Liquid Termiticides Market Outlook:

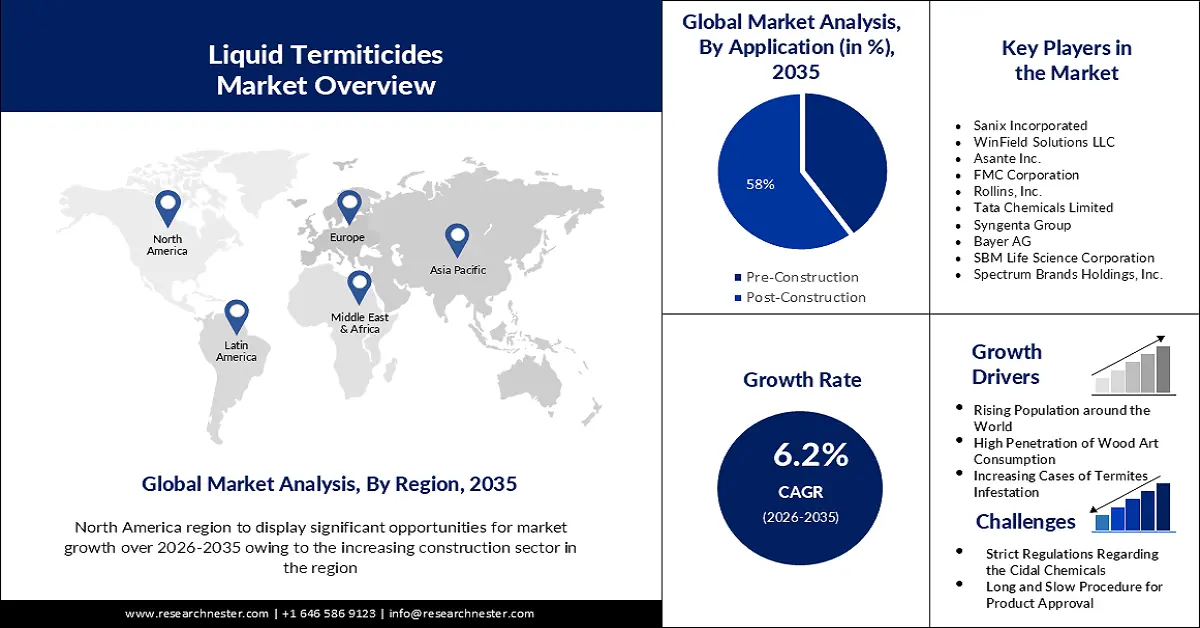

Liquid Termiticides Market size was over USD 2.48 billion in 2025 and is projected to reach USD 4.53 billion by 2035, witnessing around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of liquid termiticides is assessed at USD 2.62 billion.

The growth of the market can be attributed to the increasing number of wood constructions and abandoned or uncleaned spots of old and new buildings. The humid climate, and warm temperatures in many states are one of the reasons for the spread of termites. As per the estimations, it was observed that 900,000 homes were wood framed in 2010 which was raised by over 7% in 2020 in the U.S. and the concrete constructions decreased by more than 10%.

The market growth is also attributed to the rising long-term effectiveness, quick results, and easy application of liquid termiticides. Further, improper drainage, unrepaired pipes, less ventilation, and airflow into a house are estimated to increase the risk of termiticides and thereby drive the market growth during the forecast period. As of 2022, more than 95% of the basements in the U.S. households experience some kind of water damage and over 14 million homes are at risk to be flooded.

Key Liquid Termiticides Market Insights Summary:

Regional Highlights:

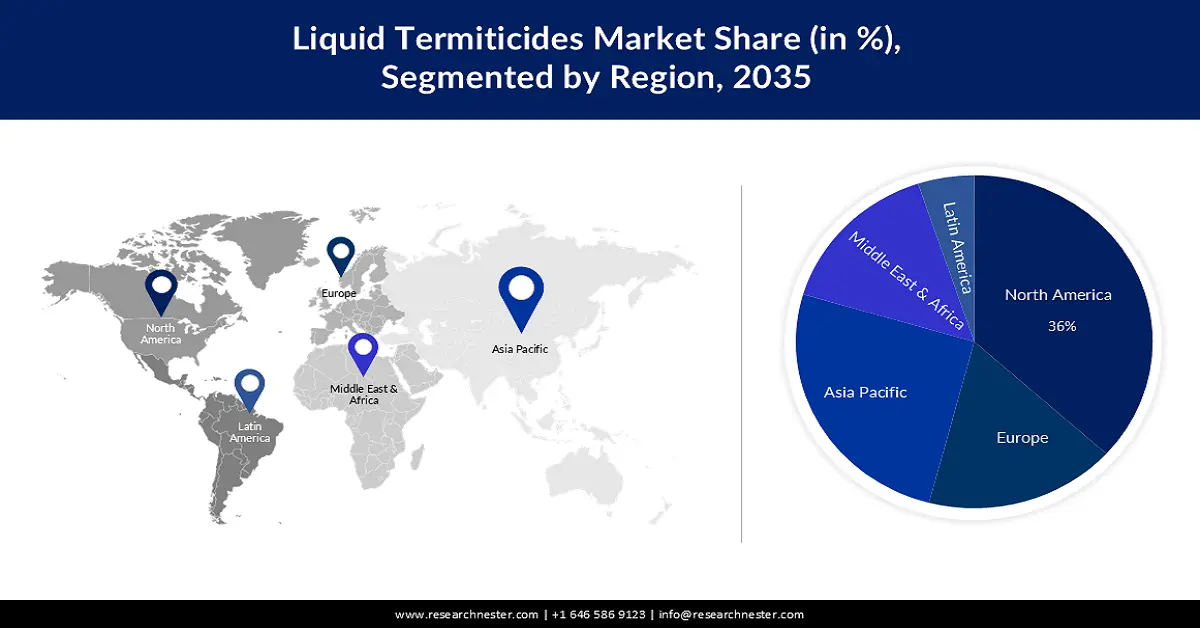

- By 2035, North America is projected to command a 36% share of the liquid termiticides market, supported by expanding construction activity and surging healthcare infrastructure spending.

- Asia Pacific is anticipated to secure around 25% share by 2035, underpinned by a rising concentration of key players and broader application adoption across multiple sectors.

Segment Insights:

- The post-construction segment is expected to capture about 58% share by 2035 in the liquid termiticides market, bolstered by the escalating use of plywood, wooden fixtures, and high-volume consumption of paper-based materials.

- The construction segment is set to account for nearly 28% share by 2035, augmented by rapid urbanization and the surge in residential building development.

Key Growth Trends:

- Increasing Cases of Termite Infestation Globally with a Lack of Awareness

- Growing Construction Activities around the world with increasing economic standards of people

Major Challenges:

- Strict Regulations regarding the Cidal Chemicals

- Long and Slow Procedure for Product Approval

Key Players: Sanix Incorporated, WinField Solutions LLC, Asante Inc., FMC Corporation, Rollins, Inc., Tata Chemicals Limited, Syngenta Group, Bayer AG, SBM Life Science Corporation, Spectrum Brands Holdings, Inc.

Global Liquid Termiticides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.48 billion

- 2026 Market Size: USD 2.62 billion

- Projected Market Size: USD 4.53 billion by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

Liquid Termiticides Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Cases of Termite Infestation Globally with a Lack of Awareness –The increasing wood production for various purposes and lack of awareness of termite generation is also increasing the risk of termite infestation in the coming years leading to market growth. Termite production is observed to raise by over 28% across the world with climate changes and the current growth rate as of 2023.

- Growing Construction Activities around the world with increasing economic standards of people – More than USD 1 trillion was spent on the construction of buildings and USD 800 on residential building construction in the United States in 2020.

- High Penetration of Wood Art Consumption with the Growing Adoption of Online Shopping – The value of wood products in the year 2026 is projected to reach more than USD 240 across North America.

- Escalating Libraries and Rising Storage of Old Books such as Manuscripts – The revenue of libraries in 2021 increased from USD 2 billion in 2020 to 2.5 billion in 2021 in the United States.

Challenges

- Strict Regulations regarding the Cidal Chemicals – The liquid termiticides cause water contamination when used near water bodies or water connection which is harmful to health and cause many complications. The complete destruction of termites is believed to cause repellent barriers in the environment which disrupts the cycle of life.

- Long and Slow Procedure for Product Approval

- Lack of Awareness of Preventive Measures

Liquid Termiticides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 2.48 billion |

|

Forecast Year Market Size (2035) |

USD 4.53 billion |

|

Regional Scope |

|

Liquid Termiticides Market Segmentation:

Application Segment Analysis

The post-construction segment in the liquid termiticides market is estimated to gain the largest revenue share of about 58% in the year 2035. The growth of the segment can be attributed to the increasing use of fall ceiling plywood and sheets, and stored wood items. The growing use of wooden doors and windows for homes and bathrooms is estimated to drive market segment growth during the forecast period. The wooden doors and windows value in the year 2020 was estimated to increase by more than 1% each year with the estimations to reach more than USD 13 billion in the U.S. The increasing use of cartons, books, and tissue papers for various applications in the kitchen is estimated to drive market segment growth. The number of tissues consumed worldwide as of 2021 was more than 40 million tons as per the estimations.

End-User Segment Analysis

Liquid termiticides market from the construction segment is expected to garner a significant share of around 28% in the year 2035. The rising urbanization across the world with increasing construction is estimated to propel market segment growth. The increasing number of construction buildings for residential purposes with rising migration rates is also estimated to drive the market segment growth in the coming years. The wooden furniture value across the globe was estimated to be more than USD 350 billion by the end of 2020 as per the estimations.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Liquid Termiticides Market - Regional Analysis

North American Market Insights

North America industry is likely to dominate majority revenue share of 36% by 2035. The growth of the market can be attributed majorly to the construction activities in the region. The construction industry in 2020 was estimated to reach more than USD 1 trillion in the U.S. The growing hospitals, and healthcare sector constructions are estimated to drive market growth during the forecast period. The healthcare expenditure of the U.S. in 2021 was estimated to increase to USD 4 trillion with a growth of 3%.

Moreover, termites are very common in the United States, which is further estimated to boost market growth.

APAC Market Insights

The Asia Pacific liquid termiticides market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the increasing presence of major key players across the region. The increasing applications in various sectors across the region are estimated to drive market growth. The growing need for the maintenance of wood and other furniture is estimated to fuel the market growth. The number of wood constructions to prevent flood loss and earthquake losses during the forecast period. For instance, the construction industry in China amounted to USD 1,050 billion in 2020.

Moreover, the growing population in the countries, including, India, China, and Japan, is also projected to boost the market growth.

Liquid Termiticides Market Players:

- Sanix Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- WinField Solutions LLC

- Asante Inc.

- FMC Corporation

- Rollins, Inc.

- Tata Chemicals Limited

- Syngenta Group

- Bayer AG

- SBM Life Science Corporation

- Spectrum Brands Holdings, Inc.

Recent Developments

- FMC Corporation signed a multi-year agreement with Corteva Agriscience to supply Rynaxypyr and Cyazypyr actives to Corteva for seed treatment insecticides.

- SBM Life Science Corporation announced the complete acquisition of Or Brun, a France-based manufacturer of natural soil fertilizers, and natural mulches.

- Report ID: 4024

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Liquid Termiticides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.