Magnetorheological Fluid Market Outlook:

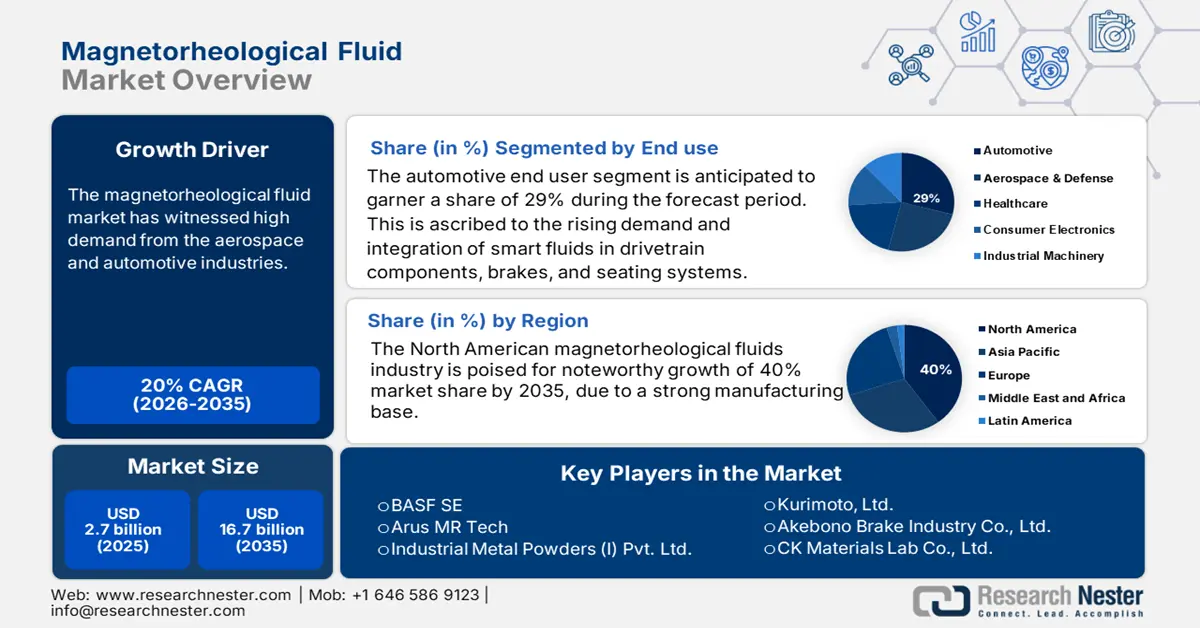

Magnetorheological Fluid Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 16.7 billion by the end of 2035, rising at a CAGR of 20% during the forecast period, i.e., 2026-2035. In 2026, the industry size of magnetorheological fluid is assessed at USD 3.2 billion.

The magnetorheological fluid market has witnessed high demand from the aerospace and automotive industries. The worldwide shipments of aircraft surpassed USD 15 billion in 2021. FAA in its report projected that the turbine-powered fleet (comprising rotorcraft) is set to grow by 15,750 units between 2021 and 2042, reaching 46,060 by 2042 and expanding at a rate of 1.9% on a yearly basis. During the same period, the turbojet fleet is also anticipated to expand at a 2.6% rate. Moreover, system traffic is projected to increase by 5.7% a year between 2022 and 2042. In terms of economic contributions and opportunities, the U.S. aerospace and defense sector demonstrated a 7.1% surge between 2022-2023, underlining a staggering USD 955 billion in sales revenue in 2023. Commercial sales totaled USD 311 billion, and defense was over USD 221 billion. Whereas the supply chain accounted for USD 422 billion in revenue output. The booming aerospace market offers massive growth prospects for magnetorheological fluid market.

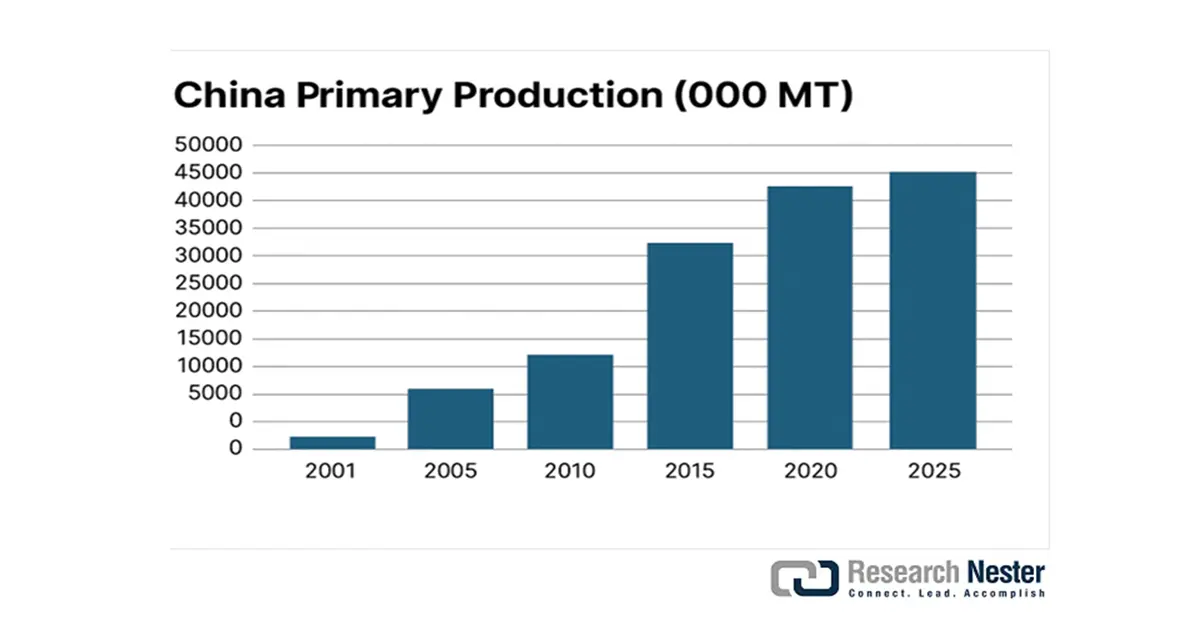

Magnetic micro-sized iron particles, additives, and non-magnetic-based fluids constitute the primary raw material supply chain. Many additives, such as oleic acid, lithium grease, aluminum stearate, guar gum, laponite, ethylene glycol monostearate, polystyrene, tetramethyl ammonium hydroxide, and stearic acid, are typically used to improve the stability and performance of magnetorheological fluids. Stearic acid reflected a cumulative trade value of USD 13.9 billion in 2023, growing at a rate of 6.4% during 2019 and 2023, as per OEC. The key exporters were Indonesia (USD 5.63 billion), Malaysia (USD 2.67 billion), and the Netherlands (USD 1.1 billion), and the importers comprised China (USD 2.37 billion), the Netherlands (USD 1.64 billion), and Italy (USD 943 million). Aluminum is a primary raw material used for manufacturing aluminum stearate, reaching a manufactured volume of 12 million metric tons in 2024 in the U.S., exhibiting an annual growth rate of 2.5%. Over the past few years, China has vaulted to emerge as top aluminum producer. Additionally, OEC data shows that the worldwide trade of iron and steel in 2023 was USD 477 billion and ranked 10th among 96 products traded.

Iron & Steel Imports and Exports, 2023

|

Importer |

Value |

Exporter |

Value |

|

China |

USD 35.2 billion |

China |

USD 66.2 billion |

|

The U.S. |

USD 33.1 billion |

Germany |

USD 32.6 billion |

|

Germany |

USD 27.8 billion |

Japan |

USD 31.6 billion |

Source: OEC

Source: The Aluminum Association

In 2025, the U.S. primary aluminum industry is operating at a capacity utilization of 53%, with 6 smelters. Subsidized Chinese production and high dependence on foreign entities for the supply chain, including raw material sourcing, have gutted the industry. According to a 2025 report by The Aluminum Association, China accounts for 90% of the worldwide production and supply of magnesium and rare earths, thereby affecting aluminum prices. In the U.S., Indiana power costs were USD 82.40 per MWh in 2023; Missouri was USD 79.00; Kentucky was USD 65.50; and South Carolina $66.80, or an average of USD 73.42 per MWh. The government is keen on bridging the gap between rising aluminum demand and declining U.S. primary production. The raw material supply chain for MRF is dependent on iron-based particles and carrier fluids, with production capacity expanding to meet rising demand. The FRED states that the producer price index (PPI) was 300.802 for industrial chemicals in July 2025, which dropped from 311.675 in July 2024.

Producer Price Index by Commodity: Chemicals and Allied Products: Industrial Chemicals

Source: FRED

The critical criterion to identify the optimal additive is dependent on the carrier medium. Typically, magnetorheological fluid is comprised of guar gum powder, silicone oil, and carbonyl iron particles. The resilience in the overall raw material supply chain has fostered the development of the market. The world trade for natural gums, resins, and miscellaneous vegetable extracts was USD 9.22 billion in 2023, expanding at an annualized growth rate of 2.56%, finds OEC. The top three exporters were China with an export value of USD 1.67 billion, India (USD 1.11 billion), and France (USD 771 million), and the key importers were the U.S. (USD 1.59 billion), Germany (USD 631 million), and China (USD 471 million).

Key Magnetorheological Fluid Market Insights Summary:

Regional Highlights:

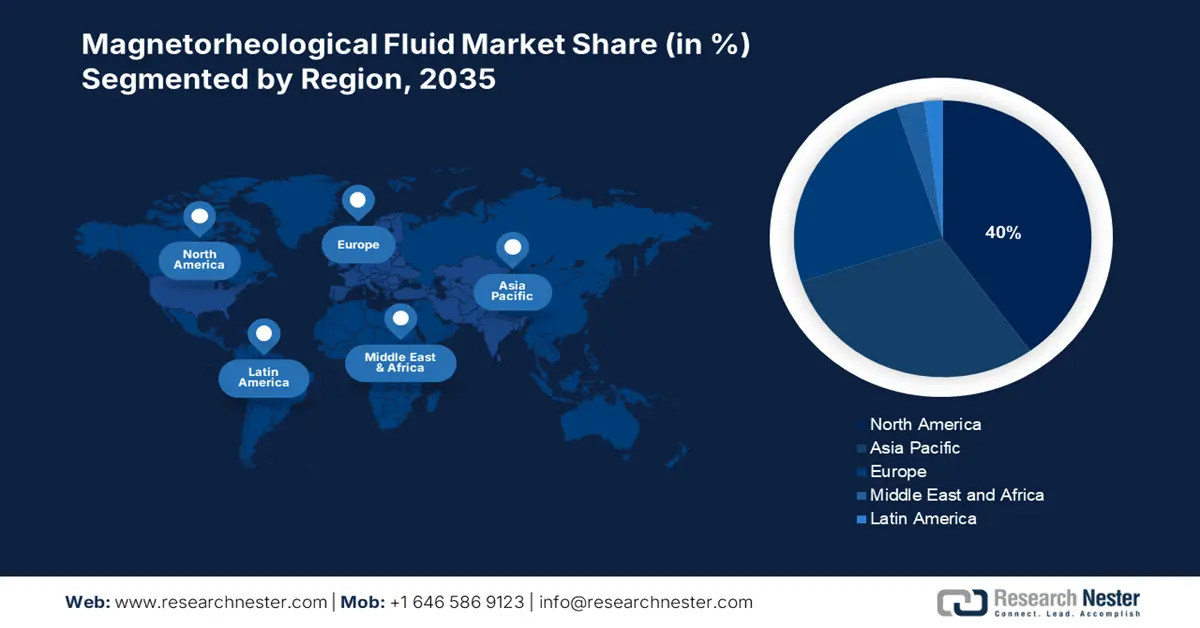

- The North American magnetorheological fluid market is poised to capture a 40% share by 2035, impelled by a strong manufacturing base supported by substantial government investment in domestic automotive manufacturing.

- The Asia Pacific market is expected to hold 35% of the global revenue share by 2035, fueled by the deployment of MRFs in automotive dampers, robotics, precision engineering, and defense sectors.

Segment Insights:

- The automotive end user segment in the magnetorheological fluid market is projected to capture a 29% share by 2035, propelled by the rising demand and integration of smart fluids in drivetrain components, brakes, and seating systems.

- The automotive suspension systems application is expected to account for 30% of the market by 2035, owing to the shift towards semi-autonomous vehicles and EVs advancing magnetorheological fluid damper developments.

Key Growth Trends:

- Rising MR application & subsequent technological developments

- Developments in MRF-driven aircraft landing systems

Major Challenges:

- High cost of MR fluid

- Temperature sensitivity and durability issues

Key Players: Lord Corporation, QED Technologies, Liquids Research Limited, BASF SE, Arus MR Tech, Industrial Metal Powders (I) Pvt. Ltd., Kurimoto, Ltd., Akebono Brake Industry Co., Ltd., CK Materials Lab Co., Ltd., Ioniqa Technologies, MRF Engineering, Kolektor Group, Anton Paar GmbH, ArProDEC, Metal Powder Industries Federation

Global Magnetorheological Fluid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.7 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 16.7 billion by 2035

- Growth Forecasts: 20% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Brazil, Mexico, Canada, France

Last updated on : 28 August, 2025

Magnetorheological Fluid Market - Growth Drivers and Challenges

Growth Drivers

- Rising MR application & subsequent technological developments: The magnetorheological fluids are popularly known as smart materials, owing to their versatility across end users such as automobile, healthcare, and construction, among several others. The MR damper utilizes the synergic effects of a magnetic damper and a variable viscosity squeezed film damper. As per a 2024 Manufacturing Review publication, MR fluids employed for braking applications consist of a Csi 45% solution (49% silicon oil, 45% carbonyl iron particles, and 1% additive). It showcased 92.34 kPa maximum yield strength. CI powder proves to be a better alternative for braking applications as compared to EI powder. The market landscape is evolving with the ongoing launch of automotive dampers. In December 2024, ZF announced the development of sMOTION active chassis dampers for boosting the driving experience. Similarly, earlier that year, in July 2024, BILSTEIN unveiled the DampTronic II, a semi-active chassis system offering cost-effectiveness and efficiency.

- Developments in MRF-driven aircraft landing systems: Dampers in aircraft are different from the on-road vehicle counterparts as the former not only improve the comfort in the taxing phase, but also absorb the landing impact. Semi-active and active landing gear systems have largely replaced traditional landing gear systems. The magnetorheological semi-active dampers are highly controllable and can be transformed from a fluid state to a semi-solid from in an applied magnetic field. Researchers have been striving to integrate aircraft landing gear systems with the negative stiffness mechanism by using an MR damper. For example, in April 2024, Byung-Hyuk Kang designed an MRF-based aircraft main landing gear system (MRAMLG) using a comprehensive skyhook controller, finite element method (FEM), and rainflow-counting (RC) algorithm.

- Rising use case in prosthetics: Magnetorheological fluids have a widespread application in developing prosthetics, dampers in vehicles and buildings, brakes, and clutches. The U.S. Government Accountability Office (GAO) October 2024 report suggests that 2 million people in the country live with limb loss, and this is anticipated to double by 2050. 200,000 individuals are projected to suffer limb loss annually. Typically, individuals experience limb loss due to sustaining a traumatic accident or diseases such as diabetes and CVD. Prosthetic and orthotic technologies are a rapidly growing medical device industry worth USD 8 billion in Canada and the U.S, with over USD 150 billion. The process of prosthetic and orthotic device procurement includes several stakeholders who determine costs and insurer strategies.

Japan R&D and Capital Investment Trends in Magnetorheological Fluids

|

Company Name |

Focus Areas |

Alignment with Global Trends |

|

Mitsubishi Chemical |

Bioplastics, smart fluids |

Strong sustainability pivot |

|

Shin-Etsu Chemical |

High-viscosity MRFs |

R&D-led profit margin expansion |

|

Sumitomo Chemical |

Nano-additives, EU regulatory |

Compliance with EU REACH & digital QC |

|

Showa Denko |

Specialty dispersions |

AI-optimized production line rollout |

|

Tosoh Corporation |

Adaptive materials |

Expansion in the medical and robotics segments |

Source: MCGC IR, DCF Modeling, Resonac Corp, Resonac ESG, Tosoh IR, Tosoh R&D

Challenges

- High cost of MR fluids: The expensive production and material costs of magnetorheological fluids remain a major restraint for widespread adoption. MR fluids require specialized nano-sized iron particles, carrier oils, and stabilizing additives, driving up manufacturing expenses. Additionally, the need for customized electromagnetic control systems further increases implementation costs, particularly in price-sensitive industries like automotive and consumer electronics. Small and medium-sized enterprises (SMEs) often find it economically unviable to integrate MR technology compared to conventional hydraulic or passive damping systems. While large OEMs in aerospace and defense can absorb these costs, the high price point limits penetration in mass-market automotive and industrial applications. Efforts to develop low-cost synthetic alternatives are ongoing but have yet to achieve commercial scalability.

- Temperature sensitivity and durability issues: MR fluids face performance degradation under extreme temperatures, restricting their use in harsh environments. At high temperatures, the carrier oil can oxidize, reducing fluid stability, while low temperatures increase viscosity, impairing responsiveness. This limits applications in automotive (under-the-hood components), aerospace (high-altitude conditions), and heavy machinery (foundries, mining). Additionally, particle sedimentation over time leads to inconsistent performance, requiring frequent maintenance or replacement. Although recent advancements (e.g., LORD Corporation’s high-temperature MRF-6050HT) have improved thermal resilience, long-term reliability remains a challenge. These limitations push industries toward more stable alternatives like electrorheological (ER) fluids or traditional hydraulic systems, slowing magnetorheological fluid market growth in critical sectors.

Magnetorheological Fluid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20% |

|

Base Year Market Size (2025) |

USD 2.7 billion |

|

Forecast Year Market Size (2035) |

USD 17.7 billion |

|

Regional Scope |

|

Magnetorheological Fluid Market Segmentation:

End use Segment Analysis

The automotive end user segment in the magnetorheological fluid market is anticipated to garner a share of 29% during the forecast period. This is ascribed to the rising demand and integration of smart fluids in drivetrain components, brakes, and seating systems. Magnetorheological fluids offer rapid responsiveness, noise reduction, and enhanced thermal resistance, which are highly critical attributes for high-performance vehicles. According to the U.S. Department of Energy, the usage of adaptive MRF-based components significantly enhances vehicle performance, while reducing brake. Market trends showcase that original equipment manufacturers are using MRF systems in engine mounts and bushings to mitigate vibration and noise.

Application Segment Analysis

The automotive suspension systems application is expected to account for 30% of the total magnetorheological fluid market share by 2035. The shift towards semi-autonomous and EVs has advanced the magnetorheological fluid damper developments, and manufacturing giants like Tesla, NIO, and BYD are funding smart suspension module developments. These suspensions comply with the Environmental Protection Agency’s Light-Duty Vehicle GHG Emission Standards as they replace conventional mechanical parts. National Highway Traffic Safety Administration data suggests that vehicles equipped with advanced suspension systems demonstrated reduction in rollover accidents and a significant improvement in braking efficiency. As OEMs prioritize passenger comfort, fuel efficiency, and regulatory compliance, this sub-segment is expected to remain dominant in the application category of the magnetorheological fluid market.

Our in-depth analysis of the global magnetorheological fluid market includes the following segments:

|

Segment |

Sub-segment |

|

Application |

|

|

End use |

|

|

Distribution Model |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Magnetorheological Fluid Market - Regional Analysis

North America Market Insights

The North American magnetorheological fluid market is poised for noteworthy growth of 40% market share by 2035, due to a strong manufacturing base, supported by substantial government investment in domestic automotive manufacturing and competitive energy fundamentals. The U.S. is witnessing an exponential surge in chemical demand owing to its strong industrial and advanced manufacturing setup. The American Chemistry Council estimated that the chemical requirements in the country will peak by 2033, and MRF is a key contributor to these dynamics. Rising government spending is a notable trend in the magnetorheological fluid market. The DOE in 2022 allocated USD 27 billion for clean energy chemical production. In addition, the National Institute of Standards and Technology aids R&D for sustainable materials, and the EPA enforces stringent safety standards that directly influence magnetorheological fluid manufacturing.

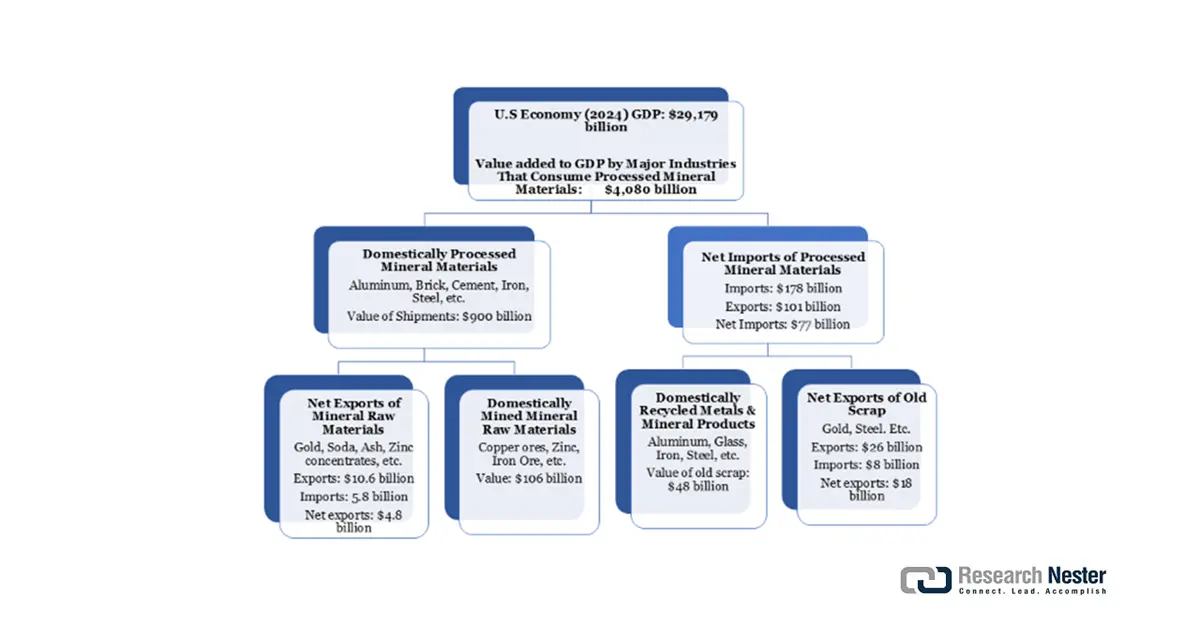

The U.S. magnetorheological fluid market has a high demand for raw materials such as iron and silicon oil. The estimated 2024 value of the country’s metal mine production reached USD 33.5 billion. The capacity utilization of the metal mining sector in 2024 remained at 53%, whereas the principal contributors to the cumulative metal mine production volume were gold- 35%; iron ore- 16%; copper- 30%; zinc- 7%; and molybdenum- 5% in 2024. 10 States alone contributed USD 3 billion worth of nonfuel mineral commodities, which included Texas, Nevada, Arizona, Minnesota, Florida, California, Alaska, Wyoming, Michigan, and Missouri. The U.S. in 2023 held a share of 4.26% in the worldwide exports of iron and steel, with exports worth USD 18.5 billion between May 2024 and April 2025. In addition, the total value of iron and steel scrap was USD 34,493 million in 2022. The booming raw material supply chain is fostering the U.S. magnetorheological fluid market development.

The Role of Nonfuel Mineral Commodities in the U.S. Economy, 2024

Asia Pacific Market Insights

The Asia Pacific magnetorheological fluid market is expected to hold a 35% of the global revenue share during the forecast owing to the presence of an industrial and manufacturing scenario in China, Japan, India, and South Korea. Demand is primarily propelled by increased deployment of MRFs in automotive dampers, robotics, precision engineering, and defense sectors. Several regional companies have adopted sustainable magnetorheological fluid technologies with the help of supportive government policies. China’s 14th Five-Year Plan, Japan’s NEDO funding, and India’s Make in India programs have led to an inflow of high investments in R&D and pilot production.

The India magnetorheological fluid market is expected to exhibit the fastest CAGR during the forecast period. The Department of Science & Technology (DST) and the Ministry of Chemicals and Fertilizers have catalyzed advanced fluids adoption in defense damping and automotive suspension systems. Numerous local businesses in 2023 incorporated eco-compliant fluidic solutions, thereby facilitating industrial-grade MRF growth. According to India Brand Equity Foundation (IBEF), India is set to emerge as third-largest in the passenger segment after the U.S. and China, reaching international and domestic freight traffic of 3.71 MMT in 2025, indicating a booming automotive and transport sector.

Europe Market Insights

The Europe magnetorheological fluid market is projected to garner a staggering growth trajectory in the forthcoming years. This is attributed to MRF usage in vibration control systems and seismic dampers in the wake of the European Green Deal’s push for eco-friendly innovations and stringent EU environmental regulations. The region benefits from robust industrial bases in Germany and France, whereas the Nordic countries are keen on promoting green technologies.

Germany magnetorheological fluid market is projected to account for 28% of the regional market share in the assessed period. This is ascribed to the flourishing automotive and aerospace industries in Germany. The Federal Ministry for Economic Affairs and Climate Action has reported an annual increase in chemical sector investments, supporting MRF adoption in electric vehicle suspensions and seismic dampers. The German Chemical Industry Association highlights a noteworthy spike in research and development since 2022.

Key Magnetorheological Fluid Market Players:

- Lord Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- QED Technologies

- Liquids Research Limited

- BASF SE

- Arus MR Tech

- Industrial Metal Powders (I) Pvt. Ltd.

- Kurimoto, Ltd.

- Akebono Brake Industry Co., Ltd.

- CK Materials Lab Co., Ltd.

- Ioniqa Technologies

- MRF Engineering

- Kolektor Group

- Anton Paar GmbH

- ArProDEC

- Metal Powder Industries Federation

The magnetorheological fluid market’s competitive landscape is dominated by key players such as Lord Corporation and QED Technologies (USA). Firms are focusing on sustainable production and innovation to capitalize on automotive demand. Strategic initiatives include partnerships for technological advancements, new product launches, and investments in smart material applications. Some of the key companies operating in the magnetorheological fluid market and their respective shares are mentioned below:

Recent Developments

- In March 2025, the American Chemical Society (ACS) published its study on Greigite (Fe3S4) synthesized magnetorheological fluids to enhance performance and suspension stability. This developed material is poised to have novel biomedical applications.

- Report ID: 5746

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Magnetorheological Fluid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.