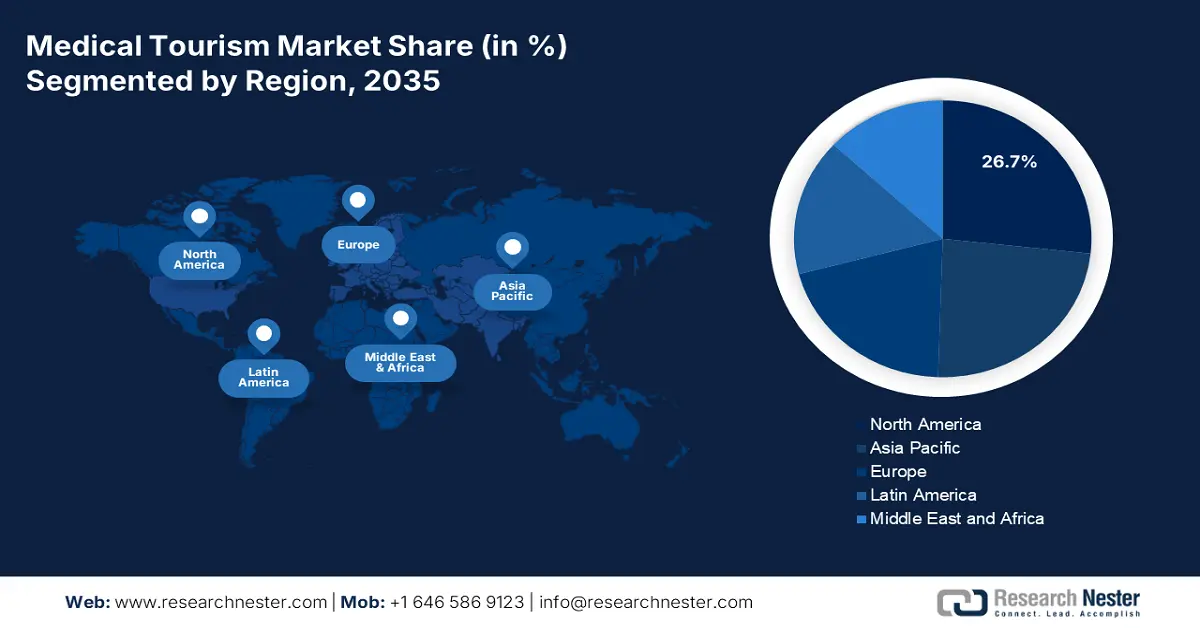

Medical Tourism Market - Regional Analysis

North America Market Insights

North America is dominating the region and is projected to hold a market share of 26.7% by 2035. The region is driven by the expansion in out-of-pocket healthcare costs, favorable bilateral treatment agreements, and long domestic wait times. The health-related tourism in the U.S. accounted for USD 6.3 billion in 2024, based on the International Trade Administration report in December 2024. Further, the U.S. Medical reimbursement expansion by provincial programs and Medicare promotes the regulated outbound treatment. Further, investments in AI-enabled care navigation platforms and concierge services are surging the trend, mainly in Ontario, California, and New York.

The U.S. market is influenced by increasing outbound travel for affordable procedures and inbound luxury wellness services. As per the ASMBS report in 2025, U.S. people travel abroad for affordable healthcare. Rising costs, long wait times, and global access have boosted demand, with procedures often 40% to 80% cheaper than in the U.S. Increased investments, follow-up travel packages, and collaborations with private payers' reimbursement portions and cross-border insurance innovations drive the market leadership.

APAC Market Insights

The Asia Pacific is the fastest-growing region in the medical tourism market and is poised to hold a significant market share by 2035. The region is driven by rising international patient flow and advanced medical infrastructure. India, South Korea, Japan, and China are the major countries leading the region. Further, government support is the primary factor in the Asia Pacific region. Based on Medical Korea report in 2024 states that nearly 1.17 million patients from 202 countries visited Korea for medical related services. Technology advancements such as robotic surgery AI AI-assisted diagnostics, enhance the medical competitiveness in the region. The patient flow is expanding beyond traditional borders due to the multilateral healthcare agreements.

Most Visited Medical Departments in Korea (2014-2024)

|

Country |

Percentage |

|

Dermatology |

23% |

|

Integrative Internal Medicine |

18% |

|

Plastic Surgery |

12% |

|

Health Screening Center |

8% |

|

Obstetrics and Gynecology |

4% |

|

Orthopedics |

4% |

|

Integrated Oriental Medicine |

3% |

|

General Surgery |

3% |

|

Dental Clinic |

3% |

Source: Medical Korea

China market is expanding and holds a significant share. As per the NLM report in August 2024, China's medical visitors grew by 30% in the past five years, aided by deregulation and investment in infrastructure in provinces such as Hainan and Guangdong. China recorded more inbound patients in 2023, with patients seeking traditional Chinese medicine (TCM), orthopedics, and wellness therapies. Traditional Chinese Medicine hospitals with integrated herbal and contemporary care are reshaping into global treatment centers.

Europe Market Insights

Europe is expanding and will dominate the market by 2035. The region is driven by cost-effective treatment options, robust cross-border healthcare cooperation, and high standards of care. European Health Data Space (EHDS). The European Union allocated €1,251 billion in 2023 on general healthcare expenditure in the EU, based on the Eurostat data in March 2025. The rising demand for orthopedic, dental, and fertility-based services has made the region an attractive point for intra-regional and international patient visits.

Germany dominates the medical tourism market in Europe. Germany's healthcare sector gross value added of about €435 billion in 2024, which is 11.5% of the overall economy of the country, based on the International Trade Administration report in August 2025. The government actively funds public hospitals by providing international patient packages, with improved language facilities and electronic documentation protocols. New programs under the Healthcare Export Strategy have enhanced infrastructure to manage inbound medical tourists in Munich, Berlin, and Hamburg.