Adeno Associated Virus Vector Manufacturing Market Outlook:

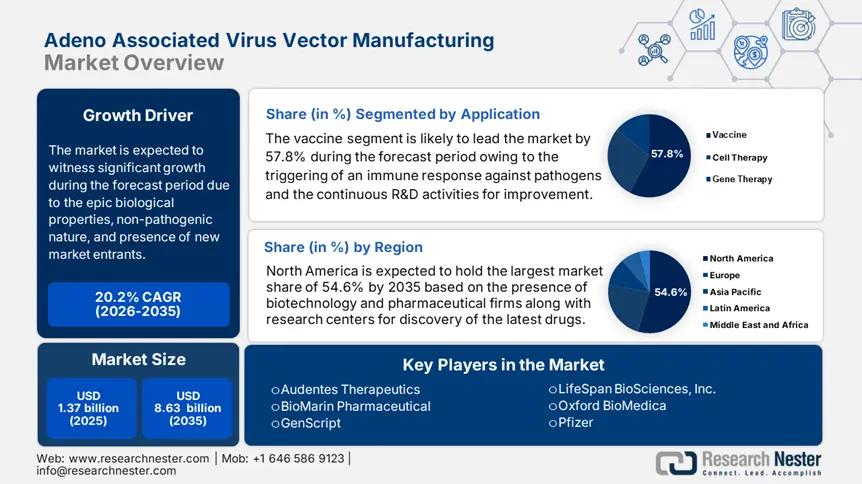

Adeno Associated Virus Vector Manufacturing Market size was over USD 1.37 billion in 2025 and is poised to exceed USD 8.63 billion by 2035, witnessing over 20.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of adeno associated virus vector manufacturing is estimated at USD 1.62 billion.

Adeno associated virus (AAV) vectors are extensively used to provide healthcare solutions to aid genetic illnesses. As per an article published by Molecular Therapy Methods and Clinical Development in September 2024, packaged AAV vectors comprise methylated cytosines with a ratio ranging between 0% to 1.7% with an average of 0.6%. Besides, these vectors also comprise materials attributed by concentrated particles, vector genome titer of DNase I-treated lysed capsids, infectious titer using 50% tissue culture infectious dose (TCID50), and identification of capsid and purity through sodium dodecyl sulfate-polyacrylamide gel electrophoresis, thereby driving the market demand globally.

The availability of AAV vectors depends upon their distribution through international shipping. In addition, the research community plays an essential role in evaluating the quality and viral preparation of vectors which is a driving factor for the market. Based on these, the payer’s pricing of the AAV vector is set that include the manufacturing and production costs. In this regard, the Addgene Organization in its 2025 report stated the price of each AAV vector based on 100 µL aliquot is USD 375 which also includes shipping charges. Moreover, in 2025, the UNC School of Medicine notified the stock AAV price per 100ul for different areas which is uplifting market expansion globally.

AAV Vector Price Per 100ul

|

Areas |

Price |

|

Corporate |

USD 340 |

|

UNC Investigators |

USD 150 |

|

External Academics |

USD 220 |

Source: UNC School of Medicine 2025

Key Adeno Associated Virus Vector Manufacturing Market Insights Summary:

Regional Highlights:

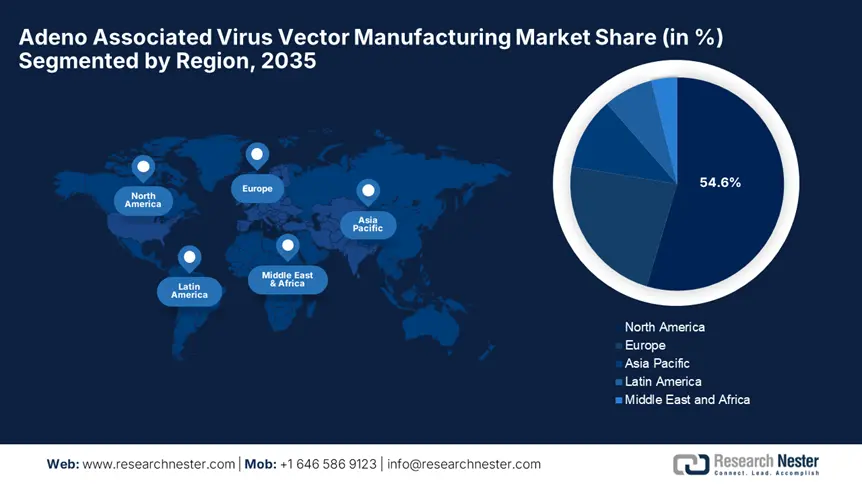

- North America commands a 54.60% share in the Adeno Associated Virus Vector Manufacturing Market, driven by strong networks among research institutions, biopharma firms, and academic collaborations, fostering robust growth by 2035.

- Asia Pacific’s adeno associated virus vector manufacturing market is gaining exceptional traction by 2035, driven by major investments from pharmaceutical firms and government strategies.

Segment Insights:

- The Neurological Disorders segment is anticipated to capture a considerable share by 2035, fueled by the increasing prevalence of neurological conditions in low- and middle-income countries.

- The Vaccine segment of the Adeno Associated Virus Vector Manufacturing Market is anticipated to capture over 57.8% share by 2035, driven by the global focus on preventing infectious diseases through vaccinations.

Key Growth Trends:

- Enhanced need for gene therapies

- Contributions from biopharmaceutical firms

Major Challenges:

- High price of manufacturing

- Presence of strict regulations

- Key Players: BioMarin Pharmaceutical, Oxford BioMedica, YPOSKESI, Sarepta Therapeutics.

Global Adeno Associated Virus Vector Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.37 billion

- 2026 Market Size: USD 1.62 billion

- Projected Market Size: USD 8.63 billion by 2035

- Growth Forecasts: 20.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (54.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Adeno Associated Virus Vector Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

-

Enhanced need for gene therapies: AAV vectors are extensively utilized for genetic therapies which is a swiftly growing field in the healthcare sector. For instance, IQVIA in its March 2024 article stated that the spending on gene therapies reached USD 5.9 billion in 2023, which is up by 38% from 2022. Furthermore, the upsurge in genetic disorders is also enhancing the demand for AAV vectors, thus a prolific growth for the adeno associated virus vector manufacturing market.

-

Contributions from biopharmaceutical firms: The growth of the market is subjected to relevant assistance from biopharmaceutical organizations. For instance, in October 2024, Virica Biotech and eXmoor Pharma declared their latest collaboration-based project sponsored by a joint UK-Canada government initiative. The purpose of this deal is to boost the manufacturing of adeno-associated vectors decisive for gene therapies, eventually dipping costs and refining the approachability of life-saving treatments, thus driving the market growth globally.

Challenges

-

High price of manufacturing: The production of AAV vectors constitutes intricate and hand-operated procedures that include vigorous vector creation, cleansing, and quality assurance. These procedures are exclusive and expensive, eventually leading to an overpriced manufacturing process which is a huge restraint in the growth of the adeno associated virus vector manufacturing market internationally. In addition, these can create boundaries for the accessibility and availability of AAV vectors, particularly for small-scale biotech businesses and academic research institutions with inadequate budgets.

-

Presence of strict regulations: Another challenge for the evolution of the market is the presence of severe and complicated regulations. The regulatory guidelines are usually provided by the government and various administrative bodies to ensure a suitable and standardized production of AAV vectors. However, the major drawback of these guidelines is that manufacturers at times fail to meet every policy mentioned, which results in poor vectors. In addition, meeting the regulatory aspect is also time-consuming which leads to high costs and delays in the overall commercialization.

Adeno Associated Virus Vector Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.2% |

|

Base Year Market Size (2025) |

USD 1.37 billion |

|

Forecast Year Market Size (2035) |

USD 8.63 billion |

|

Regional Scope |

|

Adeno Associated Virus Vector Manufacturing Market Segmentation:

Application (Vaccine, Cell Therapy, Gene Therapy)

Based on application, the vaccine segment is expected to capture over 57.8% adeno associated virus vector manufacturing market share by 2035. Vaccines are vital in thwarting and monitoring infectious illnesses, and their progress has been a priority for the healthcare sector internationally. According to the September 2024 CDC report, approximately 4 million deaths globally are successfully prevented by the provision of childhood vaccination every year. Besides, by 2030, it is projected that the measles vaccine can protect almost 19 million lives and the Hepatitis B vaccination can save nearly 14 million lives, thus driving the segment’s growth.

Therapeutic Area (Neurological Disorders, Genetic Disorders, Infectious Diseases, Hematological Diseases, Ophthalmic Disorders)

Based on the therapeutic area, the neurological disorders segment is predicted to register a considerable share in the adeno associated virus vector manufacturing market during the forecast timeline. As per the March 2024 WHO report, over 3 billion people across nations reside with neurological conditions. On one hand, more than 80% of neurological demises and health damage happen in low- and middle-income nations. On the other hand, developed countries have up to 70 times more neurological specialists per 100,000 people in comparison to developing nations. Therefore, to combat the condition, the demand for AAV vectors is increasing, suitable for market upliftment.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Scale of Operations |

|

|

Method |

|

|

Therapeutic Area |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Adeno Associated Virus Vector Manufacturing Market Regional Analysis:

North America Market Analysis

North America in adeno associated virus vector manufacturing market is likely to account for more than 54.6% revenue share by the end of 2035. The region comprises a vivacious network of associations and collaborations among research organizations, biopharmaceutical firms, and academic institutions to ensure product and service launches as well as expansions to drive the market. For instance, in May 2022, Catalent presented its latest UpTempo Virtuoso platform process for the expansion and CGMP manufacturing of adeno-associated viral (AAV) vectors. This platform regulates and rationalizes inefficient stages in AAV manufacturing to knowingly diminish the timeline from gene to clinic and allow swift first-in-human clinical assessment.

The market in the U.S. is being positively impacted due to the presence of the U.S. FDA guidelines and principles that are essential for developing, manufacturing, and approving gene therapies. As per the December 2022 FDA report, there has been approval for Luxturna catering to aid Bi-allelic RPE65 mutation-associated retinal dystrophy, Zolgensma for spinal muscular atrophy, and Hemgenix to ease Hemophilia B among adults as gene therapy products. Additionally, there have been early and late-phase trials along with study designs, external and historical controls, and evidence to ensure the effectiveness of these products on rare disorders, thus an optimistic outlook for the market in the country.

The market in Canada is achieving extensive exposure owing to the provision of funding and the presence of solution-based programs. As per the December 2024 Government of Canada Program, there has been the facilitation of an investment of USD 254,199.0 for nearly two years intending to develop the D19 clone into a comprehensible cell line for producing AAV vectors. This will eventually enhance the supply for laboratories operating on AAV-based gene therapies in the country. Moreover, in August 2024, the Government initiated the Disruptive Technology Solutions for Cell and Gene Therapy Challenge program to develop cost-effective gene therapies to aid chronic disorders, thereby driving market upliftment.

APAC Market Statistics

The adeno associated virus vector manufacturing market in Asia Pacific is gaining exceptional traction owing to investments for making advancements in government strategies and biotechnological firms. For instance, in September 2023, Otsuka Pharmaceutical Co., Ltd. declared a multi-target collaboration with ShapeTX with a deal of USD 1.5 billion to develop novel AAV gene therapies for ocular diseases. In addition, various pharmaceutical organizations in this region are deliberately occupied in the development of innovative facilities for the production of AAV vectors. Therefore, all these contributions are suitable for effective market upliftment in the region.

The market in India is well-registered with studies representing a high occurrence of neutralizing antibodies (NAbs) against various AAV serotypes, especially in hemophilia A patients. As stated in the October 2023 NLM article, the country is hyperendemic to dengue and more than 50% of adults are seropositive. Therefore, the demand for neutralizing antibodies is quite high in India in comparison to other nations. Moreover, the use of AAV as a vector is readily implemented to ensure a safety profile, high gene transmission proficiency, low immunogenicity, and steady long-term appearance, thus driving the market growth in the country.

The adeno associated virus vector manufacturing market in China is attributed to the increasing implementation of AAV vectors, suitable as a promising and popular tool for genetic medication. As per the January 2024 NLM article, a clinical study was conducted to evaluate the effectiveness of anti-AAV9 NAbs on 1oo male patients from the country suffering from Duchenne muscular dystrophy (DMD). 42% of the patient pool tested positive based on the collection of samples from 4 years to 12 years of age range. Therefore, this denotes a positive impact citing the importance of AAV vectors in the country, thus driving market expansion.

Key Adeno Associated Virus Vector Manufacturing Market Players:

- Audentes Therapeutics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioMarin Pharmaceutical

- Charles River Laboratories International, Inc.

- Oxford BioMedica

- YPOSKESI

- Sarepta Therapeutics

- GenScript

- Pfizer

- LifeSpan BioSciences, Inc.

- MilliporeSigma

- Roche

- Vironexis Biotherapeutics

- WuXi AppTec

Companies in the adeno associated virus vector manufacturing market are focusing on the extension to augment manufacturing and examine efforts. In addition, countless players are obtaining minor businesses to reinforce their market existence, expand service contributions, and expand overall competencies. For instance, in May 2024, MilliporeSigma, the U.S. and Canada Life Science business of Merck KGaA, signed a conclusive agreement to acquire Mirus Bio for USD 600 million. This acquisition enabled MilliporeSigma to provide a truly differentiated and integrated offering to meet the growing demand for these life-saving viral vector-based gene therapies.

Here's the list of some key players:

Recent Developments

- In September 2024, Vironexis Biotherapeutics unveiled its TransJoin AAV Gene Therapy Platform and a pipeline of more than ten product candidates for blood-based cancers, solid tumor metastasis prevention, and a cancer vaccine.

- In May 2024, Charles River Laboratories International, Inc. introduced its Modular and Fast Track viral vector technology (tech) transfer frameworks. This is a methodical program to drive successful and accelerated process transfer to its Maryland-based viral vector center of excellence (CoE) in as little as nine months.

- Report ID: 7381

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Adeno Associated Virus Vector Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.