Visitor Management System Market Outlook:

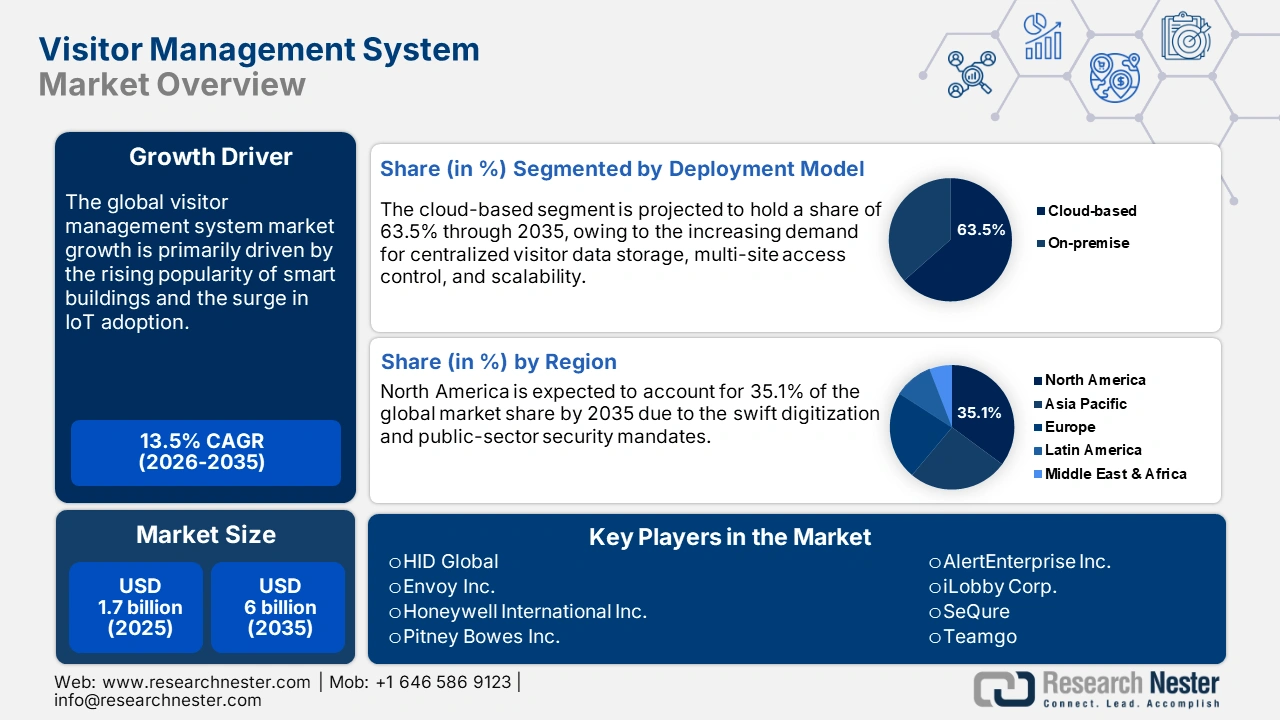

Visitor Management System Market size was USD 1.7 billion in 2025 and is estimated to reach USD 6 billion by the end of 2035, expanding at a CAGR of 13.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of visitor management system is assessed at USD 1.9 billion.

The rising demand for better security and threat mitigation is a primary driver of the visitor management system (VMS) market. Organizations, especially in government, critical infrastructure, and regulated sectors, are under increasing pressure to secure their facilities from unauthorized access, terrorism, fraud, and other threats. VMS helps by implementing real-time identity verification, biometric screening, and watchlist checking, along with logging and auditing of visitor flows. Laws and regulations around data protection, access control, immigration, and facility safety increasingly demand strict visitor tracking, screening, record-keeping, and auditing.

Furthermore, the need for operational efficiency and cost reductions fuels growth. Replacing manual or paper-based visitor logs with digital systems saves staff time, reduces errors, allows better resource planning, and improves the visitor experience. Over time, VMS can reduce the overhead of manual checks, data management, and physical security. For this, hardware assembly is the foundation for the efficient development of visitor management systems. Within hardware assembly, the software development and electronics manufacturing services (EMS) are important components. These specialized components, such as integrated circuits, microchips, RFID tags, facial recognition cameras, and touchless kiosks, are mainly sourced from Taiwan, South Korea, and Malaysia, due to the dominance of advanced manufacturing hubs.

Key Visitor Management System Market Insights Summary:

Regional Highlights:

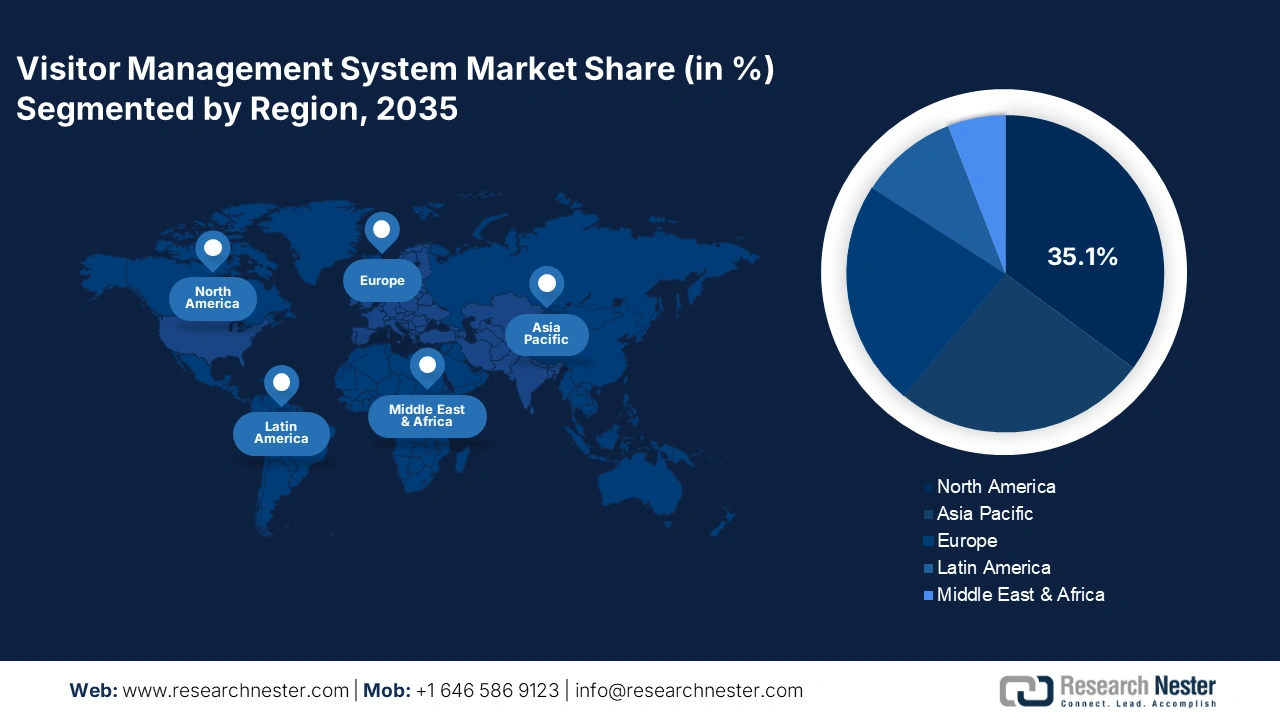

- North America is estimated to command 35.1% share by 2035, of the visitor management system market, attributable to aggressive digitization and rising public-sector security mandates.

- By 2035, Europe is expected to secure a 23.5% revenue share, sustained by strong regulatory enforcement and stringent cybersecurity mandates.

Segment Insights:

- By 2035, the cloud-based VMS segment in the visitor management system market is projected to secure a 63.5% share, underpinned by increasing investments in cloud infrastructure.

- By 2035, the BFSI segment is anticipated to account for 38.1% of the market share, supported by rising concerns about workplace safety.

Key Growth Trends:

- Growth in smart building and IoT adoption

- Government initiatives supporting digital access control

Major Challenges:

- Data protection regulations and compliance complexity

- Infrastructure gaps in emerging markets

Key Players: HID Global, Envoy Inc., Honeywell International Inc., Pitney Bowes Inc., Veristream (a Brady Corp Company), Sine (acquired by Honeywell), SwipedOn, Proxyclick (by Eptura), Vizito, AlertEnterprise Inc., iLobby Corp., SeQure, Teamgo, GoReception, Suprema HQ, HID Global, Envoy Inc., Honeywell International Inc., Pitney Bowes Inc., Veristream (a Brady Corp Company).

Global Visitor Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 6 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, Indonesia, United Arab Emirates, Mexico

Last updated on : 9 October, 2025

Visitor Management System Market - Growth Drivers and Challenges

Growth Drivers

- Growth in smart building and IoT adoption: The proliferation of IoT-enabled infrastructure is fueling demand for smart, integrated visitor management platforms. The high demand for smart buildings and homes is driving key players to introduce innovative visitor management solutions. They are focused on integrating VMS systems into building automation networks, allowing seamless interaction between HVAC, lighting, and access control systems. The OECD report about Smart City Data Governance states that, in the U.S., cities are projected to invest USD 41 trillion over the next 20 years to modernize infrastructure and capitalize on digital technologies. Thus, the rising adoption of smart buildings and IoT is expected to boost the visitor management system market growth.

- Government initiatives supporting digital access control: The swift rise in digitalization funds across various countries is set to propel the sales of visitor management technologies. The favorable government funds and grants to support the modernization of public buildings are opening lucrative doors for digital visitor management system producers. Japan’s Cabinet Office reported that the government has earmarked USD 225 million in FY2025 to advance smart city technologies, complemented by significant ongoing investments from prefectural, municipal, and private-sector stakeholders. Thus, the government programs supporting digital access control are set to double the revenues of key players in the years ahead.

Challenges

- Data protection regulations and compliance complexity: The inconsistent and fragmented data protection laws are one of the most challenging factors lowering the adoption of visitor management systems. The General Data Protection Regulation (GDPR) in the European Union and the Digital Personal Data Protection Act (2023) in India are major factors hampering the visitor management solution sales. These regulations impose strict requirements on personal data storage, consent, and transfer, which significantly impact the global sales of VMS platforms. Also, these regulatory inconsistencies raise operational costs and restrict scalability, especially for mid-tier SaaS VMS providers.

- Infrastructure gaps in emerging markets: The unavailability of stable IT infrastructure and data connectivity hinders the deployment of cloud-based or connected VMS solutions in some parts of Latin America and Sub-Saharan Africa. Many companies refrain from investing in underdeveloped markets due to unstable ROIs. The infrastructure gaps hamper both initial deployments and long-term maintenance contracts.

Visitor Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 6 billion |

|

Regional Scope |

|

Visitor Management System Market Segmentation:

Deployment Model Segment Analysis

The cloud-based VMS segment is projected to capture 63.5% of the market share through 2035. The cloud-based VMS is the most sought-after deployment model as it offers better centralized visitor data storage, multi-site access control, and scalability. In addition, the rising requirement from the U.S. federal institutions and educational facilities for systems that are compliant with NIST 800-53 and FedRAMP is directly favoring cloud-native architectures. The increasing investments of both the public and private sectors in cloud infrastructure are contributing to the segment's growth.

End user Segment Analysis

The BFSI segment is anticipated to hold 38.1% of the market share throughout the forecast period, owing to rising concerns about workplace safety and the need to efficiently handle the high volume of daily customer interactions at physical branches. For instance, the State Bank of India (SBI), the country's largest public sector bank, operates over 22,000 branches and serves more than 500 million customers. Despite the emergence of digital banking, a significant number of customers still prefer in-person visits for complicated transactions and personalized services. This consistent foot traffic necessitates efficient and secure visitor management solutions to streamline check-ins, enhance security protocols, and ensure compliance with regulatory requirements. Consequently, BFSI institutions are increasingly taking up advanced VMS technologies to handle customer flow, enhance operational efficiency, and maintain a secure banking environment.

Application Segment Analysis

The compliance management and fraud detection segment is poised to hold a 32.4% share during the forecast period as organizations face stricter data privacy, safety, and regulatory requirements. VMS platforms integrate advanced ID verification, watchlist screening, and audit trail features to avoid unauthorized access and fraudulent activities. The rise in workplace fraud and the need for secure environments across sectors such as banking, healthcare, and government are fostering adoption.

For instance, in January 2025, the U.S. Department of Homeland Security emphasized enhanced identity verification technologies in federal facilities to alleviate fraud and strengthen compliance. The DHS has adopted facial recognition and face capture technologies to improve identity verification, backed by strict testing, oversight, and privacy safeguards. This push toward biometric controls reinforces demand for visitor management systems that integrate compliance and fraud detection, as organizations aim to match government-level standards.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Deployment Model |

|

|

Offering |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Visitor Management System Market - Regional Analysis

North America Market Insights

The North America visitor management system market is estimated to account for 35.1% of the global revenue share by 2035, owing to aggressive digitization, public-sector security mandates, and increased investments in infrastructure and technology. The supportive government policies and funding programs are expected to fuel the sales of visitor management systems in the coming years. For instance, the U.S. General Services Administration (GSA) declared a USD 67 million investment for the construction of a new employee and visitor vehicle processing facility, including security checkpoints and electric vehicle charging stations, as part of the Biden-Harris Administration's Investing in America agenda. This investment depicts the government's commitment to improving security and efficiency in federal facilities, fueling the demand for advanced VMS solutions.

In the U.S., the adoption of visitor management systems is being propelled by the need for enhanced security and streamlined operations in federal facilities. The Department of Homeland Security (DHS) is investing in the construction of new headquarters for the Cybersecurity and Infrastructure Security Agency (CISA) and Immigration and Customs Enforcement (ICE), with a combined estimated investment of over USD 200 million. These developments highlight the federal government's focus on modernizing infrastructure, creating opportunities for VMS providers to offer integrated solutions that meet the evolving security requirements of government buildings.

The visitor management system market in Canada is expected to grow rapidly as government initiatives focus on improving visitor experiences and infrastructure. VMS solutions are being increasingly adopted at historical and cultural sites. Moreover, growing demand for touchless check-in, pre-registration, and contact tracing features, and rising integration of VMS in schools, hospitals, and construction sites are expected to increase the sales of VMS in the coming years.

Europe Market Insights

Europe market is expected to hold 23.5% of global revenue share throughout the projected timeframe. The strong regulatory enforcement and cybersecurity mandates are accelerating the deployment of visitor management solutions. The public sector digitization is also promoting the sales of visitor management technologies. The European Commission’s digital strategy is emphasizing secure access management systems in public facilities through hefty funding. Germany, France, and the U.K. are some of the leading marketplaces in the region.

Germany is projected to lead the sales of visitor management systems throughout the study period as increasing public investments in smart infrastructure and modernization fuel the demand for advanced VMS. The market is expected to expand due to the country’s focus on improving tourism infrastructure and digitalization. Moreover, local government has been investing in modernizing tourism facilities and encouraging digital tools to improve visitor services.

The UK visitor management system market is growing as a result of strategic investments aimed at boosting tourism and enhancing visitor experiences. The UK government, in collaboration with industry partners, has launched initiatives such as the Cruise Growth Plan, which outlines commitments to promote the growth of the cruise sector and improve visitor services. The cruise sector contributes USD 7.79 billion each year to the UK economy and provides employment for 60,000 people nationwide. The Cruise Growth Plan acknowledges this key economic impact and outlines a strategy for sustained growth, improved infrastructure, and global leadership in both sustainable and digital maritime initiatives. These initiatives encourage the adoption of advanced VMS solutions to manage the increasing number of visitors efficiently.

APAC Market Insights

The Asia Pacific market is poised to expand at a CAGR of 12.6% from 2026 to 2035. This growth can be attributed to rapid digitalization across public and private infrastructure. The healthcare and smart government offices are expected to lead the sales of visitor management solutions in the coming years. The robust expansion of educational institutions in the region is creating a profitable environment for visitor management system manufacturers. The increasing investments in defense facilities are likely to lead to the development of next-gen visitor management systems.

China is expected to hold a dominant market share through 2035 as massive government digitization initiatives, both in the public and private sectors, are propelling the sales of visitor management solutions. In China, the government's focus on developing national parks and enhancing visitor experiences is propelling the growth of the VMS market. The establishment of a national park system prioritizes the need for improved visitor management through technology. This initiative is expected to create demand for advanced VMS solutions to handle the complex procedures of visitor tracking and management in these newly developed parks.

The visitor management system market in India is increasing swiftly as the government invests in upgrading tourism infrastructure and services. According to the IBEF report of May 2025, the tourism and hospitality industry in India is projected to generate revenue of more than USD 59 billion by 2028, with Foreign Tourist Arrivals (FTAs) anticipated to reach 30.5 million by the same year. As per India’s Tourism Minister, the nation's tourism industry is predicted to expand at a CAGR of 20% over the next years, fueled by the expanding middle-income population and rising disposable income. Additionally, the same report also notes that international tourist arrivals are expected to jump to 30.5 million by 2028, indicating strong growth for the sector in the future. These investments and initiatives are propelling the need for efficient VMS solutions to control the increasing number of domestic and international visitors.

Key Visitor Management System Market Players:

- HID Global

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Envoy Inc.

- Honeywell International Inc.

- Pitney Bowes Inc.

- Veristream (a Brady Corp Company)

- Sine (acquired by Honeywell)

- SwipedOn

- Proxyclick (by Eptura)

- Vizito

- AlertEnterprise Inc.

- iLobby Corp.

- SeQure

- Teamgo

- GoReception

- Suprema HQ

- HID Global

- Envoy Inc.

- Honeywell International Inc.

- Pitney Bowes Inc.

- Veristream (a Brady Corp Company)

The global visitor management system market is characterized by the presence of leading companies and the increasing emergence of start-ups. The key players are integrating digital technologies to enhance the capabilities of their product offerings. The strict regulations and need for compliance are expected to drive the sales of advanced visitor management technologies. Some of the big companies are collaborating with other players to increase their market reach and revenue shares. The industry giants are also expanding their operations to the emerging markets to earn fruitful returns from untapped opportunities.

Here is a list of key players operating in the market:

Recent Developments

- In March 2025, Motorola Solutions signed a definitive agreement to acquire InVisit, a cloud-based visitor management solutions company headquartered in Calabasas, California. This acquisition will enhance Motorola Solutions’ cloud-native Avigilon Alta security suite for enterprise clients, strengthening their ability to address growing security risks to personnel, operations, and assets globally.

- In May 2025, Precise Biometrics expanded its visitor management business with Precise Visit by EastCoast, introducing enhanced features for improved usability, security, and visitor experience. The updates streamline check-ins, package handling, and high-security visits, while supporting single sign-on, stronger integrations, and a hardware-free option for rapid deployment. Visitors can use biometrics or QR codes for seamless access, leveraging integrated visitor and access management systems.

- Report ID: 728

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Visitor Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.