Mining Drilling Services Market Outlook:

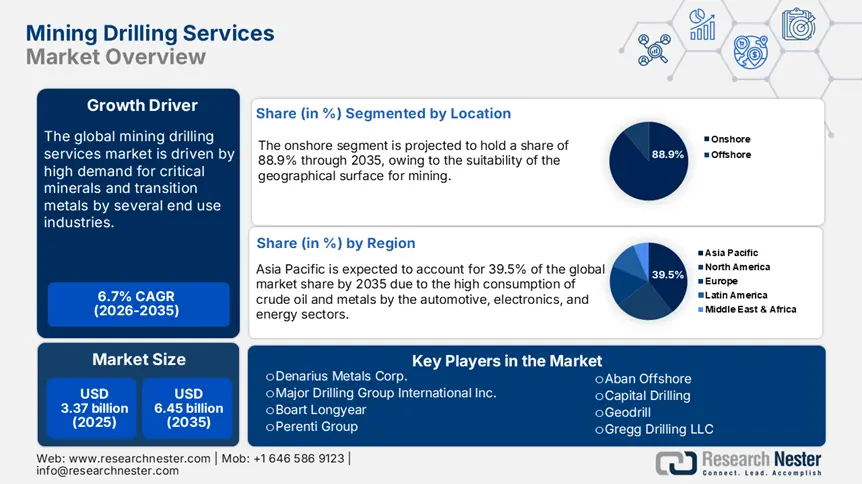

Mining Drilling Services Market size was valued at USD 3.37 billion in 2025 and is expected to reach USD 6.45 billion by 2035, expanding at around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mining drilling services is evaluated at USD 3.57 billion.

The booming mining activities across the world are set to significantly influence the sales of drilling services in the years ahead. The leading driver for mining actions is the increasing demand for critical minerals and transition metals for various applications. The growing shift toward clean energy is further augmenting the sales of critical minerals and fueling the demand for mining drilling services. The decarbonization goals are also driving governments to invest in green energy projects. The robust green transformation trend is likely to double the revenues of mining drilling service companies in the coming years.

The World Trade Organization (WTO) estimates that the value of critical mineral imports increased from USD 212.0 billion in 2017 to USD 378.0 billion by 2022. China is the largest importer of critical minerals and captures over 33.0% of the global mining drilling services market share. Chile holds the leading position as an exporter and accounts for 11.0% of the global export share. Developing countries are dominating the consumption of critical minerals owing to their swift rise in industrial activities and clean energy capacity additions. The International Energy Agency (IEA) states the demand for critical minerals expanded at a strong pace in 2023, led by lithium, following nickel, cobalt, and graphite.

Key Mining Drilling Services Market Insights Summary:

Regional Highlights:

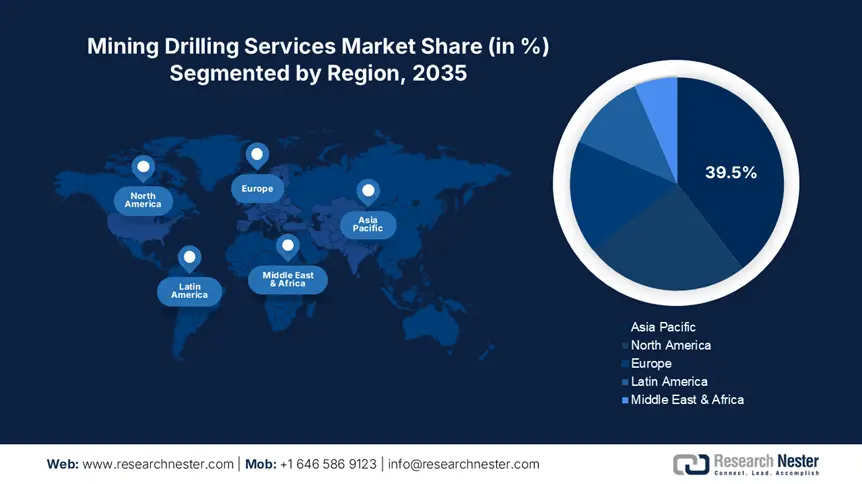

- Asia Pacific dominates the Mining Drilling Services Market with a 39.5% share, propelled by favorable mining regulations and high FDI supporting drilling service demand, ensuring strong growth through 2035.

- The Mining Drilling Services Market in North America is anticipated to grow rapidly through 2026–2035, fueled by offshore exploration and public-private investments in mining.

Segment Insights:

- The Metal application segment is projected to hold a 40.2% share by 2035, propelled by high demand for metals in construction, automotive, and electronics industries.

- The Onshore segment of the Mining Drilling Services Market is projected to hold an 88.9% share by 2035, driven by the abundance of minerals and rare earth elements in onshore regions and favorable geographical conditions.

Key Growth Trends:

- Rise in offshore exploration

- EV influencing metal mining activities

Major Challenges:

- Strict mining regulations

- High CAPEX requirement

- Key Players: Denarius Metals Corp., Major Drilling Group International Inc., Boart Longyear, Perenti Group, and Byrnecut Group.

Global Mining Drilling Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.37 billion

- 2026 Market Size: USD 3.57 billion

- Projected Market Size: USD 6.45 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Australia, Canada, Japan

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Mining Drilling Services Market Growth Drivers and Challenges:

Growth Drivers

-

Rise in offshore exploration: The increasing offshore exploration activities are fueling the sales of mining drilling services. The advanced drilling technologies are aiding companies to explore rare earth elements in deepwater. This is projected to fuel the applications of drilling services in the offshore field. For instance, the International Seabed Authority (ISA), involved in 15-year contracts with 22 different contractors for the exploration of polymetallic sulphides (PMS), polymetallic nodules (PMN), and cobalt-rich ferromanganese crusts (CFC), is significantly contributing to sales of mining drilling services.

|

|

CONTRACTOR |

PMN |

Sulphides |

CFC |

Total |

|

1 |

Interoceanmetal Joint Organization |

1 |

|

|

1 |

|

2 |

JSC Yuzhmorgeologiya |

1 |

|

|

1 |

|

3 |

Government of the Republic of Korea |

1 |

1 |

1 |

3 |

|

4 |

China Ocean Mineral Resources Research and Development Association |

1 |

1 |

1 |

3 |

|

5 |

Deep Ocean Resources Development Co. Ltd. |

1 |

|

|

1 |

|

6 |

Institut français de recherche pour l’exploitation de la mer |

1 |

1 |

|

2 |

|

7 |

Government of India |

1 |

1 |

|

2 |

|

8 |

Federal Institute for Geosciences and Natural Resources |

1 |

1 |

|

2 |

|

9 |

Nauru Ocean Resources Inc. |

1 |

|

|

1 |

|

10 |

Tonga Offshore Mining Limited |

1 |

|

|

1 |

|

11 |

Global Sea Mineral Resources NV |

1 |

|

|

1 |

|

12 |

Loke CCZ (formerly UK Seabed Resources Ltd.) |

2 |

|

|

2 |

|

13 |

Marawa Research and Exploration Ltd. |

1 |

|

|

1 |

|

14 |

Ocean Mineral Singapore Pte. Ltd. |

1 |

|

|

1 |

|

15 |

Cook Islands Investment Corporation |

1 |

|

|

1 |

|

16 |

China Minmetals Corporation |

1 |

|

|

1 |

|

17 |

Beijing Pioneer Hi-Tech Development Corporation |

1 |

|

|

1 |

|

18 |

Ministry of Natural Resources and Environment of the Russian Federation |

|

1 |

1 |

2 |

|

19 |

Government of Poland |

|

1 |

|

1 |

|

20 |

Japan Organization for Metals and Energy Security |

|

|

1 |

1 |

|

21 |

Companhia de Pesquisa de Recursos Minerais S.A.* |

|

|

1 |

1 |

|

22 |

Blue Minerals Jamaica Ltd |

1 |

|

|

1 |

|

|

|

19 |

7 |

5 |

31 |

Source: ISA

- EV influencing metal mining activities: The climbing registration of electric vehicles (EVs) is set to augment the sales of mining drilling services, owing to the high use of metals in vehicle and battery manufacturing. The growth in trade of electric vehicles is anticipated to directly propel the mining drilling services market shares providers. The IEA study states that the electric car sales totaled 14.0 million in 2023 and registered a Y-o-Y growth of 35.0%. More than 40.0 GW of battery capacity was added in the same year. The lithium demand expanded by 30.0%, and demand for nickel, cobalt, and graphite is increasing at a growth rate of 8-10%.

Challenges

-

Strict mining regulations: The mining activities majorly hamper the geological surface of any region, which directly creates environmental challenges. The biodiversity is significantly hindered due to excess drilling, leading to landslides, deforestation, and more. Many governments implement strict regulations on mining activities, limiting the sales of drilling services. The employment of sustainable practices and innovative technologies is expected to aid companies in complying with stringent mining policies.

-

High CAPEX requirement: The significant investment required for conducting a mine drilling activity often limits the revenue growth of the mining drilling services market players. Small-scale companies hesitate to invest in advanced drilling technologies owing to their high installation and maintenance costs. This leads to revenue concentration at the industry giants’ ends, resulting in low earning opportunities for budget-constrained companies. Thus, the mining drilling services, a capital-intensive business, is dominated by key players.

Mining Drilling Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 3.37 billion |

|

Forecast Year Market Size (2035) |

USD 6.45 billion |

|

Regional Scope |

|

Mining Drilling Services Market Segmentation:

Location (Onshore, Offshore)

The onshore segment is poised to hold 88.9% of the mining drilling services market share by 2035. The majority of mining activities are performed in onshore regions owing to the abundance of minerals and rare earth elements. The suitability of geographical structures also drives high investments in onshore drilling activities. This creates a profitable environment for mining drilling service companies. For instance, in February 2025, Zephyr Energy Plc announced the successful completion of its drilling operations at the State 36-2 LNW-CC-R well. Such onshore drilling operations are contributing to the segmental growth.

Application (Metal, Coal, Mineral, Quarry, Others)

The metal segment is estimated to capture 40.2% of the mining drilling services market share throughout the forecast period. The high use of metals in several industries such as construction, automotive, and electronics is backing the mining drilling service sales growth. The robust construction activities, planned and ongoing, are poised to amplify the sales of transition metals and open lucrative doors for mining drilling service providers and technology manufacturers. For instance, the Observatory of Economic Complexity (OEC) highlights that the world trade of metals amounted to USD 1.54 trillion in 2023. The leading exporting destinations were China (USD 258.0 billion), Germany (USD 122.0 billion), and the U.S. (USD 83.4 billion). While the import trade was led by the U.S. (USD 167.0 billion), China (USD 133.0 billion), and Germany (USD 107.0 billion).

Our in-depth analysis of the global mining drilling services market includes the following segments:

|

Type |

|

|

Drilling Type |

|

|

Location |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mining Drilling Services Market Regional Analysis:

Asia Pacific Market Forecast

The Asia Pacific mining drilling services market is likely to account for 39.5% of the global revenue share through 2035. The supportive government initiatives and favorable mining regulations are fueling the demand for drilling services. The positive foreign direct investments are also backing the mining activities in the region. The strong presence of end use industries is also contributing to the increasing sales of mining drilling services. China, India, Japan, Australia, and South Korea are the most lucrative marketplaces for mining drilling service providers.

China’s increasing dominance in manufacturing is directly fueling the demand for critical minerals and transition metals. The end use industries, such as automotive, electronics, and construction, are propelling the consumption of metals and minerals, creating lucrative space for mining drilling service providers. The country has over 15,000 major mining companies, the majority of focused on underground exploration. The country owns over USD 400.0 billion per year in mining and spends around USD 200.0 billion on mine supply and services annually, according to the Trade Commissioner Service analysis.

The mining activities in India are witnessing steady growth owing to supportive government policies and investments. The country’s exclusive economic zone of over 2 million sq.km creates a lucrative environment for mining drilling service providers. Furthermore, the India Brand Equity Foundation (IBEF) states that the number of reporting mines in the country totaled 2,036 in FY 2024. This highlights the strong presence of active mines is fueling a healthy demand for mining drilling services. Also, the same source states that the coal production amounted to 104.43 MT in January 2025. High coal production is also anticipated to drive the overall market growth during the foreseeable period.

North America Market Statistics

The North America mining drilling services market is anticipated to increase at the fastest CAGR between 2026 to 2035. The strong presence of key drilling service providers is expected to fuel the mining activities in the region. The rise in public-private investments and the increasing popularity of offshore exploration are likely to fuel the demand for mining drilling services in the coming years. The abundance of several minerals and metals, in both the U.S. and Canada, is significantly driving the revenue growth of mining drilling service providers.

The high exploration of coal and crude oil production is likely to boost the demand for mining drilling services in the U.S. The high hydrocarbon trade is further accelerating the onshore and offshore mining activities in the country. The robust petroleum drilling activities are expected to double the revenues of key mining drilling services market players in the years ahead. According to the U.S. Energy Information Administration (EIA) states that the new well production per rig amounted to 719 barrels/day in Anadarko, Appalachia (241 b/d), Bakken (1747 b/d), and Eagle Ford (1639 b/d) in June 2024.

Canada’s increasing leadership in electric vehicles and clean energy is fueling the demand for critical minerals and metals. This booming demand is augmenting the mining drilling activities in the county. The report by Natural Resources Canada states that the country produced more than 60 metals and minerals worth USD 51.95 billion in 2023. During the same year, the country also invested USD 3.02 billion in mineral exploration. The government’s positive approach towards mining is attracting several international companies to expand their drilling services in Canada.

Key Mining Drilling Services Market Players:

- Denarius Metals Corp.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Major Drilling Group International Inc.

- Boart Longyear

- Perenti Group

- Byrnecut Group

- PT United Tractors Tbk

- Orbit Garant Drilling Inc.

- Action Drill & Blast

- Foraco

- Ausdrill

- Aban Offshore

- Capital Drilling

- Geodrill

- Gregg Drilling LLC

The leading mining drilling service companies are adopting organic and inorganic marketing strategies to earn high profits. They are investing in advanced technologies to enhance their services and attract a wider consumer base. Industry giants are also entering into strategic collaborations as partnerships with other companies to boost their mining drilling services market reach. By expanding operations in untapped markets, the market players are estimated to earn higher gains. The organic sales of leading companies are poised to register a double-digit percent revenue growth in the years ahead.

Some of the key players include:

Recent Developments

- In April 2025, Denarius Metals Corp. announced the drill results from its surface infill diamond drilling program completed in 2024 at the Zancudo Project in Colombia. The results total approximately 2,435 meters, confirming high-grade mineralization on multiple veins.

- In November 2024, Major Drilling Group International Inc. announced the acquisition of Explomin Perforaciones. The deal was settled at an upfront payment of USD 63.0 million, with an additional USD 22.0 million through an earn-out for a total consideration of up to USD 85.0 million.

- Report ID: 7586

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mining Drilling Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.