Metalized Flexible Packaging Market Outlook:

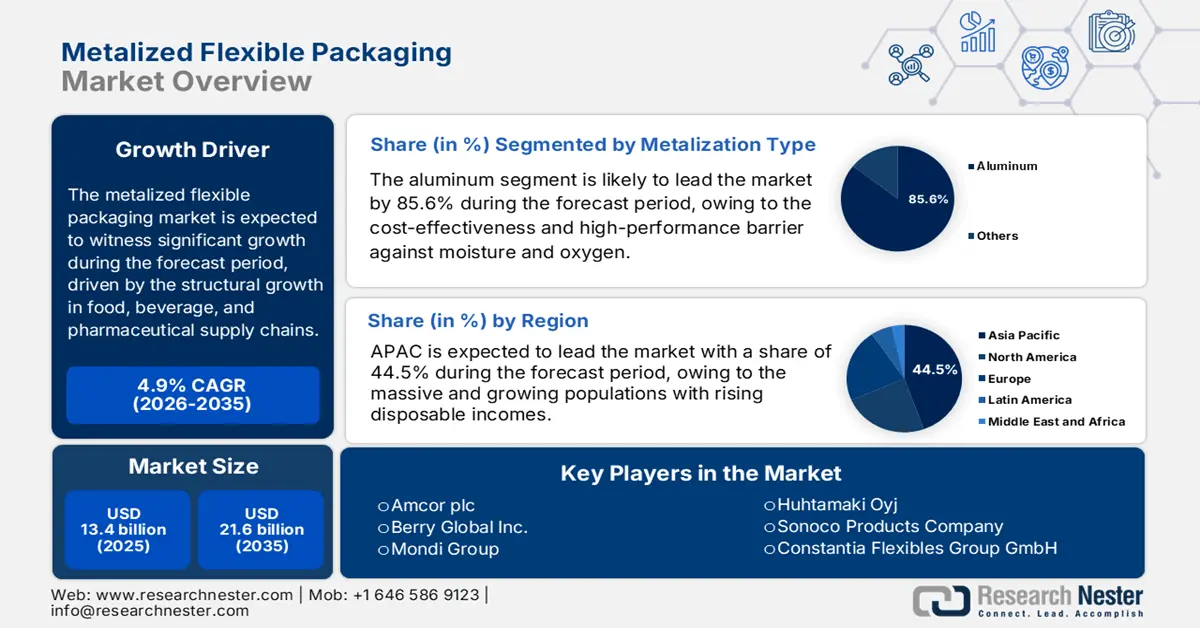

Metalized Flexible Packaging Market size was valued at USD 13.4 billion in 2025 and is projected to reach USD 21.6 billion by the end of 2035, rising at a CAGR of 4.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of metalized flexible packaging at USD 14.1 billion.

Demand for the metalized flexible packaging market is aligned with the structural growth in food, beverage, and pharmaceutical supply chains, where the shelf life extension and logistics efficiency are the core procurement priorities. The U.S. Department of Agriculture in 2023 reports that the value of U.S. processed food exports exceeded USD 14.73 billion and is driven by the packaged snacks, confectionery, and ready-to-eat categories that rely heavily on high-barrier flexible formats to manage oxidation and moisture sensitivity. In parallel, the U.S. FDA reports that the solid oral dosage forms distributed in the U.S. market are packaged in barrier-enhanced flexible formats reflecting sustained institutional preference for materials that support across long distribution cycles. On the demand side, the WHO highlights that global pharmaceutical production volumes increase and are led by the generics and over-the-counter medicines segment, where cost efficiency and lightweight packaging have become procurement standards.

The regulatory and sustainability mandates are reshaping the purchasing decisions for the markets across North America, Europe, and Asia. The EPA in October 2025 reports that it has estimated that the generation of aluminum packaging is 1.9 million tons, and the recycling of aluminum from beverage cans was 670,000 tons, underscoring both the scale of the material throughput and the demand for the production and recovery. This stimulates the pressure on the brand owners and converters to prioritize lightweight downgauged structures and to integrate packaging formats that deliver comparable barrier performance with lower material intensity. For the procurement and compliance teams, the data reinforces a shift toward the packaging solutions that can meet the extended producer responsibility thresholds and the recycled content targets without materially increasing cost to serve.

Key Metalized Flexible Packaging Market Insights Summary:

Regional Highlights:

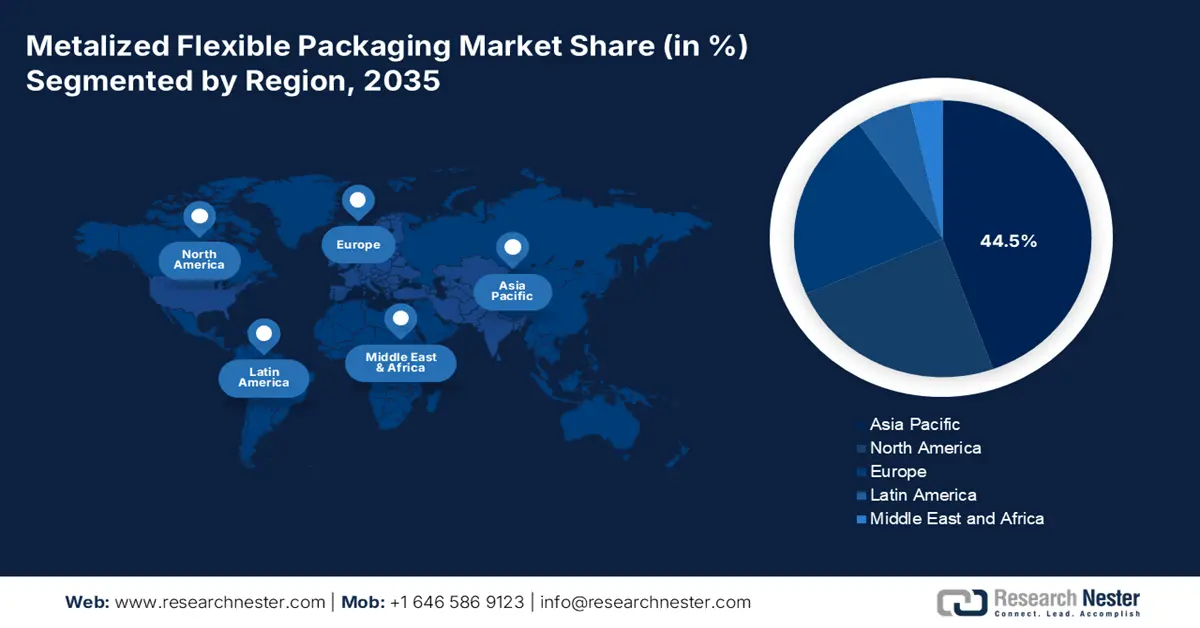

- Asia Pacific is projected to secure a 44.5% revenue share by 2035 in the metalized flexible packaging market, underpinned by expanding consumer bases, rapid urbanization, and supportive plastic waste management and EPR regulations accelerating sustainable packaging adoption.

- North America is anticipated to register the fastest growth with a CAGR of 6.1% during 2026–2035, reinforced by stringent sustainability regulations and advanced retail requirements stimulating innovation in recyclable and lightweight high-barrier packaging solutions.

Segment Insights:

- Under the metalization type segment, aluminum is projected to command over 85.6% share by 2035 in the metalized flexible packaging market, supported by its broad usage in cost-efficient, high-barrier packaging applications facilitating food waste reduction.

- In the technology segment, vacuum metalization is expected to remain the leading approach by 2035, attributed to its scalable deposition of ultra-thin metal layers that enable lightweight, material-efficient, and sustainability-aligned packaging structures.

Key Growth Trends:

- Consumer demand for circular packaging solutions

- Process innovation and automation for resource optimization

Major Challenges:

- High capital investment for advanced manufacturing

- Intense competition and price pressure from incumbents

Key Players: Amcor plc,Berry Global Inc., Mondi Group, Huhtamaki Oyj, Sonoco Products Company, Constantia Flexibles Group GmbH, UFlex Limited.

Global Metalized Flexible Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.4 billion

- 2026 Market Size: USD 14.1 billion

- Projected Market Size: USD 21.6 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Mexico, Brazil, Thailand

Last updated on : 16 January, 2026

Metalized Flexible Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Consumer demand for circular packaging solutions: The demand is based on the government regulations aiming for the reduction of packaging waste and corporate sustainability commitments. The direct financial mechanisms, such as the Extended Producer Responsibility fees, incentivize the material reduction and recyclability. The market is evolving to meet these demands via innovations in mono-material structure and design for recycling principles. This reduces the risk and aligns with the consumer sentiment. For instance, the American Bar Association Data in October 2024 indicates that the UK Government’s Plastic Packaging Tax implemented in April 2022 generated £276 million in revenue in its first year, explicitly targeting packaging with less recycled content. This creates a quantifiable cost driver for adopting new compliant material systems that often incorporate advanced lightweight metalized barriers to maintain performance within a circular framework.

- Process innovation and automation for resource optimization: The growth of the market is propelled by the capital investments in advanced manufacturing technologies that enhance the material yield, reduce energy consumption, and improve the production speed. The innovations in the vacuum metallization, such as plasma pre-treatment and advanced deposition controls, allow for thinner, more consistent metal layers that maintain high barrier properties while using less raw material. This directly lowers the per-unit costs and environmental impact. A recent development indicates that in July 2025, Dai Nippon Printing Co., Ltd. developed a vacuum metalized high-barrier PP film1, which is perfect for the mono-material packaging’s base material. This innovation has a high barrier property against oxygen and water vapor. These advancements are accelerating the industry’s shift toward more sustainable, high-performance packaging solutions without compromising on protective functionality.

- Supply chain imperatives for shelf life extension: The need to reduce the global food loss is a key driver for the high barrier packaging adoption in the metalized flexible packaging market. The metalized films provide an essential defense against oxygen and moisture, extending the shelf life of perishable goods from farm to consumers. This functionality addresses both the economic waste and food security concerns. The government research from the USDA report in May 2025 indicates that the U.S. Department of Agriculture estimates that the 31% of the 430 billion pounds of the U.S. food supply available at the retail and consumer levels went uneaten, representing USD 162 billion in lost value. This data reinforces the strategic value of the packaging that directly reduces the spoilage, supporting its integration into longer, more resilient supply chains.

Challenges

- High capital investment for advanced manufacturing: Establishing a production line for high-barrier metalized films requires a significant capital investment in vacuum metallizers, co-extruders, and precision coating machinery, with costs often exceeding several million dollars for a competitive medium-scale line. This barrier favors established players such as Amcor and Berry Global, which leverage economies of scale. New entrants must secure substantial financing or begin as converters sourcing pre-metalized film, a model seen with emerging regional players in Asia. The high fixed costs create a steep initial hurdle, limiting the rapid growth of the metalized flexible packaging market for smaller entities.

- Intense competition and price pressure from incumbents: The market is consolidated, with the top payers with a significant share. Incumbents such as Sonoco and Constantia Flexibles compete on price, especially for high-volume standardized products, squeezing margins. They also leverage existing customer relationships and full-service portfolios. A new entrant must either compete on price at a loss, specialize in a high-margin niche, or offer breakthrough innovation, a difficult proposition without an established reputation and sales channel.

Metalized Flexible Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 13.4 billion |

|

Forecast Year Market Size (2035) |

USD 21.6 billion |

|

Regional Scope |

|

Metalized Flexible Packaging Market Segmentation:

Metalization Type Segment Analysis

Under the metalization type segment, aluminum is expected to hold the largest share value with over 85.6% by 2035 in the metalized flexible packaging market. The segment is driven by the cost-effectiveness and high-performance barrier against moisture, oxygen, and light for mass market applications. According to the WITS report in 2023, Australia is the top exporter of aluminum ores and concentrates and has made a trade quantity of 37,479,500,000 kg with the value of USD 1,115,856.73K. A critical driver is its role in reducing food waste. The EPA data in October 2024 indicates that the total recycling rate of aluminum food containers and packaging materials accounts for 34.9%, highlighting the demand for the high-barrier aluminum-based packaging to extend the shelf life and mitigate food loss.

Aluminum Ores and Concentrates Exports (2023)

|

Country |

Trade Value (1000 USD) |

Quantity (Kg) |

|

Australia |

1,115,856.73 |

37,479,500,000 |

|

Turkey |

81,306.90 |

2,640,560,000 |

|

Guyana |

80,698.71 |

400,280,000 |

|

Indonesia |

68,118.09 |

1,921,430,000 |

Source: WITS 2023

Technology Segment Analysis

The vacuum metalization is the entrenched leader in the technology segment in the market. The segment is driven by its efficient scalability and ability to apply ultra-thin, precise metal layers onto flexible polymer films. This process creates the essential barrier properties while minimizing the material use, supporting the lightweighting and sustainability goals. While lamination and coating technologies are vital for creating multilayer structures and adding functional layers, they often incorporate vacuum metallized films as a core component. The technology’s energy profile is a focus for improvement. Consequently, ongoing process innovations are critical for maintaining its cost and performance advantages while meeting stricter environmental regulations.

Thickness Segment Analysis

The 20 to 40 micron thickness range is forecast to remain the leading segment in the metalized flexible packaging market. The segment is fueled by the optimal balance between performance cost and material efficiency for the vast majority of applications. Films in this range provide sufficient strength for converting into pouches and bags, an adequate substrate for metalization and printing, and a robust barrier, all without the excess material and cost of heavier gauges. The industry-wide drive for lightweighting, reducing the weight of packaging without compromising performance, is a primary driver of this segment as it directly lowers the material costs and transportation waste and emissions. This aligns with the critical sustainability goals, for instance, the EPA October 2025 data states that the containers and packaging constituted 82.2 million tons of solid waste in the U.S., highlighting the imperative for material efficiency and source reduction, solidifying the position of the 20-40 micron films as the industry standard.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Metalization Type |

|

|

Thickness |

|

|

End use Industry |

|

|

Product Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metalized Flexible Packaging Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the market and is expected to hold a revenue share of 44.5% by 2035. The market is driven by several converging factors, such as the massive and growing populations with rising disposable incomes, rapid urbanization, and the consequent expansion of modern retail and e-commerce channels. The demand is particularly strong in the food and beverage and consumer goods sectors, where metalized packaging is essential for extending shelf life, ensuring product safety, and enabling brand differentiation in crowded markets. A key regional driver is the proliferation of national-level plastic waste management policies, such as India’s Plastic Waste Management Rules and Extended Producer Responsibility frameworks, which are pushing the industry innovation towards more sustainable packaging solutions.

Rapid economic expansion, urbanization, and a formalizing retail sector are driving the India metalized flexible packaging market. The primary driver is the government’s implementation of robust Plastic Waste Management Rules, which enforce the Extended Producer Responsibility. This mandates that brands manage the post-consumer life cycle, which often incorporates a powerful incentive to adopt recyclable mono material solutions that often incorporate new metalized barrier films. This regulatory push intersects with the booming demand from the processed food, personal care, and pharmaceutical industries. For instance, the government data IBEF in December 2025 shows that India’s export of pharmaceutical products reached Rs. 2.72 lakh crore, underscoring the scale of a key end market that relies on the high barrier protective flexible packaging for its products.

China market is driven by its unparalleled manufacturing scale, vast domestic consumption, and advanced e-commerce ecosystem. The demand is propelled by the rising middle class and the concurrent growth of online retail and food delivery services, which require durable, lightweight, and high-barrier packaging. The government policy further promotes the industry upgrade via initiatives such as Made in China 2025 while enforcing strict environmental standards and pushing innovation towards more sustainable packaging formats. This dual pressure is evident in industrial output data. The report from the IPEN February 2022 data depicts that the output of plastic products in China exceeded 95.741 million tons, indicating a strong production base in which high-performance flexible packaging is a vital and growing segment.

North America Market Insights

The North America metalized flexible packaging market is the fastest growing and is expected to grow at a CAGR of 6.1% during the forecast period 2026 to 2035. The market is driven by robust regulations and advanced retail demands. The key drivers include the U.S. Plastics Pact and EPA’s National Recycling Strategy, which push for reusable, recyclable, or compostable packaging, surging the R&D into mono-material and recyclable metalized structures. The government data reports that food waste is fueling the demand for the high barrier packaging to extend shelf life. In Canada, the Zero Plastic Waste Agenda and the EPR regulations mandate sustainable design. A dominant trend is the lightweighting to reduce the material use and comply with the EPR fee structures supported by the automation investments to improve the yields. The pharmaceutical and e-commerce sectors provide steady growth, requiring tamper-evident and durable protective packaging.

The U.S. metalized flexible packaging market is driven by the regulatory mandates and consumer goods innovation. The primary trend is the rapid shift toward the sustainable, recyclable mono material structures, which is driven by the U.S. Plastics Pact and state-level Extended Producer Responsibility laws such as those in Maine and California. The federal support is evident via the EPA’s National Recycling Strategy and grants from the Bipartisan Infrastructure Law, funding modernized recycling infrastructure vital for handling flexible packaging. The demand is strong from the pharmaceutical sector due to the Drug Supply Chain Security Act requiring the high integrity tamper evident packaging. Further, the Saica Group has announced the launch of the new metalized Mono PE triplex structure in January 2024, a mono material pack with a premium metalized appearance, versatile high barrier, and adapted to the consumer needs. This innovation indicates a direct response to the regulatory and market pressures for circular solutions.

Canada market is increasingly shaped by the sustainability-led procurement frameworks, mainly the Canada Plastics Pact’s May 2025 guidance on mono-material flexible packaging. Under this roadmap, signatories representing a large share of Canada’s packaged goods sector have committed that 100% of plastic packaging be reusable, recyclable, or compostable with a target of 50% recycled content by 2030. These benchmarks are stimulating a structural shift away from the complex multi-layer laminates toward lightweight metalized films applied on single polymer substrates, enabling recyclability without compromising the barrier performance for food, beverage, and personal care applications. Demand growth in Canada is therefore increasingly driven by design substitution rather than volume expansion, positioning advanced metalized flexible packaging as a strategic enabler of circular-economy alignment across institutional and retail supply chains.

Europe Market Insights

The Europe metalized flexible packaging market is navigating a critical transition shaped by the EU’s aggressive legislative push toward a circular economy. The primary growth driver is the mandatory shift toward recyclale and reusable packaging by 2030 as mandated by the EU Packaging and Packaging Waste Regulation which is compelling massive industry R&D into high barrier mono material films. These new structures must replace traditional non recyclable laminates without compromising the vital oxygen and moisture barriers required for food and pharmaceutical products. This regulatory pressure directly fules the demand for the next gen metalized films. A trend is the significant investment in chemical recycling infrastructre that support advaced recycling projects vital for processing flexible packaging waste streams.

Germany metalized flexible packaging market is a clear consumption leader and a central hub for advanced packaging. The report from Circular Plastics NL in June 2023 states that Germany accounted for 17% of European PE and PP flexible films consumption, representing over 1.8 million tonnes and making it the single largest national market. This dominant position is driven by its world-leading industrial base, mainly in food and pharmaceutical manufacturing, which demands high-performance barrier packaging. Further, Germany also held the largest share of the installed recycling capacity for flexible PE films. This combination of being the top consumer and a leading recycler positions Germany as a vital innovation and compliance laboratory, mainly for developing the recyclable mono material structure required by the EU’s Packaging and Packaging Waste Regulation.

The robust domestic waste targets and fiscal policy are influencing the UK market. The core driver is the UK Plastic Pact, a business led imitative backed by government ambition, which targets the complete reusable, recyclable, and compostable plastic packaging. This creates immediate pressure for innovation in monomaterial recyclable barrier solutions. The EPR for packaging is being implemented, shifting the full cost of managing packaging waste from the local authorities to producers. This policy will financially reward packaging designs that are easy to recycle and penalize complex, hard-to-process materials. For instance, the report from the UK Parliament in March 2024 depicts that over 3.1 million tonnes of packaging waste were placed, quantifying the immense scale of the market being regulated and the critical need for sustainable solutions such as advanced metalized films that meet new circularity criteria.

Key Metalized Flexible Packaging Market Players:

- Amcor plc (Australia)

- Berry Global Inc. (U.S.)

- Mondi Group (UK)

- Huhtamaki Oyj (Finland)

- Sonoco Products Company (U.S.)

- Constantia Flexibles Group GmbH (Austria)

- UFlex Limited (India)

- Jindal Poly Films Limited (India)

- TOYOBO CO., LTD. (Japan)

- Cosmo Films Ltd. (India)

- Vacmet India Ltd (India)

- Glenroy, Inc. (U.S.)

- Dunmore Corporation (U.S.)

- Toray Advanced Film Co., Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Klöckner Pentaplast (Germany)

- Flex Films (India)

- Polinas Plastik Sanayi ve Ticaret A.S. (Turkey)

- SRF Limited (India)

- DUNMORE (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amcor plc is a global leader in the market, driving innovation via its development of high-barrier, lightweight, sustainable solutions. Strategically, Amcor focuses on creating recyclable mono-material plastic structures and expanding its production footprint in the high-growth regions to serve the food, beverage, and healthcare sectors, where the extended shelf life and product integrity are paramount. As per the 2025 annual report, the company has made global sales of USD 23 billion, with USD 13 billion in packaging solutions.

- Berry Global Inc is a dominant player in the metalized flexible packaging market, leveraging its massive scale and integrated manufacturing to produce the high performance films for food and consumer goods. Its key initiatives include investments in the circular economy projects, such as the advanced recycling and the strategic acquisitions to enhance its barrier technology portfolio and the sustainability offerings for global brand owners.

- Mondi Group excels in the metalized flexible packaging market by merging its deep expertise in paper-based solutions with advanced plastic barrier technologies. The company’s Mondi Action Plan 2030 focuses on designing sustainable, recyclable, flexible packaging, often using metalized coatings to replace aluminium foil, thereby reducing the material use while maintaining critical product protection for a circular economy. In 2024, the company invested €1.2 billion in total to expand capacity and increase cost competitiveness.

- Huhtamaki Oyj is a key innovator in the market, mainly for on-the-go foodservice and consumer packaging. Its strategic initiatives center on its Blueloop sustainable design platform, which creates recyclable and compostable metalized packaging structures. Huhtamaki invests in next gen on barrier coating to reduce the plastic content without compromising the performance for freshness and aroma protection.

- Sonoco Products Company holds a strong position in the metalized flexible packaging market via its diverse portfolio of engineered films and laminates for food and industrial applications. Strategically, Sonoco emphasizes vertical integration and material science to develop high-barrier metalized structures that enhance the shelf life. It actively pursues partnerships and acquisitions to boost its sustainable packaging capabilities and global reach.

Here is a list of key players operating in the global market:

The global market is very competitive and is defined by the presence of the multinational giants and the strong regional players. The key competitors are actively pursuing consolidation via mergers and acquisitions to expand their geographic reach and product portfolios. For example, in December 2025, Soteria Flexibles Corp has announced the acquisition of Imaflex Inc. The strategic initiatives are focused on sustainability, including the investment in recyclable and mono-material structures alongside technological advancements in the high-barrier firms and digital printing. To serve cost-sensitive and rapidly growing markets, major firms are also establishing local production facilities and forming strategic partnerships, turning the landscape into a dynamic mix of innovation-led and expansion-driven growth strategies.

Corporate Landscape of the Metalized Flexible Packaging Market:

Recent Developments

- In December 2025, Lecta has announced the launch of metallized paper packaging for ice cream, a paper that meets the current requirements for technical performance, industrial efficiency and sustainability in the sector.

- In December 2025, Cosmo Films has expanded its flexible packaging portfolio in India with the launch of a new range of advanced packaging films designed specifically for the pet food industry, addressing the growing demand for safe, high-performance packaging solutions in this rapidly developing segment.

- In September 2025, Siegwerk announced the launch of a fully recyclable, mono-material barrier stand-up pouch to meet the needs of converters, brand owners, and consumers seeking sustainable, high-functioning packaging.

- Report ID: 8350

- Published Date: Jan 16, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metalized Flexible Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.