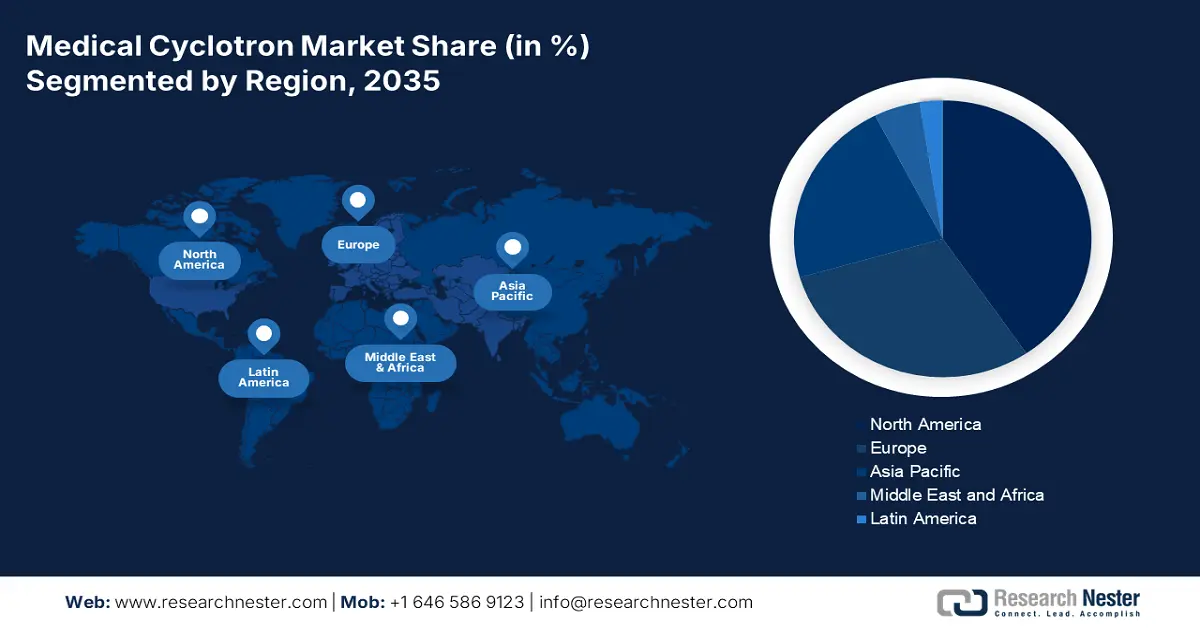

Medical Cyclotron Market Regional Analysis:

North America Market Insights

North America is expected to show dominance over the global medical cyclotron market by capturing the largest share of 40.5% during the selected tenure. The region's strong emphasis on several driving factors, such as the enlarging patient pool, advanced healthcare system, and technological innovations, is evidence of this leadership. In this regard, the National Institute of Health (NIH) recorded over 2.2 million new incidences of malignancies in North America in 2024. It also mentioned that 65.5% of these residents required PET imaging technology to detect, treat, and monitor the root cause, health impact, and progression of the disease. This highlights the existence of a sustainable demand across this landscape.

The U.S. is propagating the medical cyclotron market with a strong and expanding reimbursement structure. As evidence, the Centers for Disease Control and Prevention (CDC) presented a forecast of USD 3.6 billion to be the value of nationwide Medicare coverage for PET scans by 2030. This outlay is projected to enlist assessments in more than 41 operational centers within the U.S. territory. Simultaneously, the supportive gesture of government investors toward deploying and availing the maximum number of advanced clinical facilities and services for patients is inspiring both domestic and foreign companies to participate in this field. For instance, the NIH invested a total of USD 2.2 billion to advance cyclotron-based theranostics in 2024.

APAC Market Insights

Asia Pacific is projected to become the fastest-growing landscape of the medical cyclotron market by 2035, exhibiting the highest CAGR. Increasing cancer mortality, rapid infrastructural modernization, and government initiatives are accumulatively stimulating the region's progress in this sector. Particularly, emerging economies, such as China, India, and Malaysia, are presenting greater business opportunities for global pioneers. In addition, technologically developed countries, including Japan and South Korea, are accelerating the pace of discoveries and deployment of next-generation diagnostic and therapeutic technologies. This reflects the characteristics of a progressive and lucrative environment for this sector.

China is emerging as a regional powerhouse of manufacturing and revenue generation in the market. With a predominant control of the raw material supply chain, the country embarks on its significance as a lucrative consumer base and a dominating radiopharmaceutical producer. Additionally, China is witnessing a revolutionary shift toward digitalization, underscoring the efficiency of AI-enhanced cyclotron systems in elevating the quality and scalability of cancer care. Furthermore, the nation's propagation is also fueled by the ambitious goals of the governing bodies to make China a global healthcare giant. In this regard, the NMPA reported that the government investment in this category increased by 15.1% in the past 5 years, which supported diagnosis for more than 1.6 million patients in 2023.