Global Long Read Sequencing Market

1. Introduction

1.1. Market Definition

1.2. Product Overview

2. Assumptions And Acronyms

3. Research Methodology

4. Executive Summary- Global Long Read Sequencing Market

5. Regulatory Landscape

6. Value Chain Analysis

7. Market Dynamics

7.1. Growth Drivers

7.2. Key Trends

7.3. Key Market Opportunities

7.4. Major Roadblocks For The Market Growth

8. Industry Risk Analysis

8.1. Demand Risk Analysis

8.2. Supply Risk Analysis

9. Evaluation On The Impact Of Covid-19 On The Global Long Read Sequencing Market

10. Global Long Read Sequencing Market

10.1. Market Size (USD million), 2018-2028

> Segmentation by Technology

· Single-molecule Real-time Sequencing (SMRT) and Nanopore Sequencing, Market Size (USD million), 2018-2028

> Segmentation by Product

· Instruments, Consumables and Services, Market Size (USD million), 2018-2028

> Segmentation by Workflow

· Pre-sequencing, Sequencing and Data Analysis, Market Size (USD million), 2018-2028

> Segmentation by Application

· Identification & Fine Mapping Of Structural Variation, Tandem Repeat Sequencing, Pseudogene Discrimination, Resolving Allele Phasing, Reproductive Genomics, Cancer, Viral & Microbial Sequencing and Others, Market Size (USD million), 2018-2028

> Segmentation by End User

· Adult Academic Research, Clinical Research, Hospitals, Clinics, and Pharma & Biotech Entities, Market Size (USD million), 2018-2028

> Segmentation by Region

· North America Long Read Sequencing Market Outlook

§ Segmentation by Technology

o Single-molecule Real-time Sequencing (SMRT) and Nanopore Sequencing, Market Size (USD million), 2018-2028

§ Segmentation by Product

o Instruments, Consumables and Services, Market Size (USD million), 2018-2028

§ Segmentation by Workflow

o Pre-sequencing, Sequencing and Data Analysis, Market Size (USD million), 2018-2028

§ Segmentation by Application

o Identification & Fine Mapping Of Structural Variation, Tandem Repeat Sequencing, Pseudogene Discrimination, Resolving Allele Phasing, Reproductive Genomics, Cancer, Viral & Microbial Sequencing and Others, Market Size (USD million), 2018-2028

§ Segmentation by End User

o Adult Academic Research, Clinical Research, Hospitals, Clinics, and Pharma & Biotech Entities, Market Size (USD million), 2018-2028

§ Segmentation by Country

o U.S. & Canada Long Read Sequencing Market, 2018-2028F (USD million)

· Europe Long Read Sequencing Market Outlook

§ Segmentation by Technology

o Single-molecule Real-time Sequencing (SMRT) and Nanopore Sequencing, Market Size (USD million), 2018-2028

§ Segmentation by Product

o Instruments, Consumables and Services, Market Size (USD million), 2018-2028

§ Segmentation by Workflow

o Pre-sequencing, Sequencing and Data Analysis, Market Size (USD million), 2018-2028

§ Segmentation by Application

o Identification & Fine Mapping Of Structural Variation, Tandem Repeat Sequencing, Pseudogene Discrimination, Resolving Allele Phasing, Reproductive Genomics, Cancer, Viral & Microbial Sequencing and Others, Market Size (USD million), 2018-2028

§ Segmentation by End User

o Adult Academic Research, Clinical Research, Hospitals, Clinics, and Pharma & Biotech Entities, Market Size (USD million), 2018-2028

§ Segmentation by Country

o UK, Germany, France, Italy, Spain, Russia and Rest of Europe Long Read Sequencing Market, 2018-2028F (USD million)

· Asia Pacific Long Read Sequencing Market Outlook

§ Segmentation by Technology

o Single-molecule Real-time Sequencing (SMRT) and Nanopore Sequencing, Market Size (USD million), 2018-2028

§ Segmentation by Product

o Instruments, Consumables and Services, Market Size (USD million), 2018-2028

§ Segmentation by Workflow

o Pre-sequencing, Sequencing and Data Analysis, Market Size (USD million), 2018-2028

§ Segmentation by Application

o Identification & Fine Mapping Of Structural Variation, Tandem Repeat Sequencing, Pseudogene Discrimination, Resolving Allele Phasing, Reproductive Genomics, Cancer, Viral & Microbial Sequencing and Others, Market Size (USD million), 2018-2028

§ Segmentation by End User

o Adult Academic Research, Clinical Research, Hospitals, Clinics, and Pharma & Biotech Entities, Market Size (USD million), 2018-2028

§ Segmentation by Country

o China, India, Japan, South Korea, Australia, Malaysia and Rest of Asia Pacific Long Read Sequencing Market, 2018-2028F (USD million)

· Latin America Long Read Sequencing Market Outlook

§ Segmentation by Technology

o Single-molecule Real-time Sequencing (SMRT) and Nanopore Sequencing, Market Size (USD million), 2018-2028

§ Segmentation by Product

o Instruments, Consumables and Services, Market Size (USD million), 2018-2028

§ Segmentation by Workflow

o Pre-sequencing, Sequencing and Data Analysis, Market Size (USD million), 2018-2028

§ Segmentation by Application

o Identification & Fine Mapping Of Structural Variation, Tandem Repeat Sequencing, Pseudogene Discrimination, Resolving Allele Phasing, Reproductive Genomics, Cancer, Viral & Microbial Sequencing and Others, Market Size (USD million), 2018-2028

§ Segmentation by End User

o Adult Academic Research, Clinical Research, Hospitals, Clinics, and Pharma & Biotech Entities, Market Size (USD million), 2018-2028

§ Segmentation by Country

o Brazil, Mexico & Rest of Latin America Long Read Sequencing Market, 2018-2028F (USD million)

· Middle East & Africa Long Read Sequencing Market Outlook

§ Segmentation by Technology

o Single-molecule Real-time Sequencing (SMRT) and Nanopore Sequencing, Market Size (USD million), 2018-2028

§ Segmentation by Product

o Instruments, Consumables and Services, Market Size (USD million), 2018-2028

§ Segmentation by Workflow

o Pre-sequencing, Sequencing and Data Analysis, Market Size (USD million), 2018-2028

§ Segmentation by Application

o Identification & Fine Mapping Of Structural Variation, Tandem Repeat Sequencing, Pseudogene Discrimination, Resolving Allele Phasing, Reproductive Genomics, Cancer, Viral & Microbial Sequencing and Others, Market Size (USD million), 2018-2028

§ Segmentation by End User

o Adult Academic Research, Clinical Research, Hospitals, Clinics, and Pharma & Biotech Entities, Market Size (USD million), 2018-2028

§ Segmentation by Country

o United Arab Emirates, Saudi Arabia, Israel, South Africa and Rest of Middle East & Africa Long Read Sequencing Market, 2018-2028F (USD million)

11. Competitive Landscape

> Market Share Analysis by Manufacturer

> Company Profiles

· Oxford Nanopore Technologies

· Pacific Biosciences of California, Inc.

· FG Technologies

· Stratos Genomics

· QIAGEN

· Takara Bio Inc.

· Quantapore, Inc.

· BaseClear B.V.

12. Strategic Recommendations

Long Read Sequencing Market Outlook:

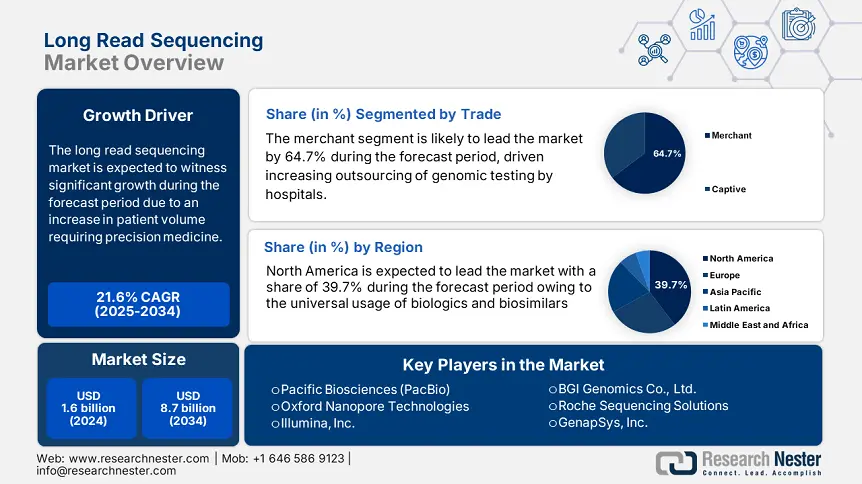

Long Read Sequencing Market size was valued at USD 1.6 billion in 2024 and is projected to reach USD 8.7 billion by the end of 2034, rising at a CAGR of 21.6% during the forecast period from, 2025 to 2034. In 2025, the industry size of long read sequencing is estimated at USD 1.9 billion.

The global long read sequencing market is aided by rising patient volume requiring precision medicine, mainly in rare genetic disorders and oncology. As per the National Cancer Institute data, nearly 2.2 million new cases were diagnosed in 2023, with a demand for guided treatment requiring genomic profiling. Further, NIH’s Genetic and Rare Diseases Information Center has stated that above 25.4 million to 30.6 million people in the U.S. are suffering from more than 6950 rare diseases requiring the long read genomic technologies to address repeat expansions and large structural variants that are undetected by short platforms. The European Commission’s Horizon Europe program has funded over €1.6 billion to personalized medicine projects for the years 2021 to 2027 in genomics and personalized medicine.

On the supply chain side, the long read sequencing (LRS) platforms, including SMRT or nanopore technologies, require specialized reagents, custom enzymes, high precision hardware, and sequencing flow cells. These raw materials are sourced and assembled from the UK, the U.S., and some parts of Asia. The U.S. Census Bureau trade data shows that the U.S. has exported nearly USD 4.7 billion nucleic acid diagnostic reagents, which is a 7.7% rise in YoY. Further, the import of precision lab equipment increased to 5.6% strengthening the distribution pipeline. As per the U.S. Bureau of Labor Statistics data, the producer price index increased to 4.6% for medical and diagnostic laboratory services in 2023, while the consumer price index rose to 3.9% for medical care commodities, highlighting the cost to end users such as clinical labs and medical care commodities. The long read sequencing market steadily expands with the rise in trade engagement.

Long Read Sequencing Market - Growth Drivers and Challenges

Growth Drivers

- Technology advancements in genomic analysis: With the growing amount of long read sequencing data, cloud platforms with AI algorithms are becoming crucial in the healthcare sector. The NIH's All of Us program in 2024 initiated a collaboration with Amazon Web Services to host long read genomic datasets for national-scale analysis. AI is now facilitating fast variant annotation, quality scoring, and clinical report generation essential for real-time oncology and infectious disease decision-making. These technologies enhance access, turnaround time, and cost, further increasing demand throughout hospitals and public health labs.

- Manufacturers' strategies and innovations: Many leading companies are adopting innovative strategies in their firms to broaden long read sequencing footprint. For example, Oxford Nanopore Technologies has collaborated with the UK's National Health Service to deploy LRS in more than 45 regional hospitals in 2024. This move is specially addressed to expand real-time sequencing for cancer patients and infectious diseases. This collaboration has surged the long read sequencing market share by 18.4% in the UK. Similarly, Pacific Biosciences introduced Revio, a 2023 high-throughput LRS platform, reducing per-genome costs by 60.6% and boosting worldwide clinical interest. Strategic partnerships are a major force behind increased adoption and access.

- Rising patient volume in rare disease genomics: In Europe, long read sequencing of diseases, particularly rare genetic disorders, is growing rapidly. As per the European Organization for Rare Diseases report, in Germany, nearly 1.6 million individuals were living with an undiagnosed rare disease in 2025, up 14.5% over the past decade. Long read sequencing is particularly well adapted for diagnosing diseases with big structural variants, including muscular dystrophy and Huntington's disease. Further, with rising clinical adoption and expanding national genomics initiatives, the patient population for long read applications will increase substantially throughout North America and Europe.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 (Patients) |

2020 (Patients) |

Growth (%) |

Comments |

|

USA |

220,005 |

1,570,003 |

613.9% |

Fueled by NIH's All of Us program, and growth in precision oncology labs |

|

Germany |

48,008 |

365,005 |

660.8% |

National rare disease registry and public-private genome initiatives |

|

France |

44,004 |

310,009 |

604.8% |

Genomic medicine initiatives under Inserm and cancer diagnostics programs |

|

Spain |

29,010 |

205,010 |

607.3% |

Ministry of Health genomics expansion via Instituto de Salud Carlos III |

|

Australia |

21,009 |

145,004 |

590.8% |

Genomics Health Futures Mission and rare disease focus |

|

Japan |

70,006 |

480,009 |

585.9% |

AMED-led cancer genome profiling and rare disease programs |

|

India |

9,010 |

122,008 |

1255.9% |

The Government of India’s GenomeIndia and DBT programs catalyzed adoption |

|

China |

37,006 |

670,005 |

1709.8% |

Precision medicine initiative, national biobank investments |

Sources: NIH, BMBF, Inserm, HAS, FEDER, Genomics Health Futures Mission, AMED, ICMR, CAS

Manufacturer Strategies Shaping Market Expansion

Revenue Opportunities for Manufacturers

|

Company Name |

Strategy Employed |

Revenue Gained ($ Million) |

Market Share Growth (%) |

|

Pacific Biosciences (USA) |

Revio launch & NIH genomic collaborations |

$124.9 million (2023) |

+34.7% |

|

Oxford Nanopore (UK) |

Adaptive sampling + NHS partnership |

$98.4 million (2023) |

+28.5% |

|

BGI Genomics (China) |

Clinical genomics expansion via MOST |

$77.8 million (2023) |

+19.3% |

|

Genewiz/Azenta (USA) |

Automation upgrades + AHRQ support |

$64.2 million (2023) |

+16.4% |

|

Nabsys (USA) |

Long-read platform optimization |

$32.9 million (2023) |

+12.5% |

Sources: Genome, Genomics England, AHRQ, MOST

Challenges

- Awareness gaps in genomics sequencing adoption: Nearly 38.5% of U.S. adults were aware of the advantages of genomic sequencing in preventive medicine, according to a 2022 CDC survey. In France and Spain, where there are no early screening programs also the adoption of LRS tools for cancer and rare diseases has also been delayed. Companies like Illumina have introduced awareness campaigns through public hospitals, but their reach remains limited to urban areas. Responding, a number of EU-supported programs, such as the 1.3+ million genomes initiative, are attempting to expand public education and genomic literacy. Moreover, collaborations between biotech companies and national healthcare systems are developing to bring about the integration of long read sequencing into routine diagnostic pipelines.

Long Read Sequencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

21.6% |

|

Base Year Market Size (2024) |

USD 1.6 billion |

|

Forecast Year Market Size (2034) |

USD 8.7 billion |

|

Regional Scope |

|

Long Read Sequencing Market Segmentation:

Trade Segment Analysis

In the trade segment, the merchant sub-segment controls the segment and is predicted to retain the share value of 64.7% by 2034. Merchant trade encompasses the sale of sequencing platforms, reagents, and services to third-party customers like clinical laboratories, CROs, and biotech companies, allowing broader market coverage. The segment is fueled by the outsourcing of genomic testing by hospitals and research centers to commercial service providers due to cost-effectiveness and scalability. As per the U.S. Census Bureau report, the exports of nucleic acid-based diagnostics, such as sequencing kits and instruments, reached $4.7 billion in 2023, which indicates a healthy global merchant supply chain. As the need for quick and decentralized genomic analysis increases, especially in oncology and infectious disease diagnostics, the merchant model will continue to dominate till 2034.

Technology Segment Analysis

Under the technology segment, nanopore sequencing technology leads the segment and is poised to hold the share value of 55.9% by 2034. Nanopore sequencing segment is driven by its real-time, portable, and cost-effective platform, benefiting resource-constrained and decentralized clinical environments. This technology is capable of handling ultra-long reads of less than 2 Mb and is increasingly applied in point-of-care diagnostics, such as tumor sequencing and infectious disease surveillance. As per the National Human Genome Research Institute report, the nanopore sequencing is poised to redefine real-time genome analysis practiced in hospitals and field diagnostics.

End user Segment Analysis

Hospitals and diagnostic labs dominate the end user segment and are anticipated to hold the market share of 41.6% by 2034. The segment is driven by rising clinical utilities for long read sequencing in cancer profiling, complex genetic disorders, and infectious disease management. Hospitals are actively integrating LRS platforms into precision medicine workflows, aided by private and public funding programs. The growing need for precise, real-time genomic insights is driving diagnostic labs to expand their capabilities, particularly those connected to national genomics programs. Moreover, the research and academic institutions continue to play a vital role in early-stage application development and innovation.

Our in-depth analysis of the global long-read sequencing market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Application |

|

|

End user |

|

|

Trade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

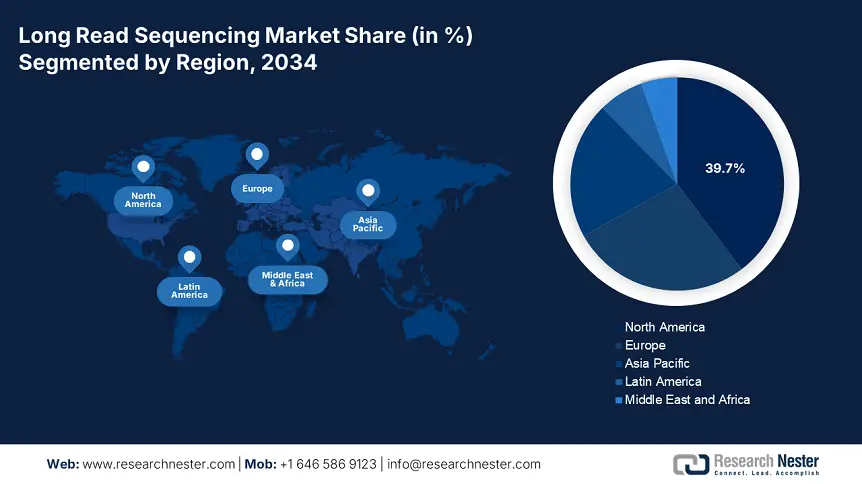

Long Read Sequencing Market - Regional Analysis

North America Market Insights

The North America long read sequencing market has the largest share of 39.7% worldwide and is expected to develop a CAGR of 17.2% during the period 2025-2034, with renewed government investment, highly developed R&D facilities, and accelerating uptake in clinical and research environments. The U.S. is fueling the region's growth by federal investments via NIH, CDC, and CMS, which collectively invested more than $5.4 billion in long read sequencing projects in 2023. Increasing Medicare and Medicaid reimbursement coverage is further driving clinical uptake, mainly for cancer genomics and rare disease diagnostics. North America's robust regulatory platform, national genomics plans, and collaborations between industries and academies will continue to make North America a dominating region.

The U.S. long read sequencing market is growing at a rapid rate, fueled by more NIH-funded genomics initiatives and expanding Medicare/Medicaid support. In 2023, over $500.4 million was spent on long-read genome research via the All of Us Research Program. The CDC further increased pathogen surveillance programs based on long read technologies in 2024 to support infectious disease surveillance. Medicare expenditures for long read sequencing reached $800.5 million in 2024, an increase of 15.4% since 2020. The CMS adapted the models of reimbursement in 2023 to enhance provider access among elderly people. Since the U.S. invests more than 9.5% of its health budget in genomics-based technologies, payer coverage and federal agency programs will accelerate the market penetration in the upcoming years.

Asia Pacific Market Insights

The APAC is the fastest-growing region in long read sequencing market is poised to hold the market share of 20.8% at a CAGR of 18.8% by 2034. India, Japan, China and South Korea are developing the region by genomic infrastructure to address the rising clinical and surgical demand. The AMED and MHLW in Japan has led to a rise of 12.6% of the healthcare budget in 2024 which is a USD 3.3 billion rise over the past three years. Further, Malaysia has doubled its patient treatment volume in the last ten years with the government funding rising up by 20.5%. the region is benefited by rising incidence of rare and genetic diseases, strong public and private R&D, and favorable government policies.

China is expected to hold the largest regional share of 27.1% by 2034 in long read sequencing market. In China, government expenditures on long read sequencing technologies increased by 15.4% during the last five years, which indicates that the nation is on the fast track to developing precision medicine. Nearly 1.8 million patients were diagnosed on long read sequencing platforms in 2023, fueled by the increasing number of complicated genetic diseases. This growth is surged by the National Medical Products Administration and the National Genomics Center, and has prioritized regulatory streamlining and clinical integration. In China, large-scale genomics projects are improving early diagnosis, mainly in the oncology and rare diseases fields.

Country-wise Government Provinces

|

Country |

Government Initiative / Investment |

Launch Year |

Budget / Funding Allocation |

|

Australia |

Genomics Health Futures Mission (GHFM) |

2021 |

AUD 500.4 million over 10 years |

|

Japan |

AMED long read sequencing funding boost via Moonshot R&D Program |

2022 |

$3.6 billion increase in national genomics budget |

|

India |

National Genomics Grid for cancer and rare disease sequencing |

2023 |

₹1,500.8 crore via DBT and ICMR |

|

South Korea |

Biohealth Strategy 2025 initiative on genome-based diagnostics |

2021 |

₩4.6 trillion investment |

|

Malaysia |

National Precision Medicine Initiative (MyPGx) |

2024 |

RM 300.9 million allocated for genomic infrastructure |

Sources: AU Govt, AMED, DBTIndia, MOH, Republic of Korea Government

Europe Market Insights

Europe long read sequencing market is expanding at a strong rate and is expected to occupy the market share of 27.2% at a CAGR of 15.6% during 2034. The region is dominated by the demand for accurate diagnostics and investments in genomic healthcare at the national level. The European Health Data Space and EU4Health Programme have committed more than €2.8 billion in funding through 2025 to support LRS infrastructure, public-private partnerships, and research networks. This joint effort makes Europe a leading global hub for next-generation sequencing, with Germany and the UK leading innovation and adoption.

Germany is expected to maintain the revenue share of 26.7% in 2034 in long read sequencing market. Germany dominates the region via strategic investment and aggressive clinical uptake. Germany's Federal Ministry of Health raised its funding on next-generation sequencing by 20.5% in the last five years, having cumulatively spent €4.4 billion in 2024. This investment highlights the national diagnostics for rare disorders and oncology via public-private partnerships. The GEMEINSAM project, which is a partnership with the German Medical Association (BÄK), accelerates clinical trials with LRS to confirm diagnostic accuracy. The biotechnology ecosystem of the country, combined with the innovation centers in Berlin, Munich, and Heidelberg, makes it a hotspot for research and commercialization.

Government Investments, Policies & Funding

|

Country |

Program / Policy Name |

Launch Year |

Budget / Funding Details |

|

UK |

NHS Genomic Medicine Service (GMS) |

2021 |

Allocated £500.4 M (2021–2023); increased to £750.6 M in 2024 for nationwide LRS diagnostics expansion. |

|

France |

France Genomic Medicine 2025 Initiative |

2021 |

Announced €670.5 M investment from 2021–2025, with €218.4 M earmarked for sequencing platforms. |

|

Italy |

National Genomics Infrastructure Framework |

2023 |

Government invested €350.8 M to build genomic reference centers across 5 regions. |

|

Spain |

Precision Medicine Strategy (IMPaCT Genómica) |

2022 |

Invested €110.5 M in 2022; expanded to €200.4 M by 2024 for sequencing and genomic research (via ISCIII). |

Sources: EMA, NHS, AIFA, AEMPS

Key Long Read Sequencing Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The long read sequencing market is becoming competitive, with top players including PacBio and Oxford Nanopore Technologies. These players are dominating the market with innovation via enhanced platforms such as nanopore sequencing and HiFi, mergers, strategic partnerships, and technological integration, including Illumina’s entry into long-read via acquisitions are redefining the landscape. Further companies in Asia, such as BGI Genomics, Strand Life Sciences, and Macrogen, are focusing on affordability and scalability. Whereas companies in Malaysia and South Korea are penetrating the localized market. Many companies are focusing on accuracy, cost efficiency, speed, and expanded clinical adoption on rare diseases, precision medicine, and oncology.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country of Origin |

2034 Est. Market Share (%) |

Industry Focus |

|

Pacific Biosciences (PacBio) |

U.S. |

18.9% |

Pioneer in SMRT sequencing; focuses on HiFi long-read sequencing systems. |

|

Oxford Nanopore Technologies |

UK |

16.5% |

Developer of portable nanopore sequencers (e.g., MinION, PromethION). |

|

Illumina, Inc. |

U.S. |

13.8% |

Expanding into long-read via Illumina Complete Long Reads and mergers. |

|

BGI Genomics Co., Ltd. |

China |

9.9% |

Provides long-read solutions via subsidiary MGI using DNBSEQ-T20 sequencer. |

|

Roche Sequencing Solutions |

Switzerland |

7.2% |

Develops sequencing platforms integrating long-read chemistry & analytics. |

|

GenapSys, Inc. |

U.S. |

xx% |

Focus on compact and affordable long-read sequencers for clinical research. |

|

Strand Life Sciences |

India |

xx% |

Offers long-read genomic diagnostics for oncology and rare diseases. |

|

Quantapore, Inc. |

U.S. |

xx% |

Emerging nanopore sequencing tech with emphasis on scalable throughput. |

|

Dovetail Genomics |

U.S. |

xx% |

Focuses on genome assembly and structure using long-read-based Hi-C technology. |

|

Nabsys, Inc. |

U.S. |

xx% |

Specializes in electronic mapping systems for high-resolution long reads. |

|

Thermo Fisher Scientific |

U.S. |

xx% |

Partnering with other firms to integrate long-read tech into Ion Torrent. |

|

Hitachi High-Tech Corporation |

Japan |

xx% |

Collaborates on nanopore and single-molecule sequencing systems. |

|

GenXys Health Care Systems |

Canada |

xx% |

Offers sequencing and precision medicine platforms in clinical settings. |

|

Macrogen, Inc. |

South Korea |

xx% |

Provides outsourced LRS services for population-scale projects. |

|

BaseClear B.V. |

Netherlands |

xx% |

Offers microbial genomics and long-read platforms for pharma R&D. |

|

Biotools Co., Ltd. |

South Korea |

xx% |

Focuses on industrial and agricultural genomics via long-read sequencing. |

|

GenomixLab Sdn. Bhd. |

Malaysia |

xx% |

Offers genomic diagnostic tools and LRS services in Southeast Asia. |

|

Nucleome Informatics Pvt. Ltd. |

India |

xx% |

Provides long-read sequencing & analysis for cancer and rare genetic diseases. |

|

Gene by Gene Ltd. |

U.S. |

xx% |

Delivers consumer and ancestry-focused long-read genome sequencing services. |

|

Cegat GmbH |

Germany |

xx% |

Offers LRS for rare disease diagnostics and precision medicine. |

Sources: SEC, EMA, EU Commission Health and Food Society, AMED, NMPA, Koreabio, ICMR, MOSTI, EU Research, GenomeWeb

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, PacBio Biosciences launched its next-generation Revio HiFi Sequencing System by providing 15 times higher throughput. The launch has increased the revenue share by 28.4% and the market share by 4.5%.

- In January 2024, Oxford Nanopore Launches PromethION 2 Solo to support real-time sequencing and AI-driven analytics. The post-launch has contributed a 17.3% rise in revenue and a 12.5% rise in unit sales.

- Report ID: 2595

- Published Date: Jul 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Long Read Sequencing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert