Membranous Nephropathy Market Outlook:

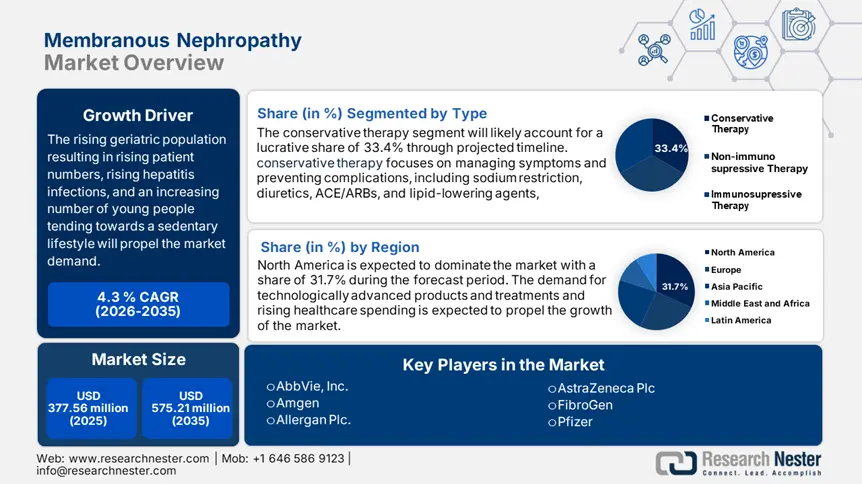

Membranous Nephropathy Market size was valued at USD 377.56 million in 2025 and is expected to reach USD 575.21 million by 2035, registering around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of membranous nephropathy is evaluated at USD 392.17 million.

The membranous nephropathy market shows a pattern of steady expansion, founded upon a coalition of demographic and clinical patterns. The growing prevalence of chronic kidney disease throughout the globe, along with population aging, offers a main impetus for market expansion. For instance, an update in March 2022, from the National Library of Medicine stated that over 800 million people, or more than 10% of the global population, suffer from chronic kidney disease. In addition to this, in October 2024, WHO published that, there will be 1.4 billion people over the age of 60, up from 1 billion in 2020. Furthermore, 60 years of age or older population is expected to increase to 2.1 billion by 2050, and 80 years of age or older is predicted to increase threefold, reaching 426 million.

Moreover, technological progress in diagnosis, such as improved serological testing and renal biopsy, allows earlier and more precise disease diagnosis and, as a result, enhances the treated patient population. For instance, in September 2024, ProKidney Corp. announced strategic updates to its Phase 3 program for rilparencel, an investigational treatment that may help patients with type 2 diabetes and advanced CKD maintain kidney function. Furthermore, therapeutic paradigm innovation, represented by the introduction of targeted immunosuppressive drugs and new biologics, responds to new unmet medical needs and enhances patients' outcome quality. This therapeutic progress, combined with increasing awareness on the part of nephrologists and primary care providers, fuels increasing treatment uptake and propels market growth.

Key Membranous Nephropathy Market Insights Summary:

Regional Highlights:

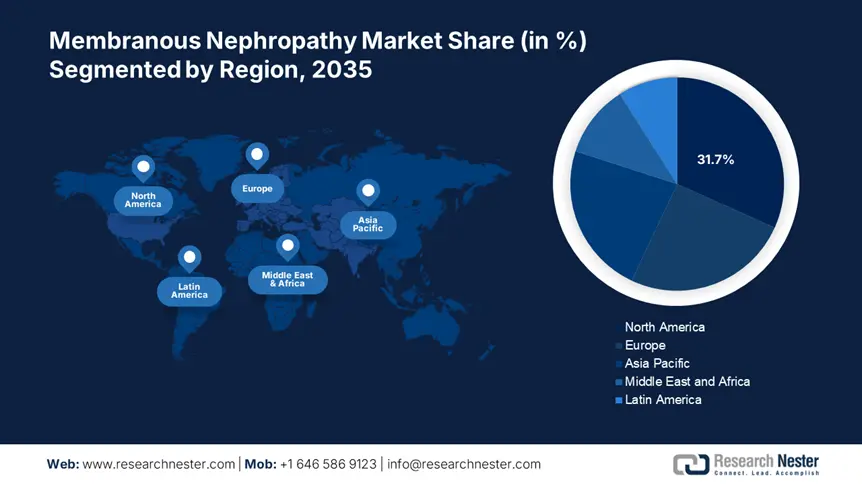

- North America holds a 31.7% share in the Membranous Nephropathy Market, attributed to well-developed healthcare infrastructure, supportive reimbursement policies, and rising insurance coverage, driving significant growth by 2035.

- Asia Pacific's membranous nephropathy market is poised for the fastest growth by 2035, fueled by increasing disposable incomes, rising awareness of chronic kidney disease, and infrastructure upgrades.

Segment Insights:

- The Conservative Therapy segment is expected to account for over 33.4% market share by 2035, driven by the safety and accessibility of conservative treatments.

Key Growth Trends:

- Development of novel therapeutic agents

- Growing healthcare expenditures in emerging economies

Major Challenges:

- Treatment complexities and side effects

- Lack of biomarkers and disease progression

- Key Players: Allergan Plc., Amgen Inc., AstraZeneca Plc, Hoffmann-La Roche Ltd, FibroGen, Pfizer Inc., and more.

Global Membranous Nephropathy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 377.56 million

- 2026 Market Size: USD 392.17 million

- Projected Market Size: USD 575.21 million by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Membranous Nephropathy Market Growth Drivers and Challenges:

Growth Drivers

- Development of novel therapeutic agents: Increasing innovation in novel therapeutic agents remains a principal driver of the membranous nephropathy market. Particularly, the advent of recently targeted immunotherapies such as rituximab and investigation into newer biologics such as calcineurin inhibitors and B-cell depleting agents offer the clinician additional therapeutic alternatives for the patients. For instance, in February 2025, Brentuximab vedotin (Adcetris, Seagen Inc., a Pfizer subsidiary) was approved by the FDA, in combination with lenalidomide and a rituximab product for adult patients who have relapsed or refractory large B-cell lymphoma (LBCL).

- Growing healthcare expenditures in emerging economies: The evolution in the growth of emerging economies, facilitates the healthcare facilities and infrastructure are likely to extend and achieve specialty care, including the specialty of nephrology. For instance, in October 2024, India's total health expenditure in 2021–2022 was Rs. USD 10448.9 billion or 3.83% of GDP, with a per capita expenditure of USD 76.2 billion. The amount spent on government health care increased significantly to USD 5015.7 billion, which accounted for 48% of THE and 1.84% of GDP which represents roughly 6.12% of total government spending. Higher access with greater awareness and consciousness of renal wellbeing propels market expansion.

Challenges

- Treatment complexities and side effects: A major challenge in the membranous nephropathy market is the side effects from treatments. Even though immunosuppressive treatments such as calcineurin inhibitors and rituximab can be beneficial, patients should be closely monitored due to the possibility of infections, nephrotoxicity, and cancer. Furthermore, extended treatment durations and patient response variability present higher management challenges. In addition, patients with comorbid conditions who are more susceptible to problems may not be able to employ these regimens due to their intrinsic toxicity. Therefore, the development of less toxic, more targeted treatments and individualized treatment approaches are critical for unmet medical requirements.

- Lack of biomarkers and disease progression: The challenge sustaining within the membranous nephropathy market is though PLA2R antibody levels are useful for monitoring and diagnosis, they are not always correlated with a patient's prognosis. Consequently, doctors struggle to modify treatment and make precise predictions about the progress of the disease. Moreover, the lack of predictive biomarkers necessitates the use of invasive renal biopsies for disease activity monitoring, resulting in less-than-ideal treatment plans, causing delays in the timely delivery of interventions and prevents the use of personalized medicine strategies.

Membranous Nephropathy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 377.56 million |

|

Forecast Year Market Size (2035) |

USD 575.21 million |

|

Regional Scope |

|

Membranous Nephropathy Market Segmentation:

Type (Conservative Therapy, Non-immunosupressive Therapy, Immunosupressive Therapy)

Conservative therapy segment is likely to capture membranous nephropathy market share of over 33.4% by 2035. It is more favorable by virtue of its targeting to moderate risk factors and stop the disease process without risking severe side effects of immunosuppressive drugs. Moreover, where advanced treatment is not accessible, conservative therapy continues to be the preferred treatment. For instance, in February 2025, Vantive launched a new independent vital organ therapy after the completion of its acquisition by Carlyle funds. Vantive leverages a 70-year history of innovation in kidney care to drive its mission of prolonging lives and enhancing possibilities. Hence, due to more specificity and safety in treatments, these therapies become accessible on a large scale.

Material Type (Urine Test (Urinalysis), Blood Test, Glomercular Filtration Rate Test, Antinuclear Antibody Test)

The urine test segment is anticipated to dominate the membranous nephropathy market throughout the projected timeframe due to the fact that it is non-invasive and well-established to be of clinical utility. For instance, in March 2020, it was unveiled that, urine test can identify and forecast acute rejection in kidney transplants, opening the door to earlier detection and treatment, a new study by UC San Francisco researchers reports. Furthermore, a trial of 601 urine samples revealed more than 95% accuracy in assessing the risk of rejection after transplant. Moreover, urine testing is retrievable, low cost, and accessible to become a standard component of daily clinical care and patient follow-up.

Our in-depth analysis of the global membranous nephropathy market includes the following segments:

|

Product Type |

|

|

Type |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Membranous Nephropathy Market Regional Analysis:

North America Market Statistics

North America membranous nephropathy market is anticipated to account for revenue share of around 31.7% by 2035. The region has a well-developed healthcare infrastructure with supportive reimbursement policies and insurance structure. For instance, in December 2024, US health care expenditure amounted to USD 4.9 trillion and grew 7.5% in 2023, rising from a 4.6% rate in 2022. In 2023, the percentage of the population with insurance stood at 92.5%, as private health insurance enrollment rose at a high rate for the second consecutive year, and both private health insurance and Medicare spending rose more than in 2022.

In the U.S. membranous nephropathy market is likely to unveil lucrative growth opportunities owing to the exorbitant R&D processes in the pharma industry, along with wide-ranging prevalence of chronic kidney ailments. For instance, the Novo Nordisk Annual Report 2023 unveiled that their first-ever therapy derived from RNA interference, Rivfloza, was approved in the US. Moreover, higher access of medical facilities with greater awareness and consciousness of renal wellbeing propels market expansion by expanding the number of diagnosed and treated patients.

Canada membranous nephropathy market is exponentially increasing its footprints through, the emphasis of the Canada healthcare system on clinical guidelines and evidence-based practice that ensures the application of the right treatment modalities. For instance, in January 2025, AstraZeneca announced an investment in Canada with an aspiration to reach USD 80 billion in total revenue and to reach patients with 20 new medicines by 2030. The company has invested over USD 161.1 million in research and development in 2023, directed towards delivery of over 210 global clinical studies of new medicines and indications.

Asia Pacific Market Analysis

The membranous nephropathy market in Asia Pacific is likely to witness fastest growth during the stipulated timeframe. The increasing disposable incomes make the newer forms of treatment affordable, such as targeted immunotherapies, hence propel market growth. The increased awareness of chronic kidney disease and the development of trained nephrologists in the region also add to the market growth trend. With infrastructure upgrading going on, along with the larger middle-class population able to afford high-end medical care, there is tremendous growth.

India membranous nephropathy market is experiencing staggering growth with the most powerful force behind the trend which is increasing availability and affordability of healthcare services. Major players are developing new products for treatment, such as targeted immunotherapies and novel biologics, to meet unmet medical needs. For instance, in January 2024, Rakuten Medical, Inc., utilizing its proprietary Alluminox platform, announced that the first patient in India was administered study treatment under its pivotal Phase 3 clinical trial (ASP-1929-301 study / ClinicalTrials.gov Identifier: NCT03769506, CTRI Number: CTRI/2023/05/052728) of Alluminox treatment (photoimmunotherapy) with ASP-1929.

The membranous nephropathy market in China is predominantly driven by improved availability of advanced diagnostic technology, such as better renal biopsy facilities and greater access to serology tests like PLA2R antibody assays. For instance, in January 2025, Poxel announced the grant of patent in China protecting the use of imeglimin for Type-2 diabetic patients with renal impairment. Moreover, the growing interest in kidney health, is driving disease diagnosis earlier in stage and enlarging the population of diagnosed patients. Therefore, the market is likely to witness phenomenal growth during projected years.

Key Membranous Nephropathy Market Players:

- AbbVie, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Allergan Plc.

- Amgen Inc.

- AstraZeneca Plc

- Hoffmann-La Roche Ltd

- FibroGen,

- Pfizer Inc.

Firms competing within the membranous nephropathy market landscape are investing in diagnostic products such as sophisticated serological testing and renal biopsy techniques in an effort to permit earlier disease diagnosis and disease monitoring. For instance, in August 2024, Borealis Biosciences came out of stealth with USD 150 million in Series A funding from Novartis AG and founding investor Versant Ventures. This investment is committed to strategic research collaboration funding to help the company develop novel solutions for kidney issues. Strategic alliances are refiguring the competitive dynamics as firms endeavor to expand their product pipeline and strengthen their position in this therapeutic niche.

Here's the list of some key players:

Recent Developments

- In October 2024, Vertex Pharmaceuticals Incorporated provided updates on kidney diseases, including APOL1-mediated kidney disease (AMKD), primary membranous nephropathy (pMN), and IgA nephropathy (IgAN) during the American Society of Nephrology's (ASN) Kidney Week Congress.

- In May 2024, Human Immunology Biosciences (HI-Bio) and Biogen Inc. announced that they have reached a definitive agreement. As per the agreement, Biogen purchased HI-Bio for USD 1.15 billion.

- Report ID: 7369

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Membranous Nephropathy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.