by the Orphanet Journal of Rare Diseases in September 2024, a clinical study was conducted on 180 MPS patients to evaluate the disease burden. The study revealed that the direct medical expenses for hospitalization were ¥81,086.7, which accounted for 63.7% of the overall cost, thereby effectively contributing towards the market’s upliftment in the overall country.

The mucopolysaccharidosis treatment market in South Korea is also developing due to robust health technology assessment, cost-effective analysis, the government’s increased utilization of Risk-Share Agreements (RSAs), and manufacturers’ ability to represent real-world evidence. In this regard, the May 2024 NCBI article denoted that since the initiation of the health technology reassessment in the country, 262 cases have been successfully reassessed, of which 126 cases, that is 48.1% were related to health services that were initially not covered by the National Health Insurance (NHI).

Europe Market Insights

Europe in the mucopolysaccharidosis treatment market is expected to account for a considerable market share during the projected timeline. The market’s exposure in the region is highly fueled by the aspects of centralized administrative approval by the Europe Medicines Agency (EMA), pricing and reimbursement policies, and suitable medical and scientific instruments sourcing. According to an article published by the NLM in September 2024, the authorization system in the region granted approval for 14 drugs and 12 drugs in the UK. Additionally, as per the developmental status, the region comprises 3 drugs, followed by 5 drugs in the UK, thus suitable for boosting the market’s exposure.

The mucopolysaccharidosis treatment market in Germany is also growing, owing to the presence of the Act on the Reform of the Market for Medicinal Products (AMNOG), appropriate comparator therapy, the National Association of Statutory Health Insurance Funds, and strong health and clinical economic data. As per an article published by the Multiple Sclerosis and Related Disorders in August 2024, an estimated 29,604 multiple sclerosis (MS) therapy beginners have been identified in the country, of which 29.6% readily followed the HHAE strategy. Additionally, in 2022, a 14% increase in the strategy has been observed in the country, thereby denoting therapists’ importance for the market’s upliftment.

The mucopolysaccharidosis (MPS) treatment market in France is developing due to the rating and assessment provision by the Transparency Committee under the French National Authority for Health (HAS), the premium price aspect, and broad reimbursement policies. According to the April 2024 WHO report, the complementary health insurance (CHI) in the country has optimized the financial aspect for almost 95% of the population. This is because domestic households with low income are able to utilize it for free or else implement it with a subsidy, which has created a huge opportunity for the market to flourish.

Medical and Scientific Instruments 2023 Export and Import in Europe

|

Countries |

Export (USD) |

Import (USD) |

|

Belgium |

20 million |

4.3 million |

|

Spain |

15.6 million |

- |

|

UK |

15.1 million |

13.2 million |

|

Germany |

13.8 million |

153 million |

|

Ireland |

10.7 million |

29.3 million |

|

Italy |

9.5 million |

24.6 million |

|

Poland |

9.0 million |

4.5 million |

|

Russia |

7.5 million |

1.3 million |

Source: OEC, August 2025