Education Technology Market Outlook:

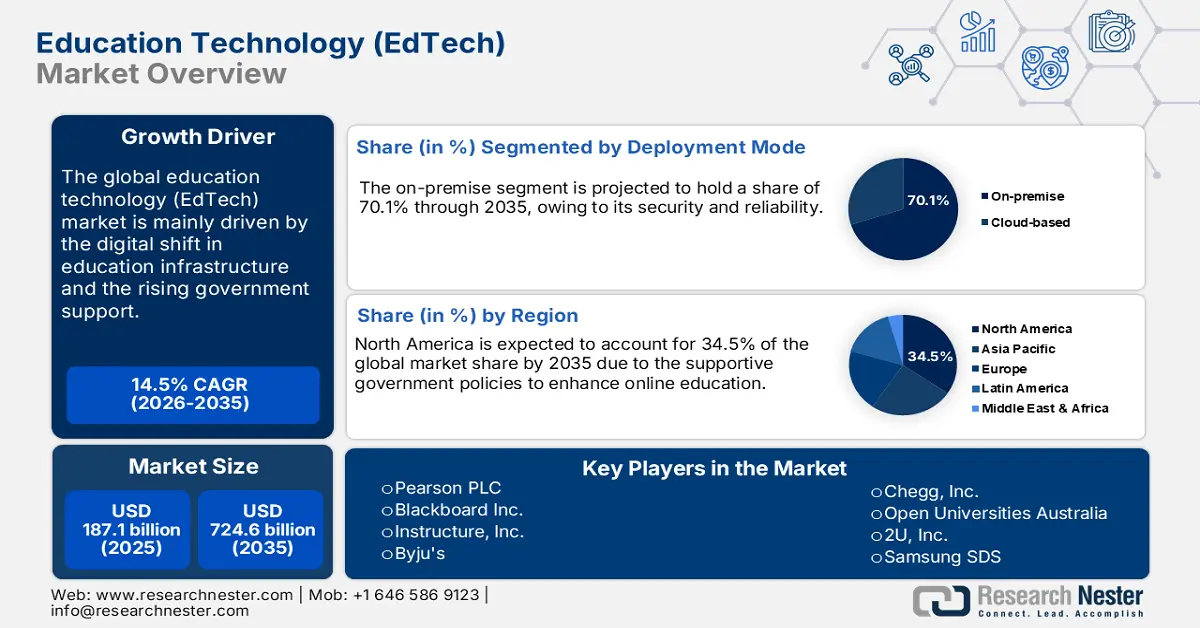

Education Technology Market size was USD 187.1 billion in 2025 and is estimated to reach USD 724.6 billion by the end of 2035, expanding at a CAGR of 14.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of education technology is assessed at USD 214.2 billion.

The EdTech solution sales are mainly driven by the production and supply of software platforms and hardware components such as tablets, smartphones, laptops, and VR/AR headsets. The raw materials, such as semiconductors and batteries used for the production of these technologies, are produced in the U.S., China, South Korea, and Japan. The U.S. Bureau of Labor Statistics (BLS) states that in August 2025, the producer price index (PPI) for computer and peripheral equipment manufacturing stood at 60.720. The increasing domestic and cross-border trade of smart devices represents lucrative opportunities for education technology manufacturers.

|

Global Educational Spending Per Pupil |

||

|

Country |

Elementary Schools |

Secondary Schools |

|

Luxembourg |

$25,584 |

$29,988 |

|

Korea |

$14,873 |

$19,360 |

|

Slovenia |

$12,170 |

$11,964 |

|

France |

$10,554 |

$15,463 |

|

Spain |

$10,181 |

$12,542 |

|

New Zealand |

$8,967 |

$10,690 |

|

Colombia |

$4,364 |

$4,335 |

|

Mexico |

$2,933 |

$3,242 |

Source: Education Data Initiative

The Federal Reserve Bank of St. Louis reveals that the producer price index for net inputs to educational and vocational structures, trade services, was calculated at 169.140 in August 2025. Also, according to the Education Data Initiative 2025 report, the federal, state, and local governments spend around USD 878.2 billion, or about $17,700 per student, to support K-12 public schools. Such positive public spending strategies are expected to propel the sales of digital learning technologies in the years ahead.

Key Education Technology Market Insights Summary:

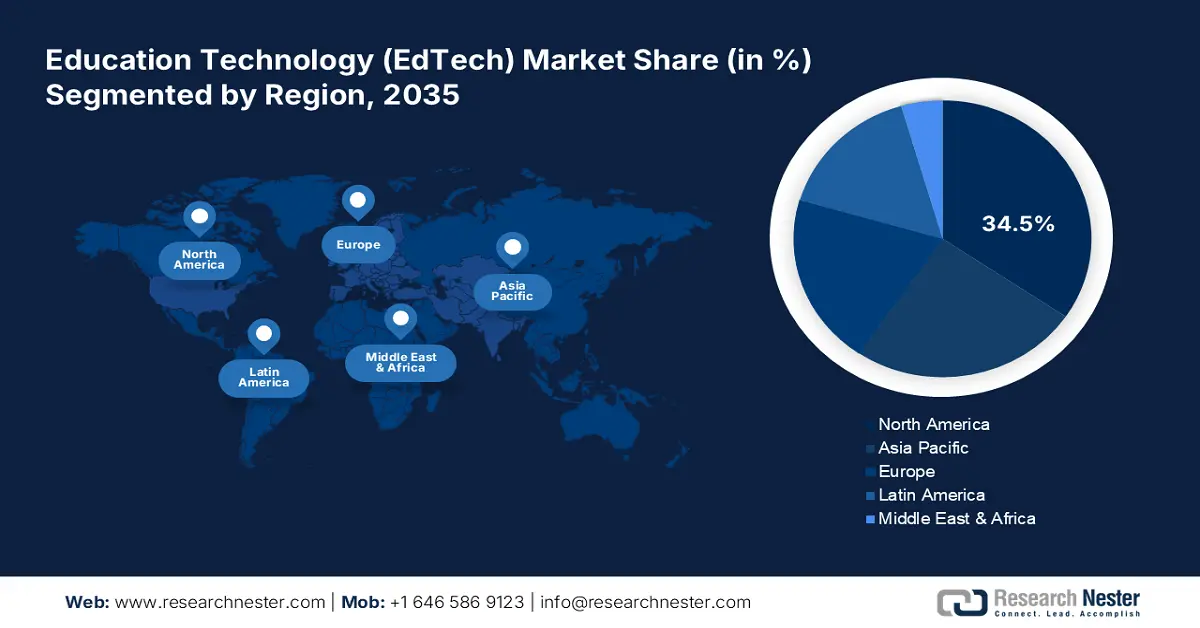

Regional Highlights:

- The North America education technology market is predicted to hold a 34.5% share by 2035, propelled by next-gen digital infrastructure and robust internet connectivity.

- The Asia Pacific market is expected to grow at a CAGR of 12.9% during 2026–2035, impelled by increasing investments in ICT and digital education infrastructure.

Segment Insights:

- The on-premise segment is projected to capture 70.1% of the Education Technology Market share through 2035, driven by security and reliability factors.

- The hardware segment is estimated to hold 41.5% share by 2035, fueled by technological advancements and rising demand for customized and advanced EdTech solutions.

Key Growth Trends:

- Surge in mobile learning and BYOD policies

- Government-backed digital education initiatives

Major Challenges:

- Unstable pricing models

- Poor digital infrastructure

Key Players: Blackboard Inc., Instructure, Inc., Byju's, Chegg, Inc., Open Universities Australia, Kahoot! AS, Samsung SDS, 2U, Inc., Wiley & Sons, Top Hat, Simplilearn, Mindvalley, Coursera, Edmentum, Benesse Corporation, Z-kai Inc., JMO Corporation, Classi Corp, Gakken Holdings.

Global Education Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 3 October, 2025

Education Technology Market - Growth Drivers and Challenges

Growth Drivers

- Surge in mobile learning and BYOD policies: The growth in BYOD policies in the education systems is expected to drive the use of online education software solutions. As per the analysis by the Global System for Mobile Communications Association (GSMA) in 2025, 5G services have reached over half of the world’s population (54%), and 4G is available to 93% of people. The rise in smartphone penetration is also boosting the demand for mobile-friendly EdTech platforms. Asian countries are modernizing their education systems, and the favorable policies are accelerating the demand for mobile education technologies. Furthermore, in Europe, more people are using their own devices for work or school, owing to the high levels of mobile device ownership, easy availability of public Wi-Fi, fast home internet, and strong connectivity networks.

- Government-backed digital education initiatives: The robust capital spending on the modernization of education infrastructure is poised to boost the sales of online learning technologies worldwide. The PM eVidya program by the government of India is bridging digital access in K-12 education. The India Brand Equity Foundation (IBEF) reports that India’s EdTech sector is estimated to surpass USD 29 billion by 2030. The continuous technological innovation and collaborations with public entities are set to offer high-earning opportunities for education technology producers.

- Technological innovations: The technological advancements are set to uplift the profit shares of EdTech companies in the coming years. The modernization of education systems fuels the sales of innovative digital skilling solutions. The integration of AI and ML is also poised to boost the productivity and effectiveness of the EdTech platforms. The tech-savvy end users are set to lead the sales of AI and ML-powered online learning software systems in the years ahead. In July 2025, the American Federation of Teachers (AFT), together with the United Federation of Teachers, Microsoft Corp., OpenAI, and Anthropic, launched the National Academy for AI Instruction. This USD 23 million program is set to offer free AI training and resources to all 1.8 million AFT members, starting with K-12 teachers. Thus, technological innovations are expected to be the game changers for the Ed Tech market.

Challenges

- Unstable pricing models: The fluctuating tariffs and currency exchange are hindering the sales of advanced education technologies. The shifts in the taxation and subscription licensing laws lead to instabilities in the pricing of the online learning solutions. The most affected products are SaaS-based platforms, due to consistent regulatory hurdles and a single pricing model internationally. This instability also affects operational efficiency and limits the adoption rates of new education technologies.

- Poor digital infrastructure: The infrastructure gaps are hampering the adoption of online learning platforms. The budget constraint education technology (EdTech) market are lacking in advanced education infrastructure and internet connectivity. According to an analysis by the International Telecommunication Union (ITU), around 38% of Internet penetration was reported in Africa in 2024. Due to this, many education technology companies are deterring from investing in these regions.

Education Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 187.1 billion |

|

Forecast Year Market Size (2035) |

USD 724.6 billion |

|

Regional Scope |

|

Education Technology Market Segmentation:

Deployment Mode Segment Analysis

The on-premise segment is projected to capture 70.1% of the EdTech market share through 2035. Security and reliability are prime factors influencing the sales of on-premise education technologies. The majority of educational institutions in developed markets prefer on-premise solutions as they offer direct management of sensitive student and staff data. The stringent privacy regulations, such as GDPR, also necessitate institutions to invest in on-premise EdTech platforms.

Type Segment Analysis

The hardware segment is estimated to hold 41.5% of the EdTech market share throughout the study period. The specialized hardware components are vital for the production of advanced EdTech solutions. Governments and institutions heavily invest in hardware to bridge the digital divide, particularly in primary and secondary education. The U.S. Bureau of Labor Statistics reveals that the producer price index for hardware manufacturing stood at 214.010 in August 2025. The continuous technological advancements and increasing demand for customized and advanced Edtech solutions are likely to fuel the sales of specialized hardware components in the years ahead.

Sector Segment Analysis

The K-12 school segment is anticipated to hold 42.3% of the EdTech market share throughout the forecast period. The digital transformation programs are boosting the K-12 learning platforms. North America, Asia-Pacific, and Europe are expected to lead the sales of K-12 digital learning solutions in the coming years. The World Economic Forum (WEF) estimates that in the coming decade, there are expected to be 800 million primary and secondary school graduates and 350 million college graduates worldwide. The same source also projects that the global spending on education is expected to reach USD 10 trillion by 2030, with educational technology (Edtech) playing a key role in this growing education system. The rising investments in online learning platforms are estimated to propel the overall segmental growth in the years ahead.

Our in-depth analysis of the EdTech market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Model |

|

|

Learning Type |

|

|

Sector |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Education Technology Market - Regional Analysis

North America Market Insights

The North America education technology market is expected to capture 34.5% of the global revenue share through 2035. The next-gen digital infrastructure and robust internet connectivity are fueling the adoption of EdTech technologies in the region. The increasing investments in the 5G infrastructure projects and booming innovations in digital technologies are foreseen to increase the sales of next-gen learning solutions. The shift towards public-private investments is leading to the modernization of the digital education system in both the U.S. and Canada.

The robust access to high-speed internet networks is increasing the use of online learning platforms in the U.S. Through the Emergency Broadband Benefit program, more than 7.5 million households have successfully and smoothly accessed the internet in the country. Furthermore, high budgets for the expansion of digital education infrastructure are set to attract several EdTech investors in the coming years. In September 2025, First Lady Melania Trump announced the launch of Fostering the Future Together. This initiative indicates that a global group of countries is working to improve children’s lives through better education, innovation, and technology. The first step includes partnering with private companies to offer kids access to new educational tools, including robotics, AI, and blockchain. Such initiatives are poised to positively influence the sales of EdTech solutions in the years ahead.

Similar to the U.S., in Canada, the supportive government policies and funding initiatives are expected to boost the sales of digital education technologies during the foreseeable period. The government announced that the USD 2.35 billion Universal Broadband Fund is focused on bringing high-speed internet to projects across the country. The expansion of the 5G network in the country is set to increase the adoption of digital learning platforms. The government also aims to offer internet to 100% of individuals by 2030. Furthermore, in March 2023, the Minister of Innovation, Science, and Industry announced that 23 non-profit organizations across Canada were estimated to receive around USD 12.85 million in funding for the second phase of the Digital Literacy Exchange Program (DLEP). This funding aims to help these groups teach digital skills to people who need them the most. Thus, the supportive government policies and funding are set to transform the Canada EdTech market in the years ahead.

APAC Market Insights

The Asia Pacific education technology (EdTech) market is foreseen to rise at a CAGR of 12.9% between 2026 and 2035. The increasing investments in ICT and the digital education infrastructure are expected to boost the sales of innovative EdTech solutions in the years ahead. The strong presence of key players in Japan, China, India, and South Korea is set to fuel the sales of innovative digital learning solutions. The supportive government policies and funding are also anticipated to boost the revenues of education technology companies.

China is expected to lead the sales of EdTech solutions during the projected period, owing to high public investments in the modernization of education systems. The cloud-first strategies are also increasing the use of scalable digital education software solutions in public schools. The International Trade Administration (ITA) reports that China has the world’s biggest education system, with 270 million students, 16 million teachers, and over 500,000 schools. The evolving education sectors are directly opening high-earning opportunities for EdTech solution producers.

The growth in the upgradation of education infrastructure and public-private investments in robust connectivity networks is poised to drive the growth of the India EdTech market through 2035. The 2024-25 Interim Budget allocated a record USD 8.82 billion to the Department of School Education and Literacy. The Digital Bharat and Make in India initiatives are attracting new companies to enter the EdTech business. The AI and ML trend is also poised to fuel innovations in India-manufactured EdTech systems.

Europe Market Insights

The Europe EdTech market is projected to account for the second-largest share through 2035. The robust digitalization is anticipated to fuel the trade of online learning applications in the years ahead. The rising Internet penetration and EU-funded digital education initiatives are further contributing to the increasing sales of EdTech platforms. The growing demand for personalized learning platforms is set to reshape the education technology market in the years ahead.

The strong startup ecosystem and supportive government funding are expected to drive the U.K. EdTech market growth during the foreseeable period. The increasing demand for English-language education is also likely to fuel innovations in the years ahead. The British Educational Suppliers Association (BESA) reports that in the 2022/23 school year, primary schools in the U.K. spent an average of USD 20,160 on IT, while secondary schools spent an average of USD 81,270. This indicates that digitalization is opening lucrative doors for EdTech solution producers.

The Germany education technology market is poised to be driven by the strong federal and state-level investment in digital education. The DigitalPakt Schule program, which allocates around USD 7.15 billion in funding, is also a key driver for the sales of EdTech solutions. The swift rise in the digital infrastructure expansion, including the education sector, is accelerating the application of the latest skilling technologies. The corporate learning and vocational training segment is also propelling the demand for dual-education models.

Key Education Technology Market Players:

- Pearson PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blackboard Inc.

- Instructure, Inc.

- Byju's

- Chegg, Inc.

- Open Universities Australia

- Kahoot! AS

- Samsung SDS

- 2U, Inc.

- Wiley & Sons

- Top Hat

- Simplilearn

- Mindvalley

- Coursera

- Edmentum

- Benesse Corporation

- Z-kai Inc.

- JMO Corporation

- Classi Corp

- Gakken Holdings

The EdTech market is characterized by the presence of key players and the increasing emergence of new companies. The industry giants are investing heavily in research and development activities to introduce next-gen education technologies. They are also forming strategic collaborations and partnerships with other players to increase their education technology (EdTech) market share and revenue streams. Startups are focused on the introduction of innovative digital learning platforms to stand out from the crowd. The personalization trends are set to double the revenues of key EdTech manufacturers in the coming years. The key players are also employing regional expansion strategies to earn lucrative gains from untapped opportunities.

Recent Developments

- In August 2025, the San Diego County Office of Education started a new online training series to help families deal with technology challenges. The eight-part program aims to teach parents about online safety and help them support their child’s learning in the digital world.

- In July 2025, Pearson opened a new center in its London offices to create and test products and services using the latest technologies for learning at school and work. This Lab is set to have a global impact, keeping Pearson a leader in innovation.

- Report ID: 3403

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Education Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.