Marine Scrubber System Market Outlook:

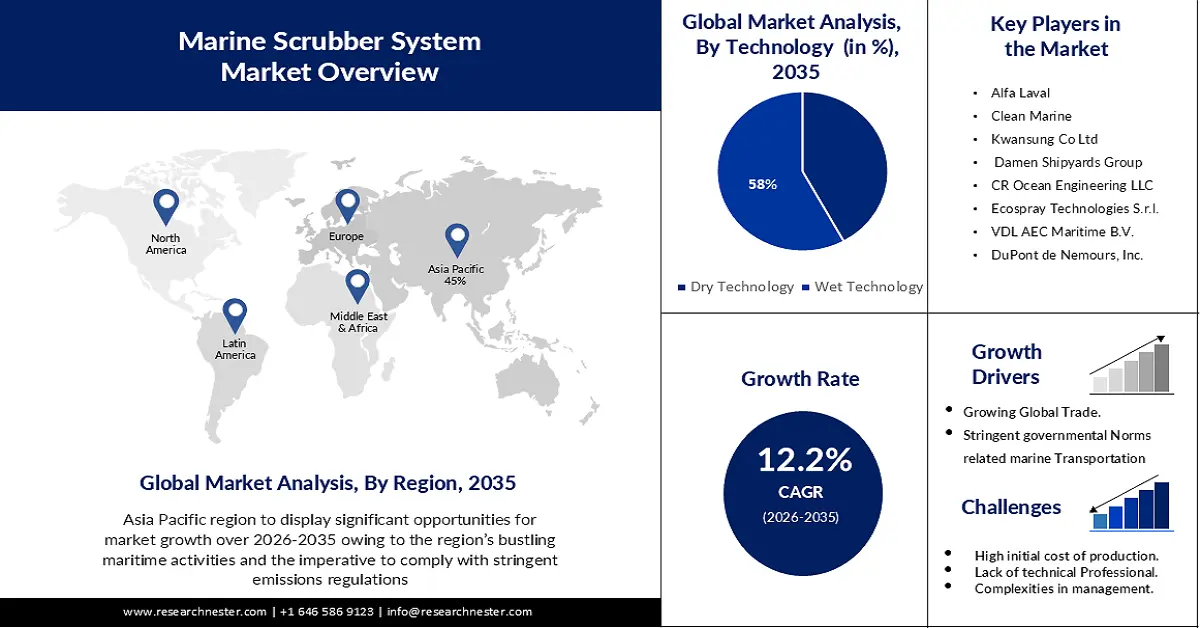

Marine Scrubber System Market size was valued at USD 7.9 billion in 2025 and is set to exceed USD 24.98 billion by 2035, registering over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine scrubber system is estimated at USD 8.77 billion.

The marine scrubber systems market statistics will be enhanced by the growth of sophisticated maritime systems that adhere to more stringent rules and regulations. The government is concentrating on lowering ship emissions as a result of a notable increase in maritime transportation. For instance, new legislative recommendations to cut net emissions by 55% by 2030 were agreed by the European Commission in July 2021. By extending the EU Emissions Trading System (ETS) to maritime traffic, this project is anticipated to cap emissions below the ETS level overall.

Also, marine scrubber systems offer a cost-effective solution for ship operators compared to alternative methods like switching to low-sulfur fuels. The initial investment in scrubber technology can be offset by the long-term savings on fuel costs, making it an attractive option for the shipping industry.

Key Marine Scrubber System Market Insights Summary:

Regional Highlights:

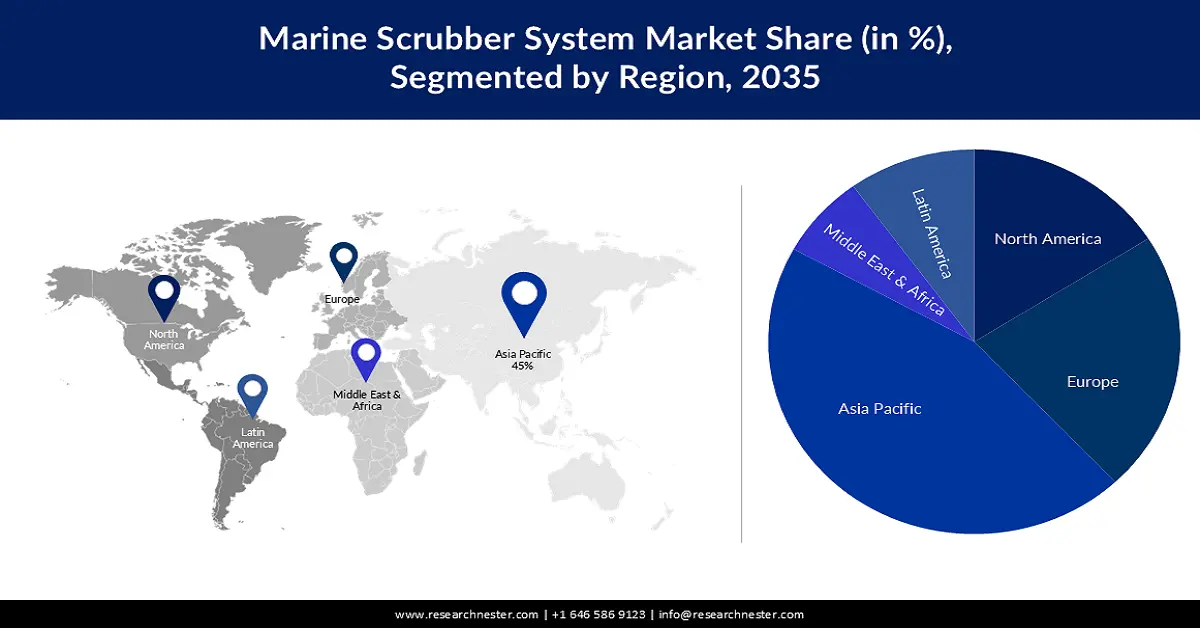

- Asia Pacific marine scrubber system market is expected to capture 45% share by 2035, driven by bustling maritime activities and compliance with stringent emissions regulations.

Segment Insights:

- Wet technology segment in the marine scrubber system market is forecasted to achieve 58% growth by the forecast year 2035, driven by growing adoption of sustainable scrubbing technologies with flexible operation.

- The hybrid fuel segment in the marine scrubber system market is projected to hold a majority share by 2035, driven by advancements in energy storage and emission-reduction technologies.

Key Growth Trends:

- Fuel Price Volatility

- Global Trade Growth

Major Challenges:

- Initial Investment Costs

Key Players: Alfa Laval, Clean Marine, Kwansung Co Ltd, Damen Shipyards Group, CR Ocean Engineering LLC, Ecospray Technologies S.r.l., VDL AEC Maritime B.V., DuPont de Nemours, Inc., Langh Tech Oy Ab, Valmet.

Global Marine Scrubber System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.9 billion

- 2026 Market Size: USD 8.77 billion

- Projected Market Size: USD 24.98 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Marine Scrubber System Market Growth Drivers and Challenges:

Growth Drivers

- Fuel Price Volatility- Fluctuations in fuel prices make low-sulfur fuels more expensive at times. Marine scrubber systems provide flexibility by allowing vessels to use higher-sulfur fuels, offering a hedge against unpredictable fuel cost variations contributing to operational cost stability, and promoting sustainable marine fuel. For instance, in November 2017, the NYK Group developed a fuel additive called Wax Breaker to combat coagulation. To ensure safe operations, it promotes the improvement of oil fluidity at temperatures below 40 C. To prevent coagulation at lower temperatures, it is inserted in MGO and MDO. It's helping to promote the safety of shipping, thus propelling the market’s growth.

- Global Trade Growth- The increasing demand for maritime transportation due to the growth in global trade enhances the need for fuel-efficient solutions. Marine scrubber systems enable vessels to comply with emissions standards while maintaining operational efficiency, aligning with the rising demand for shipping services.

- Technological Advancements – Ongoing advancements in marine scrubber technology are leading to more efficient and reliable systems. Continuous improvements in design and materials contribute to enhanced performance, durability, and ease of maintenance, encouraging the adoption of scrubber systems in the maritime sector.

- Long-term environmental sustainability- Beyond regulatory compliance, the maritime industry is increasingly recognizing the long-term environmental benefits of adopting cleaner technologies. Marine scrubber systems contribute to reducing air pollutants, greenhouse gas emissions, and overall environmental impact, aligning with broader sustainability goals.

Challenges

- Initial Investment Costs- One major challenge for the marine scrubber system market is the high upfront cost associated with purchasing and installing these systems. Shipowners may find it financially burdensome to make the initial investment, particularly for older vessels, despite potential long-term savings on fuel.

- The complexity of managing marine scrubber systems can pose a challenge for ship crews, potentially leading to operational inefficiencies, increased downtime, and higher maintenance.

- Shifts in fuel prices and availability may impact the economic viability of using scrubbers, affecting the return on investment for ship operators.

Marine Scrubber System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 7.9 billion |

|

Forecast Year Market Size (2035) |

USD 24.98 billion |

|

Regional Scope |

|

Marine Scrubber System Market Segmentation:

Technology Segment Analysis

Wet technology segment in the marine scrubber system market is estimated to hold the largest revenue share, accounting for 58%, owing to the growing adoption of sustainable scrubbing technologies. The preference for environmentally friendly wet scrubbing systems is also explained by its positive attributes, which include ease of design, flexibility in operation, and adaptability to different water alkalinity levels. Wet marine scrubber systems are quite effective; the open loop type treats exhaust and removes Sox using naturally occurring seawater that is available during the maritime voyage. They are preferred for use, especially for large ocean-going vessels that operate far from coastal areas, due to these utilization features.

Fuel Segment Analysis

Marine scrubber system market from the hybrid fuel segment is poised to garner the majority of the revenue share over the forecast period. Surging advancements in energy storage technology will drive the segment’s growth. For instance, in September 2022, Freudenberg e-power systems received type-approval from the Italian classification society RINA for the world’s first fuel cell system powered by methanol. This system utilizes fuel reforming technology combined with long-life PEM (proton exchange membrane) fuel-cell units that make up a scalable, modular system. Such developments, alongside the use of technology in mitigating local emissions in populated regions and maneuvering port operations in deep vessels, may proliferate the Industry growth from the hybrid fuel segment.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Fuel |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Scrubber System Market Regional Analysis:

APAC Market Insights

Asia Pacific marine scrubber system market is expected to hold the largest market share, amounting to 45% of the global market. The region is witnessing robust growth propelled by the region’s bustling maritime activities and the imperative to comply with stringent emissions regulations. For instance, Asia accounted for 42% of exports and 64% of imports in 2021, making it the top maritime freight handling hub in the globe. The major East-West routes, which connect Asia, Europe, and the United States, accounted for around 40% of all containerized traffic in 2021. 12.9% of all East-West travel was via non-mainland routes like the Mediterranean-South Asia. Governments, aligned with international standards like the IMO 2020 sulfur cap, are steering the maritime industry toward cleaner practices. The market is buoyed by the cost-effectiveness of scrubber systems in mitigating sulfur emissions, offering a strategic advantage amid fluctuating fuel prices. Asia Pacific’s vast shipping fleet and growing seaborne trade contribute to the increasing adoption of these technologies. Technological advancements and a burgeoning awareness of environmental sustainability further shape the market. The Asia Pacific market reflects a dynamic interplay of economic, regulatory, and environmental factors in the pursuit of cleaner and more compliant maritime operations.

European Market Insights

European marine scrubber system market is anticipated to hold a significant market share over the forecast period. The market is thriving amidst a maritime landscape marked by strict emission regulations and a commitment to sustainable shipping practices. European Union directives and the IMO’s sulfur emission caps are propelling the adoption of scrubber technologies across the region. The market is driven by a collective push towards environmental responsibility, aligning with the EU’s Green Deal and climate objectives. European shipowners, cognizant of the long-term economic benefits and compliance advantages, are increasingly investing in scrubber systems. The European market exemplifies a harmonized effort to balance economic efficiency with stringent emission standards in the pursuit of a greener maritime industry.

Marine Scrubber System Market Players:

- Yara International ASA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alfa Laval

- Clean Marine

- Kwansung Co Ltd

- Damen Shipyards Group

- CR Ocean Engineering LLC

- Ecospray Technologies S.r.l.

- VDL AEC Maritime B.V.

- DuPont de Nemours, Inc.

- LiqTech Holding A/S

- Langh Tech Oy Ab

- Valmet

Recent Developments

- To supply a low-maintenance wash water filtration system suitable for use with closed loop and hybrid scrubber applications, CR OCEAN ENGINEERING LLC has agreed with Oberlin Filter Company USA.

- Mitsubishi Shipbuilding Co., Ltd., a division of Mitsubishi Heavy Industries, Ltd. (MHI) Group, has acknowledged that its marine SOx scrubbers, the DIA-SOx R series, comply with the new SOx emissions requirements. Following confirmation of the excellent outcome of sea trials, the classification societies Lloyd's Register and Nippon Kaiji Kyokai approved the first two scrubber retrofitted units onboard ultra-large container ships. As a result, the Flag States of Panama and Singapore also approved the units.

- Report ID: 5585

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine Scrubber System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.