Mass Spectrometer Market Outlook:

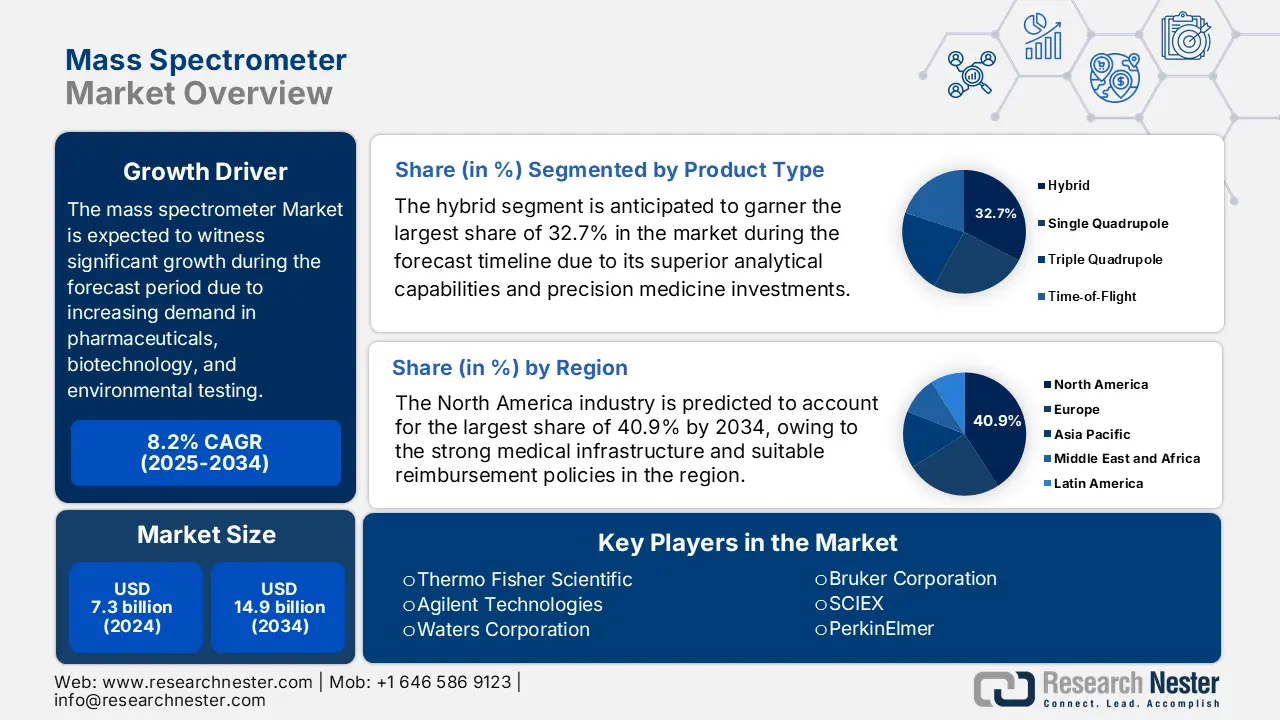

Mass Spectrometer Market size was over USD 7.3 billion in 2024 and is anticipated to exceed USD 14.9 billion by the end of 2034, growing at over 8.2% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of mass spectrometer is estimated at 7.6 billion.

The demand from pharmaceuticals, biotechnology, and clinical diagnostics, whereby the need for precise analytical tools supports drug development and quality control are key factor behind the growth of the market. Also, the amplifying patient pool who are in extreme need of advanced diagnostics, such as cancer screening, infectious disease testing, and metabolic disorder analysis, contributes towards market expansion. In this regard, the report from the National Institute of Health stated that an estimated 2.2 million new cancer cases were diagnosed in the U.S. in 2023, which underscores the clear presence of a consumer base necessitating high-throughput mass spectrometry for biomarker validation, thus a positive market outlook.

Furthermore, the supply chain is yet another aspect providing opportunities for numerous organizations that comprise APIs and medical devices, wherein the U.S. FDA reports that over 40.7% of imported drugs undergo mass-spectrometry-based verification. In addition, the U.S. Bureau of Labor Statistics observed that the Producer Price Index (PPI) for laboratory analytical instruments such as mass spectrometers increased by a significant 4.6% year-over-year from 2023 to 2024, owing to the high manufacturing costs. Therefore, the presence of all of these factors responsibly uplifts the market growth internationally.

Mass Spectrometer Market - Growth Drivers and Challenges

Growth Drivers

- Public spending trends: The robust spending from governments across the world is readily blistering growth in the market. The investments in precision medicine and clinical diagnostics are significantly accelerating adoption in this sector. In this regard, the U.S. FDA notes that its 2024 budget of USD 452.6 million for advanced analytical tools and technologies enhances drug safety, thereby boosting demand. On the other hand, the data from Medicare states that the federal spending of USD 2.4 billion in 2023 on spectrometry-based diagnostic tests is mainly driven by oncology and infectious disease screening initiatives.

- Financial and functional advantages: The mass spectrometer diagnostics are emerging as the most effective forms, which is encouraging many pharmaceutical firms to operate in the market. The study from the Agency for Healthcare Research and Quality in 2022 observed that hospitals utilizing mass spectrometry for sepsis detection reduced ICU stays by a significant 18.4% thereby saving a total of USD 1.4 billion yearly. Besides, early-stage cancer screening through mass-spectrometry reduces late-stage treatment costs by USD 4.2 billion within five years.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

Growth Rate |

Key Driver |

|

U.S. |

2.5 |

5.2 |

8.9% |

Oncology, FDA regulations |

|

Germany |

1.2 |

2.6 |

9.9% |

Universal healthcare, precision medicine |

|

France |

1.1 |

2.1 |

10.8% |

National biotech investments |

|

Spain |

0.8 |

1.6 |

11.8% |

Infectious disease screening |

|

Australia |

0.6 |

1.8 |

11.4% |

Government-funded diagnostics |

|

Japan |

1.5 |

3.1 |

9.1% |

Aging population, cancer diagnostics |

|

India |

0.8 |

3.5 |

20.6% |

Hospital expansion, affordable diagnostics |

|

China |

1.9 |

6.9 |

13.8% |

Pharma R&D, national health reforms |

Feasible Expansion Models Shaping the Market

Revenue Feasibility Models (2022-2024)

|

Model |

Region |

Revenue Impact |

Key Driver |

|

Public-Private Partnerships |

India |

+12.7% (2022-2024) |

Govt. tenders |

|

Oncology Reimbursement |

U.S. |

+9.3% (2023) |

Medicare coverage |

|

Pharma QC Mandates |

Europe |

+7.7% (2023-2024) |

FDA/EU-GMP rules |

|

Portable Spectrometers |

Africa |

+15.2% (2022-2024) |

WHO diagnostics push |

Challenges

- Higher upfront costs for healthcare systems: This aspect poses a significant hurdle for the market to reach a wider group of audience. In this regard, the report from the World Health Organization in 2024 stated that a single clinical mass spectrometer costs around USD 550,000 to USD 1.9 million, which makes the adoption least in developing countries. SCIEX announced the launch of a pay-per-use leasing model in India, which appreciably reduced the upfront costs by a significant 60.6%.

- Lack of standardized protocols: Despite the presence of heightened demand, the market still faces disparities in terms of inadequate protocols. As evidence, the Centers for Disease Control and Prevention (CDC) study found that 40.7% of labs in the U.S. utilize inconsistent protocols. The leading firm, Agilent, announced a collaboration with the National Institute of Health in 2024 to establish standardized workflows for these devices in the oncology department to overcome such hampering factors.

Mass Spectrometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.2% |

|

Base Year Market Size (2024) |

USD 7.3 billion |

|

Forecast Year Market Size (2034) |

USD 14.9 billion |

|

Regional Scope |

|

Mass Spectrometer Market Segmentation:

Product Type Segment Analysis

The hybrid segment is anticipated to garner the largest share of 32.7% in the market during the forecast timeline. Its superior analytical capabilities and precision medicine investments are the key factors propelling the dominance of this subtype. The hybrid systems are a combination of high mass accuracy (sub-ppm) with rapid scanning, which is highly essential for multi-omics research. Besides, Thermo Fisher’s Orbitrap Fusion witnessed a 20.8% enhanced adoption in 2023, owing to the heightened pharmaceutical demand.

Application Segment Analysis

The pharmaceutical & biotech segment is projected to grow at a considerable rate, with a share of 25.4% in the market by the end of 2034. The regulatory mandates for drugs and biologics & and biosimilars boom are reinforcing the segment’s growth in this sector. Over 82.4% of top-selling drugs are biologics, such as Keytruda and Humira necessitate mass spectrometry for post-translational modification analysis. Furthermore, Agilent’s Q-TOF systems are currently utilized in 90.5% of biopharmaceutical labs for intact protein analysis, thus a wider segment scope.

Our in-depth analysis of the mass spectrometer market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mass Spectrometer Market - Regional Analysis

North America Market Insights

North America market is projected to dominate with the largest share of 40.9% during the forecast tenure. The market’s upliftment in this region is attributed to the presence of strong medical infrastructure and suitable reimbursement policies. The U.S. accounts for 85.8% of regional demand, and Canada contributes the remaining 14.2% of the region’s share owing to the provincial healthcare initiatives and mandates imposed on mass spectrometry adoption. Furthermore, the pioneers such as Pfizer and Merck invested USD 900.4 million yearly on mass spectrometry-based drug development, thus suitable for standard market growth.

The U.S. market is readily dominating the region on account of USD 5.4 billion received through federal funding for precision medicine and proteomics research as of the NIH 2024 report. Besides, the Centers for Medicare & Medicaid Services (CMS) revealed that Medicare is enabling coverage to mass spectrometry-based diagnostics for over 12.6 million seniors, benefiting both patients and service providers. On the other hand, pharmaceutical R&D investments are expanding, wherein 90.3% of the top 20 drug makers use these spectrometers for quality control, according to a 2023 PhRMA report.

There is an immense exposure for the mass spectrometer market in Canada, which is effectively driven by an estimated USD 3.6 billion in federal healthcare spending and provincial investments such as Ontario’s investment of USD 502.5 million towards a mass spectrometry initiative. According to the report from Health Canada, it mandated MS for 70.6% of drug quality control, which in turn boosts the demand. Further, BioteCanada reports a 15.7% increase in the mass spectrometry adoption for environmental testing, thus reinforcing the country’s captivity in this sector.

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the market, growing at a CAGR of 8.9%. The market’s upliftment in the region is supported by rising chronic disease burdens, pharmaceutical outsourcing, and government-led healthcare modernization. This landscape is dominated by China with a 45.6% regional share, followed by Japan and India. Besides South Korea’s K-BioHealth 2030 initiative, which prioritizes AI and mass spectrometry integration coupled with Malaysia’s 12th Plan funds lab upgrades for halal pharma compliance, also contributes towards regional growth in this field.

The market in China is showcasing its dominance in the Asia Pacific, which is fueled by massive government investments and pharmaceutical expansion. In this regard, the National Medical Products Administration (NMPA) in 2024 noted that it assigned a total of USD 2.2 billion for MS-based drug quality control, which marks a 15.6% increase from 2022. It further underscored that this grant aligns with the country’s Made in China 2025 initiative, which aims to localize 70.5% of high-end MS production by the end of 2030. Further, the country hosts an estimated 1.7 million patients who currently require MS diagnostics for oncology and infectious diseases.

India is also augmenting its position in the regional mass spectrometer market with the presence of strong administrative support and increasing demand for mass spectrometers. As evidence, the Production Linked Incentive (PLI) scheme resulted in 18.6% spending growth over the last decade, surpassing USD 1.9 billion in 2024. Besides, the country witnessed 2.6 million patients diagnosed with the mass spectrometry in 2023, which is 3 times when compared to the previous decade. Furthermore, from the tenure 2022 to 2024, over 200 new mass spectrometry systems were installed in public hospitals, representing a profitable business atmosphere in the country.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

National Medical Devices Policy |

AUD 150.6 |

2023 |

|

Japan |

PMDA’s SAKIGAKE Fast-Track MS Approval |

USD 135.8 |

2021 |

|

South Korea |

K-BioHealth 2030 Strategy |

USD 375.4 |

2024 |

|

Malaysia |

12th Malaysia Plan (Healthcare Modernization) |

USD 260.6 |

2021 |

Europe Market Insights

Europe mass spectrometer market is poised for robust growth driven by the existence of stringent regulatory standards, rising aging populations, and precision medicine adoption. In this regard, the European Medicines Agency’s (EMA) 2024 guidelines imposed mandates on mass spectrometry for 95.4% of biologic drug approvals, which remarkably fueled the 6.4% CAGR. Simultaneously, the Europe’s Health Data Space made a provision of €2.8 billion for mass spectrometry-based diagnostics, which attracts both domestic and international players to establish their footprint in the region’s market.

Germany dominates the all over regional market, extensively facilitated by its regulatory and industrial powerhouses. The mandates imposed by the country’s Federal Ministry of Health (BMG) on raw material testing and batch release create a €4.3 billion annual demand from the pharmaceutical sector alone. Simultaneously, the leading firms such as Bayer and Boehringer Ingelheim invested €1.6 billion in MS-based drug development for the tenure 2023 to 2025, concentrating on biologics characterization. Further, 80.5% of hospitals in the country are utilizing MS for sepsis and cancer diagnostics as per BAK data, thus positively impacting market expansion.

The U.K. is readily growing in the mass spectrometer market due to the digitalization initiatives and post-Brexit supply chain shifts. NHS allocated a budget of £2.4 billion for the tenure 2024 to 2030 that integrates MS with Electronic Health Records (EHRs), thereby enabling an estimated 15.6 million patients to access precision diagnostics. In response Association of the British Pharmaceutical Industry (ABPI) estimates that this may require 500 new mass spectrometry systems by the end of 2027. The ABPI also implemented a 2025 strategy, which aims to localize 62% of MS manufacturing, whereas it was 30.3% in 2022, thus reducing import reliance.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

France |

Health Innovation 2030 Plan |

€501.2 |

2023 |

|

Italy |

PNRR Healthcare Modernization |

€300.3 |

2021 |

|

Spain |

Strategic Health Technology Plan |

€250.7 |

2022 |

Key Mass Spectrometer Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global mass spectrometer market is extremely consolidated, wherein pioneers such as Thermo Fisher, Agilent, and Waters are gaining control over the maximum revenue share. Technological integrations, collaborations, and regulatory agility are a few of the strategies implemented by the leading firms to secure their global market positions. In this regard, Agilent in 2024 announced a partnership with Europe’s healthcare system for environmental mass spectrometers, which is a €150.6 million deal. On the other hand, the Niche players such as Kore, Extrel concentrate on defense and process industries, leveraging AI and automation.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Thermo Fisher Scientific |

U.S. |

25.5% |

Pharma QC, Clinical Diagnostics |

|

Agilent Technologies |

U.S. |

18.3% |

Life Sciences, Environmental |

|

Waters Corporation |

U.S. |

12.6% |

Biopharma, Food Safety |

|

Bruker Corporation |

U.S./Germany |

8.4% |

Proteomics, NMR-MS Hybrid |

|

SCIEX |

U.S./Canada |

xx% |

Translational Research |

|

PerkinElmer |

U.S. |

xx% |

Diagnostics, Environmental |

|

LECO Corporation |

U.S. |

xx% |

Food, Forensics |

|

MKS Instruments |

U.S. |

xx% |

Semiconductor, Advanced Materials |

|

Kore Technology |

UK |

xx% |

Defense, Security |

|

Spectro Analytical |

Germany |

xx% |

Metals, Mining |

|

Extrel CMS |

U.S. |

xx% |

Process Monitoring |

|

Advion |

U.S. |

xx% |

Compact MS Systems |

|

Bio-Rad Laboratories |

U.S. |

xx% |

Clinical Diagnostics |

|

MassTech |

U.S. |

xx% |

Academic Research |

|

AMETEK |

U.S. |

xx% |

Industrial Process Control |

Recent Developments

- In May 2024, Agilent announced the launch of 6546XT Q-TOF, which enhances precision in biologic drug characterization, reducing false positives by 40.8%. The launch secured $202.5 million in pre-orders, with 60.7% originating from Asia-Pacific pharma firms.

- In March 2024, Thermo Fisher launched the Orbitrap Astral, a high-resolution mass spectrometer for proteomics, boasting 5x faster analysis than previous models. The system has been adopted by over 15 top cancer research centers, driving a 9.8% revenue increase in the second quarter of 2024.

- Report ID: 4222

- Published Date: Jul 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mass Spectrometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert