Laboratory Information Management Systems Market Outlook:

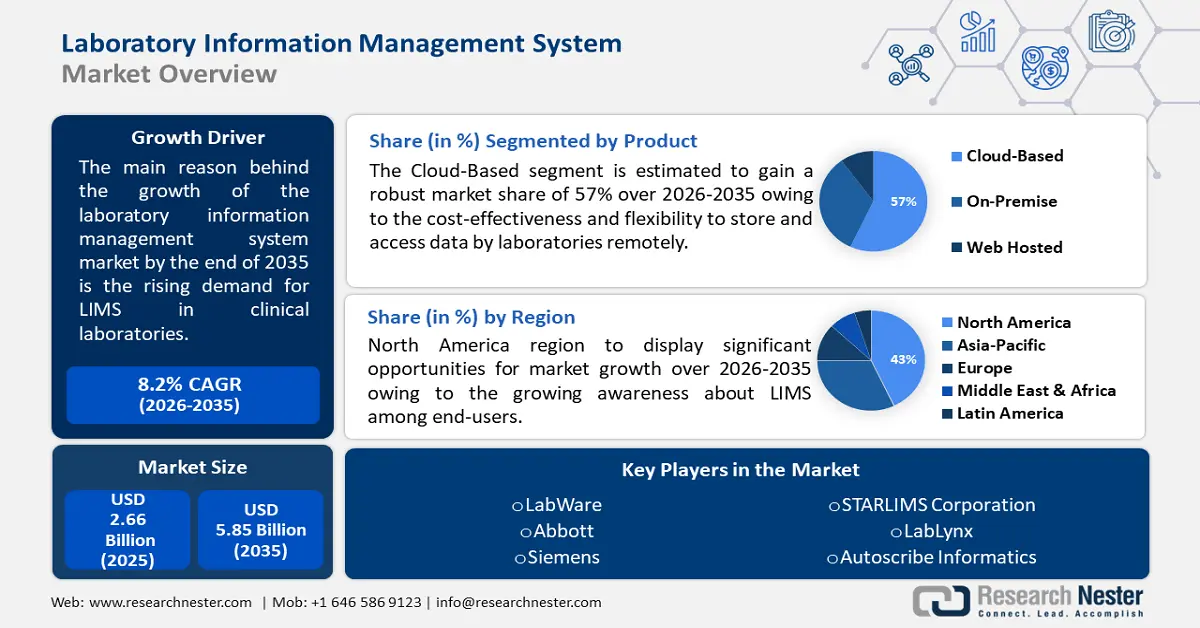

Laboratory Information Management Systems Market size was valued at USD 2.66 billion in 2025 and is set to exceed USD 5.85 billion by 2035, registering over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of laboratory information management systems is estimated at USD 2.86 billion.

The market growth is attributed to the rising demand for LIMS in clinical laboratories due to the increasing stress on laboratory personnel and infrastructure. The rising use of LIMS facilitates efficient workflows in laboratories. Additionally, the rising demand for 24/7 laboratory testing services boosts the market growth of LIMS. According to a recent report, in the financial year 2022, over 894 million tests were conducted in laboratories across India.

Key Laboratory Information Systems Market Insights Summary:

Regional Highlights:

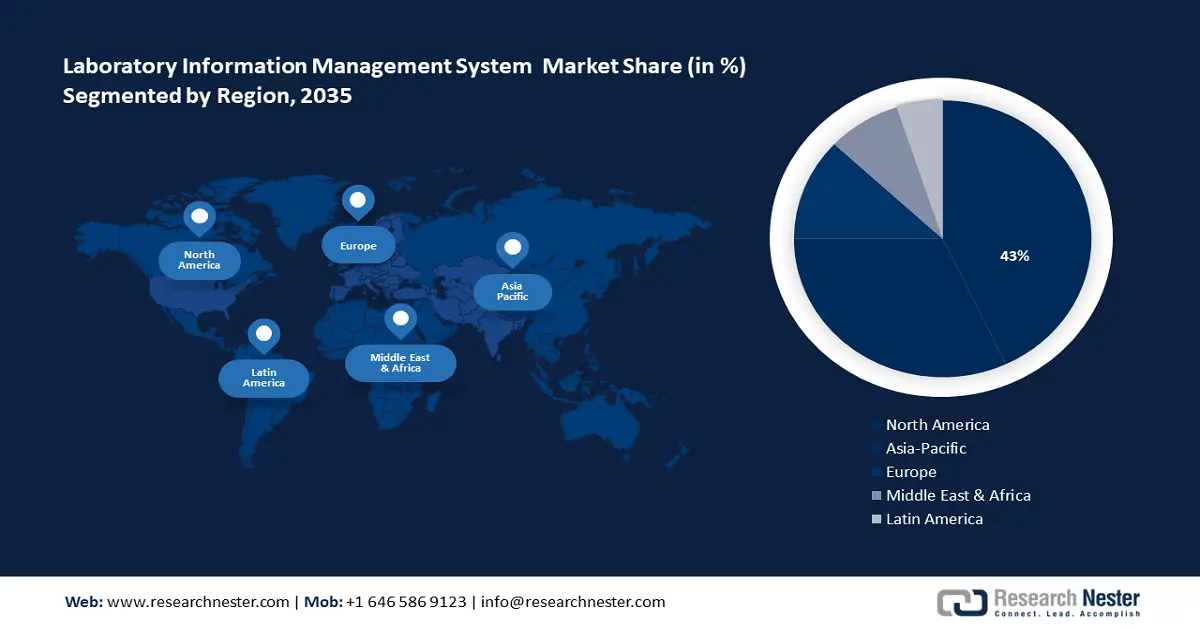

- North America’s laboratory information management systems (LIMS) market is predicted to capture 43% share by 2035, driven by increased LIMS awareness, presence of advanced labs, and rising R&D in pharmaceuticals.

- Asia Pacific market will exhibit huge growth during the forecast timeline, fueled by LIMS outsourcing, skilled labor, and growing healthcare sector.

Segment Insights:

- The cloud-based segment in the laboratory information management systems market is forecasted to achieve a 57% share by 2035, driven by flexibility, cost-effectiveness, and support for remote access in laboratories.

- The services segment in the laboratory information management systems market is expected to secure a 54% share by 2035, driven by rising automation adoption and increased outsourcing needs for data management in labs.

Key Growth Trends:

- Technological advancements in healthcare

- Growing use of biobanks

Major Challenges:

- High maintenance cost of LIMS

- Lack of trained professionals

Key Players: Thermo Fisher Scientific Inc., LabWare, Abbott, Siemens, STARLIMS Corporation, Autoscribe Informatics, PerkinElmer Inc., LabVantage Solutions Inc., LabLynx, Agilent Technologies, Inc.

Global Laboratory Information Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.66 billion

- 2026 Market Size: USD 2.86 billion

- Projected Market Size: USD 5.85 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Laboratory Information Management Systems Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in healthcare - The rising technological advancements and integration of IoT devices in the healthcare sector stimulate the laboratory information management systems market growth. Moreover, the ongoing innovations in LIMS such as artificial intelligence, machine learning, and data analytics improve the productivity and overall performance of LIMS. According to recent information, it is estimated that AI applications can cut annual US healthcare costs by USD 150 billion in 2026.

Furthermore, the incorporation of advanced technology in healthcare diagnostics ensures users with cutting-edge solutions and enhances decision-making within laboratory workflows. - Growing use of biobanks - The growing popularity of biobanks which store biological samples for research purposes led to the adoption of LIMS. LIMS organizes the data generated by biobanks to ensure an accurate sample. In addition, the increasing demand for personalized healthcare has stimulated the popularity of biobanking which further leads to the expansion of laboratory information management systems.

Moreover, the growing research activity in healthcare has encouraged researchers to adopt LIMS in bio banking operations which help in data accessibility and quality. According to a source, there are currently 370 registered biobanks that have given permission to be listed. - Rising investments in healthcare infrastructure - The growing population and rising chronic diseases have led to an increase the investments in healthcare infrastructure. Moreover, the government support towards the development of laboratory infrastructure and to conduct research effectively boosts the laboratory information management systems (LIMS) market growth.

Furthermore, the rising investments in Research and development activity in healthcare and the initiatives taken by the government’s towards digitalization led to expand the adoption of laboratory information management systems. LIMS effectively manages the laboratory data and also ensures regulatory compliance aligning with precision medicine.

Challenges

- High maintenance cost of LIMS - Huge investments are required for the initial installation and maintenance of the laboratory information management systems. Smaller laboratories may not afford LIMS due to their limited budget and maintenance of LIMS usually costs more which poses a challenge to these laboratories as well as hampers the laboratory information management systems market growth.

- Lack of trained professionals - Limited awareness and skills among healthcare professionals regarding laboratory information management systems hinder its market growth. Due to a lack of trained professionals, the adoption of LIMS has become restricted in pharmaceutical, biotechnology, and medical device companies.

Laboratory Information Management Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 2.66 billion |

|

Forecast Year Market Size (2035) |

USD 5.85 billion |

|

Regional Scope |

|

Laboratory Information Management Systems Market Segmentation:

By Product Segment Analysis

Cloud-based segment is set to dominate laboratory information management systems market share of over 57% by 2035, attributed to the flexibility to store and access data by laboratories remotely. Cloud-based LIMS solutions are cost-effective as they are largely adopted by all laboratories including small-scale to large-scale laboratories which makes it a preferred choice.

Additionally, cloud-based LIMS solutions have various benefits as they promote collaborations, integration across various research facilities, and streamlined operations which boost the segment growth.

By Component Segment Analysis

In laboratory information management systems (LIMS) market, services segment is estimated to account for revenue share of around 54% by 2035, attributed to the rising adoption of automation in laboratories across various sectors such as healthcare, research, and pharmaceuticals. According to a source, there are 26,519 diagnostic & medical laboratories businesses in the US as of 2023.

In addition, several research labs face the challenge of a lack of resources and skills to maintain data. In that case, LIMS services are outsourced which include compliance with regulatory standards and efficient data management. Moreover, the growing demand for LIMS outsourcing solutions stimulates the segment growth in the forecast period.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Component |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Laboratory Information Management Systems Market Regional Analysis:

North American Market Insights

North America industry is set to hold largest revenue share of 43% by 2035, due to growing awareness about LIMS among end-users and the presence of advanced research laboratories. The stringent regulatory standards and the rising R&D in pharmaceutical and research laboratories boost the market growth in the region. According to source, in 2021, overall pharmaceutical expenditures in the US grew 7.7% as compared to 2020.

The economic development in the US led to the rise of biobanks and biorepositories which has expanded the adoption of laboratory information management systems.

In Canada, an increasing governmental support and investments towards the development of laboratory automation technology further expands the market.

APAC Market Analysis Insights

The Asia Pacific region will also encounter huge growth for the laboratory information management systems market during the forecast period and will hold the second position owing to the growing demand of laboratory information management systems and contract research organizations (CROs).

The rising popularity of LIMS outsourcing in India due to the skilled labor and cost-effective solutions expands market. In addition, the healthcare industry is growing in India due to various factors such as technological developments, rising chronic diseases, awareness of health, increasing aging population. According to the source, about 21% of the elderly in India reportedly have at least one chronic disease. Furthermore, the need for data management and LIMS is surging which boosts the laboratory information management systems (LIMS) market growth.

Laboratory Information Management Systems Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LabWare

- Abbott

- Siemens

- STARLIMS Corporation

- Autoscribe Informatics

- PerkinElmer Inc.

- LabVantage Solutions Inc

- LabLynx

- Agilent Technologies, Inc.

The various key players in the laboratory information management systems market are LabWare, Abbott, Siemens, STARLIMS Corporation, LabLynx, and Autoscribe Informatics among others.

Recent Developments

- Autoscribe Informatics - Autoscribe Informatics, a global leader in LIMS announced the launch of Matrix Gemini version 6.5. Moreover, the company has also introduced a new web browser application known as the New Matrix Gemini Web application. This application will meet the requirements of a modern laboratory information solution. Additionally, the new web application is also available with immediate effect as a beta release in v6.5. Customers will be able to take benefit of the new web application by upgrading their previous version.

- LabVantage Solutions Inc. - LabVantage Solutions Inc., introduced a digitally native ecosystem to boost speed in R&D laboratories. This digitally native ecosystem will enable R&D labs to improve productivity by reducing operational costs and also decision-making capabilities. It is a significant step in the scientific domain to digitalize R&D laboratory processes with the inclusion of advanced technologies such as semantic search. Semantic search helps in the searchability of large amounts of data by utilizing semantic core and knowledge graph.

- Report ID: 4236

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.