Learning Management System Market Outlook:

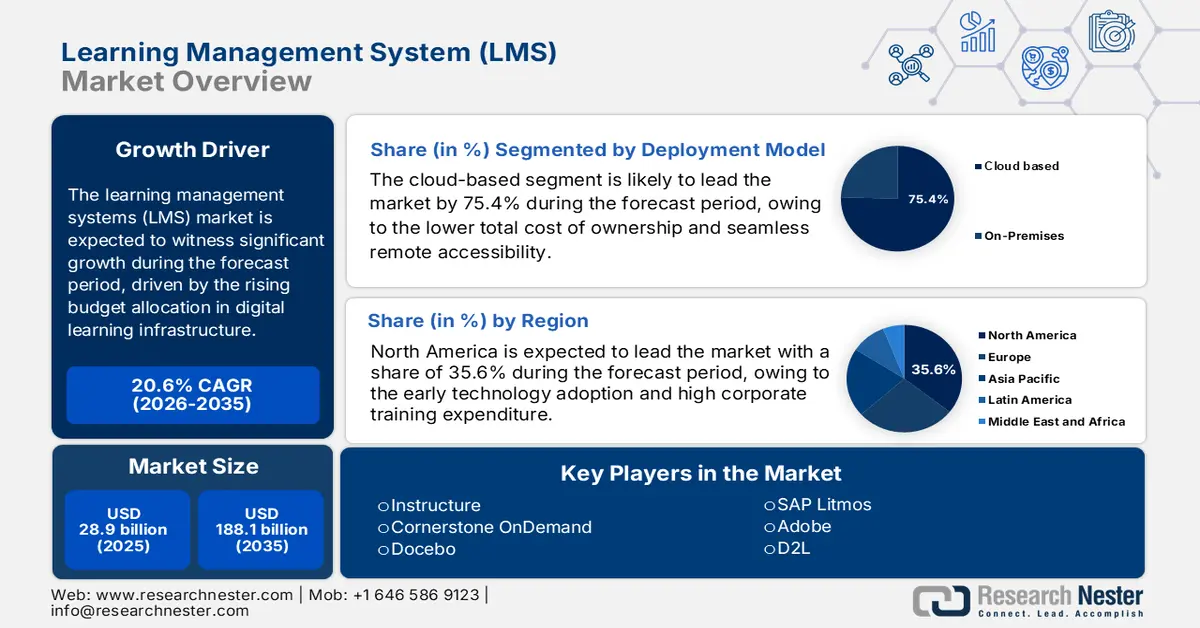

Learning Management System Market size was valued at USD 28.9 billion in 2025 and is projected to reach USD 188.1 billion by the end of 2035, rising at a CAGR of 20.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of learning management system is estimated at USD 34.8 billion.

The global learning management system (LMS) market continues to gain power as governments and publicly funded institutions expand digital learning infrastructure and allocate higher budgets toward scalable training and education delivery. As per the World Economic Forum report in January 2022, the U.S. is the leading country in the enrollment of online learning and accounts for 17.2 million. Further, the federal allocations support this shift, enhancing educational technology and digital access. The parallel developments are visible across Europe, with the member states using the EU Digital Education Action Plan funding to strengthen the centralized LMS system for assessment skills, tracking, and compliance reporting. The investments and adoption mandates reflect strong momentum for LMS vendors serving government, education, and large organizational buyers.

Top 10 Countries with the Most Online Learners

|

Country |

No. of Learners (millions) |

|

U.S. |

17.3 |

|

India |

13.6 |

|

Mexico |

4.8 |

|

Brazil |

3.7 |

|

China |

3.3 |

|

Canada |

2.4 |

|

R ussia |

2.4 |

|

UK |

4 |

|

Colombia |

2.2 |

|

Egypt |

1.6 |

Source: World Economic Forum January 2022

Further, the LMS market expansion is concurrently constrained and shaped by the strong data security, privacy, and procurement regulations, mainly within the public sector and educational contracts. Compliance with the frameworks such as the Family Educational Rights and Privacy Act, and adherence to cybersecurity standards set by the NIST are the non negotiable requirement for vendor participation. These regulations increase the technical complexity and cost of market entry and operation. The public procurement processes often impose pricing constraints with contracts mandating cost structures significantly below the commercial rates, pressuring vendor margin and favoring incumbents with the scale to absorb lower per unit profitability. The growth is mainly due to a function of feature innovation but is equally dependent on a vendor's ability to navigate a complex regulatory landscape, demonstrate rigorous security protocols, and deliver cost-effective solutions within highly structured procurement frameworks.

Key Learning Management System Market Insights Summary:

Regional Insights:

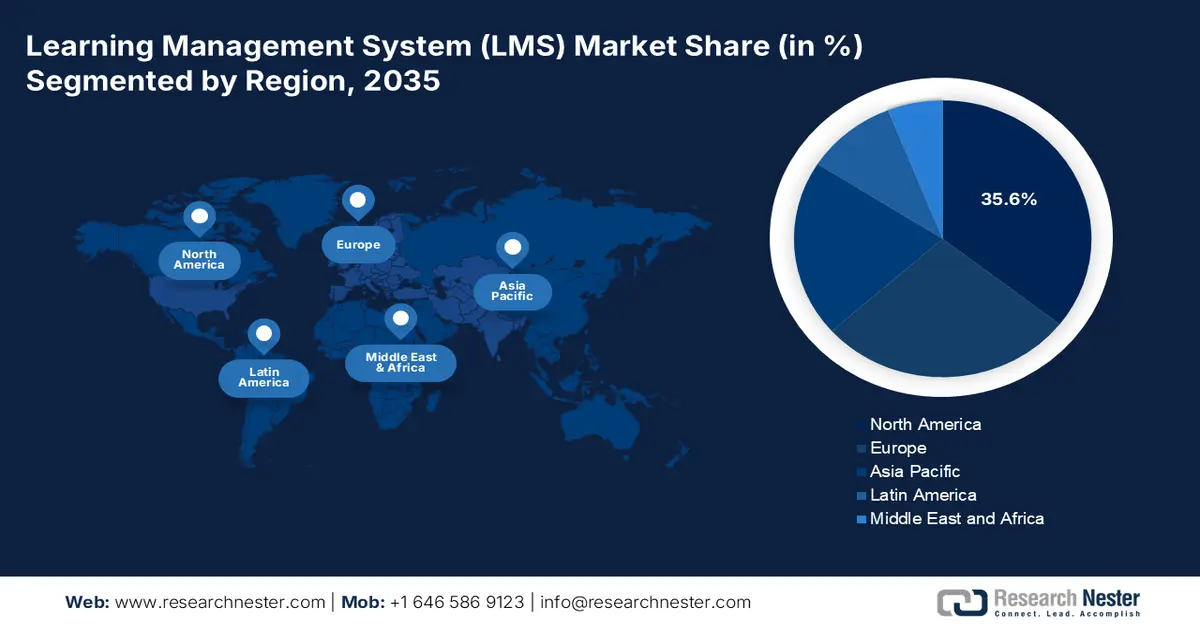

- North America is projected to secure a 35.6% share by 2035 in the learning management system market, underpinned by early technology uptake, elevated corporate training investments, and sustained public-sector education spending that reinforce skills-based and hybrid learning adoption.

- Asia Pacific is expected to expand at a robust 22.5% CAGR during 2026–2035, accelerated by large-scale digital transformation programs, government-led education modernization, and rapid enterprise adoption of online workforce upskilling platforms.

Segment Insights:

- Cloud-based deployment within the learning management system market is forecast to account for a dominant 75.4% share by 2035, propelled by scalability benefits, lower ownership costs, and pervasive demand for remote accessibility.

- Distance learning / online delivery mode is anticipated to retain its leading position through 2035, reinforced by the entrenched shift toward hybrid and flexible learning models across academic and corporate institutions.

Key Growth Trends:

- Rising government investment in digital education infrastructure

- Strategic shift to skills-based hiring and development

Major Challenges:

- Significant upfront development & integration costs

- Rapid pace of technological change

Key Players: Instructure (U.S.), Cornerstone OnDemand (U.S.), Docebo (Canada/Italy), SAP Litmos (U.S.), Adobe (Captivate Prime) (U.S.), D2L (Brightspace) (Canada), PowerSchool (ScholarSuite) (U.S.), Moodle Pty Ltd (Australia), Cypher Learning (U.S.), Absorb LMS (Canada), Open LMS (Australia), Epignosis (Greece), iSpring (Russia), CrossKnowledge (France), Hitachi Learning Hub (Japan), CLN (Cyber Learning Network) (South Korea), Thinkific (Canada), Paradiso LMS (U.S.), Frog by edotco (Malaysia), LearnUpon (Ireland)

Global Learning Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.9 billion

- 2026 Market Size: USD 34.8 billion

- Projected Market Size: USD 188.1 billion by 2035

- Growth Forecasts: 20.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Vietnam

Last updated on : 16 December, 2025

Learning Management System Market - Growth Drivers and Challenges

Growth Drivers

- Rising government investment in digital education infrastructure: Governments across major economies are increasing budget allocation for digital learning modernization, directly surging the adoption of the learning management system market. The U.S. Department of Education 2023 reports that the over under the Achieving Academic Excellence pillar, the government invested USD 122 billion to improve students’ learning, supporting the LMS-led curriculum delivery and remote learning infrastructure. Similarly, the EU’s Digital Education Action Plan outlines the multi-country funding to expand the institutional digital learning systems. The learning management system market is expanding significantly as public-sector education systems prioritize scalable learning platforms across North America and Europe.

- Strategic shift to skills-based hiring and development: In the learning management system market, organizations are moving from the role based to skills-based talent strategies to enhance their agility. The World Economic Forum report in January 2025 denotes that the 39% of workers' core skills are expected to change in the next five years. This requires the learning management systems platforms that integrate with the HR system to map existing skills, identify gaps, and deliver personalized learning pathways at scale. The LMS demand is increasingly tied to talent intelligence and people analytics features, moving the platform from a simple course repository to a core system for strategic workforce planning. This evolution makes the LMS a vital component of the talent supply chain, directly linking the learning investment to the measurable business outcomes and workforce readiness.

Workers Core Skills Expected to Change (2016-2025)

|

Year |

Core Skills Which Will Change in the Next 5 Years |

Core Skills Which Will Remain the Same |

|

2016 |

35 |

65 |

|

2018 |

42 |

58 |

|

2020 |

57 |

43 |

|

2023 |

44 |

56 |

|

2025 |

39 |

61 |

Source: World Economic Forum January 2025

- Digital infrastructure modernization: Governments are modernizing their digital infrastructure, which also includes the education and training systems. This often involves large-scale centralized LMS procurements for the public schools, universities, and civil service training. These contracts are high-value and long-term but come with robust requirements for interoperability, accessibility, and cost controls. For instance, the European Union’s Digital Education Action Plan prioritizes the adaptation of education systems to the digital age, influencing member state investments in the EdTech infrastructure. This driver creates substantial opportunities via complex market opportunities for compliant vendors. Success in the learning management system (LMS) market depends less on feature novelty and more on security, scalability, and the ability to provide verifiable total cost of ownership models that meet public budgetary constraints.

Challenges

- Significant upfront development & integration costs: Building a scalable, secure, and feature rich cloud native LMS requires a sustainable initial investment often exceeding a million in R&D. The challenge extends to developing seamless integrations with the key systems, such as Microsoft Teams, Zoom, and Salesforce. The leading companies are focusing heavily on their API and extensibility, but for a startup, this development cost is a major barrier to achieving the necessary interoperability that enterprise clients demand from day one.

- Rapid pace of technological change: The expectation for the AI-driven personalization, adaptive learning, and flawless mobile experience is now a table stake. Keeping pace requires continuous R&D. The top players have made significant investments in their AI-powered skills ontology and personalized career paths. A new entrant must not only match current AI capabilities but also innovate, requiring access to top-tier data science talent and ongoing investment that strains early-stage resources.

Learning Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.6% |

|

Base Year Market Size (2025) |

USD 28.9 billion |

|

Forecast Year Market Size (2035) |

USD 188.1 billion |

|

Regional Scope |

|

Learning Management System Market Segmentation:

Deployment Model Segment Analysis

Under the deployment model, the cloud based are dominating in the learning management system market and are projected to hold the share value of 75.4% by 2035. The segment is driven by the model’s inherent advantages of scalability, lower total cost of ownership, and seamless remote accessibility that became non-negotiable during and after the pandemic. The shift is supported by the broader federal initiative in digital modernization. For instance, the U.S. government’s adoption of cloud services is reflected in its IT spending. The report from Congress.gov in April 2024 states that the total federal IT spending in 2025 is estimated to be USD 75.1 billion, which includes cloud spending. This data accelerates the migration of public and associated private sector platforms to the cloud. This policy ensures cloud-based LMS solutions will become the standard for enterprises and academic institutions seeking agile, secure, and interoperable systems.

Delivery Mode Segment Analysis

Within the delivery mode segment, the distance learning or online is forecasted to be the leading subsegment in the LMS market. The permanent institutionalization of hybrid and flexible learning models across corporate training and academia is the core driver. This trend is firmly evidenced by enrollment data that shows a sustained commitment to the online formats. As per the National Center of Education Statistics report in May 2023, nearly 4.4 million students took distance education in 2021. Further, the percentage of students participating in distance education in public institutions reached 41% for the 2-year course. This data highlights the demand for a large user base accustomed to digital delivery, ensuring that the LMS platforms optimized for asynchronous and synchronous remote instruction will remain the central infrastructure for learning, solidifying this sub-segment's leading LMS market position through 2035.

Percentage of Undergraduate Students Who Participated in Distance Education Courses (2021)

|

Level of institution |

Public |

Private nonprofit |

Private for-profit |

|

2-year |

41 |

35 |

15 |

|

4-year |

20 |

20 |

71 |

Source: National Center of Education Statistics report May 2023

Component Segment Analysis

By 2035, the solutions are expected to lead the component segment as it constitutes the core software product. However, the vital and rapidly growing services encompassing implementation, integration, training, support, and consulting are essential for realizing the platform’s value. The complexity of modern LMS deployments that require integration with the HRIS, CRM, and content ecosystems drives the demand for expert services. The importance of skilled implementation is underscored by the federal investments in digital workforce development. For example, the U.S. Department of Labor reported that significant grants for expanding registered apprenticeships, many of which fund the digital infrastructure and related implementation services needed to track and deliver training effectively. This highlights how public-private investment in skilling initiatives directly fuel the demand for the LMS-related services.

Our in-depth analysis of the learning management system market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Model |

|

|

End user |

|

|

Delivery Mode |

|

|

Component |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Learning Management System Market - Regional Analysis

North America Market Insights

North America is expected to dominate the learning management system market and is poised to hold the market share of 35.6% by 2035. The market is driven by early technology adoption, high corporate training expenditure, and significant federal and state education spending. The key drivers include the strategic shift to skills-based workforce education development, mandated compliance training in regulated industries, and the permanent institutionalization of hybrid education models. A primary trend is the demand for LMS platforms that integrate with HR and talent intelligence systems to map skills and close competency gaps. The LMS market is defined by high competition, a push for AI-driven personalization, and strong data security requirements, aligning with the frameworks from the NIST. The market further creates significant opportunity for vendors offering interoperable, analytics-rich platforms that can demonstrate clear ROI through improved talent mobility and operational efficiency metrics.

The U.S. LMS market is driven by the substantial federal investment in workforce upskilling and the modernization of public education infrastructure. A core trend is the alignment of LMS procurement with the national skills strategies, evidenced by the U.S. Department of Labor’s consistent awarding of hundreds of millions in annual grants for apprenticeship programs that require strong systems for tracking and delivery. Further, the report from Harvard Online in May 2024 depicts that 60% of the undergraduate students have enrolled in one course. This raises the demand for the learning management systems platform. Further, the permanent shift to digital learning is confirmed by the NCES data showing that over half of postbaccalaureate students are enrolled in distance education. The demand is concentrated on platforms that ensure data security per NIST frameworks, support micro-credentialing, and integrate with existing government and enterprise IT ecosystems for strategic human capital development.

In Canada, the learning management system market is defined by the strong federal and provincial commitments to digital skills development and immigration integration. A key trend is the use of LMS platforms to support national upskilling initiatives, such as those under the future skills centres, which invest in innovative training and skills research. The government spending prioritizes the bilingual and accessible platforms that serve diverse populations, including the initiatives for indigenous skills development. The report from the Government of Canada in August 2024 states that the PSPC Learning Services explicitly states that the ALTO is the centralized LMS used to deliver, manage, and report on the departmental training activities. ALTO replaces legacy systems with a single learning management system that meets requirements and manages and tracks 14 million training activities annually. This data highlights the rising government adoption, modernization of training infrastructure, and enterprise-level training activity management, driving the growth of the LMS market.

APAC Market Insights

The Asia Pacific is the fastest-growing learning management system market, expected to grow at a CAGR of 22.5% during the forecast period 2026 to 2035. The market is driven by the massive digital transformation initiatives expanding the internet access and strong government mandates for education technology and workforce upskilling. The key drivers include the national programs such as India’s Digital India and China’s education modernization plans that fuel the demand in public education and civil service training. The corporate sector’s rapid adoption of formal online training to address skill shortages in growing economies is another major catalyst. A primary trend is the demand for the mobile first cost effective and locally localized platforms that can operate in varied connectivity environments. The market is also seeing a rise in the partnerships between the global LMS vendors and local telecom on IT service providers to enhance the reach and compliance with robust regional data sovereignty laws.

China’s learning management system is defined by a strong centralized government direction in education technology and corporate upskilling, creating a large but distinct ecosystem. The demand is primarily driven by the national policies like the Education Modernization 2035 plan and mandates fr the vocational skills development. The Ministry of Education actively promotes the Internet and Education, leading to significant platform procurement for the public schools and universities. A major statistic indicating this effort is the April 2025 Open Praxis survey, which found that China had 14.38 million open and remote education students enrolled in 2021. This data reflects the vast size of integrated digital learning. This environment favors the domestic compliant vendors, and platforms must adhere strictly to cybersecurity laws and data localization requirements, limiting the foreign competition while ensuring the sustained public sector growth.

The learning management system market in India is experiencing an explosive growth fueled by the world’s largest youth population, rapid digitalization, and strong policy support via the National Education Policy. This policy explicitly pushes for online learning and mandates that top universities offer digital courses, directly driving the institutional procurement. The corporate demand is equally robust, aimed at closing the nation’s vast skills gap. A prime example is the latest acquisition of eAbyas Info Solutions by Moodle to serve the EdTech industry in India in December 2022. This acquisition enables the Moodle company to enter into the largest and fastest-growing eLearning markets. The market demands highly scalable, mobile-first, and cost-effective solutions capable of operating in diverse linguistic and connectivity environments.

Europe Market Insights

In Europe, the learning management system market is a mature and actively growing sector primarily driven by the digitization of corporate training, higher education, and compliance-driven industries. A major unifying trend is the implementation of the European Union’s Digital Education Action Plan that pushes for enhanced digital competencies across member states, creating structured demand for educational technology. In the corporate sphere, the need for continuous upskilling and reskilling to meet the demands of the digital economy is a significant driver, mainly in tech and financial hubs. Further, the robust regulations in sectors such as finance, pharmaceuticals, and data privacy mandate documented employee training, making the LMS solutions essential for compliance. The market is defined by the preference of the platforms that aid multiple languages integrate with existing enterprise software and offer strong data security hosted within the EU.

The UK’s learning management system market is one of the most advanced markets in Europe and is driven by a highly digitalized corporate sector, robust professional compliance requirements, and a strong government advocacy for technology in education and skills. A key public driver is the Department of Education’s Skills for Jobs white paper that prioritizes flexible employer-led training, creating a sustained demand for the platforms that can deliver and track vocational qualifications. The government has backed this with significant funding, for example, the DfE’s for the further education sector, which is a primary user of LMS, has made a significant investment in continuing digital infrastructure. This policy and funding environment, coupled with the UK’s concentration of multinational corporations and global financial services firms that require robust compliance and upskilling platforms, ensures the market remains innovation-led and highly competitive.

In Germany, the learning management system market is defined by a systematic regulation-driven demand mainly within its world-leading manufacturing and engineering sectors that require certified and documented vocational training. A major catalyst is the national DigitalPakt Schule, a federal and state agreement to digitalize education. While initially focused on the school infrastructure, its principles spill over into a broader digital learning culture. The pact involves a substantial investment; the report from the Federal Ministry of Finance data in June 2025 has noted that the country has invested 4 million euros in digital infrastructure. This creates a foundational demand in higher education and corporate training. Further, the dual educational systems and strict data privacy laws demand LMS solutions that are secure, integrate with vocational frameworks, and support formal credentialing, favoring robust, compliant platforms.

Key Learning Management System Market Players:

- Instructure (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cornerstone OnDemand (U.S.)

- Docebo (Canada/Italy)

- SAP Litmos (U.S.)

- Adobe (Captivate Prime) (U.S.)

- D2L (Brightspace) (Canada)

- PowerSchool (ScholarSuite) (U.S.)

- Moodle Pty Ltd (Australia)

- Cypher Learning (U.S.)

- Absorb LMS (Canada)

- Open LMS (Australia)

- Epignosis (Greece)

- iSpring (Russia)

- CrossKnowledge (France)

- Hitachi Learning Hub (Japan)

- CLN (Cyber Learning Network) (South Korea)

- Thinkific (Canada)

- Paradiso LMS (U.S.)

- Frog by edotco (Malaysia)

- LearnUpon (Ireland)

- Infrastructure is a dominating player in the learning management system (LMS) market primarily via its Canvas platform. Its strategic advancement actively lies in leveraging data analytics and open API integrations to create a seamless, unified educational ecosystem. By ensuring interoperability with hundreds of edtech tools and student information systems, infrastructure optimizes the delivery and personalization of learning at scale, moving education beyond physical classrooms into a connected digital environment.

- Cornerstone OnDemand has significantly shaped the corporate learning management system (LMS) market by integrating talent management with learning. Its advancement focuses mainly on using LMS data and AI to map skill development directly to career paths and business outcomes. This strategic initiative ensures a dynamic skills-based approach to workforce development, optimizing the internal mobility and closing competency gaps in real time to adapt to evolving organizational needs.

- Docebo is another player in the learning management system (LMS) market by pioneering an AI-powered user-centric platform. Its key advancement is embedding artificial intelligence throughout the LMS to automate content tagging, curate personalized learning paths, and measure engagement. This ensures an optimized learning experience that increases the adoption and knowledge retention, positioning the LMS as a central driver of a continuous learning culture. The company’s subscription revenue reached USD 54.0 million in 2024.

- SAP Litmos has advanced the corporate learning management system market via its philosophy of simplicity and speed to training. Its strategic initiative is the seamless integration of its LMS with business workflow, mainly via the extensive SAP ecosystem. This ensures training can be launched and consumed directly within the tools employees use daily, optimizing compliance and performance support without disrupting the flow of work.

- Adobe with Adobe Captivate Prime in the learning management system (LMS) market by deeply integrating content creation with learning delivery. Its core advancement uses the Adobe Creative Cloud ecosystem to enable streamlined workflow from content creation to deployment, optimizing the speed and the experiential quality of digital learning programs.

Here is a list of key players operating in the global market:

The global LMS market is highly fragmented, competitive, and is dominated by the U.S.-based vendors, but with strong regional specialists. A key strategic initiatives focus on leveraging AI for personalized learning paths and automated content, expanding into the corporate upskilling market, and is achieving scalability via cloud native architecture. Major players are aggressively pursuing integrations with HR and productivity software ecosystems to become central workflow hubs. The consolidation via acquisition is common, as seen with PowerSchool and Open LMS, to quickly gain market share and new capabilities. For example, Workday completes the acquisition of Sana to build the next generation of enterprise knowledge tools. The rise of micro credentials and a focus on user experience are also vital battlegrounds for differentiation.

Corporate Landscape of the Learning Management System (LMS) Market:

Recent Developments

- In August 2025, Softlogic Life has introduced a future-ready learning management system to empower its high-performing sales force. This launch marks a major milestone in the digital transformation roadmap and people development strategy that is associated with evolving tech and future-ready learning management.

- In August 2025, Paradiso Solutions has officially launched Paradiso Free LMS, a powerful, all-in-one learning management system designed to empower organizations of all sizes. This advanced platform is now available at no cost, enabling businesses to deliver seamless employee training, increase engagement, and achieve measurable results without the burden of expensive software.

- In September 2024, INDIBA announced the launch of its state-of-the-art learning management system. This platform is designed to provide clients with access to a variety of training resources, ensuring they are equipped with the latest knowledge and skills to optimize the use of INDIBA’s technology.

- Report ID: 8325

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Learning Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.