Blood Group Typing Market Outlook:

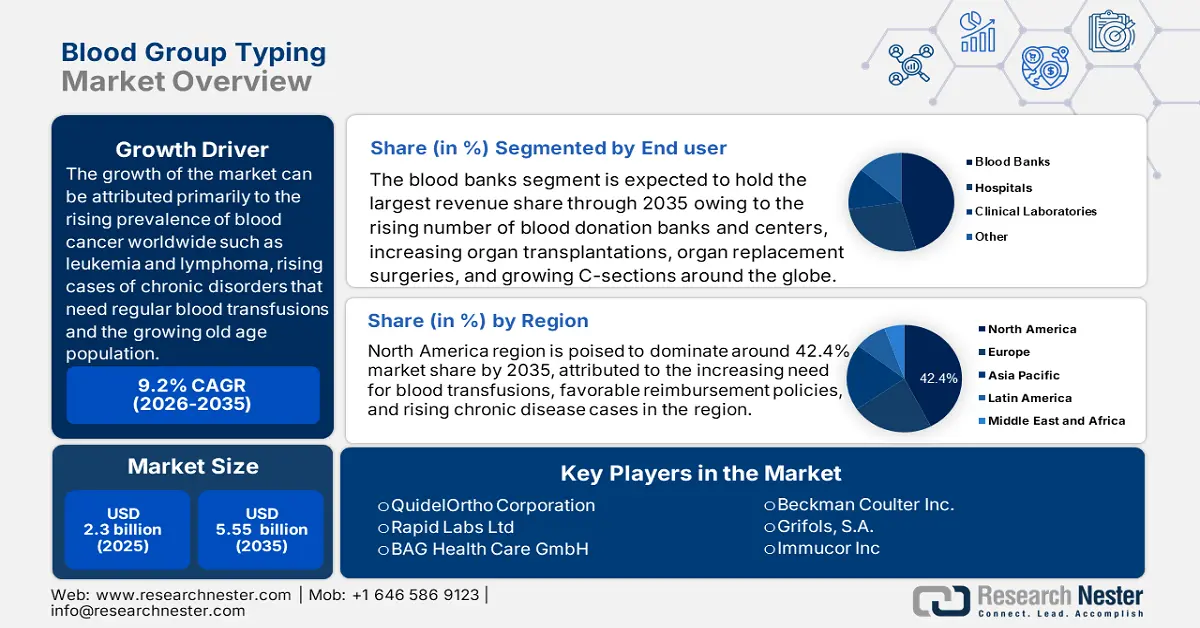

Blood Group Typing Market size was over USD 2.3 Billion in 2025 and is poised to exceed USD 5.55 Billion by 2035, witnessing over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blood group typing is estimated at USD 2.49 Billion.

The growth of the market can be attributed primarily to the rising prevalence of blood cancer worldwide such as leukemia and lymphoma, rising cases of chronic disorders that need regular blood transfusions such as anemia, and cancer, and the growing old age population as bone marrow of geriatrics cannot replenish blood that is lost. The rising prevalence of these diseases is anticipated to generate a high demand for blood group typing in the healthcare sector. According to the American Cancer Society, in the year 2022, 60,650 new cases of leukemia were diagnosed, 24,000 people died from leukemia, and 20,050 cases of acute myeloid leukemia (AML) were reported in the United States.

In addition to the aforementioned factor, the rise in the number of donations across the world is estimated to increase blood group typing procedures in the healthcare sector. Also, the high prevalence of accidents, injuries, and trauma that led to massive blood transfusion as a treatment is anticipated to bring more positive opportunities for the blood group typing market over the next years. Moreover, rising demand for blood and blood-related products, the emergence of advanced technologies, growing awareness of early disease diagnosis and screening, and the growing need for safe blood transfusions, coupled with a rise in blood donations worldwide, are expected to drive global blood group typing market growth during the forecast period. Approximately 40% of the 118.5 million blood donations collected worldwide are collected in high-income countries, home to 16% of the world's population, according to World Health Organization data. Furthermore, the global market is projected to witness steady growth over the analysis period on the account of the development of automated blood typing technologies such as polymerase chain reaction (PCR) which is based on microarray techniques that have enhanced the speed of transfusion diagnostics along with its standardization and safety.

Key Blood Group Typing Market Insights Summary:

Regional Highlights:

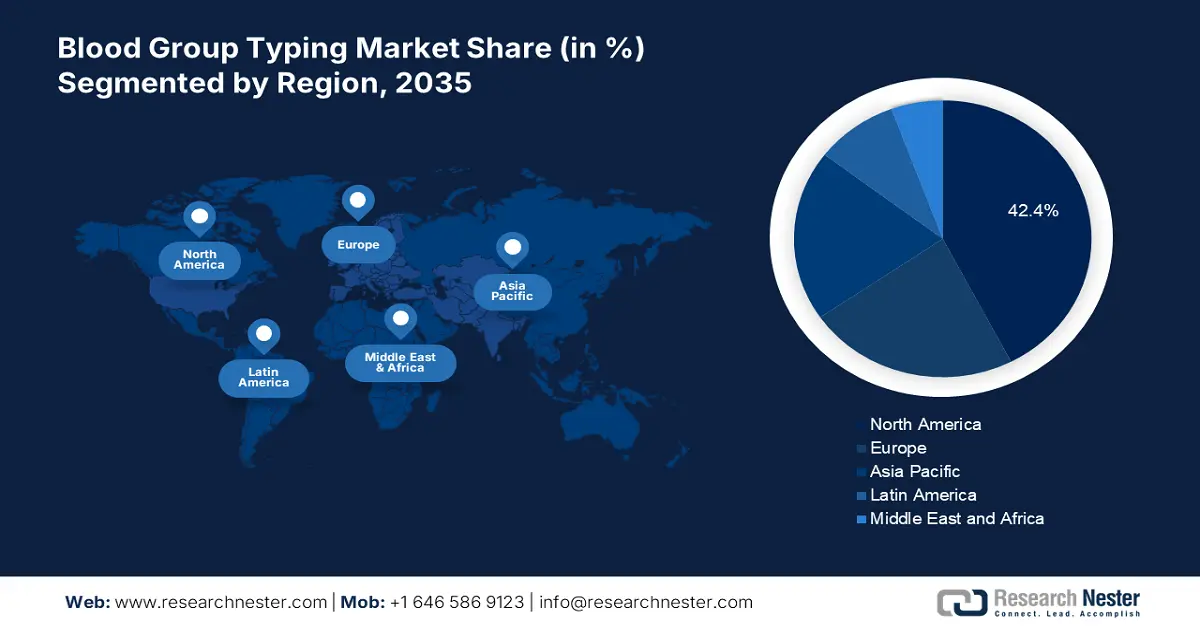

- North America blood group typing market will hold over 42.4% share by 2035, attributed to the increasing need for blood transfusions, favorable reimbursement policies, and rising chronic disease cases in the region.

- Asia Pacific market will capture a significant revenue share by 2035, driven by significant investments in advanced blood typing technologies and a large patient pool in need of blood transfusion diagnostics.

Segment Insights:

- The ABO (test type) segment in the blood group typing market is projected to hold a significant share by 2035, driven by its use in organ and tissue transplantation procedures.

- The blood banks segment in the blood group typing market is projected to hold the largest share by 2035, driven by the rising number of blood donation banks, organ transplantations, and C-sections globally.

Key Growth Trends:

- Increasing Prenatal Testing to Detect Genetic Disorders of Baby Before Birth

- Rising Prevalence of Thalassemia Worldwide with Increasing Migrations

Major Challenges:

- Reduction in Blood Donation Camps During COVID 19

- Risk of Concern During Blood Transfusion

Key Players: Seegene Inc,QuidelOrtho Corporation, Rapid Labs Ltd, BAG Health Care GmbH, Quotient Suisse SA, Bio-Rad Laboratories Inc., Beckman Coulter Inc., Grifols, S.A., Immucor Inc., Novacyt Group.

Global Blood Group Typing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 Billion

- 2026 Market Size: USD 2.49 Billion

- Projected Market Size: USD 5.55 Billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 10 September, 2025

Blood Group Typing Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Prenatal Testing to Detect Genetic Disorders of Baby Before Birth - To prevent hemolytic anemia in newborns during pregnancy (HDN), blood typing tests are very important during pregnancy. Hence, the rising demand for prenatal testing during pregnancy is expected to higher the adoption of blood group typing during the forecast period. For instance, 86% of pregnancies generally involved invasive diagnostic testing. As of 2019, in Taiwan trisomy 21 and 18 are found at a rate of 96% and 98%, respectively, compared to 74% and 82% respectively in 2006.

-

Rising Prevalence of Thalassemia Worldwide with Increasing Migrations - An individual with thalassemia has less hemoglobin than the average person due to an inherited blood disorder. Thus, for timely diagnosis of thalassemia and treatment, blood group typing technologies is anticipated to grow considerably over the next few years. It was observed that around the world, approximately 4.5 out of every 10,000 live births are affected by this disease.

-

Growing Need for Blood Transfusion Owing to Rising Surgeries, Injuries, and Illness - For instance, over 4.4 million people need blood transfusions every year in the United States. It is also anticipated that this number is expected to go up in the future.

-

Increasing Road Traffic Accidents as Drunk Driving, Speeding and Distracted Driving Grow - As a result of heavy blood loss during road traffic accidents, there is a surge in the demand for blood transfusions, which is projected to positively impact the blood group typing market. Around 1.3 million people die each year in road traffic accidents globally, according to the World Health Organization.

-

Growth in the Number of Blood Donors with Government Blood Camps Rising Awareness among People - For instance as compared to 2019, new donor registrations in 2020 grew from 23,990 to 36,500, with the greatest growth between weeks 11–20 from 10,880 to 26,620 in United States.

Challenges

- Lack of Healthcare Infrastructure in Developing Countries - Highly expensive healthcare facilities are not covered by insurance, and some do not have any insurance help. Growing living costs and increasing food prices leave no choice for low-income people but to let go of their healthcare needs.

- Reduction in Blood Donation Camps During COVID 19

- Risk of Concern During Blood Transfusion

Blood Group Typing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 2.3 Billion |

|

Forecast Year Market Size (2035) |

USD 5.55 Billion |

|

Regional Scope |

|

Blood Group Typing Market Segmentation:

End-user Segment Analysis

The global blood group typing market is segmented and analyzed for demand and supply by end-user in hospitals, blood banks, clinical laboratories, and others. Among these segments, the blood banks segment is anticipated to capture the largest market size in the global blood group typing market owing to the rising number of blood donation banks and centers, increasing organ transplantations, organ replacement surgeries, and growing C-sections around the globe. For instance, there are about 13,300 blood centers in 169 countries that reported collecting about 106 million blood donations worldwide. Moreover, increasing blood donation campaigns, and government initiatives to raise awareness about donating blood are expected to augment segment growth over the forecast period.

Test Type Segment Analysis

The global blood group typing market is also segmented and analyzed for demand and supply by test type into ABO, antigen, antibody screening, cross-matching, and HLA. Out of all these segments, the antibody screening segment is attributed to garner the highest segment share by the end of the forecast period. Several factors such as high blood transfusion cases, the high prevalence of chronic diseases among the world population, and the rising number of pregnant women are anticipated to augment the need for blood screening in hospitals and clinic settings. On the other hand, the ABO segment is also anticipated to hold a significant share by 2035. ABO blood typing is being heavily used to identify and match organs and tissue transplantation procedures thus, creating a positive outlook for segment growth. Further, patients requiring long-term transfusion therapy in case of chronic diseases including sickle cell disease to obtain phenotypically compatible units are also anticipated to impetus the requirement of blood group typing procedures during the forecast period.

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Group Typing Market Regional Analysis:

North American Market Insights

North America region is poised to dominate around 42.4% market share by 2035, attributed to the increasing need for blood transfusions, favorable reimbursement policies, and rising chronic disease cases in the region. For instance, nearly 5,000 units of platelets and 6.500 units of plasma are needed daily in the U.S. and Nearly 16 million blood components are transfused each year in the U.S. Furthermore, availability of favorable reimbursement policies, rising cases of chronic diseases many of which require blood type determination for effective treatment, and high prevalence of infectious diseases are expected to drive blood group typing market growth in the region during the forecast period.

APAC Market Statistics Market Insights

On the other hand, the market in the Asia Pacific region is also estimated to hold a significant market share. The massive investments in developing advanced blood group typing technologies along with the presence of a large pool of patients waiting for blood transfusion diagnostics are the major factors for the market growth during the forecast period. Rising healthcare expenditure and improved hospital settings for blood donations also anticipated to bring lucrative growth opportunities for the market.

Blood Group Typing Market Players:

- Seegene Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- QuidelOrtho Corporation

- Rapid Labs Ltd

- BAG Health Care GmbH

- Quotient Suisse SA

- Bio-Rad Laboratories Inc.

- Beckman Coulter Inc.

- Grifols, S.A.

- Immucor Inc.

- Novacyt Group

Recent Developments

-

QuidelOrtho Corporation has completed a merger between Quidel Corporation and Ortho Clinical Diagnostics Holdings plc to create QuidelOrtho, one of the leaders in invitro diagnostics.

-

Seegene Inc. and Bio-Rad Laboratories, Inc., a global leader in biotechnology, have announced a partnership to develop diagnostic testing products for the American market.

- Report ID: 4555

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Group Typing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.