Oncolytic Virotherapy Market Outlook:

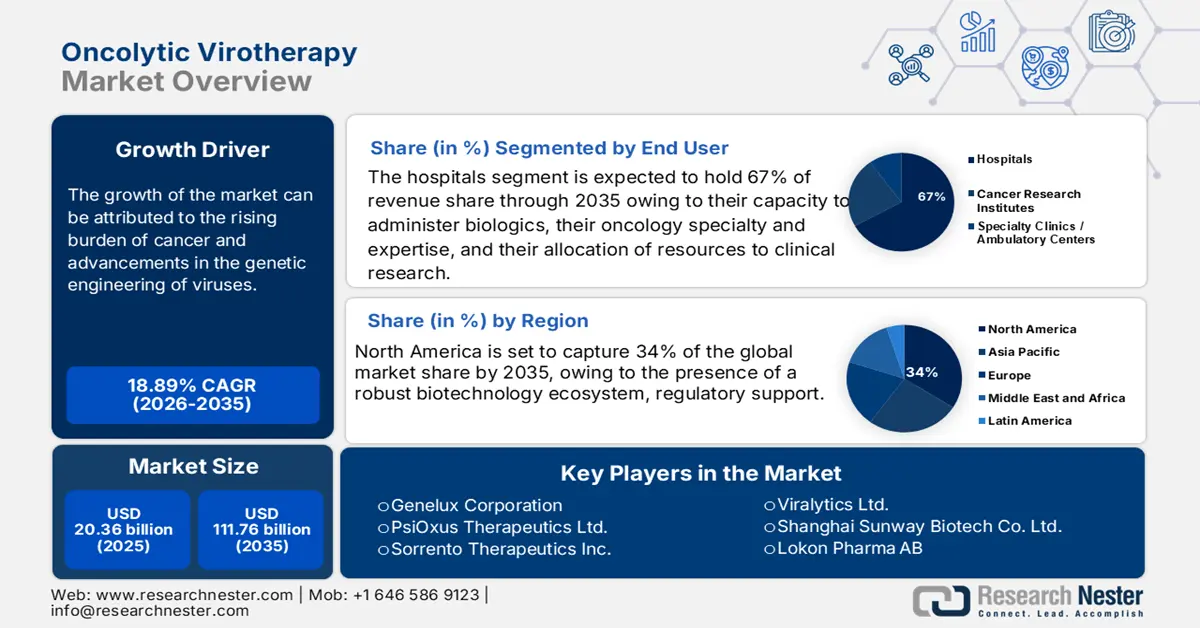

Oncolytic Virotherapy Market size was valued at USD 20.36 billion in 2025 and is projected to reach USD 111.76 billion by the end of 2035, rising at a CAGR of 18.89% during the forecast period, from, 2026-2035. In 2026, the industry size of oncolytic virotherapy is assessed at USD 25.03 billion.

Currently, the market is experiencing unprecedented progress due to advances in genetic engineering, regulatory momentum. Newer viral constructs are being designed with immune-enhancing transgenes. There is a growing trend in combining oncolytic viruses and other cancer therapies, as we move toward a more unified approach to cancer treatment. In terms of regulatory approvals, Fast Track or Breakthrough Designation approval has the potential to expedite trials and move them forward more rapidly toward market approval. Furthermore, Japan's conditional approval of the HSV-based Teserapure for malignant glioma signifies that innovative oncolytic therapies are gaining traction on a global scale.

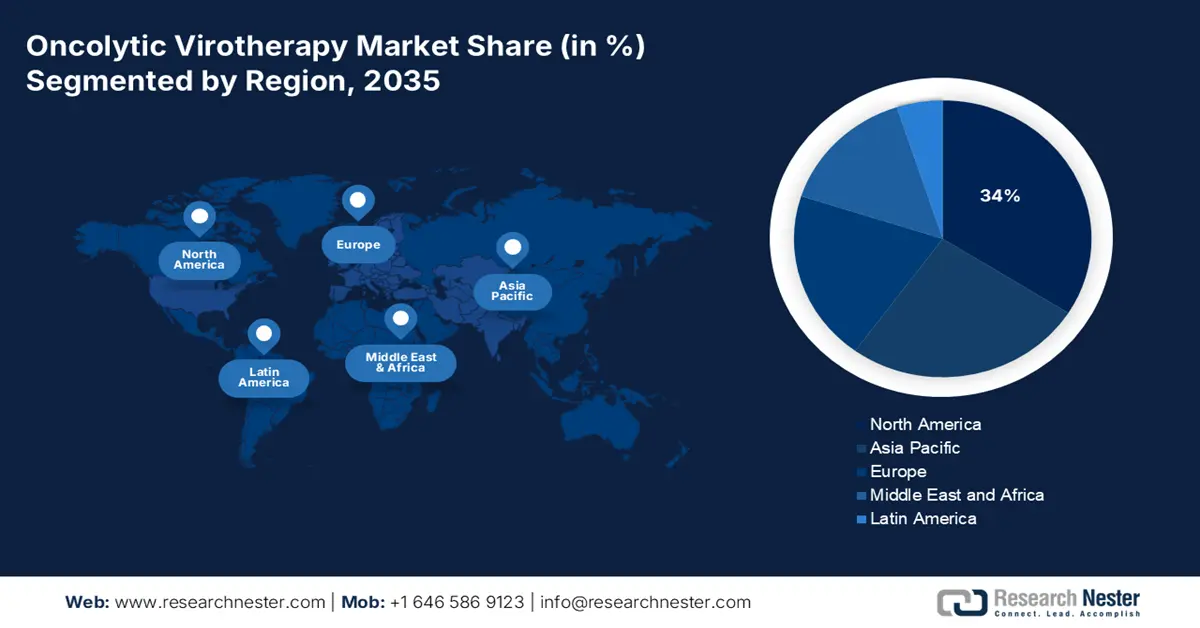

In terms of geography, North America remains firm in its place as the innovation capital—supported by large biotech financing, regulatory encouragement, and innovative clinical trial activity. Moreover, the Asia-Pacific region is growing rapidly with regulatory changes supporting increased clinical activity. Market growth in North America and the Asia Pacific is also supported by the emergence of personalized virotherapies that improve the precision and safety of treatment. In addition, collaborative efforts between biotechs, academic virologists, and AI-generated design platforms are helping to improve vector specificity and accelerate the breadth of pipelines. Collectively, all these developments are moving oncolytic virotherapy from a niche experimental therapeutic to an exciting foundation of new multi-modal cancer treatments.

Key Oncolytic Virus Therapy Market Insights Summary:

Regional Highlights:

- North America is expected to secure a 34% share by 2035 in the oncolytic virotherapy market, fuelled by a strong biotechnology ecosystem and regulatory initiatives that accelerate the development and approval of advanced biologics.

- The Asia-Pacific region is projected to expand significantly through 2035, underpinned by rising biotechnology capabilities, increasing cancer prevalence, and regulatory reforms that support broader clinical implementation.

Segment Insights:

- The hospitals segment is anticipated to command a 67% share by 2035 in the oncolytic virotherapy market, owing to their advanced oncology infrastructure, extensive clinical research capacity, and comprehensive pathways that enable timely access to complex biologic therapies.

- The genetically engineered viruses segment is positioned to dominate the market over the forecast period, supported by their ability to deliver precise tumor targeting, enhanced safety features, and improved immune activation through advanced genetic modifications.

Key Growth Trends:

- Rising burden of cancer

- Advancements in genetic engineering of viruses

Major Challenges:

- Complex manufacturing and scalability issues

- Limited tumor selectivity and penetration

Key Players: Replimune Group Inc., Oncolytics Biotech Inc., Sorrento Therapeutics Inc., PsiOxus Therapeutics Ltd., Transgene S.A., SillaJen Inc., Genelux Corporation, Viralytics Ltd., Shanghai Sunway Biotech Co. Ltd., Targovax ASA, Lokon Pharma AB, Vyriad Inc., Oncorus Inc., VCN Biosciences, CG Oncology Inc., Daiichi Sankyo (DELYTACT), Pfizer Inc., Merck & Co. Inc., Transgene Biotek Ltd.

Global Oncolytic Virus Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Oncolytic Virotherapy Market - Growth Drivers and Challenges

Growth Drivers

-

Rising burden of cancer: As per the National Cancer Institute, globally, there were 9.7 million cancer-related deaths and about 20 million new cases in 2022. As a result, there is an ongoing need for more targeted and efficacious treatments. Its unique promise can be valuable in patients who have not adequately responded to standard therapies. There is an increase in researchers' ERD in solid tumours and in previously hopeless instances. As a result of compound cancer implications being better genetically understood, precision virotherapies will shift toward gleaning applicable insights from clinical experience. Additionally, governmental and world health organizations are spending more on immuno-oncology R&D through clinical investigations.

-

Advancements in genetic engineering of viruses: Sustainable molecular engineering technologies can facilitate next-generation oncolytic viruses (OVs) that deliver different immune-stimulatory genes. This capacity to engineer viruses for specific impact on host immunity and/or to specifically target the cancer cells has improved the precision and effectiveness of virotherapy. Vector platform companies adapt viruses into proprietary viral backbones with engineered safety, persistence, and therapeutic payloads. This has led to a rise in IND filings and Phase I/II trials around the world.

-

Supportive regulatory environment: Regulatory bodies like the FDA, EMA, and PMDA (Japan) are becoming far more supportive of oncolytic virotherapy. In fact, Japan approved G47Δ (Teserpaturev) under a conditional approval for glioma, a significant milestone. The U.S. FDA approved Fast Track designation for ImmVira's MVR-T3011 and future pipeline candidates. These types of accelerated pathways provide shorter development timelines and stimulate early innovation. Additionally, new updated regulatory guidance for Genetically Modified Organisms (GMOs) is becoming easier to navigate for virotherapies. In fact, regulatory bodies are showing more awareness and willingness to accommodate combination products and personalized virotherapies aligned with the goals of precision oncology.

Challenges

-

Complex manufacturing and scalability issues: Producing oncolytic viruses requires very specialized facilities that must work under strict biosafety protocols. Further, there are more logistics needed to maintain a cold chain on top of the work being done with either a mucosal or parenteral route of administration. Furthermore, there is still a technical and regulatory hurdle when considering the processes surrounding scaling up viral vector manufacturing while still maintaining purity, potency, and safety. The timelines for developing viable GMP-compliant viral production processes are also longer. Therefore, this, in turn, limits the ability for more rapid commercialization as well as incurs additional costs to manufacture.

-

Limited tumor selectivity and penetration: Achieving exact tumour selectivity while sparing normal tissues represents a significant obstacle. Some oncolytic viruses may not replicate well across all types of tumors, or may not sufficiently penetrate the hypoxic cores of tumors. In addition, the dense tumour microenvironments and extracellular matrices will often block or limit the diffusion of the virus, leading in tumours to a limited efficacy upon access to the tumour. New engineering approaches are necessary to deliver virotherapy more effectively, improving tropism and spread in tissue.

Oncolytic Virotherapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.89% |

|

Base Year Market Size (2025) |

USD 20.36 billion |

|

Forecast Year Market Size (2035) |

USD 111.76 billion |

|

Regional Scope |

|

Oncolytic Virotherapy Market Segmentation:

End User Segment Analysis

The hospitals segment is estimated to account for the largest share of 67% in the oncolytic virotherapy market over the discussed timeframe. Hospitals will continue to dominate the end-use segment due to their capacity to administer biologics, their oncology specialty and expertise, their allocation of resources to clinical research, and their ability to provide a complete patient access pathway. Hospital-based oncology centers often access more complex therapies sooner than hospital-affiliated community oncologists, as well as have a more elaborate trial process for new oncolytic agents. These advantages of hospitals will lead to increased patient access to oncolytic viruses for their comprehensive treatment approaches.

Type Segment Analysis

The genetically engineered viruses segment is poised to dominate the market. Genetically engineered viruses are at the forefront of development because they can be designed to target tumors more precisely than other options. Moreover, they potentially could make the treatment safer by transferring genes to reduce off-target effects, and they can improve immune activation. Clinical developments such as talimogene laherparepvec (T-VEC) also illustrate the relevance of genetic modifications, and indicate that the modifications could make treatment safer and more effective in human trials

Application Segment Analysis

The solid tumors segment is likely to grasp a substantial share of the market. Solid tumors are by far the largest application segment, based on the high global incidence of breast, lung, and prostate cancers. Oncolytic viruses can infiltrate tumor microenvironments and replicate instead of favorably, where conventional treatments may fail. With advanced solid tumours on the rise, the need for alternative locoregional treatments is warranted.

Our in-depth analysis of the oncolytic virotherapy market includes the following segments:

|

Segments |

Subsegments |

|

Virus Type |

|

|

Application |

|

|

Route of Administration |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oncolytic Virotherapy Market - Regional Analysis

North America Market Insights

North America is expected to capture the highest share of 34% in the global oncolytic virotherapy market by the end of 2035. The growth is driven by the presence of a robust biotechnology ecosystem, regulatory support. The North American biotechnology sector, and the U.S. FDA have accelerated oncolytic virus innovation by granting fast-track designations, orphan drug approval, and support for genetically engineered biologics. For instance, according to the National Cancer Institute, the Food and Drug Administration (FDA) has approved T-VEC, an immunotherapy that uses one oncolytic virus, to treat metastatic melanoma. Although numerous are undergoing clinical trials, oncolytic viral treatments for other cancer types have not yet received approval. North American biotechnology will remain innovative and aggressive towards clinical deployment of complex biologics.

The U.S. positioned to be the lead in the market from having a multi-faceted biotech and pharmaceutical ecosystem. The country is home to a multitude of innovative companies progressing on developing advanced oncolytic virus therapeutics. The heavy investments for innovating in oncology research, levels of clinical trials, and oncolytic virotherapy’s complementary pathology with immunotherapy continually create a strong foundation for robust development and research. Additionally, the U.S. has a high level of adoption for early availability of drugs.

Canada's rise in the market is not coincidental, as the country has a beneficial backdrop of increased government funding for life sciences and cancer research. Moreover, Canada has universal healthcare and a developed clinical basis that supports the opportunity to conduct trials and safely deliver more complex biologic therapies. A 2023 report by the Fraser Institute states that in terms of the number of doctors per 1000 population, Canada came in at number 28 out of 30 nations with universal health care. In this context, we see an encouraging trend in Canadian biotech companies making virotherapy innovation a priority, often with a cooperative approach with the academic centres to speed up this process of development.

APAC Market Insights

The market in the Asia-Pacific region is anticipated to experience substantial growth by 2035. Thee growth can be attributed to the increased advancements in biotechnology, more cases of cancer, and regulatory reforms in larger countries. The region is experiencing a transformation in oncology with the increased interest in personalized and immune-based therapies. The Asia-Pacific also benefits from a diverse and relatively large patient population, which allows for comparatively easier and less expensive clinical trials. Investment in advanced healthcare by government agencies and hospitals allows for the implementation of virotherapies. For instance, India Investment Grid lists 1147 healthcare investment projects in India totalling USD 31.75 billion across all states.

The rapid growth of India’s oncolytic virotherapy market is led by the increasing healthcare investments and advances of regulatory reforms to/target clinical trials and drug approvals on time. This evolution facilitates the stepwise process of bringing new forms of therapies to market/commercialization, as this growth, given its larger cancer patient population, is expanding rapidly, and healthcare is often limited. Indeed, access to better awareness, aches for/ cravings medicine are increasing to advance healthcare/stage, which all offer India’s market as accommodating. Urban healthcare infrastructure is finding robust change to deliver and access to the complex, sophisticated therapies being developed. India's partnership with westernized biotech serves to increase innovation, technology transfer and increasing India's footing as a spontaneous and trusted nation and brand.

China is poised to lead the oncolytic virotherapy market due to its significant levels of government support for biotechnology and healthcare innovation, and relatively low barriers to entry in the marketplace. In addition, with recent regulatory changes such as accelerated approval pathways and loosened regulations for biologics, the time it takes to get a new therapy to market has been drastically reduced. China's large population also means there are numerous individuals for clinical trials and therapies. Additionally, as the government has begun to explore personalized medicine and immunotherapies, funding in oncolytic virotherapy has opened up. Domestic biopharmaceutical companies, academic institutions, and international collaborators, are working together to generate ongoing collaboration and development of oncolytic virus-based therapies.

Europe Market Insights

The oncolytic virotherapy market in Europe is expected to continue to grow steadily through 2035, given the several common factors that create an environment conducive to innovation, clinical advancement, and market adoption. Europe is home to several prominent biotech hubs, which make virotherapy R&D investments publicly and privately supported. Notably, many European regulatory bodies have created adaptive frameworks for the assessment of advanced therapy medicinal products (ATMPs). This regulatory clarity benefits all innovative continents, as it will result in pursuing the development and commercialization of virotherapies in a process for viropharmaceutical benefactor startups and large pharmaceutical companies. Further to these collaborative biopharmaceutical advancements, oncolytic virotherapy also benefits from many European cancer research networks.

Germany is distinguished by a strong pharmaceutical industry. Germany is strong on precision medicine and advanced treatment protocols for cancer. This is making it well-positioned to adopt leading-edge practices like oncolytic virotherapy. Strong healthcare systems in the country ensure patient access to new treatments. Participating in international clinical trials that foster the use of any innovative strategy leads to the diffusion and early adoption of such therapies in Germany.

Due to a vibrant biotech ecosystem and ongoing funding in cancer research, France is poised to establish a sizable oncolytic virotherapy market. The French National Agency for Medicines and Health Products Safety (ANSM) actively promotes access to emerging therapies through various supportive regulatory pathways. With France's universal healthcare system, innovative cancer treatments can be administered to broad patient populations. A collaborative environment between industry and research institutions. This aids in the clinical development and uptake of virotherapy.

Key Oncolytic Virotherapy Market Players:

- Amgen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Replimune Group Inc.

- Oncolytics Biotech Inc.

- Sorrento Therapeutics Inc.

- PsiOxus Therapeutics Ltd.

- Transgene S.A.

- SillaJen Inc.

- Genelux Corporation

- Viralytics Ltd.

- Shanghai Sunway Biotech Co. Ltd.

- Targovax ASA

- Lokon Pharma AB

- Vyriad Inc.

- Oncorus Inc.

- VCN Biosciences

- CG Oncology Inc.

- Daiichi Sankyo (DELYTACT)

- Pfizer Inc.

- Merck & Co. Inc.

- Transgene Biotek Ltd.

A few biotech players appear to dominate the oncolytic virotherapy space, capturing over half of the market. A second layer of global players in Europe, Asia, and Oceania—also expanding their products in a myriad of viral platforms through partnerships, regulatory success, and through combination therapy clinical trials. Now, there is a growing number of Japanese, Indian, and other local developers. Multi-national pharmaceutical companies such as Pfizer and Merck continue to support development mostly through partnerships and investing in research and development (R&D). The competitive landscape signifies an exodus out of single-viral modalities and an influx of regional oncolytic virotherapy development.

Recent Developments

- In February 2025, UroGen Pharma Ltd. announced the acquisition of IconOVir Bio, Inc.'s new oncolytic virus, ICVB-1042, and the start of strategic research partnerships to investigate how its RTGel technology can improve the efficacy of other immunotherapies. The company has seen strong sales growth of 15.6% over the last 12 months, and it claims impressive gross profit margins of 90%.

- In June 2025, UP Oncolytics, a neuro-oncology biotechnology company, was awarded a matching grant of USD 75,000 from the University of Wisconsin and the Wisconsin Economic Development Corporation (WEDC). The money will help UP Oncolytics lead therapy, an oncolytic virus that targets gliomas, the most prevalent type of brain cancer, continue its preclinical development. The business is also investigating its use in other forms of cancer.

- Report ID: 2988

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oncolytic Virus Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.