LNG Filling Stations Market Outlook:

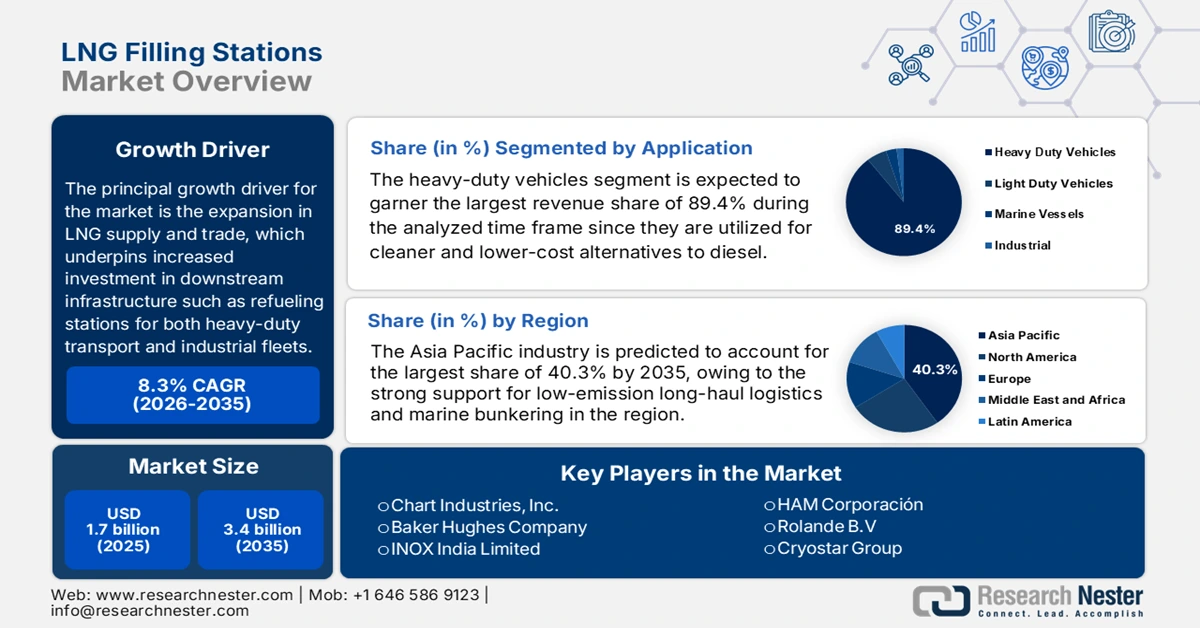

LNG Filling Stations Market size was valued at USD 1.7 billion in 2025 and is projected to reach USD 3.4 billion by the end of 2035, rising at a CAGR of 8.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of LNG filling stations is estimated at USD 1.8 billion.

The principal growth driver for the LNG filling stations market is the global expansion in LNG supply and trade, which underpins increased investment in downstream infrastructure such as refueling stations for both heavy-duty transport and industrial fleets. Therefore, the U.S. Department of Energy reported that the U.S. is observed to be the world’s top natural gas producer, is expanding its LNG exports, which reached 12 Bcf/d in 2024 and are projected to grow to 26 Bcf/d by the end of the decade, surpassing Qatar by 40%. It also stated that the U.S. LNG is shipped across all nations, primarily to Europe and South Korea, through eight large-scale export terminals and authorized projects, including new approvals for non-FTA countries. DOE regulatory oversight, through FECM, ensures proper exports under the Natural Gas Act, providing a framework that supports continued investment and expansion of this sector.

Global LNG Trade Overview - 2023: Key Exporters, Importers, and Volumes

|

Region / Country |

Activity |

Details |

|

Global |

Trade Volume |

Average 52.9 Bcf/d, +3.1% YoY |

|

U.S. |

Exports & Production |

Resumed full production by April 2023; top global exporter; +12% exports YoY. |

|

Indonesia |

Export Capacity |

Added third LNG train to expand exports |

|

Australia & Qatar |

Exports |

Major exporters, together with the US, accounted for 60% of global LNG exports. |

|

China |

Imports |

Largest LNG importer; +12% YoY |

Source: International Trade Council

Furthermore, the supply chain for LNG filling‑station infrastructure spans raw‑material inputs such as cryogenic steel, compressors, pumps, manufacturing of modular station components, site assembly and deployment, and global logistics, including export of manufactured goods. On trade dynamics, as per an article published by the U.S. Department of Energy in April 2022, the global LNG fleet comprised over 540 vessels, supporting exports from 20 countries, including the U.S., to more than three dozen import markets. It also underscored that U.S. LNG exports reached nearly 2 Tcf, averaging 6.5 Bcf/d by the end of 2020, which marks a 30% increase from 2019 that was delivered to countries across five continents. Hence, the increasing number of LNG import terminals across the globe is efficiently enhancing global distribution efficiency and reducing supply bottlenecks in the market.

Key LNG Filling Stations Market Insights Summary:

Regional Highlights:

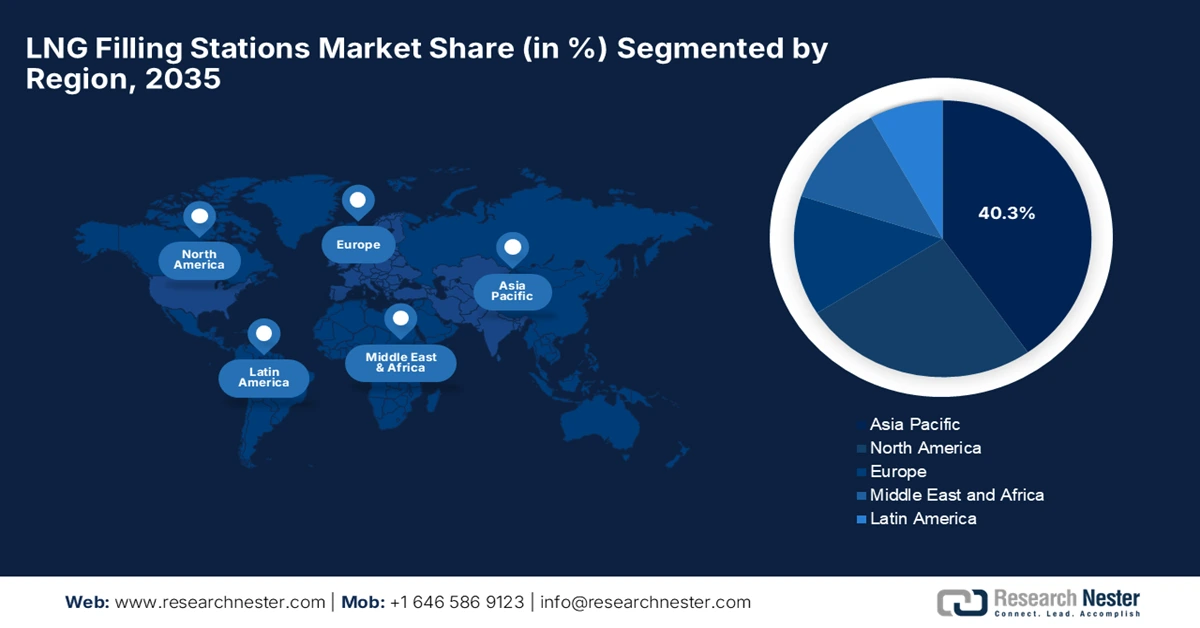

- Asia Pacific is projected to secure a 40.3% share by 2035 in the LNG filling stations market, anchored by strong support for low-emission long-haul logistics and marine bunkering.

- North America is anticipated to capture a considerable share by 2035, bolstered by rising deployment of LNG-powered trucks and efforts to decarbonize long-haul transport.

Segment Insights:

- Heavy-duty vehicles are set to command an 89.4% share by 2035 in the LNG filling stations market, spurred by cleaner and lower-cost alternatives to diesel and regulatory pressure on heavy-vehicle emissions.

- Permanent stations are projected to hold a 60.4% share by 2035, underpinned by their high-throughput capability suited for heavy-duty fleets and regulatory support for large-scale LNG infrastructure investment.

Key Growth Trends:

- Environmental & regulatory pressure

- Transportation sector shift

Major Challenges:

- High capital & infrastructure costs

- Limited vehicle adoption & demand uncertainty

Key Players: Chart Industries, Inc. - U.S., Baker Hughes Company - U.S., INOX India Limited - India, Cryostar Group - France, HAM Corporación - Spain, Rolande B.V. - Netherlands, Linde Engineering - Germany, Air Water Inc. - Japan, Tokyo Gas Co., Ltd. - Japan, Samsung Heavy Industries Co., Ltd. - South Korea, Greenfuel Energy Pvt Ltd - India, Westport Fuel Systems - Canada

Global LNG Filling Stations Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Spain, Italy, Canada

Last updated on : 17 November, 2025

LNG Filling Stations Market - Growth Drivers and Challenges

Growth Drivers

- Environmental & regulatory pressure: Governments across different nations are pushing transport, maritime, and heavy-industry sectors to reduce greenhouse-gas emissions and air pollutants, which in turn is increasing demand for LNG since it presents a lower‐carbon alternative, especially in heavy-duty transport and marine applications. DOE in February 2025 reported that it issued an order removing regulatory barriers to the use of liquefied natural gas as a marine fuel, specifically modifying prior oversight for ship-to-ship LNG bunkering at U.S. ports. Therefore, this action supports growth in the LNG marine fuel sector by simplifying rules for facilities such as JAX LNG in Jacksonville, Florida, which supplies LNG to ships such as cruise liners and tankers. DOE further underscored that the move aligns with tightening global emissions regulations, as the number of LNG-fueled vessels is projected to nearly double to over 1,200 ships by the end of 2028, thus benefiting the LNG filling stations market.

- Transportation sector shift: LNG is increasingly being considered for long-haul trucks, buses, marine vessels, and also industrial fleet vehicles since it has the capacity to offer cost savings and emission reductions when compared to conventional fuels. In June 2024, Volvo Trucks India reported that it successfully delivered 20 LNG-powered FM 420 4X2 heavy-duty tractors to Delhivery for long-haul logistics routes, which can be around 1000 km. It also stated that these trucks use high-pressure direct injection technology, thereby offering up to 20% lower CO₂ emissions and 15% to 20% better fuel economy when compared to conventional spark-ignited LNG engines. Furthermore, the company also noted that growing LNG infrastructure and the country’s shift toward a gas-powered economy make this a key step toward achieving its net-zero 2040 vision, positively impacting the market growth.

- Infrastructure & technology advancements: This is recognized as one of the primary growth drivers for the LNG filling stations market, wherein advances in cryogenic storage, modular station builds, and mobile or skid‐mounted LNG refuelling units are making LNG stations even more attractive for both investors and operators. Bahamas Power and Light, in September 2025, announced its plans to launch its first LNG engines at the Clifton Pier Power Station, which marks a major step in its transition to cleaner energy. It also underscored that the engine is also integrating LNG with utility-scale solar, battery energy storage systems, and distributed generation across the Family Islands to enhance grid resilience and stabilize costs. Therefore, the hybrid approach, modeled on Ragged Island, aims to lower greenhouse gas emissions and deliver an extremely reliable, affordable, and environmentally responsible power to consumers in the area.

Global Post-FID LNG Projects and Planned Capacity Additions (2025-2031)

|

Country |

Project |

Status |

Year of FID/Approval |

Expected First LNG |

Nameplate Capacity (bcm/yr) |

Nameplate Capacity (mtpa) |

|

Republic of the Congo |

Congo FLNG 2 |

Under construction |

2022 |

2025 |

3.3 |

2.4 |

|

Gabon |

Cap Lopez |

Under construction |

2023 |

2026 |

1.0 |

0.7 |

|

Mozambique |

Coral North FLNG |

Under construction |

2025 |

2028 |

4.9 |

3.6 |

|

Nigeria |

NLNG |

Under construction |

2019 |

2027 |

10.9 |

8.0 |

|

Senegal |

Tortue FLNG - Phase 1 |

In operation |

2018 |

2025 |

3.4 |

2.5 |

|

Australia |

Pluto LNG |

Under construction |

2021 |

2026 |

6.8 |

5.0 |

|

Indonesia |

Genting FLNG |

Under construction |

2024 |

2026 |

1.6 |

1.2 |

|

Malaysia |

ZFLNG |

Under construction |

2022 |

2027 |

2.7 |

2.0 |

|

Argentina |

Southern Energy FLNG - Phase 1 |

Under construction |

2025 |

2027 |

3.3 |

2.4 |

|

Argentina |

Southern Energy FLNG - Phase 2 |

Under construction |

2025 |

2028 |

4.8 |

3.5 |

|

Oman |

Marsa LNG |

Under construction |

2024 |

2028 |

1.3 |

1.0 |

|

Qatar |

North Field East (NFE) |

Under construction |

2021 |

2026 |

43.5 |

32.0 |

|

Qatar |

North Field South (NFS) |

Under construction |

2023 |

2028 |

21.8 |

16.0 |

|

UAE |

Ruwais LNG |

Under construction |

2024 |

2028 |

13.0 |

9.6 |

|

Canada |

Cedar LNG |

Under construction |

2024 |

2028 |

4.5 |

3.3 |

|

Canada |

LNG Canada |

Under construction (commissioning) |

2018 |

2025 |

19.0 |

14.0 |

|

Canada |

Woodfibre LNG |

Under construction |

2022 |

2027 |

2.8 |

2.1 |

|

Mexico |

ECA LNG - Phase 1 |

Under construction |

2020 |

2026 |

4.4 |

3.2 |

|

Mexico |

Fast LNG Altamira 2 |

Under construction |

2023 |

2027 |

1.9 |

1.4 |

|

US |

Corpus Christi - Stage 3 |

Under construction (commissioning) |

2022 |

2025 |

13.6 |

10.0 |

|

US |

Corpus Christi - Midscale Trains 8-9 |

Under construction |

2025 |

2028 |

6.8 |

5.0 |

|

US |

Golden Pass LNG |

Under construction |

2019 |

2025 |

21.2 |

15.6 |

|

US |

Plaquemines LNG - Phase 2 |

Under construction (commissioning) |

2023 |

2025 |

9.1 |

6.7 |

|

US |

Port Arthur LNG - Phase 1 |

Under construction |

2023 |

2027 |

18.4 |

13.5 |

|

US |

Port Arthur LNG - Phase 2 |

Under construction |

2025 |

2030 |

18.4 |

13.5 |

|

US |

Rio Grande LNG Trains 1-3 |

Under construction |

2023 |

2027 |

23.9 |

17.6 |

|

US |

Louisiana LNG |

Under construction |

2025 |

2029 |

22.4 |

16.5 |

|

US |

CP2 LNG - Phase 1 |

Under construction |

2025 |

2027 |

19.6 |

14.4 |

|

US |

Rio Grande LNG Train 4 |

Under construction |

2025 |

2030 |

8.0 |

5.9 |

|

US |

Rio Grande LNG Train 5 |

Under construction |

2025 |

2031 |

8.0 |

5.9 |

|

Qatar |

North Field West (NFW) |

Approved - not under construction |

2024 |

– |

21.7 |

16.0 |

Challenges

- High capital & infrastructure costs: This is the major hurdle for the LNG filling stations market since it necessitates specialized infrastructure, which includes cryogenic storage tanks, compressors, vaporisers, dispensers, and safety systems. In terms of permanent stations, it can cost over USD 1 million, whereas in case of smaller mobile stations still require hundreds of thousands of dollars, raising a concern among small-scale manufacturers. Therefore, the existence of high upfront capital makes it challenging for smaller operators to enter the market. Furthermore, the long payback period, often several years, can discourage investors, ultimately limiting the speed and scale of station network expansion.

- Limited vehicle adoption & demand uncertainty: The LNG filling stations market is being negatively impacted by factors such as limited vehicle adoption as well as demand uncertainty. In this regard, the financial viability of LNG stations depends heavily on having enough LNG-powered vehicles to maintain utilization. In addition, there has been a slow adoption of LNG trucks and buses, which creates uncertainty for operators, as low throughput undermines profitability. Therefore, fleet operators may hesitate to invest in LNG vehicles, hence causing a major obstacle for market expansion. Furthermore, in areas where LNG vehicles exist, uneven regional adoption can leave some stations underused, leading to a major barrier to network growth.

LNG Filling Stations Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 billion |

|

Regional Scope |

|

LNG Filling Stations Market Segmentation:

Application Segment Analysis

Heavy-duty vehicles based on the application segment are expected to garner the largest revenue share of 89.4% during the analyzed time frame. The trucks, buses, and long-haul transport are utilized for cleaner and lower cost alternatives to diesel in heavy transport and coupled with regulatory pressure on heavy vehicle emissions, and the longer range/quick refueling advantage of LNG compared to some alternatives. In October 2025, Isuzu Motors announced that it had launched upgraded heavy-duty GIGA LNG and GIGA CNG trucks, which are a combination of low-emission performance with enhanced safety features, including the emergency driving stop system. It also stated that these vehicles support carbon-neutral initiatives by running on LNG, CNG, or biomethane without modifications, offering ranges exceeding 1,000 km, hence reinforcing their usability.

Station Type Segment Analysis

By the end of 2035 permanent stations segment is expected to attain a significant share of 60.4% in the LNG filling stations market. The growth in the segment is efficiently propelled by their ability to offer extremely high throughput capability, which is more suitable for heavy-duty fleets and long-haul operations, and to benefit from economies of scale. Also, the regulatory support for large-scale infrastructure investment and dedicated fleet refueling corridors further drives this sub‐segment. In August 2025 Ministry of Petroleum & Natural Gas announced that the Government of India is actively promoting the adoption of LNG by allowing 100% FDI under the automatic route for LNG infrastructure, which also includes terminals and imports, with eight regasification terminals currently operational, totaling 52.7 MMTPA. It also stated that the initiatives include setting up LNG retail stations along major highways, the Golden Quadrilateral, and key mining clusters, with 29 stations already operational across both public and private sectors.

Fueling Mode Segment Analysis

In terms of fueling mode, the fixed infrastructure segment is likely to attain a lucrative share in the LNG filling stations market throughout the analyzed timeframe. The subtype supports high fleet operations and is less constrained when compared to mobile units in throughput, and is more aligned with major transport corridors and logistics hubs. Also, the increasing investments in infrastructure, pipeline connectivity, and integration with large fleets support the fixed‑station model. In addition, their ability to combine LNG supply with complementary energy solutions, such as compressed natural gas or renewable energy integration, also strengthens the fixed model’s role as a backbone for the growing gas-based transport ecosystem. Therefore, these factors make fixed LNG stations a critical enabler for scaling sustainable transport and logistics operations globally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Station Type |

|

|

Fueling Mode |

|

|

End user |

|

|

Tank Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

LNG Filling Stations Market - Regional Analysis

APAC Market Insights

By the end of the forecast duration, Asia Pacific is expected to be the dominating region in the LNG filling stations market, capturing the largest revenue share of 40.3%. The strong support for low-emission long-haul logistics and marine bunkering is the key factor driving this proprietorship. Most of the governments across the region are proactively promoting natural gas usage in heavy-duty transport, in turn increasing the number of LNG stations along key freight corridors. In February 2023, THINK Gas announced the launch of two LCNG stations in Kochuveli and Cherthala, inaugurated by Kerala Chief Minister. It stated that each station can handle 200 tons of natural gas per day, thereby supporting thousands of vehicles, households, and businesses across southern Kerala. Furthermore, the initiative is part of Kerala’s vision to become a clean energy state, wherein the firm is planning to develop 291 CNG stations and 361 km of pipeline network to promote natural gas adoption and reduce vehicular pollution across the state.

China is gaining traction in the LNG filling stations market due to the presence of an energy transition strategy that supports both on-road heavy vehicles as well as maritime applications. As evidence, the country’s government reported that in November 2022, Shenzhen Port in South China’s Guangdong province completed its first-ever LNG bunkering operation for an international vessel, marking a major milestone in China’s maritime clean-fuel transition. It also stated that this LNG bunker vessel XIN AO PU TUO HAO refueled the dual-fuel container ship CMA CGM SORBONNE at Yantian Port, making Shenzhen the first port in South China and the fourth globally to provide LNG filling services. Hence, this shift to LNG-powered shipping significantly reduces sulfur oxide emissions by 100% and nitrogen oxides by 85% when compared with conventional oil-fueled ships.

India has a huge opportunity to capitalize on the LNG filling stations market owing to the strong government support and infrastructural developments. Most of the companies in the country are developing new LNG dispensing stations, which are suitable for long-haul trucking. In this regard, the Ministry of Petroleum & Natural Gas in August 2025 stated that the country’s government is actively promoting LNG adoption by allowing 100% FDI for LNG infrastructure, supporting private and state-owned LNG retail stations, and implementing policy reforms for transport and industrial use. It also stated that currently, eight LNG regasification terminals operate with a combined capacity of 52.7 MMTPA, while 29 LNG retail stations, which are 13 state-owned, 16 private. They are functional along major highways and industrial hubs, boosting the growth of India’s economy.

North America Market Insights

North America is predicted to grab a considerable share in the market throughout the discussed tenure. The region is primarily focused on strategic freight corridors rather than mass passenger applications. Also, the U.S. fleet operators are deploying LNG-powered trucks, whereas infrastructure providers announce heavy-duty LNG stations aligned with major trucking routes. Moreover, the adoption is also fueled by the need to decarbonize long-haul transport and strengthen energy diversification. Public and private collaborations are supporting infrastructure rollout, particularly in terms of heavy-duty commercial fleets that operate across interstates and regional supply chains. Furthermore, the presence of established LNG producers is helping align the market toward sustainable transport fuels, hence creating an optimistic market opportunity.

The U.S. is set to witness robust expansion in the regional LNG filling stations market as logistics and fleet operators expand their use of LNG-powered trucks, whereas federal and state initiatives encouraging cleaner transport are boosting infrastructure investments. Most of the energy companies are partnering with logistics providers to establish refueling hubs that ensure a reliable LNG supply for commercial transport fleets. In this regard, Sempra Infrastructure in July 2024 announced that it has signed a fixed-price EPC contract with Bechtel Energy for the Port Arthur LNG Phase 2 project in Texas, building on the ongoing Phase 1 development. This Phase 2 project is authorized by the Federal Energy Regulatory Commission, which will add two liquefaction trains with a combined capacity of approximately 13 Mtpa, doubling the facility’s total LNG output to 26 Mtpa, delivering secure, low-carbon energy solutions.

There is a huge exposure for Canada in the LNG filling stations market due to the long-haul trucking network, particularly across provinces such as Alberta, British Columbia, and Ontario, which rely heavily on cross-country transport. The country’s market also benefits from government incentives and policies that promote cleaner fuels in the transport sector are encouraging fleet operators to shift from diesel to LNG. In November 2025, LNG Canada announced that Train 2 of its LNG processing facility had entered production, joining Train 1 to make both units fully operational. This marks a major step in expanding Canada’s LNG export capacity and diversifying its energy trade with worldwide partners. Hence, the company continues to focus on extremely safe and responsible operations while supporting Canada’s position as a major player in the market.

Europe Market Insights

Europe is emerging as one of the largest and most influential landscapes for the LNG filling stations market, efficiently driven by stringent emissions standards for heavy goods vehicles as well as maritime shipping. Also, LNG prime fleet operators and energy companies are actively supporting LNG for HGVs, and many stations are situated along major trucking corridors, and port logistics enable long-haul LNG trucking and bunkering applications as well. In February 2022, HAM Group introduced EDUX, which is a mobile and transportable LNG-CNG service station designed for flexible refueling of trucks, heavy vehicles, and light vehicles. It was developed by HAM Criogénica and the R&D team. The unit stores 60,000 liters of LNG at low pressures, delivering up to 12,000 kg/h of LNG and 300 kg/h of CNG, hence improving fuel logistics.

Germany is the key powerhouse for Europe’s LNG filling stations market, which is effectively propelled by the strategy of deploying LNG infrastructure while also transitioning toward renewable gaseous fuels. In September 2022, Liqvis announced that it had inaugurated its eleventh LNG filling station at Autohof Salzbergen near the A30/A31 and 28 km from the Dutch border. The company also underscored that this station operates 24/7 with two LNG dispensers for trucks. In addition, customers can use the Liqvis token, Liqvis card, or a variety of common fleet cards from providers like DKV, UTA, Hoyer-Card, Eurowag, BayWa-Card, Alternoil, LogPay, On Turtle, Romac Fuels, Vulcangas, and The Fuel Company. Hence, this expansion strengthens LNG refueling accessibility along major freight routes in Germany and nearby cross-border corridors, hence suitable for market expansion.

The U.K. is readily blistering growth in the regional LNG filling stations market, backed by both logistics fleet deployments and infrastructure building for alternative fuels like bio-LNG. Simultaneously, government incentives and private investments are fueling the development of an efficient alternative fuels infrastructure, including bio-LNG, which is gaining traction as a renewable and sustainable option. This dual approach fleet conversion, along with infrastructure expansion, is positioning the U.K. as a key leader in Europe’s LNG refueling landscape, thereby enhancing both operational efficiency and environmental sustainability for transport operators. Furthermore, the increasing partnerships between energy providers and transport firms are significantly accelerating station deployment, supporting the countries’ emphasis on net-zero emissions and clean mobility solutions.

Key LNG Filling Stations Market Players:

- Chart Industries, Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baker Hughes Company - U.S.

- INOX India Limited - India

- Cryostar Group - France

- HAM Corporación - Spain

- Rolande B.V. - Netherlands

- Linde Engineering - Germany

- Air Water Inc. - Japan

- Tokyo Gas Co., Ltd. - Japan

- Samsung Heavy Industries Co., Ltd. - South Korea

- Greenfuel Energy Pvt Ltd - India

- Westport Fuel Systems - Canada

- Chart Industries, Inc. is considered to be a leading manufacturer that specializes in cryogenic equipment for industrial gases, and also includes LNG fueling infrastructure. The company offers modular LNG stations, storage tanks, and transfer systems that support heavy-duty transport and industrial applications. In addition, the company’s global presence spans North America, Europe, and Asia, with strategic partnerships to supply LNG refueling networks, giving it a strong position in the LNG transition industry.

- Baker Hughes Company is historically known for oilfield services, and has successfully expanded into LNG infrastructure with high-capacity LNG fueling stations and compressors for the transportation and chemical sectors. The firm provides scalable LNG solutions that are capable of handling industrial and fleet demand. In addition, Baker integrates advanced monitoring and automation to optimize both operational efficiency and safety. The company also proactively participates in projects which are supporting energy transition strategies in North America, Europe, and the Middle East, for both public and private LNG supply networks.

- INOX India Limited, through its INOXCVA division, is one of the most prominent manufacturers of cryogenic equipment and LNG fueling solutions. The company’s focus lies in modular LNG stations, storage tanks, and transportable refueling units for industrial and vehicular applications. The company has successfully developed partnerships with fleet operators and energy distributors across India and Southeast Asia, hence positioning itself as a key player in emerging LNG markets.

- Cryostar SAS, based in France, is a leading provider of cryogenic pumps, compressors, and LNG fueling infrastructure in Europe. Its product portfolio includes on-site LNG stations, transfer systems, and storage solutions, which are suitable for both industrial and transport applications. The company emphasizes safety, efficiency, and low-boil-off technologies to meet the heightened demand for sustainable transport fuels in Europe. Furthermore, the company serves the energy, chemical, and logistics sectors, with profitable collaborations and turnkey projects to expand its footprint.

- Linde Engineering is a part of the Linde Group, and it efficiently delivers large-scale LNG stations, storage tanks, and integrated fueling systems for industrial and commercial vehicles. The company combines its expertise in both gas processing and cryogenics with innovative technologies for energy efficiency and reduced emissions. The company’s LNG solutions are deployed across all nations, particularly in Europe and Asia, thereby supporting energy transition and regulatory compliance initiatives.

Below is the list of some prominent players operating in the global market:

The market is witnessing intensifying competition since manufacturers are willing to supply modular, high-throughput, and low-emission refuelling solutions for heavy-duty transport and industrial fuel switching. U.S. firms such as Chart Industries emphasise turnkey station packages and modular skid-mounted solutions. In July 2023, BP and OMV reported that they had signed a 10-year LNG supply agreement under which BP would deliver up to 1 million tonnes of LNG per year to OMV starting in 2026. It also stated that the LNG will be sourced from BP’s global portfolio and received at the Gate LNG terminal in Rotterdam or other terminals based in Europe. Moreover, the partnership is expected to strengthen Europe’s energy security and diversify OMV’s gas supply portfolio, which already includes production from Norway and Central Europe.

Corporate Landscape of the LNG Filling Stations Market:

Recent Developments

- In November 2025, Essar Group announced that its Ultra Gas & Energy Ltd is investing Rs 900 crore (USD 101 million) to expand its LNG refueling network across India, targeting 100 stations by the end of 2028, primarily along high-traffic cargo corridors.

- In September 2025, ORLEN announced that it had expanded its LNG operations globally, completing its first delivery of 100 million cubic meters of LNG to Japan’s Osaka Gas using its gas carrier Ignacy Jan Padarewski.

- Report ID: 8238

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

LNG Filling Stations Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.