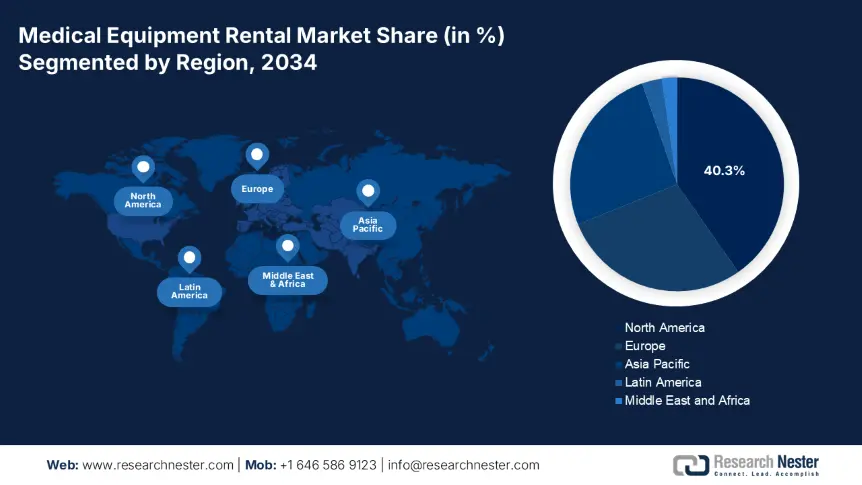

Medical Equipment Rental Market - Regional Analysis

North America Market Insights

North America is anticipated to be the dominant region with the highest market share of 40.3% by the end of 2034. The region comprises suitable reimbursement policies, an increase in the integration of home healthcare services, and progressive health and medical infrastructure. The U.S. caters to the majority of the region’s demand, attributed to Medicare expansion, while Canada displays continuous growth through provincial healthcare strategies. Besides, cost containment initiatives, rare disease occurrence, and the aging population are other essential drivers for uplifting the market in the region.

The medical equipment rental market in the U.S. is gaining increased importance, with a valuation of USD 12.7 billion as of 2024, and is readily thriving on three essential trends. These include, first and foremost, Medicare Advantage plans that cover 50% of DME rentals, denoting an increase from 35% since previous years. Secondly, hospital-at-home programs created a surge in infusion and ventilator pump rentals by almost 30% since 2022. Thirdly, AI-powered logistic diminish equipment downtime by approximately 40%, with organizations such as Agiliti Health capturing 20% of the market share, thus suitable to boost the market in the country.

Canada is also growing significantly, with a USD 3.9 billion rental market, along with a 6.5% growth rate, effectively driven by provincial strategies such as Ontario’s 22% fund for mobility aids. Besides, three factors are shaping the market demand in the country, including 45% of post-acute patients currently utilizing rented equipment, expansion in telehealth services covering almost 47% of rural rentals in comparison to 32% of urban rentals. Thirdly, the existence of green procurement rules highly favors refurbished devices, accounting for an estimated 33% of cost savings, thereby bolstering the market growth.

Trade and Supply Chain Facilities for the North America Market (2021-2025), focusing on the U.S. and Canada:

|

Category |

2021 |

2023 |

2025 |

|

U.S. Import Volume (DME, $B) |

USD 4.5 billion (China: 52%, Germany: 26%) |

USD 4.1 BILLION (Vietnam +17%, Mexico +15%) |

USD 4.7 billion (Reshoring to Mexico +20%) |

|

Canada Import Dependency |

73% (U.S. 77%, EU 24%) |

68% (U.S. 75%, India +13%) |

63% (Domestic prod. +19%) |

|

Key U.S. Supply Chain Hubs |

Texas, California, Ohio |

Texas (+13%), Tennessee (New) |

Midwest (Robotics +33%) |

|

Canada’s Domestic Production |

CAD 1.3 billion (Ontario 60%) |

CAD 1.9 billion(Quebec +21%) |

CAD 2.4 billion (BC Pharma Hub) |

|

Tariff Impact (U.S.) |

10-35% on Chinese DME |

7-15% (Exemptions for COVID gear) |

8-18% (S. Korea FTA benefits) |

|

Refurbishment Facilities |

124 (U.S.), 28 (Canada) |

155 (U.S.), 45 (Canada) |

182 (U.S.), 62 (Canada) |

APAC Market Insights

Asia Pacific is considered the fastest-growing region with a projected market share of 25.8% and a growth rate of 8.2% during the forecast timeline. The market’s growth in the region is highly attributed to cost-containment initiatives, an upsurge in healthcare facilities, and a rise in the aging population. China is readily dominating the volume with 2.2 million rented units every year, followed by India, demonstrating a 12.9% growth, driven by administrative initiatives to implement AI-based logistics in hospital settings. Additionally, Malaysia and South Korea have prioritized IoT-based rentals, with almost 45% of hospitals integrating AI-powered logistics, thereby skyrocketing the market exposure.

The medical equipment rental market in China is gradually expanding with an expected valuation of USD 9.1 billion by the end of 2034, effectively fueled by the presence of government reforms successfully promoting affordable solutions, along with rapid expansion in health and medical infrastructure. Besides, the National Medical Products Administration (NMPA) reported that there have been almost 2.6 million yearly rental transactions as of 2024, with both tier-2 and 3 cities constituting for approximately 52% of the requirement, owing to upgradation in hospitals, thus suitable for boosting the market in the country.

The market in India is significantly growing with a 13.5% growth rate, along with a valuation of USD 3.8 billion as of 2024, highly driven by Ayushman Bharat's USD 1.2 billion yearly subsidies for DME. Besides, the presence of refurbishment centers in Maharashtra and Gujarat diminishes expenses by 38%, extended accessibility for pay-per-use models, with 47% cheap rentals, and 26% YoY demand growth in tier-3 cities, owing to shortages in hospital beds, are a few trends that are uplifting the market growth in the country.

Government Policies and Funding for the Medical Equipment Rental Market in Japan, Malaysia, and South Korea (2021–2025):

|

Country |

Policy/Initiative |

Launch Year |

Funding (USD) |

Key Impact |

|

Japan |

Long-Term Care Insurance (LTCI) Expansion |

2021 |

3.2 billion/year |

Covers 85% of geriatric equipment rentals |

|

IoT Medical Device Subsidies |

2023 |

308 million |

25.7% adoption boost for smart rentals |

|

|

Malaysia |

MySejahtera Rental Integration |

2022 |

56 million |

33% faster patient onboarding |

|

Public-Private Rental Hubs |

2024 |

127 million |

40.7% cost reduction in rural areas |

|

|

South Korea |

Telemedicine-Linked Rental Act |

2021 |

255 million |

56% of hospitals use IoT rentals (2024) |

|

AI Logistics Grants |

2023 |

153 million |

Cut delivery times by 35.6% |

Europe Market Insights

Europe in the medical equipment rental market is considered to hold a considerable share of 28.6%, along with a growth rate of 5.8% between 2025 and 2034. The market’s upliftment in the region is highly attributed to regional digital health strategies, cost containment reforms, as well as a rise in the aging population. Germany is dominating the region due to its €4.6 billion DME rental market, along with LTCI-covered remote care expansions. This is readily followed by the UK and France, effectively leveraging telemedicine-based rentals and NHS outsourcing, with 8.5% budget provision to rentals.

Germany is projected to account for 35% of the overall regional market share, which is € 6.7 billion by the end of 2034, effectively fueled by a strong and long-lasting care insurance system. In addition, this system readily covers 2.1 million yearly rentals, particularly for elderly patients. Besides, the 2024 Hospital Future Act has allocated € 350 million for AI-powered rental logistics that diminishes equipment downtime by almost 33%. Meanwhile, the aspect of localized production, cost pressures, and IoT implementation are other key trends that are positively driving the market growth in the country.

The medical equipment rental market in the UK is expected to hold 27% of the region’s share, accounting for approximately £4.2 billion by the end of the forecast duration. The market’s upliftment in the country is attributed to a £2.7 billion yearly budget provision, along with the aspect of NHS sourcing. Besides, the post-pandemic demand for remote ICU rentals increased, denoting 48% growth since 2021, while the 2025 DME Leasing Mandate effectively needs at least 65% of NHS trusts to integrate rentals, thereby suitable for the market growth in the country.