Methyl Oleate Market Outlook:

Methyl Oleate Market size was over USD 2.4 billion in 2025 and is anticipated to cross USD 4.02 billion by 2035, growing at more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of methyl oleate is assessed at USD 2.51 billion.

The rise in the pesticide industry is attributed to market growth along with the increasing use of methyl oleate as a substitute for methylbenzene in the pesticide industry is expected to have a positive impact on market growth. The national estimates for pest control workers are about 85,370 employees available in 2021 in the United States, as per the U.S. Bureau of Labor Statistics.

The growing chemical industries as well as the increased use of methyl oleate in the petroleum industry as a lubricant along with the rising consumption of petroleum products is estimated to boost the market growth.

Key Methyl Oleate Market Insights Summary:

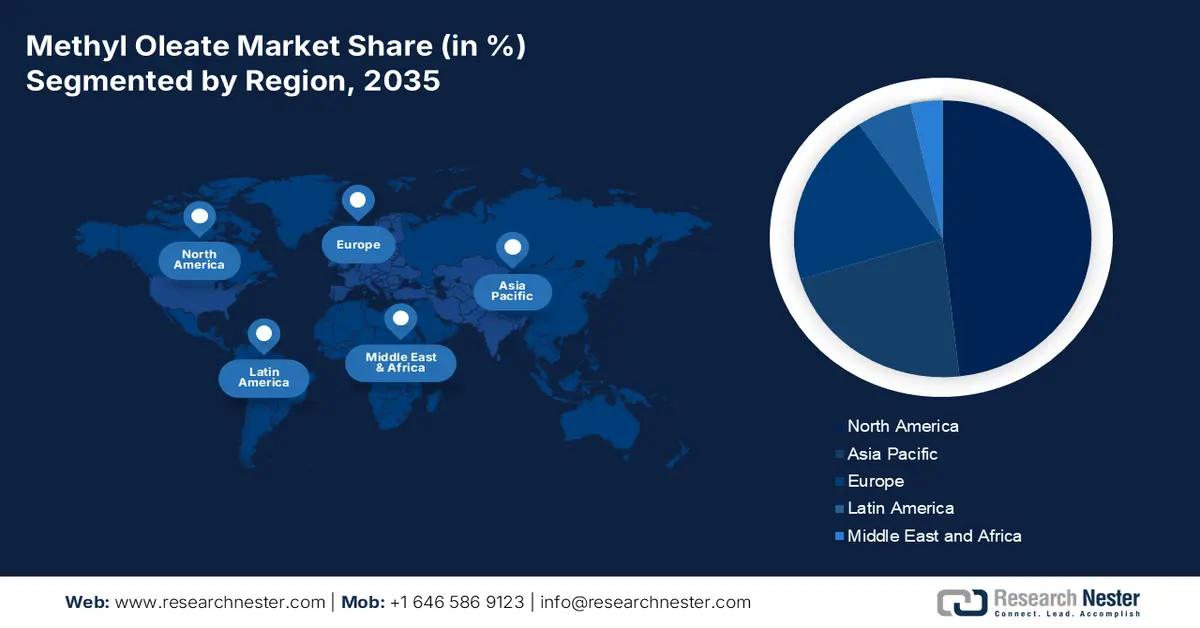

Regional Highlights:

- North America is expected to secure the largest revenue share by 2035 in the methyl oleate market, owing to increasingly stringent restrictions on synthetic chemicals and their associated health and environmental risks.

Segment Insights:

- The agrochemicals segment is projected to command the largest share by 2035 in the methyl oleate market, sustained by its escalating utilization in pesticides, herbicides, plant growth chemicals, and metalworking fluids.

Key Growth Trends:

- Rapid Growth of the Chemical Industry

- Increasing Demand for Food and Beverages

Major Challenges:

- High Cost of Methyl Oleate

- Increasing Use of Ethyl Oleate

Key Players: Tokyo Chemical Industry Co., Ltd., Lion Corporation, KLK OLEO, Croda International Plc, acme synthetic chemicals, Tri-Tech Chemical Company, Hebei Jingu Plasticizer Co., Ltd., Victorian Chemical Company Pty Ltd, Wilmar International Limited.

Global Methyl Oleate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.51 billion

- Projected Market Size: USD 4.02 billion by 2035

- Growth Forecasts: 5.3%

Key Regional Dynamics:

- Largest Region:North America (Largest Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 24 November, 2025

Methyl Oleate Market - Growth Drivers and Challenges

Growth Drivers

-

Rapid Growth of the Chemical Industry - The increasing use of chemicals by other industries fuels the growth of the chemical industry. Also, the high price of chemicals and closure of many plants across China, and high inflation during the pandemic are estimated to boost the methyl oleate market. The total industrial production in 2022 raised from 0.6% to 3.9%.

-

Increasing Demand for Food and Beverages - 11.9% of U.S household consumer expenditures share was occupied by food ranking third in 2020.

-

High Demand for Detergent Surfactants Such as Methyl Ester Ethoxylates - The value of detergents and washing preparations increased from 99.5 in 2009 to 111.3 in 2019.

-

Growing Paint Industry – The total number of paint and coating establishments in United States in 2020 was 50,000.

-

Increase Use of Personal Care and Cosmetic Products - The average annual expenditure on personal care products raised from 762 in 2017 to 786 in 2019

Challenges

-

High Cost of Methyl Oleate – owing to the rising prices of chemicals globally. The disadvantage is associated with the large amount of energy required in the reboiler to purify the mixture is expected to hinder market growth in the near future.

-

Increasing Use of Ethyl Oleate

- Industries Still Use Conventional Chemicals

Methyl Oleate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 4.02 billion |

|

Regional Scope |

|

Methyl Oleate Market Segmentation:

Application Segment Analysis

The global methyl oleate market is segmented and analyzed for demand and supply by application into printing inks, agrochemicals, metal working fluids, cleaning chemicals, lubricants, absorbents, plasticizers, cosmetics, and others. Out of these, agrochemicals are anticipated to hold the largest market size by the end of 2035 on the back of increasing use in metalworking fluids and agrochemicals such as pesticides, herbicides, plant growth chemicals, and weedicides. The worldwide exported value of herbicides, anti-sprouting products, and plant growth regulators in 2021 was 15,432,371.

Our in-depth analysis of the global market includes the following segments:

|

By Source |

|

|

By Grade |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Methyl Oleate Market - Regional Analysis

North American Market Insights

North America industry is poised to hold largest revenue share by 2035, owing to stringent regulations on the use of synthetic chemicals owing to their ill effects on health and the environment. FDA removed 7 synthetic flavoring substances and flavor enhancers in 2018. Among them, 6 substances are ethyl acrylate, methyl eugenol, pulegone, pyridine, synthetically derived benzophenone, and myrcene.

Methyl Oleate Market Players:

-

Archer Daniels Midland Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tokyo Chemical Industry Co., Ltd.

- Lion Corporation

- KLK OLEO

- Croda International Plc

- acme synthetic chemicals

- Tri-Tech Chemical Company

- Hebei Jingu Plasticizer Co., Ltd.

- Victorian Chemical Company Pty Ltd

- Wilmar International Limited

Recent Developments

- Stepan Company - introduced STEPOSOL ME a naturally derived methyl oleate from soyabean oil. This product was approved for use as an insert ingredient under U.S EPA 40 CFR 180.910 with REACH registered. Also, exhibit thaw stability, excellent freeze, and opt for solvents or co-solvents in agricultural applications.

- Report ID: 4387

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methyl Oleate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.