Mobile Application Testing Solutions Market Outlook:

Mobile Application Testing Solutions Market size was valued at USD 6.22 billion in 2025 and is set to exceed USD 28.16 billion by 2035, registering over 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mobile application testing solutions is estimated at USD 7.13 billion.

The stable supply of raw materials is accelerating the production of mobile application testing solutions across the world. The study by the U.S. Bureau of Labor Statistics projects that in the last 5 years, the producer price index of the electronic computer manufacturing has risen by around 2.9% per year. This reflects the growth in the adoption of mobile solutions is fueling the use of testing applications. The robust government investments in the technology sector are also set to accelerate the production and commercialization of mobile application testing systems. This is understood by the USD 64.4 billion of investment in the technology sector by the U.S. government in 2023. The booming e-commerce sector is also projected to double the sales of smart mobile devices in the coming years, and subsequently fuel the adoption of application testing solutions. The high use of mobile devices in the healthcare, fintech, and education sectors is set to drive innovations in application testing technologies in the years ahead.

Key Mobile Application Testing Solutions Market Insights Summary:

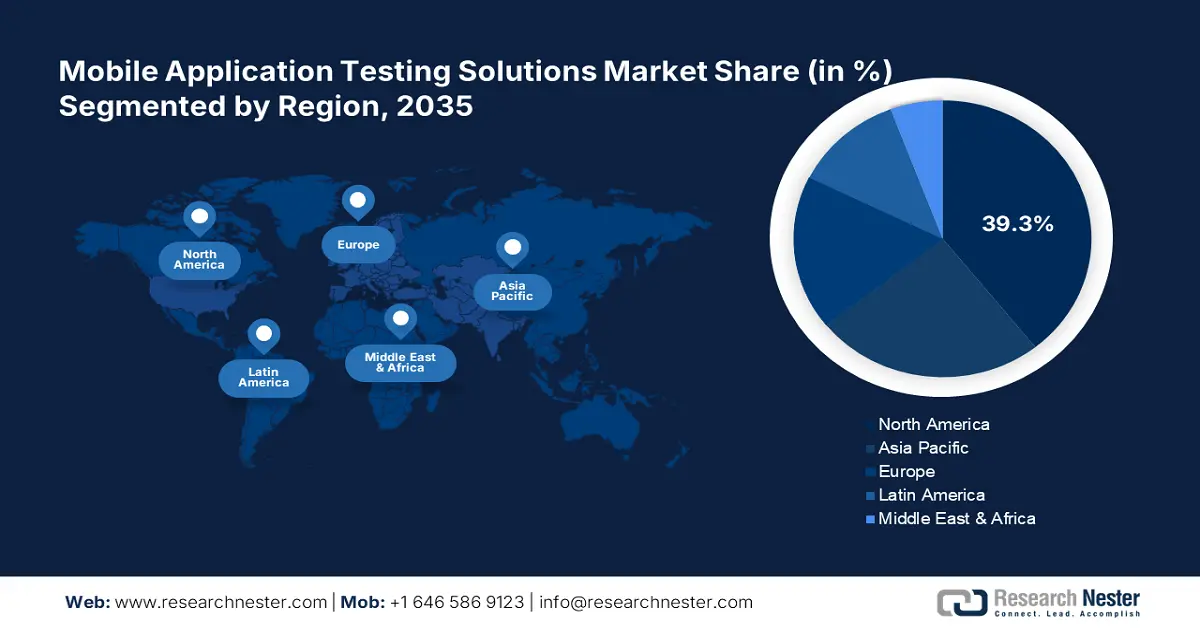

Regional Highlights:

- The North America mobile application testing solutions market is anticipated to hold a 39.30% share by 2035, driven by the allocation of significant budgets to expand the cybersecurity sector.

- The Asia Pacific market is poised for substantial growth over the forecast period 2026–2035, driven by increasing investment in digitalization projects in key countries.

Segment Insights:

- The cloud-based deployment segment in the mobile application testing solutions market is poised for substantial growth during 2026-2035, driven by scalability, cost-efficiency, and accessibility across platforms.

- The automation testing segment in the mobile application testing solutions market will experience substantial growth over the forecast period 2026-2035, driven by the mitigation of manual intervention and high-speed testing.

Key Growth Trends:

- Proliferation of mobile devices

- Need for advanced and reliable security testing technologies

Major Challenges:

- High cybersecurity costs

- Intense competitiveness

Key Players: Accenture Plc, IBM Corporation, Capgemini, Cognizant Technology Solutions, and Microsoft Corporation.

Global Mobile Application Testing Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.22 billion

- 2026 Market Size: USD 7.13 billion

- Projected Market Size: USD 28.16 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Mobile Application Testing Solutions Market Growth Drivers and Challenges:

Growth Drivers

- Proliferation of mobile devices: The expanding mobile use across the world is boosting a high demand for application testing technologies. The high trade of smartphones represents lucrative earning opportunities for mobile application testing solution companies. Research Nester’s study highlights that more than 70.5% of the global population is Android users. This is significantly propelling the installation of mobile application testing technologies.

- Need for advanced and reliable security testing technologies: The growth in online threats, such as data privacy, malware attacks, and ransomware, is fueling a high demand for advanced and reliable testing solutions. The NIST’s cybersecurity frameworks are fueling the adoption of testing applications on several mobile devices. The robust rise in digitalization and mobile banking is anticipated to offer high-earning opportunities for application testing solutions.

Challenges

-

High cybersecurity costs: The costly cybersecurity solutions are deterring budget-constrained users from investing in them. The compliance costs for testing vulnerabilities average USD 1.1 to 1.2 million for mid-sized entities, reveals the Research Nester’s study. The high installation and maintenance costs of the advanced mobile application testing solutions are expected to lower their sales in the SME segment.

-

Intense competitiveness: The highly competitive environment is challenging the profit margins of mobile application testing solution producers. According to the World Trade Organization (WTO), the pricing wars are majorly limiting innovation and hindering new mobile application testing solutions market entries. The low revenue-earning opportunities are expected to hamper the entry of mobile application testing solution investors.

Mobile Application Testing Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 6.22 billion |

|

Forecast Year Market Size (2035) |

USD 28.16 billion |

|

Regional Scope |

|

Mobile Application Testing Solutions Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is anticipated to hold 63.5% of the global mobile application testing solutions market share by 2035. The scalability, cost-efficiency, and accessibility across all platforms are contributing to the increasing sales of cloud-based solutions. The growth in mobile ecosystem complexity is pushing end users to invest in flexible and reliable testing infrastructure, including cloud-based testing solutions. The U.S. National Institute of Standards and Technology (NIST)highlights that the Cloud Computing Standards Roadmap is expected to dominate enterprise IT strategies by 2030. The large-scale enterprises are investing heavily in cloud-based testing platforms.

Testing Type Segment Analysis

The automation testing segment is poised to capture 51.2% of the global market share throughout the assessed period. The mitigation of manual intervention and high speed is accelerating the use of automation mobile application testing solutions. The Institute of Electrical and Electronics Engineers (IEEE) states that AI and ML integrated automated testing solutions are enhancing the overall productivity of the end users. Furthermore, the high performance of these applications is anticipated to increase their use in the large-scale enterprise segments in the coming years.

Our in-depth analysis of the global mobile application testing solutions market includes the following segments:

|

Testing Type |

|

|

Deployment Mode |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile Application Testing Solutions Market Regional Analysis:

North America Market Insights

The North America mobile application testing solutions market is estimated to account for 39.3% of the global revenue share through 2035. The allocation of significant budgets to expand cyber cybersecurity sector is poised to encourage key players to advance their product portfolios. The digitalization trend, 5G infrastructure expansion, and booming use of smartphones are anticipated to increase the application of mobile application testing technologies in the region. The U.S. and Canada are both foreseen to offer fruitful earning opportunities offer mobile application testing solution companies in the years ahead.

The swiftly expanding healthcare, e-commerce, and fintech sectors of the U.S. are likely to increase the sales of mobile application testing technologies during the foreseeable period. The strict regulatory mandates for cybersecurity are accelerating innovations in the mobile application testing solutions. The data protection policies are also backing the adoption of mobile application testing systems. The robust investments in the advanced wireless connectivity networks are set to double the revenues of mobile application testing solution companies.

The 5G technology expansion and investments in next-gen mobile connectivity networks are anticipated to increase the demand for mobile application testing systems in Canada. The telecommunications and finance sectors are estimated to drive the sales of mobile application testing solutions in the coming years. The government policies aimed at the expansion of digital technologies across every industry are also expected to open lucrative doors for mobile application testing solution producers.

APAC Market Insights

Asia Pacific region is poised to witness substantial growth through 2035. The governments in countries such as China, Japan, India, and South Korea are increasingly investing in digitalization projects, which is creating a profitable environment for mobile application testing solution companies. The robust use of mobile for various purposes, such as digital marketing, shopping, and transactions, is accelerating the demand for reliable testing solutions.

China, a semiconductor manufacturing hub, is expected to lead the sales of mobile application testing solutions in the years ahead. The consistent investments in the ICT sectors are set to drive innovations in testing solutions. The high adoption g 5G networks is also expected to increase the adoption of mobile application testing technologies in the years ahead. The growth in the e-commerce and logistics sectors is further set to fuel the demand for advanced mobile application testing technologies.

The ongoing digital movement in India is attracting several mobile application testing solution investors. The robust use of mobile for online transactions is fueling the demand for advanced mobile application testing solutions. The Digital Bharat and Make in India initiatives are driving the country as investment investment-worthy mobile application testing solutions market. Furthermore, the electronics, logistics, e-commerce, healthcare, and finance companies' increasing use of mobile devices is set to propel the sales of automation and cloud-based testing solutions.

Mobile Application Testing Solutions Market Players:

- Accenture Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Capgemini

- Cognizant Technology Solutions

- Microsoft Corporation

- Sauce Labs Inc.

- Synopsys, Inc.

- Infosys Limited

- Wipro Limited

- Cigniti Technologies

- Samsung SDS

- AppLabs (DXC Technology)

- Atlassian Corporation

- Perfecto (Perforce Software)

- Axiata Digital Services

The leading companies in the mobile application testing solutions market are earning high profits through the sales of cloud-based and automated testing solutions. They are employing various organic and inorganic marketing strategies such as technological innovations, new product launches, and mergers & acquisitions to double their profits. The industry giants are entering into strategic partnerships with other players to boost their market reach. They are also collaborating with raw material suppliers for the consistent production of end use products. The majority of key players are targeting high-potential markets to earn lucrative shares from the untapped opportunities.

Recent Developments

- In May 2025, Testsigma announced the launch of its Autonomous Testing Tools, powered by agentic AI. Through this innovation, the company generated a 30.4% rise in customer acquisition in Q2’25

- In April 2025, Google’s Firebase revealed the introduction of App Testing Agent, a codeless solution for Android apps. The solution cuts testing time by 35.3% compared to conventional methods.

- Report ID: 154

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile Application Testing Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.