Magnetorheological Fluid Market Outlook:

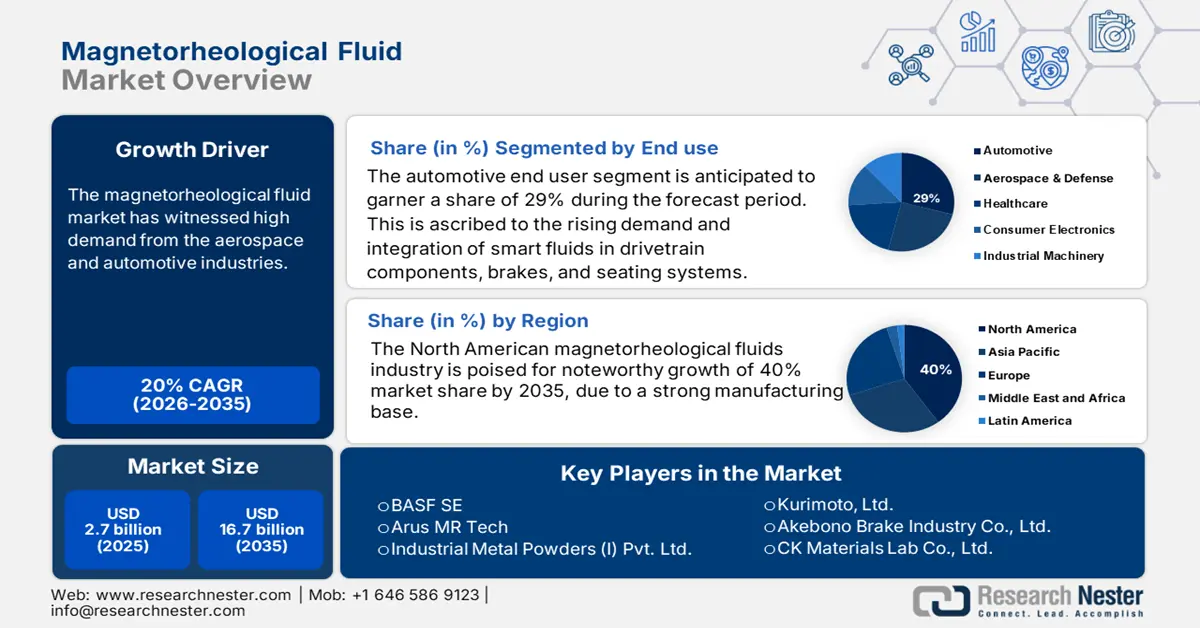

Magnetorheological Fluid Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 16.7 billion by the end of 2035, rising at a CAGR of 20% during the forecast period, i.e., 2026-2035. In 2026, the industry size of magnetorheological fluid is assessed at USD 3.2 billion.

The magnetorheological fluid market has witnessed high demand from the aerospace and automotive industries. The worldwide shipments of aircraft surpassed USD 15 billion in 2021. FAA in its report projected that the turbine-powered fleet (comprising rotorcraft) is set to grow by 15,750 units between 2021 and 2042, reaching 46,060 by 2042 and expanding at a rate of 1.9% on a yearly basis. During the same period, the turbojet fleet is also anticipated to expand at a 2.6% rate. Moreover, system traffic is projected to increase by 5.7% a year between 2022 and 2042. In terms of economic contributions and opportunities, the U.S. aerospace and defense sector demonstrated a 7.1% surge between 2022-2023, underlining a staggering USD 955 billion in sales revenue in 2023. Commercial sales totaled USD 311 billion, and defense was over USD 221 billion. Whereas the supply chain accounted for USD 422 billion in revenue output. The booming aerospace market offers massive growth prospects for magnetorheological fluid market.

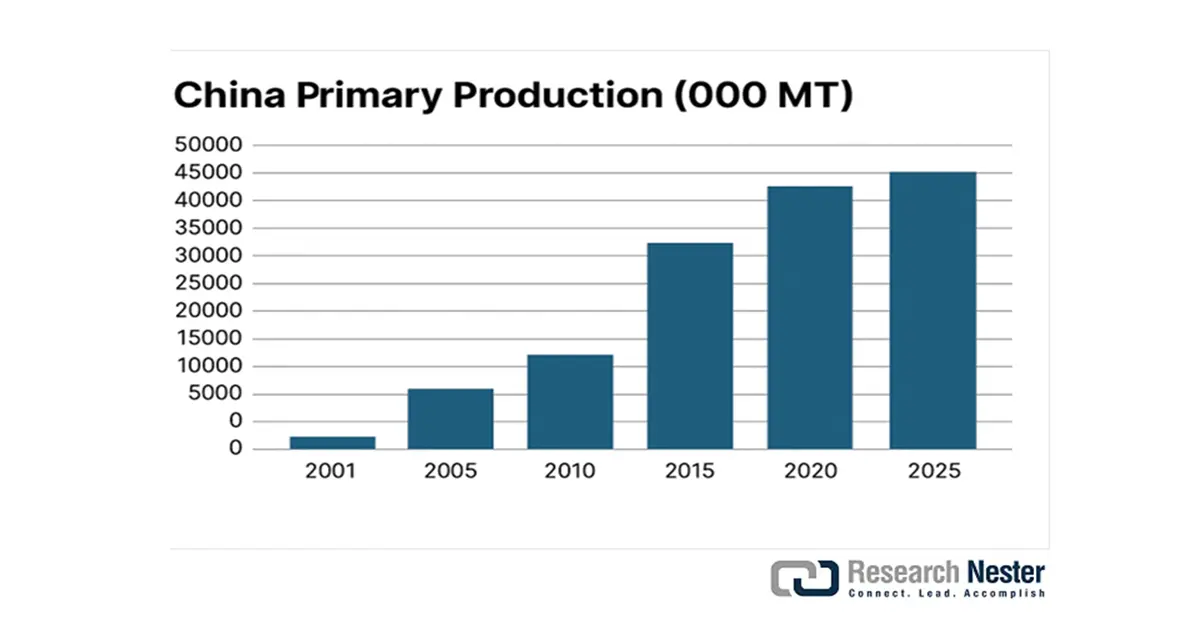

Magnetic micro-sized iron particles, additives, and non-magnetic-based fluids constitute the primary raw material supply chain. Many additives, such as oleic acid, lithium grease, aluminum stearate, guar gum, laponite, ethylene glycol monostearate, polystyrene, tetramethyl ammonium hydroxide, and stearic acid, are typically used to improve the stability and performance of magnetorheological fluids. Stearic acid reflected a cumulative trade value of USD 13.9 billion in 2023, growing at a rate of 6.4% during 2019 and 2023, as per OEC. The key exporters were Indonesia (USD 5.63 billion), Malaysia (USD 2.67 billion), and the Netherlands (USD 1.1 billion), and the importers comprised China (USD 2.37 billion), the Netherlands (USD 1.64 billion), and Italy (USD 943 million). Aluminum is a primary raw material used for manufacturing aluminum stearate, reaching a manufactured volume of 12 million metric tons in 2024 in the U.S., exhibiting an annual growth rate of 2.5%. Over the past few years, China has vaulted to emerge as top aluminum producer. Additionally, OEC data shows that the worldwide trade of iron and steel in 2023 was USD 477 billion and ranked 10th among 96 products traded.

Iron & Steel Imports and Exports, 2023

|

Importer |

Value |

Exporter |

Value |

|

China |

USD 35.2 billion |

China |

USD 66.2 billion |

|

The U.S. |

USD 33.1 billion |

Germany |

USD 32.6 billion |

|

Germany |

USD 27.8 billion |

Japan |

USD 31.6 billion |

Source: OEC

Source: The Aluminum Association

In 2025, the U.S. primary aluminum industry is operating at a capacity utilization of 53%, with 6 smelters. Subsidized Chinese production and high dependence on foreign entities for the supply chain, including raw material sourcing, have gutted the industry. According to a 2025 report by The Aluminum Association, China accounts for 90% of the worldwide production and supply of magnesium and rare earths, thereby affecting aluminum prices. In the U.S., Indiana power costs were USD 82.40 per MWh in 2023; Missouri was USD 79.00; Kentucky was USD 65.50; and South Carolina $66.80, or an average of USD 73.42 per MWh. The government is keen on bridging the gap between rising aluminum demand and declining U.S. primary production. The raw material supply chain for MRF is dependent on iron-based particles and carrier fluids, with production capacity expanding to meet rising demand. The FRED states that the producer price index (PPI) was 300.802 for industrial chemicals in July 2025, which dropped from 311.675 in July 2024.

Producer Price Index by Commodity: Chemicals and Allied Products: Industrial Chemicals

Source: FRED

The critical criterion to identify the optimal additive is dependent on the carrier medium. Typically, magnetorheological fluid is comprised of guar gum powder, silicone oil, and carbonyl iron particles. The resilience in the overall raw material supply chain has fostered the development of the market. The world trade for natural gums, resins, and miscellaneous vegetable extracts was USD 9.22 billion in 2023, expanding at an annualized growth rate of 2.56%, finds OEC. The top three exporters were China with an export value of USD 1.67 billion, India (USD 1.11 billion), and France (USD 771 million), and the key importers were the U.S. (USD 1.59 billion), Germany (USD 631 million), and China (USD 471 million).