Machine Translation Market Outlook:

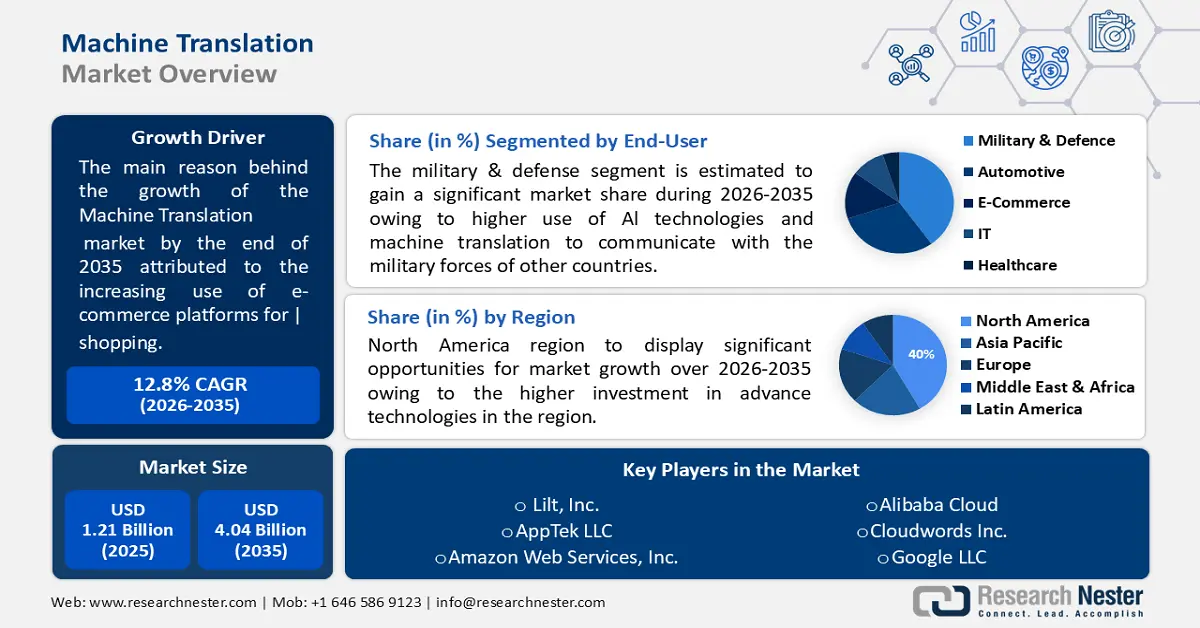

Machine Translation Market size was over USD 1.21 billion in 2025 and is projected to reach USD 4.04 billion by 2035, witnessing around 12.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of machine translation is evaluated at USD 1.34 billion.

The market growth can be attributed to the increasing use of e-commerce platforms for shopping. In the world of growing digitization, the need for e-commerce is also propelling. People from different parts of world are using the services, which makes the need for machine translation even more important. Food delivery and same-day choices might propel e-commerce in South Korea to around a 45% growth rate over the next five years.

In addition to these, factors that are believed to fuel the machine translation market expansion include the rise in the number of languages used by corporate to expand their business. For instance, Netflix is producing local-language original content, offering multiple dubbing and subtitle options, and customizing its user experience to regional audience. Moreover, Uber have added multiple languages to its apps and websites.

Key Machine Translation Market Insights Summary:

Regional Highlights:

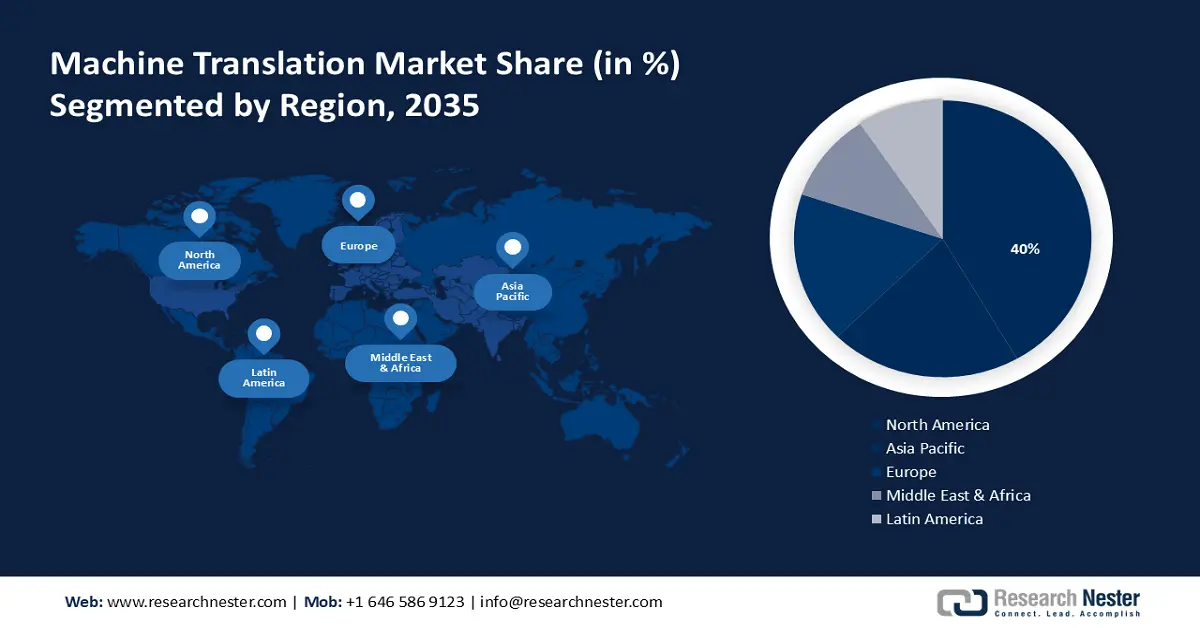

- North America machine translation market will hold over 40% share by 2035, backed by AI/ML investments and e-commerce expansion.

- Europe market will secure 25% share by 2035, driven by EU multilingual tech support and language innovation programs.

Segment Insights:

- The military & defense segment in the machine translation market is projected to capture the largest share by 2035, driven by increased use of AI and machine translation for cross-country military communication.

- The cloud segment in the market is projected to achieve a significant share by 2035, driven by the rising adoption of cloud services facilitating machine translation deployment.

Key Growth Trends:

- Growing Demand for Multilingual Communication

- Increasing Demand for Mobile Devices

- Growing Advancement in Natural Language Processing

- Rising Prevalence of E-Commerce

Major Challenges:

- The Level of Accuracy is Compromised

- Lack of Context Translation

- Implementation cost of machine translation is much high than human translator

Key Players: Lilt, Inc., AppTek LLC, Amazon Web Services, Inc., Alibaba Cloud, Cloudwords Inc., Google LLC, IBM Corporation, Lionbridge Technologies, LLC., Microsoft Corporation, Smart Communications, Inc.

Global Machine Translation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.21 billion

- 2026 Market Size: USD 1.34 billion

- Projected Market Size: USD 4.04 billion by 2035

- Growth Forecasts: 12.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 October, 2025

Machine Translation Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Multilingual Communication – Successful multilingual businesses have more inventive environments that aid in their ability to compete globally, while English-only businesses risk falling behind. In order to do business without communication hurdles, around 90% of American employers heavily rely on personnel who can speak languages other than English. Moreover, almost 56% of businesses believe that within the next five years, the need for a bilingual workforce will rise.

- Increasing Demand for Mobile Devices – Mobile translation encompasses both the use of a mobile platform for human translation as well as mobile apps that increasingly use machine translation technology to translate words and phrases from your smartphone. China, India, and the US are the top three nations for smartphone usage.

- Growing Advancement in Natural Language Processing – NLP ensures the smoother, faster, and more secure translation of languages. In the near future, more than 75% of companies in the United Kingdom with active natural language processing (NLP) initiatives want to raise their spending.

- Rising Prevalence of E-Commerce– E-commerce platforms use machine translation for localizing the business. Considering that customers prefer to read product information in their own language, a localized e-commerce platform also fosters trust and brand loyalty while also helping to increase sales.

- Rising Use of Chatbots –In order to deliver quick responses, chatbots often make use of neural machine translation engines, which allow them to instantly adapt to a wide range of languages. Since 2019, there has been a remarkable 92% increase in the use of chatbots as a brand communication channel, worldwide. In 2020, around 25% of customers interacted with firms via chatbots, which was higher than nearly 13% in 2019.

Challenges

- The Level of Accuracy is Compromised – Human brain is very complicated, and it is very difficult to decode each and everything a human can say. Moreover, the quality of experienced translators is considerably above what even the greatest AI translation systems can equal.

- Lack of Context Translation

- Implementation cost of machine translation is much high than human translator

Machine Translation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.8% |

|

Base Year Market Size (2025) |

USD 1.21 billion |

|

Forecast Year Market Size (2035) |

USD 4.04 billion |

|

Regional Scope |

|

Machine Translation Market Segmentation:

End-user Segment Analysis

The military & defense segment is estimated to gain the largest machine translation market share in the year 2035, due to the higher use of AI technologies and machine translation to communicate with the military forces of other countries. Machine translation is crucial in finding out information, helping others, and building connections with the country where we are not familiar with the knowledge local language. For instance, with the aid of a 600gm artificial intelligence-based device created by an Indian start-up, Indian soldiers patrolling the Line of Actual Control (LAC) are able to understand Mandarin and respond back immediately to the Chinese soldiers.

Deployment Segment Analysis

The cloud segment is expected to garner a significant share by 2035. The growth of the segment is primarily attributed to the rising adoption of cloud services, which further facilitates the deployment of machine translation within the companies. The introduction of cloud coworking and machine translation technology, has the potential to lower operating costs. It permits the smooth use of technologies and machine translation techniques. Furthermore, the responsiveness is enhanced via cloud-based machine translation.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Deployment |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Machine Translation Market Regional Analysis:

North American Market Insights

The North America machine translation market is projected to be the largest with a share of about 40% by the end of 2035. The regional market revenue growth is led by rising investment in advanced technologies such as artificial intelligence and machine learning as a service. In 2019, the United States made USD 37 billion in the market for machine learning applications. Additionally, funding for AI companies in the US has increased significantly in recent years, going from just under USD 300 million in 2011 to over USD 17 billion in 2019. Artificial intelligence is used in machine translation to translate text from one language to another without the need for a human translator.

Europe Market Insights

The European market is estimated to register a share of 25% by 2035. The growth is majorly towing o the rising efforts put by the government to boost the conservation of technology for multilingualism. The EU promotes language technology research, development, and application in order to remove language barriers while conserving and advancing multilingualism. According to European Commission, there are two active programs in Europe to remove the language barrier. For instance, by supporting language technology across sectors, the Horizon Europe Program promotes research and innovation. Moreover, the Digital Europe Program promotes the use of linguistic technology by the public and corporate sectors in Europe.

APAC Market Insights

The machine translation market in the Asia Pacific will hold a significant share of 20% by 2035, impelled by the rising efforts to put natural language processing in use across all sectors. In July 2022, Fronteo Inc. and NTT East Japan formed a partnership to research how digital health will advance after natural language AI is applied to it. It is done to boost Japan natural language processing. On the other hand, growing investment to boost the implementation of AI technology is also expected to boost the market growth in the region. For the implementation of technology that can improve the analysis of massive amounts of data for AI-assisted systems and put it to use in the future, the Japanese government allocated about USD 19 million.

Machine Translation Market Players:

- Lilt, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AppTek LLC

- Amazon Web Services, Inc.

- Alibaba Cloud

- Cloudwords Inc.

- Google LLC

- IBM Corporation

- Lionbridge Technologies, LLC.

- Microsoft Corporation

- Smart Communications, Inc.

Recent Developments

-

AppTek announces the launch of a new neural machine translation system that takes metadata into account as inputs to modify the output and gives localization specialists access to more precise user-influenced machine translations. Apptek also added hundreds of language and dialect pairs to its main machine translation platform.

-

Lilt, Inc. collaborated with Foresite Technology Solutions to bring multiple language content to the platform of Foresite and increase the productivity and skills of construction workers. Moreover, Foresite seeks to reduce communication-related safety concerns for construction workers.

- Report ID: 4767

- Published Date: Oct 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Machine Translation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.