Lateral Flow Assays Market Outlook:

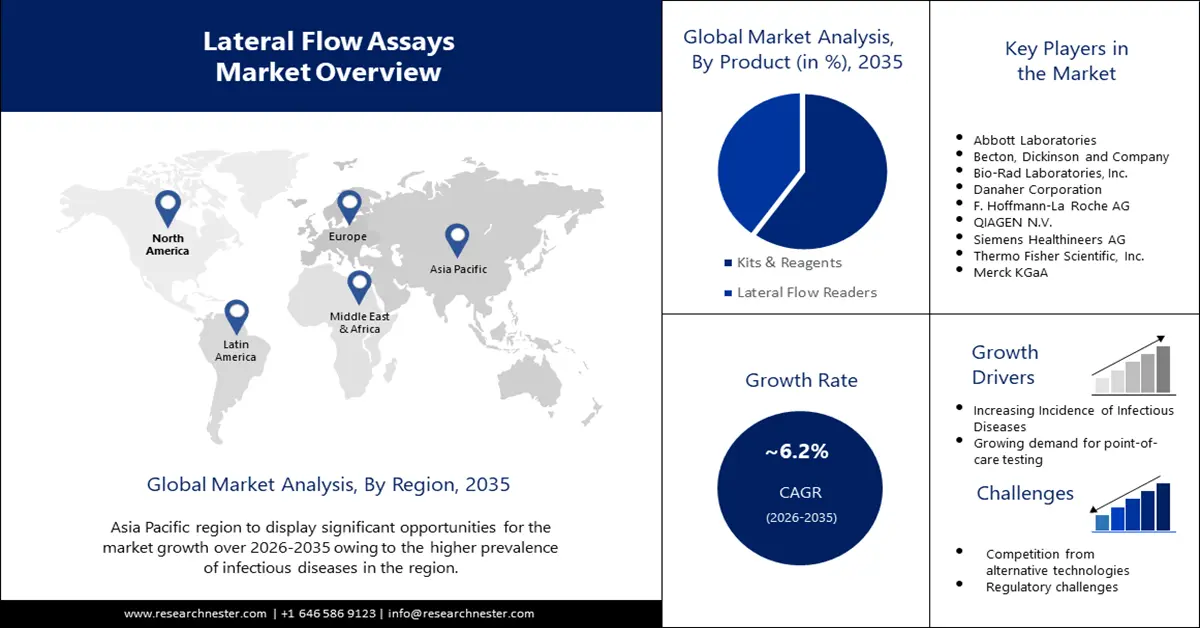

Lateral Flow Assays Market size was over USD 9.76 billion in 2025 and is anticipated to cross USD 17.81 billion by 2035, witnessing more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lateral flow assays is assessed at USD 10.3 billion.

The growth of the market is mainly due to the increasing prevalence of infectious diseases. According to the World Health Organization (WHO), infectious diseases are the leading cause of death worldwide, accounting for about 25% of all deaths worldwide.

Increasing demand for diagnostic test products that use lateral flow technology for the detection of diseases, is further predicted to drive the lateral flow assays market. In 2020, an estimated 38 million people were living with HIV/AIDS worldwide, with 1.5 million new infections and 690,000 deaths. Tuberculosis (TB) remains one of the top 13th causes of death globally with about 10.6 million new cases and 1.6 million deaths in 2021.

Key Lateral Flow Assays Market Insights Summary:

Regional Highlights:

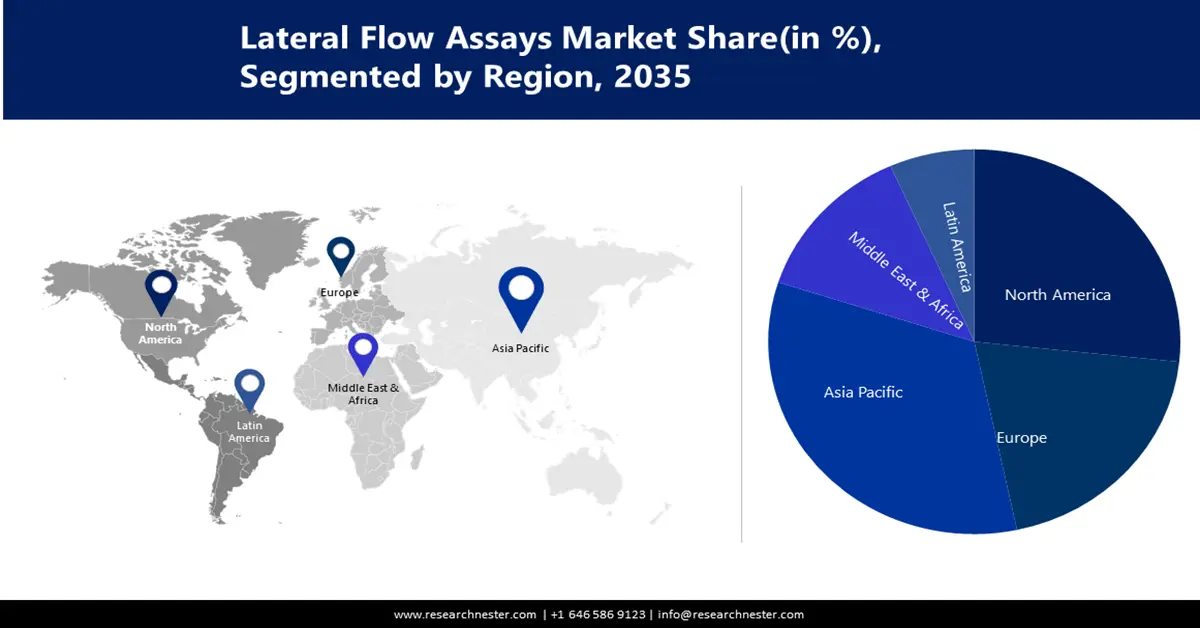

- Asia Pacific lateral flow assays market will secure around 34% share by 2035, driven by high burden of infectious diseases requiring rapid diagnosis.

- North America market will capture a 26% share by 2035, driven by technological advancements in lateral flow analysis technologies.

Segment Insights:

- The kits & reagents segment in the lateral flow assays market is projected to capture a 60% share by 2035, driven by the growing demand for rapid anti-care tests in various environments.

- The diagnostic laboratory segment in the lateral flow assays market is expected to maintain the largest share by 2035, supported by increased demand for lateral flow analysis testing for viral infections.

Key Growth Trends:

- Increasing Research Costs

- Growing Demand for Point-of-the-Care Testing

Major Challenges:

- Lack of Sensitivity and Specificity

- Competition from Substitute Technologies

Key Players: Abbott Laboratories, Becton, Dickinson, and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, F.Hoffmann-La Roche AG, QIAGEN N.V., Siemens Healthineers AG, Thermo Fisher Scientific, Inc., Merck kGaA, PerkinElmer Inc.

Global Lateral Flow Assays Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.76 billion

- 2026 Market Size: USD 10.3 billion

- Projected Market Size: USD 17.81 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Lateral Flow Assays Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Research Costs – The growth of the global lateral flow assays market is driven by increased investment in research and development activities. This helps to find more viable solutions for biosafety cabinets. Research reports show that global R&D spending has grown from around USD 680 billion to over USD 2.5 trillion in 2020.

- Growing Demand for Point-of-the-Care Testing – Point-of-the-care diagnostics devices have become increasingly important in recent years due to their ability to provide fast and accurate results in a variety of environments. Lateral flow assays are well suited to POCTs due to their simplicity, portability, and ease of use.

- Growing Demand for Food Safety Testing - The demand for food safety testing is increasing globally, due to factors such as the increasing incidence of foodborne illnesses, and safety regulations. Food changes and consumer awareness is increasing about the safety and quality of the food they eat. Side flow testing is widely used for food safety testing due to its ease of use, fast turnaround time, and ability to detect a wide range of contaminants such as pathogens, toxins, and allergens.

Challenges

- Lack of Sensitivity and Specificity – Lateral flow assays are known to have limitations in terms of sensitivity and specificity compared to other diagnostic methods, such as PCR or ELISA. This can lead to false-positive or false-negative results, which can be a significant challenge in various applications.

- Competition from Substitute Technologies

- Regulatory Limitations Associated

Lateral Flow Assays Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 9.76 billion |

|

Forecast Year Market Size (2035) |

USD 17.81 billion |

|

Regional Scope |

|

Lateral Flow Assays Market Segmentation:

End Users

The diagnostic laboratory segment is estimated to hold the largest share of the lateral flow assays market during the time period. The growth of the segment is driven by increased demand for flow analysis testing. Moreover, for any viral spread of infections, lateral flow tests are used by various institutions and governments to confirm symptomatic and asymptomatic infections.

Product

Lateral flow assays (LFA) market from the kits and reagents segment is set to occupy a noteworthy gain of 60% by the end of 2035. The growth of this segment is driven by the growing demand for rapid anti-care tests. These products are widely used in different environments, such as clinics, hospitals, and home testing, due to their simplicity, ease of use, and anti-fast turnaround times. The growth of new innovative anti-horizontal scanning technologies, such as smartphone-based anti-flow digital scanning, is also driving demand for kits and reagents.

Our in-depth analysis of the global lateral flow assays (LFA) market includes the following segments:

|

Product |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lateral Flow Assays Market Regional Analysis:

APAC Market Insights

The Asia-Pacific lateral flow analysis market is predicted to hold the largest share of 34% during the assessment period. The Asia-Pacific region has a high burden of infectious diseases, which is driving the need for lateral flow testing for rapid and accurate diagnosis. Several countries in the Asia-Pacific region such as China and India are investing heavily in health infrastructure.

North American Market Insights

The North America lateral flow analysis market is assumed to hold a notable share of 26 % during the forecast period. North America is at the heart of technological advancements, driving the development of new and innovative transverse flow analysis technologies, and is anticipated to drive the growth of the market in the region.

Lateral Flow Assays Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson, and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F.Hoffmann-La Roche AG

- QIAGEN N.V.

- Siemens Healthineers AG

- Thermo Fisher Scientific, Inc.

- Merck kGaA

- PerkinElmer Inc.

Recent Developments

- Abbott Laboratories announced the launch of a new lateral flow antigen test called the BinaxNOW COVID-19 Ag Card home test. This test is intended for non-prescription, and over-the-counter use, and provides results in 15 minutes. It is the first COVID-19 test authorized for non-prescription use by the US Reel and Drug Administration (FDA).

- Becton, Dickinson, and Company: SD announced the acquisition of a lateral now and clinical diagnostics company, Infiammatix. Inflammatix's technology enables rapid diagnosis and triage of patients with suspected infectious or inflammatory conditions. The acquisition is expected to enhance BD's diagnostic capabilities and expand its presence in the infectious disease market.

- Report ID: 4871

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lateral Flow Assays Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.