Medical Device Testing Market Outlook:

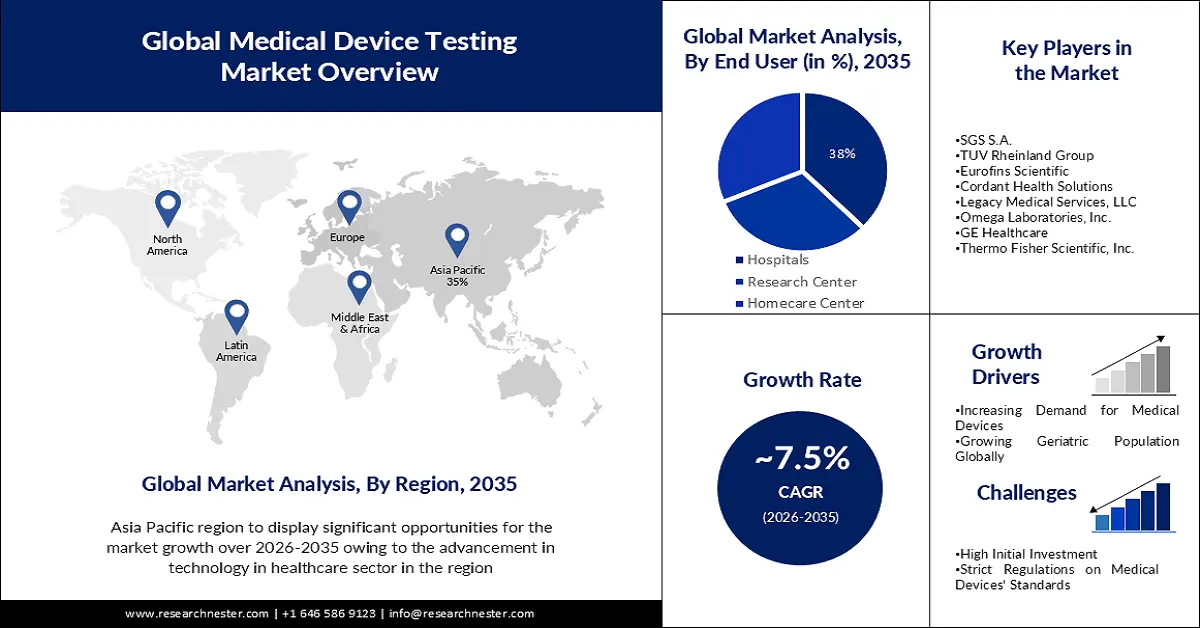

Medical Device Testing Market size was valued at USD 11.13 billion in 2025 and is set to exceed USD 22.94 billion by 2035, registering over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical device testing is estimated at USD 11.88 billion.

Consumers repeatedly are demanding effectiveness, outstanding performance, and security from medical devices. This factor has raised the demand for the verification and validation of medical devices. Therefore, it is compulsory for manufacturers to properly define and test medical devices for confirmation of quality. The government authorities of various regions have mandated the medical testing procedure for medical devices before their use.

Advancement in technology such as the adoption 0f AI or IoT in multiple medical devices is expected to create lucrative growth opportunities for the sector. Various companies are now incorporating these technologies into their devices. Innovative and advanced medical devices aid in accurate results of disease diagnosing invention in medical devices and also offers cost-friendly technology-based therapeutic tools for disease treatment. Various government authorities and companies do promote medical research centers. In 2021, PaxeraHealth declared that it had established an AI-based imagining platform in the United States

Key Medical Device Testing Market Insights Summary:

Regional Highlights:

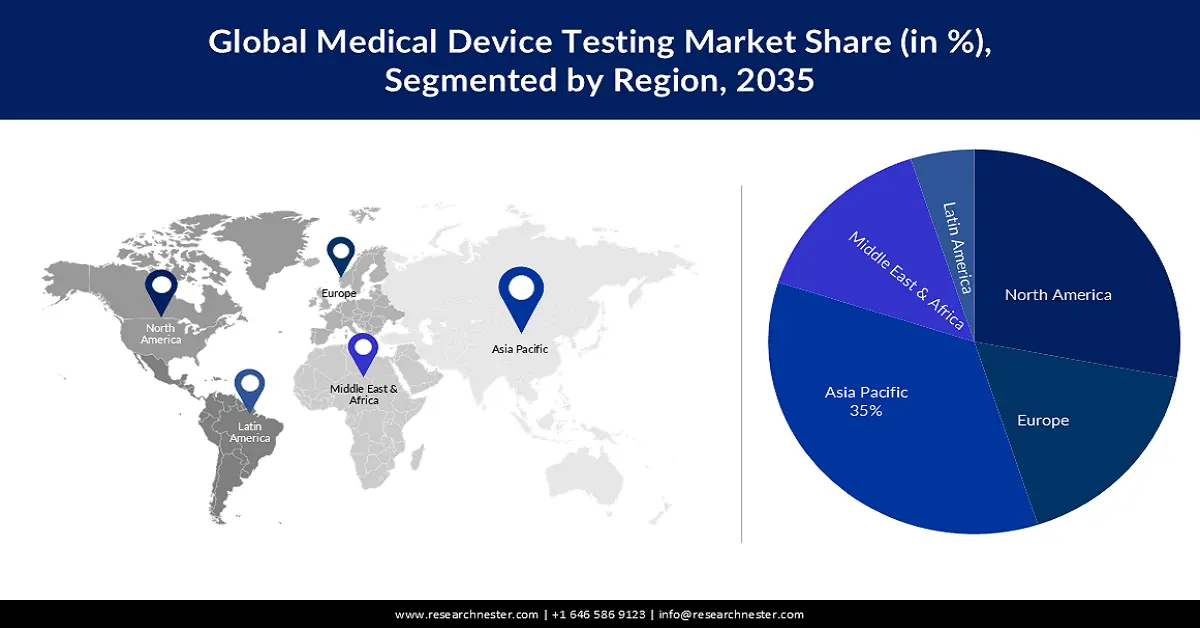

- By 2035, the Asia Pacific region is projected to capture a 35% share of the Medical Device Testing Market, supported by the expanding geriatric population that elevates the need for disease-related devices and corresponding testing.

- The North American region is anticipated to witness notable growth through 2026–2035, propelled by escalating investments in testing and R&D activities.

Segment Insights:

- By 2035, the Testing segment is expected to secure a substantial share of the Medical Device Testing Market, underpinned by rising demand for advanced, high-quality products and enhanced pre-production cost efficiency.

- The Hospital segment is forecasted to hold a 38% share by 2035, spurred by hospitals' consistent need to verify device safety and performance across a wide spectrum of equipment.

Key Growth Trends:

- Increasing Demand for Medical Devices

- Growing Geriatric Population Globally

Major Challenges:

- High Initial Investment

- Strict Regulations on Medical Device Standards

Key Players: Intertek Group PLC, SGS S.A., TUV Rheinland Group, Eurofins Scientific, Cordant Health Solutions, Legacy Medical Services, LLC, Omega Laboratories, Inc., GE Healthcare, Thermo Fisher Scientific, Inc., Siemens AG.

Global Medical Device Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.13 billion

- 2026 Market Size: USD 11.88 billion

- Projected Market Size: USD 22.94 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Singapore

Last updated on : 9 September, 2025

Medical Device Testing Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Medical Devices – As the utilization of medical devices grows, consumers start demanding devices that ensure safe, and effectiveness and meet regulatory requirements. This attribute has boosted the growth in the medical device testing market, as market players now offering testing services and equipment to ensure the quality of medical devices. As per the statistics, the revenue in the Medical Devices segment reached a value of USD 480 billion in 2021.

- Growing Geriatric Population Globally – As the geriatric population increases, the demand for various medical devices also seems to grow owing to the demand for treatment of aged people suffering from various health conditions and diseases. This has increased the invention of innovative and advanced medical devices as well as raised the focus on ensuring that these devices are effective and safe with the help of rigorous testing methods. By 2030, 1 in 6 people is estimated to be over the age of 60 years old. An estimated 2.1 billion people are anticipated to be above the age of 60 or under the geriatric population by 2050 globally.

- Growing Complexity in Medical Devices – The complexities in medical devices are growing day by day, which is expected to drive the need for specialized testing services and devices. As medical devices become complex the testing needed for the medical equipment to check their safety and effectiveness becomes complex which raises the demand for medical device testing.

- A surge in Demand for In-Vitro Tests – Medical device testing is used in In-vitro diagnostics to detect various harmful health conditions such as HIV, malaria, hepatitis, and others. It is tested on human body samples such as on blood or tissue.

Challenges

- High Initial Investment – Medical device testing involves high initial investment, especially in terms of complex devices that need extensive testing. This can emerge as a barrier in front of this market in the upcoming times.

- Strict Regulations on Medical Device Standards

- Rapidly Changing Technology

Medical Device Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 11.13 billion |

|

Forecast Year Market Size (2035) |

USD 22.94 billion |

|

Regional Scope |

|

Medical Device Testing Market Segmentation:

Services Segment Analysis

Testing segment is expected to account for remarkable medical device testing market share by the end of 2035. The testing segment is high in demand in the medical device testing market owing to increased demand for advanced products, awareness among consumers, and high-quality products. The testing service aids in reducing the cost of the pre-production phase along with this it enhances the marketability of medical devices.

Moreover, in response to the urgent demands of patients and healthcare systems around the world dealing with COVID-19. Medtronic PLC announced in March 2020 that it had increased production by more than 40% to date and was on track to more than double its capacity to manufacture and supply ventilators.

End-User Segment Analysis

The hospital segment is predicted to hold 38% share of the global medical device testing market in the projected period. Hospitals use all types of medical devices from simple diagnostic devices to complex ones, and these devices must be checked and verified before use to ensure their safety and effectiveness.

Our in-depth analysis of the global market includes the following segments:

|

Services |

|

|

Technology |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Device Testing Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 35% by 2035, attributed to the large geriatric population in countries, such as India and China. As the old population rises in the region prevalence of chronic and other kinds of diseases grows leading to the major demand for medical devices and medical device testing.

Moreover, improving healthcare facilities, along with rising health awareness amongst the people, are projected to boost the market growth.

North American Market Insights

The North American medical device testing market is poised to observe substantial growth throughout the projected period. The regional growth is ascribed to the high investment in testing activities, along with increasing investment in R&D activities in the region. The American Medical Association estimates that the United States spent USD 4.3 trillion, or USD 12.914 per person, on healthcare in 2021.

Additionally, as more medical devices are approved in the area, rising demand for medical device testing services may promote market expansion.

Medical Device Testing Market Players:

- Intertek Group PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SGS S.A.

- TUV Rheinland Group

- Eurofins Scientific

- Cordant Health Solutions

- Legacy Medical Services, LLC

- Omega Laboratories, Inc.

- GE Healthcare

- Thermo Fisher Scientific, Inc.

- Siemens AG

Recent Developments

- Eurofins Scientific and Transgenic Inc. Acquired Genetic Lab Co., Ltd. To establish a network of clinical diagnostics laboratories in Asia.

- Intertek expanded its business to personal protective equipment services, including respirator precertification testing after COVID-19.

- Report ID: 3866

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Device Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.